You’re staring at Zillow again. It’s 11:00 PM, and you’re looking at a three-bedroom ranch that costs twice what it did in 2019, wondering if you’re about to make the biggest financial mistake of your life. Everyone has an opinion. Your uncle says wait for the "crash." Your lender says "marry the house, date the rate." Honestly, both of them are kind of oversimplifying a situation that is incredibly personal and, frankly, pretty stressful.

So, should I wait to buy a home, or is now actually the right time to jump in despite the chaos?

The housing market in 2026 isn't the same beast it was a few years ago. We aren't seeing those 20% year-over-year price jumps anymore, but we also aren't seeing prices plummet back to 2015 levels. It’s a grind. Inventory is still tight because homeowners who locked in 3% rates back in the day are clinging to those mortgages like life rafts. If they sell, they have to buy something else at a much higher rate. That "lock-in effect" is real, and it’s keeping supply low, which keeps prices stubbornly high even when demand cools off.

The math behind the "Wait and See" approach

Most people waiting are betting on two things: lower interest rates or a housing market crash. Let’s talk about the crash first. To get a 2008-style collapse, you need a massive wave of forced selling. Back then, it was subprime mortgages and adjustable rates that blew up in people's faces. Today, lending standards are much tighter. According to data from the Federal Reserve Bank of St. Louis, household debt service ratios are actually quite healthy compared to historical averages. People have equity. They aren't walking away from their homes unless they absolutely have to.

Wait.

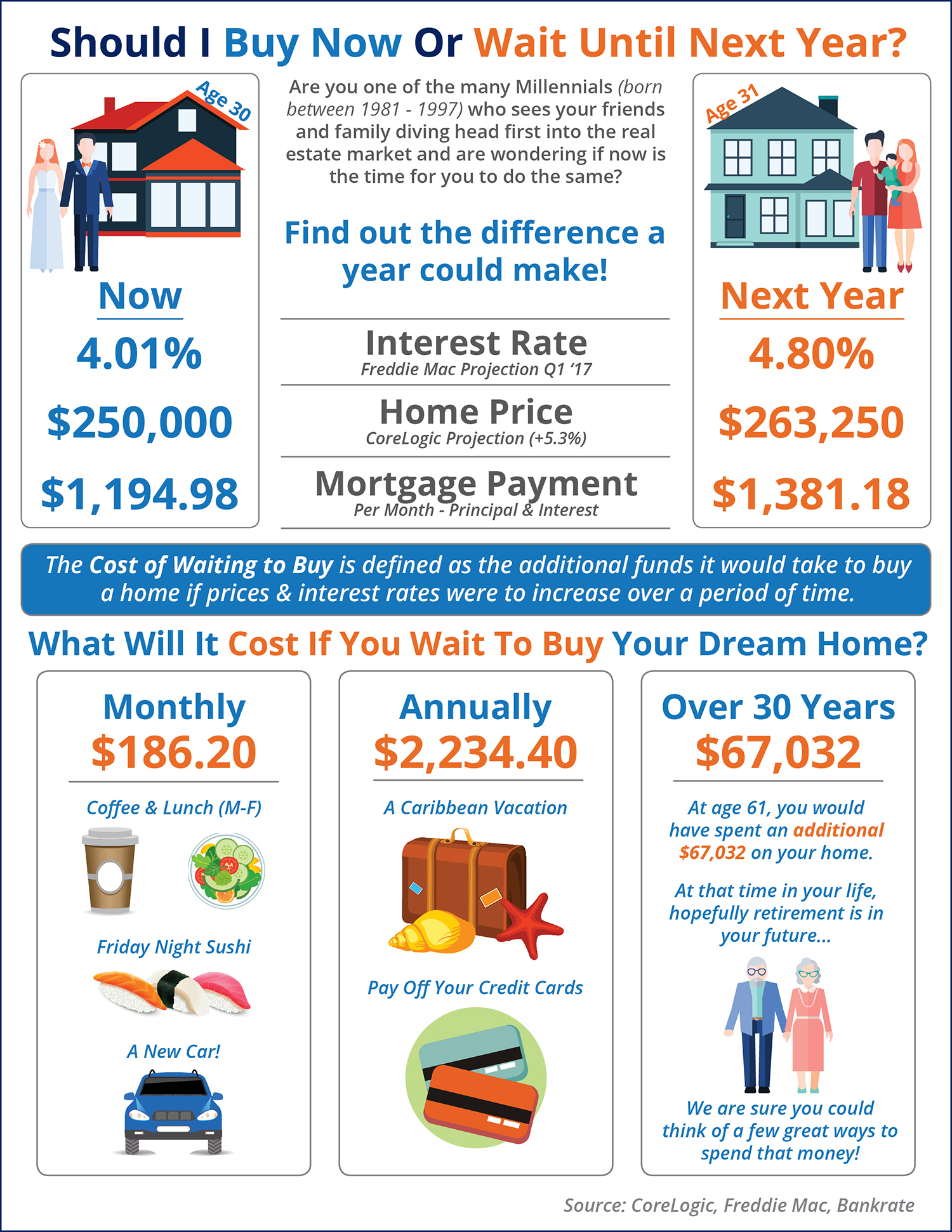

If you wait for rates to drop to 4% or 5%, what do you think happens? Every other person who was asking "should I wait to buy a home" suddenly hits the "buy" button. You get more competition. Multiple offers return. Bidding wars start. You might save $300 a month on your mortgage payment but end up paying $50,000 more for the house because you were fighting ten other buyers. It’s a trade-off.

