You're between jobs. Or maybe you're a freelancer in Kansas City tired of seeing half your paycheck vanish into a Marketplace premium that costs more than your mortgage. Whatever the reason, you're looking at short term health insurance Missouri options. But here is the thing: if you haven't looked at these plans in the last few months, almost everything you thought you knew is probably wrong.

Federal regulators basically flipped the script in mid-2024. Before, you could string these plans together for years. Now? You're looking at a very different animal. It’s shorter. It’s stricter. Honestly, it’s a bit of a headache if you don't know the new math.

The 2024 Rule Change That Actually Matters

For a long time, Missouri was pretty "wild west" with short-term plans. You could get a 364-day policy and renew it until it basically felt like permanent coverage. The Biden-Harris administration changed that with a final rule that took full effect for new policies sold after September 1, 2024.

Now, "short term" actually means short term.

Policies are now capped at an initial term of just three months. You can technically extend it, but the total duration cannot exceed four months in a 12-month period with the same insurer. This wasn't just some random bureaucratic tweak. It was designed to stop people from accidentally buying "junk insurance" when they thought they were getting full coverage. If you’re in St. Louis or Springfield trying to bridge a gap, you need to realize that the bridge just got a lot shorter.

What This Insurance Is (and Definitely Isn't)

Let’s be real. Short-term plans are cheap for a reason. They don't have to follow the Affordable Care Act (ACA) rules.

They can—and usually will—ask about your medical history. If you have asthma, diabetes, or even high blood pressure, an insurer in the Show-Me State can straight-up deny you. Or they’ll take your money but won't cover anything related to those "pre-existing conditions."

It’s a gamble.

📖 Related: The Human Heart: Why We Get So Much Wrong About How It Works

You’re basically buying a catastrophic safety net. It’s for the "oh no, I broke my leg at Johnson's Shut-Ins" moments, not for your monthly maintenance meds or your annual check-up. Most of these plans won't cover maternity care, mental health services, or even prescription drugs in some cases. You have to read the fine print like a hawk. Seriously.

The Cost Factor

Why do Missourians keep buying them if they're so limited? Price.

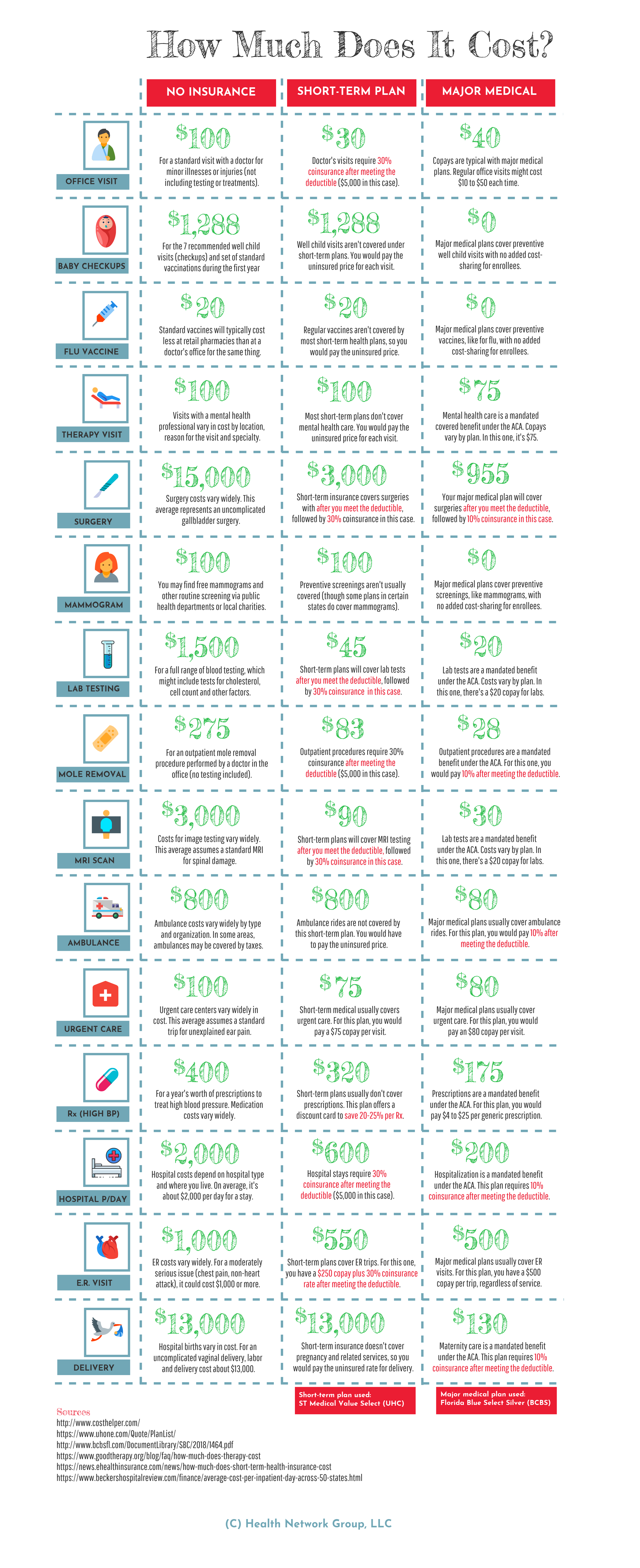

A monthly premium for a young, healthy person in Columbia might be $80 for a short-term plan, while the cheapest Bronze plan on the ACA exchange could be $350 or more without a subsidy. If you’re someone who doesn't qualify for those hefty government subsidies (the Advanced Premium Tax Credits), that price difference is huge.

