You’re standing at a busy counter in Colombo, or maybe you're sitting at your desk in Chennai staring at a flickering forex screen, wondering why on earth the SL rupees to Indian rupees conversion looks so lopsided. It's frustrating. One minute the Sri Lankan Rupee (LKR) seems to be gaining ground, and the next, a shift in central bank policy sends it spinning.

Money is weird.

Specifically, the relationship between the LKR and the Indian Rupee (INR) is one of the most volatile yet interconnected currency pairings in South Asia. If you've got a pocket full of "Ceylon" notes, you're holding a currency that has survived a massive sovereign debt crisis, a total economic overhaul, and a slow, painful crawl back to stability. But don't expect a one-to-one swap. Far from it.

The Reality of the SL Rupees to Indian Rupees Exchange

Most people check Google and see a number. They think that’s the price. Honestly, it’s not.

The "mid-market rate" you see on search engines is basically a theoretical average. It's the midpoint between what banks buy at and what they sell at. If you actually try to trade SL rupees to Indian rupees at a physical exchange house or through a bank transfer like Wise or Western Union, you’re going to hit a wall of fees and "spreads."

The spread is where they get you.

Back in 2022, when Sri Lanka’s economy took a nose-dive, the LKR plummeted. We saw rates where one Indian Rupee could buy nearly four or five Sri Lankan Rupees. It was chaotic. Since then, the Central Bank of Sri Lanka (CBSL) has been working overtime to tighten things up. Under the guidance of officials like Governor P. Nandalal Weerasinghe, the LKR has seen periods of surprising "appreciation," but it remains a "soft" currency compared to the relatively "harder" Indian Rupee.

India’s economy is a behemoth. Sri Lanka’s is an island economy recovering from a debt default. That fundamental difference is why your SL rupees to Indian rupees conversion usually feels like you’re trading a handful of silver for a couple of gold coins.

💡 You might also like: Canada Tariffs on US Goods Before Trump: What Most People Get Wrong

Why the Rate Fluctuates Every Single Day

It’s not just random.

Three things drive the value of your LKR when you're looking to turn it into INR. First, there’s the tourism factor. When Indian tourists flock to Galle or Kandy, they bring INR or USD. This influx of foreign currency helps strengthen the LKR. If the tourists stop coming—like they did during the pandemic or the 2022 protests—the LKR starves.

Second, there is the IMF.

The International Monetary Fund's Extended Fund Facility (EFF) for Sri Lanka comes with strings attached. Big ones. These include requirements for the CBSL to build up foreign exchange reserves. When the central bank buys dollars to build those reserves, it can actually weaken the LKR, making your SL rupees to Indian rupees rate worse for the Sri Lankan side.

Third, we have the trade balance. Sri Lanka imports a massive amount of goods from India—everything from onions to Tata motors. To pay for these, Sri Lanka needs INR or USD. This constant demand for Indian currency keeps the INR in a position of power.

Common Misconceptions About Carrying Cash

You can't just walk across the border with a suitcase of cash. Well, you can, but you'll get in trouble.

