Honestly, if you told someone two years ago that we’d be staring at silver prices today per ounce in US markets hitting the $90 mark, they probably would’ve laughed you out of the room. It sounds like a fever dream. Yet, here we are on Saturday, January 17, 2026, and the "poor man’s gold" is currently trading around **$90.04 to $90.88**.

Sure, we’ve seen a slight dip of about 2% this morning as some traders cash out their wins. But let’s be real: after silver surged over 140% in 2025, a tiny pullback is basically just the market taking a breather.

What’s wild is how fast this happened. On New Year’s Day last year, silver was sitting at a humble $29. Now, it’s flirting with triple digits. If you’re checking the price because you’re thinking about "stacking" some physical coins or you’re just curious why your grandmother’s silverware suddenly feels like a down payment on a house, you’ve got to look at the "why" behind these numbers. It isn't just inflation; it’s a perfect storm of industrial hunger and a massive shortage that nobody seems to be able to fix.

The Reality of Silver Prices Today Per Ounce in US Markets

The spot price you see on your screen right now—that $90.88 figure—is the base price for raw, unrefined silver. But if you actually try to buy a one-ounce American Silver Eagle today, you’re going to pay a premium. Dealers like APMEX or JM Bullion are quoting closer to **$93 to $98** for physical coins because the demand is just that high.

✨ Don't miss: Is US Stock Market Open Tomorrow? What to Know for the MLK Holiday Weekend

Why the massive jump?

Well, for one, the world is physically running out of the shiny stuff. We are currently in the sixth consecutive year of a silver supply deficit. That’s a fancy way of saying we’re using a lot more silver than we’re digging out of the ground. In 2025 alone, the gap was somewhere between 160 and 200 million ounces. You can’t just "turn on" a new silver mine, either. Most silver is actually a byproduct of mining for things like copper and zinc. So, even with prices skyrocketing, miners aren't exactly rushing to open new shafts just for silver. It takes 10 to 15 years to get a new mine running.

The Solar and EV Hunger

Silver isn't just for jewelry or keeping as a "prepper" asset anymore. It’s the backbone of the green energy transition.

🔗 Read more: Big Lots in Potsdam NY: What Really Happened to Our Store

- Solar Panels: The solar sector alone is gobbling up over 200 million ounces a year.

- Electric Vehicles: Every EV has about one to two ounces of silver in it for its conductivity.

- AI Data Centers: This is the new one. The massive infrastructure needed for AI requires high-end electronics that rely on silver.

Is Triple-Digit Silver Actually Coming?

There’s a lot of chatter among analysts like Alan Hibbard at GoldSilver about silver hitting $100 or even $175 later this year. It sounds crazy, but the math is starting to back it up.

