If you’ve been keeping an eye on the ticker symbol FUN lately, you know the vibe is, well, complicated. Most people see the name Six Flags and think of Batman coasters or those slightly chaotic Fright Fest ads. But if you actually dig into the recent Six Flags press releases, a very different—and much more corporate—story starts to emerge.

We aren't just talking about new rides anymore.

Since the July 1, 2024, merger with Cedar Fair, the company has been firing off updates that feel more like a high-stakes chess match than a day at the theme park. Honestly, it’s been a bumpy ride. While the executives are busy talking about "synergies" and "operational efficiencies," the stock price has taken some serious hits, and the legal teams are staying busy.

The Merger Reality Check

Basically, the "Merger of Equals" wasn't exactly a smooth handoff. When the companies combined, they kept the Six Flags name but adopted the Cedar Fair ticker (FUN) and moved the headquarters to Charlotte, NC.

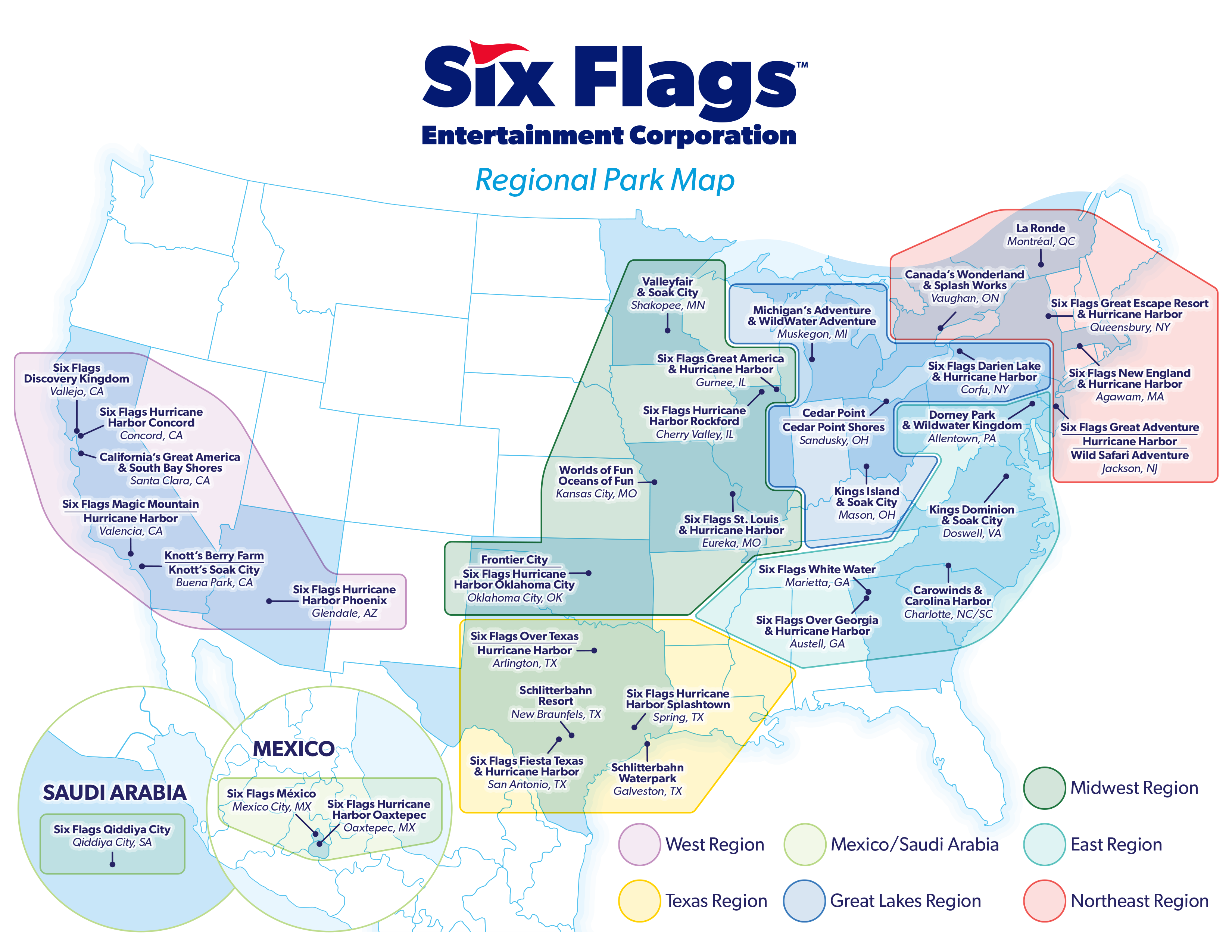

According to the official paperwork, the goal was to create a powerhouse with 27 amusement parks and 15 water parks. But by late 2025, the tone of their communications shifted from "look at this giant portfolio" to "we might need to sell some stuff."

