Life in South Dakota has a way of throwing curveballs when you least expect them. Maybe you just transitioned out of a job at Sanford Health in Sioux Falls, or perhaps you're a recent South Dakota State University grad waiting for your first professional gig to start. You need coverage. You're looking at short term health insurance South Dakota options because, honestly, the ACA Marketplace prices can feel like a punch to the gut if you don't qualify for a massive subsidy.

But here is the thing.

The rules changed. Big time. If you’re searching for these plans in 2026, the landscape looks nothing like it did a few years ago. Most people assume they can just grab a 364-day plan and forget about it. They can't. Federal regulations and South Dakota’s own insurance division have tightened the reins, making these plans a very specific tool rather than a permanent lifestyle choice.

The 2024 Rule Change That Still Echoes Today

Back in the day, you could basically string together short-term plans to create a makeshift "permanent" insurance shield. It was a loophole. The Biden-Harris administration effectively closed that door with a final rule that took full effect by late 2024, limiting the initial term of these plans to just three months.

You can technically extend it to a total of four months if the insurer allows it, but that's the hard ceiling.

Why does this matter for a rancher in Rapid City or a tech worker in Aberdeen? It means these plans are now strictly "bridge" insurance. If you try to use short term health insurance South Dakota to cover a year-long gap, you're going to find yourself uninsured and scrambling at the 120-day mark. The South Dakota Division of Insurance follows these federal guidelines closely. They don't want residents getting stuck with "junk insurance" that disappears right when a chronic condition develops.

It's about risk. These plans are medically underwritten. That is a fancy way of saying the insurance company can look at your medical history and say, "No thanks."

If you have cancer, diabetes, or even certain structural back issues, a short-term provider in the Mount Rushmore State will likely deny your application. This is the polar opposite of the Affordable Care Act (ACA), where pre-existing conditions don't matter. With short-term coverage, your history is everything.

🔗 Read more: No Alcohol 6 Weeks: The Brutally Honest Truth About What Actually Changes

What Actually Gets Covered (and What Doesn't)

Don't expect the world. Seriously.

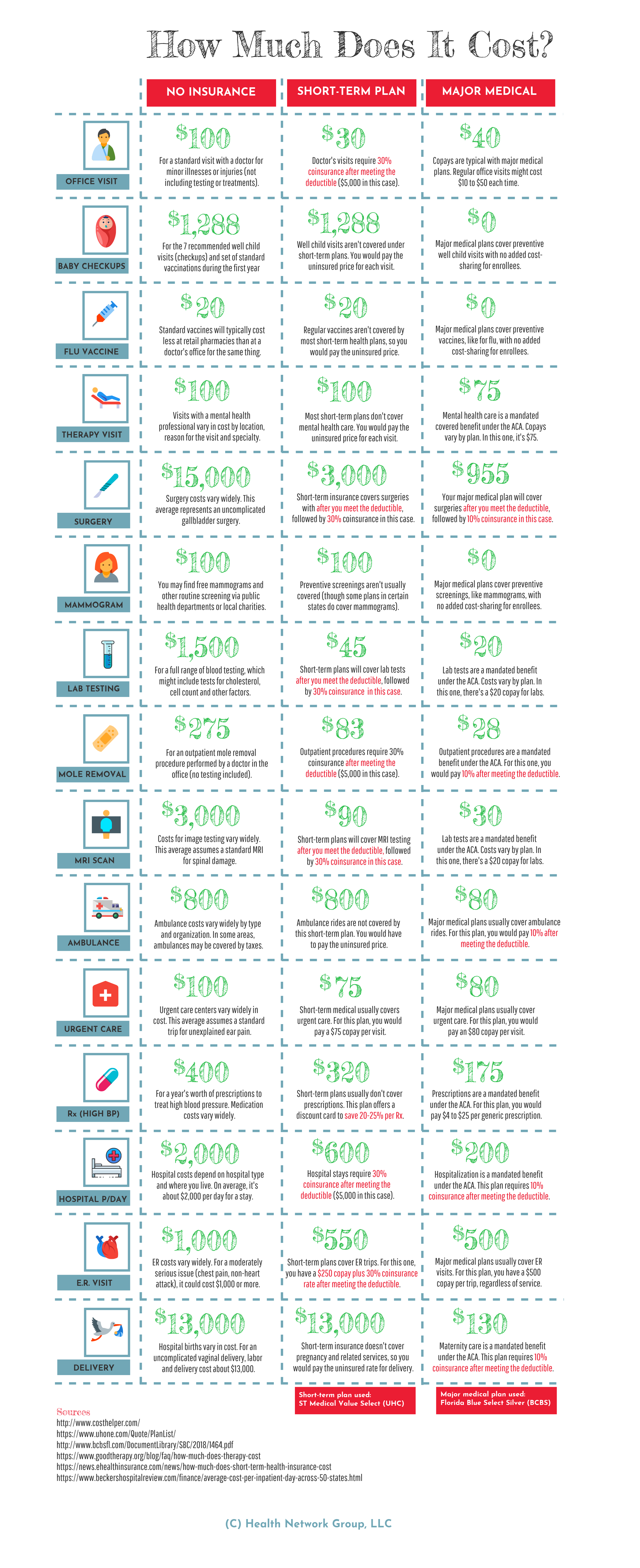

Short-term plans are designed for catastrophes. If you get into a wreck on I-90 or appendicitis hits out of nowhere, these plans are a lifesaver. They keep you from filing for bankruptcy over a $50,000 hospital bill. However, they are notoriously stingy with the "everyday" stuff.