But you have to account for the "hidden" costs:

- Deductibles: Often $5,000 to $10,000.

- Out-of-pocket max: Sometimes non-existent or incredibly high.

- Coverage caps: They might only pay out $100,000 or $1 million over the life of the policy. In a major ICU stay, $100,000 vanishes in about three days.

Missouri Specifics: The MO Department of Commerce and Insurance

Missouri's state regulators generally follow the federal lead, but they do provide some oversight through the Department of Commerce and Insurance (DCI). While some states like California or New York have effectively banned these plans, Missouri still allows them.

The DCI hasn't added extra restrictions beyond the federal four-month cap, meaning the market is still active here. Major players like UnitedHealthcare (through Golden Rule) or Pivot Health often show up in Missouri searches.

One thing you should know: these plans are not "Minimum Essential Coverage." That phrase used to matter more when the individual mandate penalty was active. Now, the main risk isn't a tax penalty; it’s the fact that if you get sick on a short-term plan, you can’t just jump over to a "real" ACA plan until the next Open Enrollment period in November—unless you have a qualifying life event.

👉 See also: Ankle Stretches for Runners: What Most People Get Wrong About Mobility

And here is the kicker: losing your short-term coverage because it reached its time limit does not count as a qualifying life event. You could be left totally uninsured for months.

Who Should Actually Consider This?

Honestly, the list is pretty small now.

- The New Employee: You just started a job in Jefferson City. Your benefits don't kick in for 60 days. You're healthy and just need a "safety net" so a car accident doesn't bankrupt you.

- The Recent Grad: You just walked across the stage at Mizzou. You’re off your parents' plan but haven't landed the "big" job yet.

- The Missed-the-Window Crowd: You forgot to sign up for ACA coverage in December. You don't have a special enrollment period. You're basically praying nothing happens until next year.

If you fall into these categories, short term health insurance Missouri serves its purpose. It’s a temporary band-aid.

Red Flags to Watch For

Don't buy the first thing that pops up on a Google ad. There are a lot of "health share" plans and "limited indemnity" plans that masquerade as short-term insurance. They aren't the same.

Limited indemnity plans pay you a fixed amount—like $100 for a doctor visit. If the visit costs $300, you’re on the hook for the rest. They don't care about your total bills. They just cut a small check.

Always look for the "Disclosure of Rights" in the policy documents. Federal law now requires these plans to have a giant, bold notice at the top of the application and the first page of the policy. It basically says, "This is not comprehensive insurance." If you don't see that warning, you might be looking at a scam or a very poorly regulated product.

How to Navigate the Choice

Check the network. This is where people get burned in rural Missouri. If you're in a spot like West Plains or Kirksville, make sure there are actually doctors in that plan's network nearby. Short-term plans often use smaller networks than the big-name Blue Cross Blue Shield plans you might be used to.

✨ Don't miss: Can DayQuil Be Taken At Night: What Happens If You Skip NyQuil

Also, look at the "Coinsurance." Even after you hit that massive $5,000 deductible, the plan might only pay 80% of the costs. You’re still paying 20% of a hospital bill that could easily hit six figures.

Actionable Steps for Missouri Residents

If you're currently shopping, don't just guess.

First, go to HealthCare.gov and put in your zip code and estimated income. With the current subsidies from the Inflation Reduction Act (which have been extended), you might find that a "real" Silver or Gold plan is actually cheaper than a short-term plan. This is especially true if your income is under 400% of the Federal Poverty Level.

Second, if you still decide on a short-term plan, verify the company through the Missouri DCI website. Make sure they are licensed to sell in the state.

Third, get a "start" and "end" date in writing. Since you can only have these plans for four months total, you need a plan for what happens on day 121. Mark your calendar. If your short-term coverage ends in July, and Open Enrollment isn't until November, you are in a danger zone.

Finally, compare at least three different quotes. Don't give your phone number to "aggregator" sites unless you want 500 phone calls from brokers in ten minutes. Go directly to the carrier sites or use a trusted local Missouri agent who can show you both Marketplace and short-term options side-by-side.

Understand that these plans are a tool, not a solution. They are the "spare tire" of the insurance world. You shouldn't drive on a spare tire for 500 miles, and you shouldn't rely on short-term insurance for your long-term health.

What To Do Right Now

- Check your eligibility for Medicaid (MO HealthNet) if your income is low; Missouri expanded Medicaid, so more people qualify now than a few years ago.

- Calculate the "Total Cost of Care"—add the premium plus the deductible. If that number is higher than your savings account, the plan isn't actually protecting you.

- Read the exclusions list for words like "Sports Injuries," "Self-Inflicted," or "Pre-existing." You'll be surprised what they won't pay for.