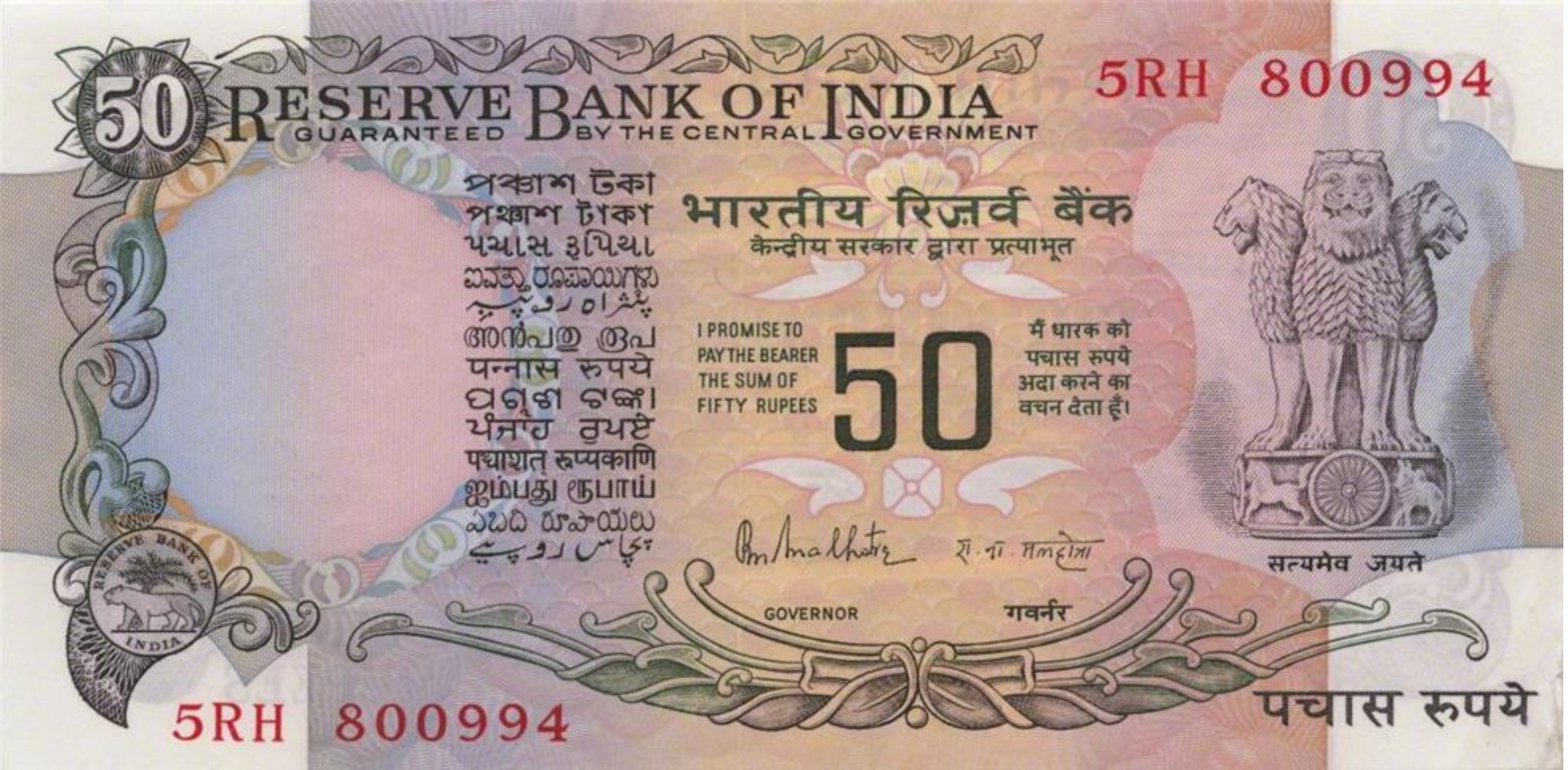

- The 25,000 INR Rule: The Reserve Bank of India (RBI) is pretty strict. Generally, residents of India traveling back from Sri Lanka can only bring in up to ₹25,000 in physical notes.

- The LKR Limit: Sri Lanka has its own outgoing limits. If you’re leaving Bandaranaike International Airport with millions of LKR in your bag, Customs will have questions.

- The "Black Market" Trap: In Pettah or certain parts of Colombo, you might find guys offering "better" rates for SL rupees to Indian rupees than the banks. Be careful. Not only is it technically illegal, but the risk of getting counterfeit notes or simply getting robbed is way higher than the 2% you think you’re saving.

How to Actually Get the Best Conversion

If you're moving a lot of money, stop using retail banks. They are slow and expensive.

📖 Related: Bank of America Orland Park IL: What Most People Get Wrong About Local Banking

Fintech has changed the game. Services that use peer-to-peer matching often give you a rate much closer to the one you see on Google. However, even these services struggle with the LKR because it isn't a "freely convertible" currency in the same way the Euro or Yen is.

For the average traveler, the move is usually to carry a multi-currency card. Load it with INR if you’re coming from India, or use a card that converted from USD. In the world of SL rupees to Indian rupees, the US Dollar often acts as the "bridge." You convert LKR to USD, then USD to INR. It sounds like extra steps, but because the USD market is so liquid, the total fees can sometimes be lower than a direct LKR-INR swap.

The Future of LKR and INR Integration

There is a lot of talk about "de-dollarization" in South Asia.

India and Sri Lanka have been discussing the use of INR for trade settlements. This is a big deal. If Sri Lanka can pay for Indian exports directly in Indian Rupees without involving the US Dollar, the volatility of the SL rupees to Indian rupees rate might settle down. It would create a more direct corridor for value.

But we aren't there yet.

Right now, the LKR is like a patient in rehab. It's getting stronger, it's walking on its own, but it still needs the crutch of high interest rates and IMF oversight. India, meanwhile, is sprinting. The gap between the two currencies represents the gap between two very different economic stages.

What You Need to Do Now

If you are holding Sri Lankan Rupees and need to convert them to Indian Rupees, timing is your best friend.

👉 See also: Are There Tariffs on China: What Most People Get Wrong Right Now

Don't wait until you're at the airport. Airport exchange desks are notorious for "convenience fees" that can eat up to 10-15% of your total value. It’s daylight robbery, honestly. Instead, check the daily rates posted by the Bank of Ceylon or the State Bank of India.

Watch the news for these specific triggers:

- IMF Review Dates: Successful reviews usually lead to a stronger LKR.

- Fuel Price Adjustments: Sri Lanka spends a lot of forex on oil. High oil prices hurt the LKR.

- RBI Interest Rate Decisions: If India raises rates, the INR usually gets stronger, making it more expensive to buy with your SL rupees.

Practical Steps for Your Conversion:

Check the official "Buying Rate" at a major commercial bank in Colombo—this is the most honest look at what your LKR is worth. Avoid "Zero Commission" booths; they just bake the fee into a terrible exchange rate. If you're an expat sending money home to India, look into digital platforms that offer "Locked-in" rates, so you don't get screwed by a sudden dip while your transfer is processing.

Always keep your exchange receipts. If you have leftover LKR at the end of a trip and want to change it back to INR, some places won't even talk to you unless you can prove where you got the original currency.

The SL rupees to Indian rupees market is complicated, but it isn't a total mystery. It's a reflection of two neighbors trying to balance their books while the rest of the world watches. Hold onto your wallet, watch the charts, and never take the first rate you're offered.