You’ve probably seen the headlines about underperforming parks. In a November 2025 update, CEO John Reilly—who took over after a leadership shuffle—admitted that the company’s performance wasn’t meeting expectations. They’ve actually started categorizing their parks into two groups: the "outperformers" (making up 70% of the money) and the "underperformers" (the other 30% that are basically dragging the ship down).

What the 2026 Press Releases Are Actually Saying

Fast forward to right now, January 2026. The most recent Six Flags press releases are focused on one thing: debt.

On January 7, 2026, the company announced it was pricing $1.0 billion in senior notes. In plain English? They are borrowing a massive amount of money to pay off older debt that was coming due in 2027. It's a classic "kick the can down the road" move, but at a higher interest rate (8.625%).

💡 You might also like: What Did The Dow Jones Do Yesterday: The Red Reality Facing Wall Street

Why does this matter to you?

Because every dollar spent on interest is a dollar not spent on painting the coasters or hiring more staff. However, it’s not all doom and gloom in the newsroom. They just announced that five of their newest attractions for 2026 were named among the "Best New Theme Park Attractions" by USA TODAY.

- Rapterra: A massive launched wing coaster.

- Siren’s Curse: A tilt coaster that looks terrifying.

- Wrath of Rakshasa: Breaking records for steep drops.

The Saudi Arabia Wildcard

One of the weirdest—and most interesting—updates came just a few days ago. On December 31, 2025, Six Flags Qiddiya City officially opened in Saudi Arabia.

It’s the first park outside North America, and it’s home to Falcons Flight, which is now officially the tallest and fastest roller coaster in the world. It’s a strange contrast. In the U.S., they are talking about closing parks like Six Flags America in Maryland to save cash. Meanwhile, in Saudi Arabia, they are building world-record-breaking monsters.

Is the Guest Experience Actually Getting Better?

Honestly, it depends on which park you visit. The company is leaning hard into "digital transformation." Their recent press releases talk about "revolutionizing thrills" through mobile apps and better in-park tech.

But there is a catch.

A class-action lawsuit (City of Livonia Employees' Retirement System v. Six Flags Entertainment Corporation) alleges that the company didn't disclose how much the guest experience had actually degraded before the merger. There are claims that staff cuts under former leadership made the parks harder to run.

You’ve probably felt this if you’ve waited two hours for a lukewarm burger.

Real Talk on the 2026 Pipeline

If you’re looking for what’s coming next, keep an eye on these specific 2026 debuts mentioned in their latest media kits:

- Tormenta Rampaging Run (Six Flags Over Texas): A 309-foot "giga-dive" coaster.

- Quantum Accelerator (Six Flags New England): A family-style "straddle" coaster.

- Looney Tunes Land (Six Flags Magic Mountain): A massive reimagining of the kids' area.

Actionable Insights for Fans and Investors

If you're trying to make sense of the noise, here is the "too long; didn't read" version of the current state of Six Flags:

- Check the Investor Relations Page: Don't just follow fan blogs. If you want the real numbers, go to

investors.sixflags.com. Look for the 8-K filings. That’s where they have to tell the truth about things like park closures or massive loans. - Watch the "Non-Core" List: If your local park is on the list of "underperformers" (about 30% of their portfolio), don't be surprised if maintenance slows down or the park is sold for real estate development.

- Leverage the Season Pass: Despite the financial drama, the "Six Flags Plus" and "All Park Passport" programs are still the best way to get value, especially now that you can theoretically use them at former Cedar Fair parks like Cedar Point or Carowinds.

- Monitor Debt Refinancing: The company is aiming to get its debt-to-earnings ratio below 4.0x by the end of 2026. If they miss this, expect more "efficiency" cuts at the parks.

The era of Six Flags just being about "more rides" is over. We are now in the era of Six Flags as a massive, debt-heavy real estate and entertainment conglomerate trying to figure out which parts of its soul it can afford to keep.