Let’s be real for a second. If you’re looking into short term health insurance AZ, you’re probably in a bit of a scramble. Maybe you just quit a job that sucked, or you're waiting for your new company's benefits to kick in, or perhaps you missed the Open Enrollment window and now you're staring at a potential tax penalty—except, wait, there isn't a federal penalty anymore. See? Things get confusing fast.

Arizona is a bit of a "Wild West" when it comes to these plans. Unlike states like California or New York that have basically banned short-term medical plans, Arizona has leaned into them. But that doesn’t mean they’re a magic bullet. They are basically financial "duct tape." They hold things together for a while, but you wouldn't use them to build a permanent foundation for your life.

The 2024 Rule Change That Flipped the Script

We have to talk about the elephant in the room. The federal government recently changed the rules on how long these plans can actually last. If you were looking at short term health insurance AZ a couple of years ago, you could find plans that lasted nearly three years.

Not anymore.

As of September 2024, new federal regulations capped the initial term of these plans at just three months. You can renew them for a total of four months, but that’s the hard limit. If you see a website promising you a "12-month short-term plan" in Phoenix or Tucson today, they are either selling you an old product or a "fixed indemnity" plan, which is a totally different beast. Honesty is key here: these plans are now truly short-term. They are for the "gap." They are for the "in-between."

Why People in Arizona Actually Buy These

Arizona’s self-employed population is booming. From Scottsdale freelancers to contractors in Mesa, people are looking for a way to not go bankrupt if they trip over a Gila monster and break an arm.

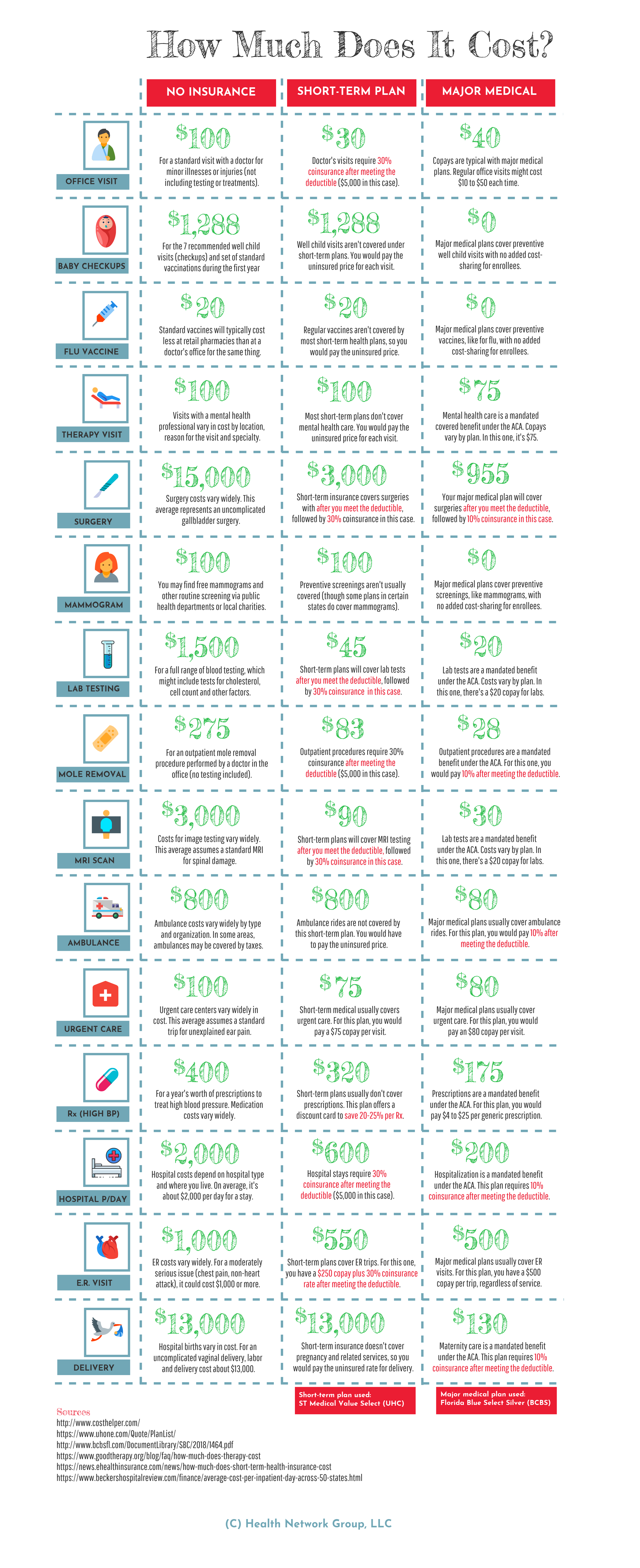

The price tag is the biggest draw. You might see a short-term plan for $80 a month while an ACA-compliant "Bronze" plan on the marketplace is $400. That is a massive difference. But—and this is a big "but"—you get what you pay for. These plans are cheap because they don't cover everything. They aren't required to cover maternity care, mental health, or prescription drugs in the same way your "regular" insurance does.

If you have a pre-existing condition, stop reading right now. Seriously.

Short-term plans in Arizona use medical underwriting. This means they will ask you questions. "Do you have cancer?" "Have you been treated for diabetes?" If the answer is yes, they can—and probably will—deny you coverage or simply refuse to pay for anything related to those conditions. It’s brutal, but that’s the trade-off for the low premium.