- Prescription Drugs: Many plans won't cover them unless you're physically in a hospital bed. That monthly asthma inhaler? You're probably paying out of pocket.

- Maternity: Almost never covered. If you're planning on growing your family, stay far away from short-term options.

- Mental Health: Coverage is spotty at best. Some plans offer it; many don't.

I've talked to folks who thought their $150-a-month premium was a steal until they realized it didn't cover their basic blood work or a simple doctor's visit for a sinus infection. You have to read the fine print. Look for the "Summary of Benefits." If it doesn't explicitly say it covers a service, it probably doesn't.

The Cost Factor in South Dakota

South Dakota is an expensive state for healthcare. We have a few massive players—Avera and Sanford—and not a whole lot of competition in the rural stretches. This drives up the cost of care. Consequently, even the premiums for short term health insurance South Dakota have crept up.

You might pay $100 a month for a plan with a $10,000 deductible. Or you might pay $300 for a $2,500 deductible.

But here is the kicker: the deductible is often "per term," not per year. If you have a three-month plan and you get sick in month two, you pay your deductible. If you then start a new three-month plan and get sick again, you start at zero. Your deductible "resets." That is a brutal financial reality that catches people off guard.

Who Is This Actually For?

It’s for the "In-Betweeners."

💡 You might also like: The Human Heart: Why We Get So Much Wrong About How It Works

- The Job Hopper: You left a job with benefits and your new company has a 90-day waiting period.

- The New Resident: You just moved to Brookings and missed the Special Enrollment Period for the ACA.

- The Young Invincible: You’re 26, off your parents' plan, healthy as a horse, and just need a "safety net" while you freelance.

If you fall outside these categories, you’re playing a dangerous game. For instance, if you’re trying to save money but you have a chronic condition like Crohn's disease, the insurer will likely find out. They practice "post-claims underwriting" sometimes. This means they might wait until you submit a big claim, then dig through your records to find a reason to deny it based on a pre-existing condition you didn't disclose or didn't know you had.

It’s a bit cutthroat.

The Alternative Nobody Looks At

People often jump to short-term plans because they think they missed the Open Enrollment deadline (which usually runs Nov 1 to Jan 15). But South Dakota expanded Medicaid. If your income is below a certain threshold—roughly $20,000 for an individual—you might qualify for South Dakota Medicaid. It's free or very low cost, and it covers way more than a short-term plan ever will.

Then there are Special Enrollment Periods (SEPs). Did you get married? Have a baby? Lose other coverage? Move? You might have 60 days to get a "real" ACA plan that covers everything. Check HealthCare.gov before you sign your life away to a short-term carrier.

Honestly, the "savings" of a short-term plan disappear the moment you need a specialist.

Navigating the Providers in SD

You won't find every big-name company selling these in South Dakota. Companies like UnitedHealthcare (through Golden Rule) or Pivot Health are common players in the state. Each has its own network.

Network matters.

📖 Related: Ankle Stretches for Runners: What Most People Get Wrong About Mobility

If you live in Sioux Falls, you need to know if the plan plays nice with Avera or Sanford. If you’re out in the Black Hills, check if Monument Health is in-network. Getting "out-of-network" care on a short-term plan is basically the same as having no insurance at all in many cases. The "discounted rate" disappears, and you're stuck with the "sticker price" of the hospital.

Critical Next Steps for South Dakotans

If you've decided that a short-term plan is your only viable bridge, don't just click the first ad you see on Google.

First, verify the "Look-Back" period. This is the window of time the insurer will check for pre-existing conditions. In South Dakota, this is usually five years. If you've been treated for a condition in the last five years, it won't be covered. Period.

Second, check the "Max Out-of-Pocket." Some plans have a deductible but no "ceiling" on your coinsurance. You want a plan that has a hard limit on how much you can lose in a worst-case scenario. If the max out-of-pocket is $20,000, ask yourself: Do I actually have $20,000 in the bank? If the answer is no, the insurance isn't doing its job of protecting your assets.

Third, look at the "End Date" carefully. Remember the four-month rule. If your plan ends and you haven't found a permanent solution, you cannot just renew the same plan. You'll have to apply for a different one, and any health issue that cropped up during the first four months will now be considered a "pre-existing condition" for the second plan. It's a "one and done" system now.

Finally, consult the South Dakota Division of Insurance website. They maintain a list of licensed agents and companies. If a company isn't on that list, they shouldn't be selling to you. Avoid the "health sharing ministries" that often masquerade as insurance; they aren't legally required to pay your claims at all.

Short-term insurance isn't a "set it and forget it" solution. It is a temporary bridge. Treat it like a spare tire: it gets you to the shop, but you shouldn't be driving on the highway with it for six months. Stay informed, read every line of that policy, and keep your eyes on the next Open Enrollment period.