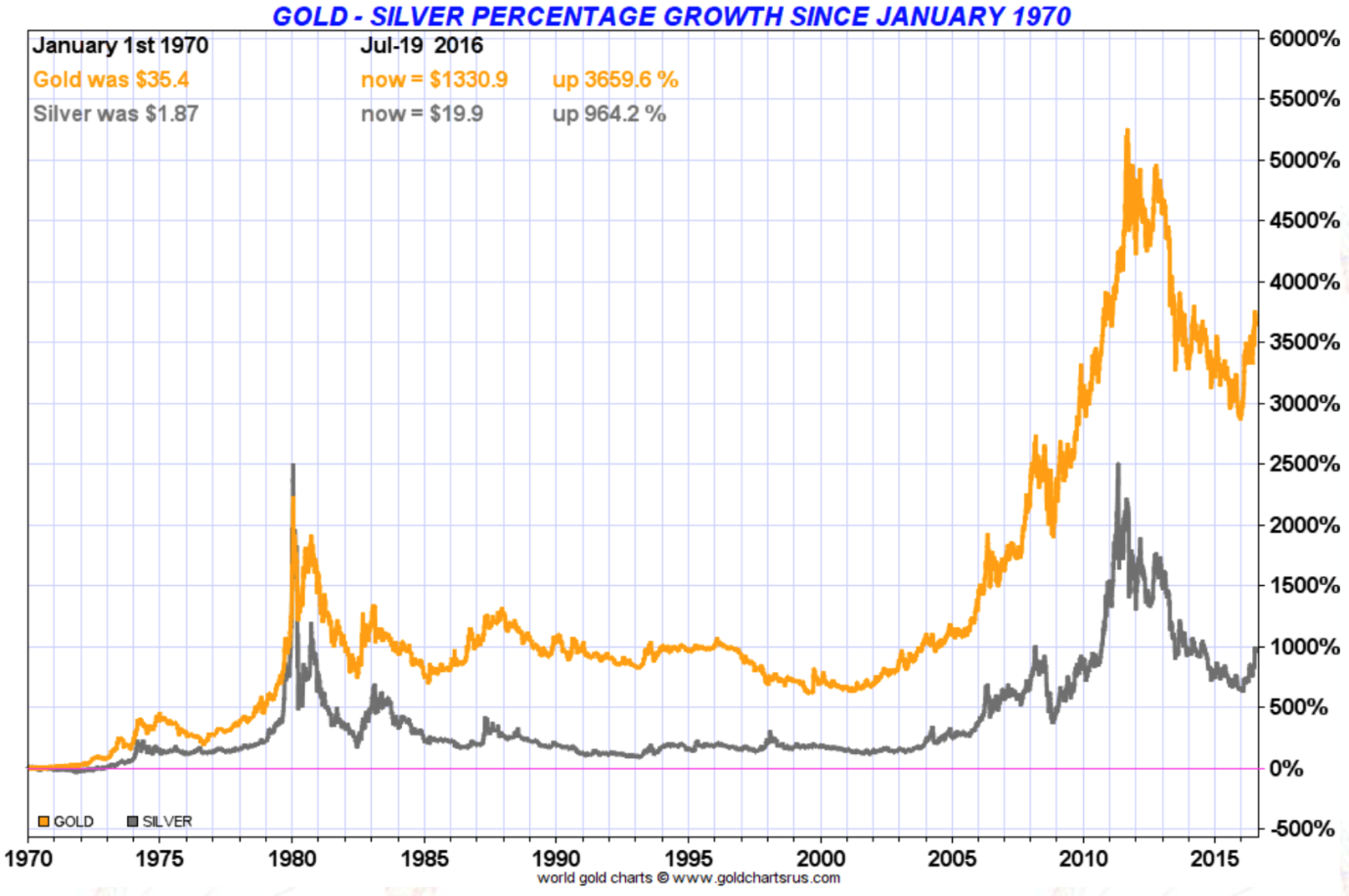

The gold-to-silver ratio is a big indicator here. Historically, that ratio was around 15:1. In early 2025, it was a staggering 100:1. As of today, it has compressed to about 57:1. This means silver is outperforming gold by a massive margin. When that ratio drops, it usually signals that silver is playing catch-up, and it has a lot of room left to run.

Geopolitics is the other elephant in the room. With ongoing tensions in South America (major mining hubs) and sanctions affecting Russian output, the global supply chain for silver is incredibly fragile. The U.S. government has even started discussing silver as a "national security issue." When the government starts getting nervous about a metal, you know the price is going to get spicy.

💡 You might also like: Why 425 Market Street San Francisco California 94105 Stays Relevant in a Remote World

What You Should Actually Do Now

If you're looking at silver prices today per ounce in US and wondering if you missed the boat, don't panic. Most experts, like those at Monetary Metals, suggest a "dollar-cost averaging" approach. Don't dump your entire savings into silver at $90. Instead, buy a little bit every month.

- Watch the $86 Support: If the price dips toward $86, that’s historically been a strong "buy" signal lately.

- Physical vs. Paper: If you want "crisis insurance," buy physical bars or coins. If you just want to play the price movement, look at ETFs like SLV (though be careful with the fees).

- Avoid the Hype: Don't buy "collector" coins with high markups. Stick to "bullion" where you’re paying for the metal, not the pretty picture on the front.

The market is volatile right now. We might see a drop back to $75 or a spike to $110 by next month. But as long as we keep building solar panels and EVs while the mines stay closed, the long-term trend for silver looks higher than it has in decades.

Your Next Steps:

Check your local coin shop's "buy-back" rates today. Even if the spot price is $90, some shops may offer you a bit less depending on their inventory. If you are buying, compare at least three online dealers for the lowest premium over spot. If you're a long-term holder, consider moving your physical holdings into a secure, insured vault rather than keeping a high-value "stack" at home given the current price surge.