🔗 Read more: Exercises to Get Big Boobs: What Actually Works and the Anatomy Most People Ignore

Navigating the Arizona Providers

In the Arizona market, you’ll mostly see names like UnitedHealthcare (through Golden Rule Insurance Company), Pivot Health, and Everest. They all play in the same sandbox.

UnitedHealthcare is the big dog in AZ. They have a massive network. If you’re in a rural spot like Kingman or Sierra Vista, network matters. You don't want to buy a plan and then realize the only doctor who accepts it is a three-hour drive away in Tempe.

Pivot Health is often a bit more "tech-forward." They make it easy to sign up on your phone while you’re waiting for your Dutch Bros coffee. But again, read the fine print. Arizona’s Department of Insurance and Financial Institutions (DIFI) monitors these companies, but they don't hand-hold you through the policy. You have to be your own detective.

The "Gap" Reality

Let’s look at a real-world scenario. You’re 28. You just moved to Flagstaff for a new gig that starts in 60 days. You’re healthy. You mountain bike every weekend.

For you, short term health insurance AZ makes total sense. You just need "catastrophic" protection. If you wipe out on a trail and end up in the ER, you don't want a $50,000 bill. A short-term plan will likely cover that ER visit after you meet your deductible (which will probably be high, like $5,000 or $10,000).

Compare that to someone who is 55 and takes blood pressure medication. For that person, a short-term plan is a minefield. The insurer might label the high blood pressure as a pre-existing condition and deny any claims related to a stroke or heart attack. That’s the nuance people miss.

How to Not Get Scammed

The internet is full of "lead generation" sites. You type in your phone number looking for a quote and suddenly 40 different agents from Florida are calling you at dinner time.

To avoid this, go directly to the carrier websites or use a licensed Arizona broker who has a physical office you can visit. Look for the "Summary of Benefits and Coverage." If a plan doesn't provide one, run.

💡 You might also like: Products With Red 40: What Most People Get Wrong

Also, watch out for "Association Plans." Sometimes you’ll be told you’re joining a "Small Business Association" to get insurance. Often, these are just ways to skirt around state regulations. They might be fine, but they aren't traditional short term health insurance AZ and they often have even fewer protections.

The Fine Print You’ll Probably Skip (But Shouldn’t)

Most people focus on the monthly premium. That's a mistake.

Look at the "out-of-pocket maximum." On some AZ short-term plans, this can be as high as $20,000. If you have a major accident, you are on the hook for that twenty grand before the insurance company pays the rest.

Then there's the "per-period maximum." Some plans might only pay out $100,000 or $250,000 for the entire time you're covered. In the world of modern medicine, $100,000 is about three days in the ICU. It goes fast.

Is it Better Than Nothing?

Usually, yes.

Going uninsured is a massive gamble. Arizona hospitals are required to stabilize you in an emergency, but they aren't required to do it for free. They will send you the bill. And they will collect.

Having a short-term plan means you have a contract. You have a negotiated rate. Even if the insurance company only pays a portion, the "contracted rate" they have with the hospital is often 50% lower than the "sticker price" you’d pay as an uninsured person.

Arizona Specifics: The Heat and The Health

It sounds weird, but the environment in Arizona matters for insurance. We have high rates of skin cancer and respiratory issues due to dust (looking at you, Valley Fever).

📖 Related: Why Sometimes You Just Need a Hug: The Real Science of Physical Touch

Most short term health insurance AZ plans will treat Valley Fever as a new illness if you contract it while on the plan. But if you've had it before? Pre-existing. Denied.

This is why these plans are for the healthy and the temporary.

Making the Choice

If you are currently between jobs or waiting for the next Open Enrollment, you have a few options:

- COBRA: It’s expensive but it’s the exact same coverage you had at your old job.

- ACA Marketplace: If you lost your job recently, you qualify for a Special Enrollment Period. This is almost always better than a short-term plan if you have health issues.

- Short-Term Medical: Use this if you are healthy, the Marketplace is too expensive, and you only need coverage for 30-90 days.

Honestly, the "best" plan is the one that doesn't leave you bankrupt. For a healthy 24-year-old in Tucson, that might be a $90 short-term plan. For a family of four in Gilbert, it’s almost certainly an ACA plan with a subsidy.

Actionable Steps to Take Right Now

Stop scrolling and do these three things if you're considering a short-term option in the Grand Canyon State.

First, check your "Special Enrollment" eligibility. Go to Healthcare.gov and see if your job loss or move qualifies you. If it does, you can get "real" insurance that covers pre-existing conditions and prescriptions. Do this first because the window is usually only 60 days from your "qualifying event."

Second, if you decide to go the short-term route, calculate your total exposure. Add the premium for four months to the deductible and the out-of-pocket maximum. That is your "worst-case scenario" number. If that number is $25,000 and you don't have $25,000, you need to look at a plan with a lower deductible, even if the monthly cost is higher.

Third, verify the network. Call your favorite doctor's office in Phoenix or Flagstaff and ask: "Do you accept the UnitedHealthcare Choice Plus network for short-term plans?" Don't trust the insurance company's website; they are notoriously out of date. Talk to the person at the front desk. They know which cards get rejected and which ones don't.

Lastly, set a calendar reminder for the day your plan expires. Because these plans no longer auto-renew beyond that four-month total, you could easily find yourself with zero coverage on day 121 if you aren't paying attention.

Short-term plans are a tool. They are a hammer, not a house. Use them to hit the nail you need to hit right now, then put them away and find something permanent as soon as you can.