👉 See also: ¿Quién es el hombre más rico del mundo hoy? Lo que el ranking de Forbes no siempre te cuenta

Renting vs. Buying in the current climate

Renting feels like throwing money away, but sometimes it’s the smarter tactical move. If you’re only planning to stay in a city for two years, buying is almost certainly a bad idea. The closing costs alone—usually 2% to 5% of the loan amount—will eat any equity you build.

However, if you're looking at a five-to-ten-year horizon, the math shifts. Even with a 7% interest rate, you’re paying down your own principal instead of your landlord's. Plus, there are tax benefits like the mortgage interest deduction, though these are less impactful for some since the standard deduction was raised years ago.

Why the "Perfect Time" is a total myth

Market timing is a loser’s game. Professional investors with billions of dollars get it wrong all the time. If they can’t nail the bottom of the market, you probably won't either. The "perfect time" usually only looks perfect in the rearview mirror.

Think about 2020. People were terrified. Everything was shutting down. If you bought then, people thought you were crazy. Now, those people look like geniuses.

Buying a home is a lifestyle decision that happens to have a large financial component. If you just got married, or you're expecting a kid, or you're tired of your neighbor’s bass thumping through the apartment wall at 2:00 AM, those are valid reasons to buy. Don't let a fluctuating Federal Reserve chart dictate your life stages.

✨ Don't miss: Philippine Peso to USD Explained: Why the Exchange Rate is Acting So Weird Lately

Real-world scenarios to consider

Let’s look at a few specific situations where waiting actually makes sense:

- Your credit score is "meh": If you’re sitting at a 640, taking six months to pay down debt and get to a 720 will save you tens of thousands of dollars over the life of the loan. That’s a productive wait.

- You don't have an emergency fund: If buying a house drains every cent you have, you are one broken water heater away from disaster. Don't do it.

- The local market is weird: If a major employer just left your town, prices might actually soften significantly.

On the flip side, if you have a stable job, a 20% down payment (or even 3.5% for an FHA loan), and you found a house you actually like, waiting is just gambling.

What the experts are actually seeing

Lawrence Yun, the Chief Economist at the National Association of Realtors (NAR), has frequently pointed out that the lack of inventory is the primary driver of prices. We are millions of homes short of where we need to be. Builders are trying to catch up, but labor is expensive and land is scarce. This isn't a "bubble" inflated by fake demand; it's a supply problem. Supply problems take a decade to fix, not a few months of high interest rates.

When you ask "should I wait to buy a home," you're really asking "will I regret this in two years?"

Maybe.

🔗 Read more: Average Uber Driver Income: What People Get Wrong About the Numbers

If prices dip 5%, you might feel a little sting. But if you’re still living in the house and enjoying your backyard, does it matter? It only matters the day you sell.

The hidden costs people forget

Don't just look at the P&I (Principal and Interest). Insurance premiums are skyrocketing in states like Florida, Texas, and California. Property taxes get reassessed when a home sells, often jumping significantly from what the previous owner was paying.

I’ve seen buyers get their keys and then realize they can't afford the $800-a-month property tax bill that the Zillow estimate missed. Get a real estimate from a local title company or your lender before you commit.

Actionable steps for the "Should I Wait" dilemma

If you are currently on the fence, stop doom-scrolling and do these four things to get clarity.

- Run a "Shock Test" on your budget: Calculate a mortgage payment at a rate 1% higher than today's current average. If that number makes you nauseous or leaves you with zero "fun money," you can't afford the house. You need a buffer.

- Check the "Days on Market" (DOM): Look at your target neighborhood. Are houses sitting for 45 days? You have leverage. Negotiate for a "2-1 buydown" where the seller pays to lower your interest rate for the first two years. It’s a common tactic right now that saves you way more than a small price cut.

- Audit your local inventory: In some cities, there is a glut of new-construction condos. In others, there hasn't been a new single-family home built in years. Market conditions are hyper-local. What's happening in Boise doesn't matter if you're buying in Charlotte.

- Define your "Why": Write down why you want a house. If "making a quick profit" is in your top three, wait. If "stability for my family" or "having a garden" is #1, start looking.

The reality is that should I wait to buy a home is a question only your bank account and your gut can answer together. If you're waiting for the world to make sense, you'll be renting forever. If you're waiting for a deal that feels like 2012, you're chasing a ghost. Buy when you are financially ready and plan to stay put. Everything else is just noise.

Next Steps for Potential Buyers:

- Get a Pre-Approval, Not a Pre-Qualification: A pre-approval involves a deep dive into your finances and shows sellers you are a serious, vetted buyer.

- Analyze the "Price-to-Rent" Ratio in Your Zip Code: If renting a similar home is significantly cheaper than a mortgage (including taxes/insurance), it may be worth waiting and investing the difference in a brokerage account.

- Interview Three Real Estate Agents: Ask them specifically about "off-market" listings and how many "seller concessions" they’ve successfully negotiated in the last 60 days.