Finding a doctor in Phoenix shouldn't feel like a high-stakes poker game where the house always wins. Yet, for thousands of Arizonans sitting in that awkward gap between jobs or waiting for open enrollment, that's exactly what it feels like. You're healthy. You just need a safety net. But the terminology—deductibles, coinsurance, "non-renewals"—is enough to make anyone want to just hide under the covers and hope they don't trip on the rug.

Honestly, short term health insurance Arizona is one of the most misunderstood financial tools in the Grand Canyon State. It’s not "fake" insurance, but it’s definitely not a Cadillac plan from a Fortune 500 employer either. It is a bridge. A temporary, sometimes frustrating, but often necessary bridge.

If you’re currently scrolling through options because you missed the November deadline or your COBRA premiums cost more than your mortgage, you have to be careful. The rules changed recently. The federal government stepped in, and what used to be a 364-day plan is now a much shorter leash.

Why Arizona’s Short Term Market Changed in 2024 and 2025

For a long time, Arizona was the Wild West of limited-duration plans. You could string together almost three years of coverage if you played your cards right. Not anymore.

Thanks to a final rule issued by the Biden-Harris administration that took full effect for policies sold or issued after September 1, 2024, "short term" actually means short term again. We’re talking about an initial contract term of no more than three months. Even with renewals, the total duration cannot exceed four months.

This is a massive shift for people in Mesa or Tucson who used these plans as a permanent, cheap alternative to the Affordable Care Act (ACA).

Why did they do this? Essentially, the Department of Health and Human Services (HHS) grew tired of "junk plans" confusing consumers. They wanted to make sure people weren't surprised when a plan didn't cover their chemotherapy or a pregnancy. These plans are now legally required to include a "Notice to Consumers" in prominent print. It basically says: This is not comprehensive coverage. Read the fine print or prepare for a headache.

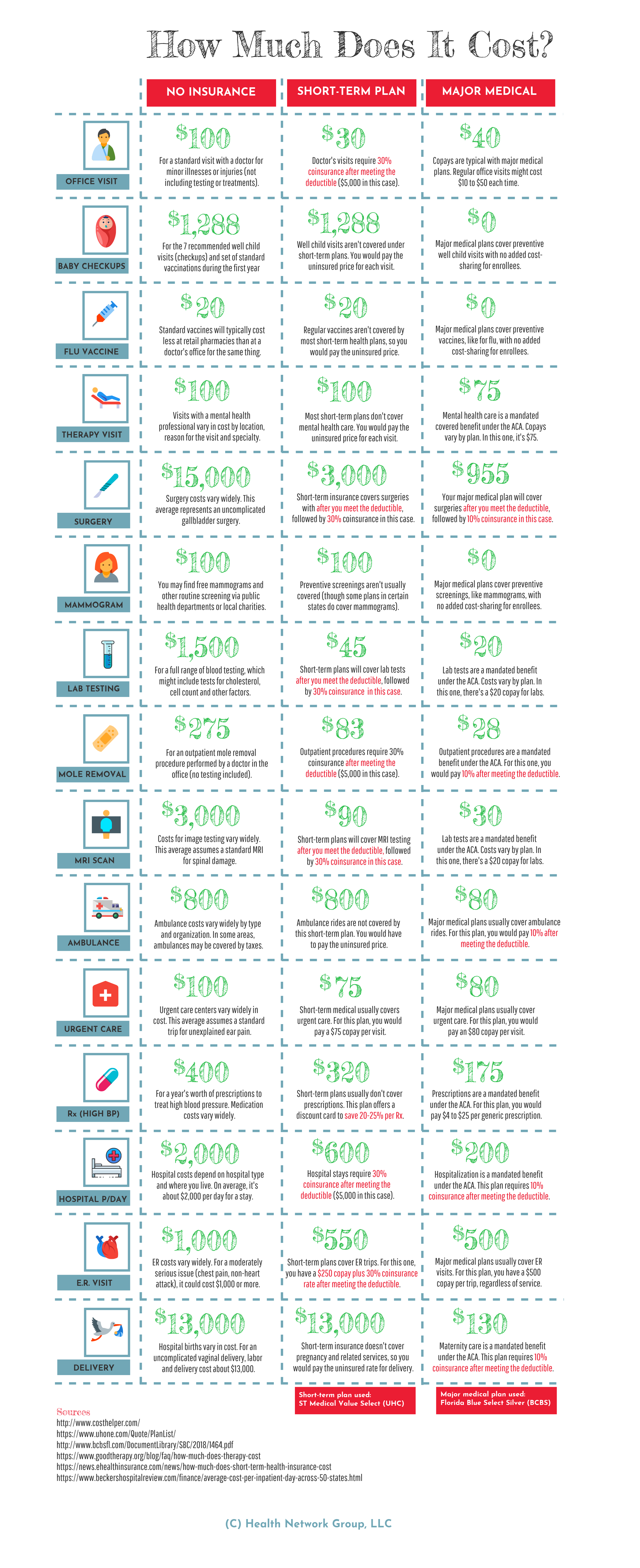

The Trade-off: Price vs. Protection

It’s cheap. That’s the lure.

You might see a premium for $80 a month while an ACA plan is $450. But here is the kicker: short term health insurance Arizona providers can—and will—deny you for pre-existing conditions. If you have asthma, a history of cancer, or even certain types of chronic back pain, they can look at your medical records and say "no thanks."

In contrast, an ACA plan (Obamacare) must take you. It’s guaranteed issue. Short-term plans use medical underwriting. They ask questions. They dig. If you lie on the application and they find out later, they can rescind the policy entirely. It’s brutal, but it’s the reality of the private, non-ACA market.

✨ Don't miss: Egg Supplement Facts: Why Powdered Yolks Are Actually Taking Over

What These Plans Actually Cover (and What They Definitely Don't)

Imagine you’re hiking Camelback Mountain. You slip. You break an ankle.

A short-term plan is great for that. It’s designed for the "broken arm" scenarios—emergency room visits, sudden appendicitis, or a freak bout of pneumonia. It’s catastrophic coverage in its purest form.

But if you’re looking for a plan to cover your monthly insulin, your therapist, or your annual OB-GYN exam, you’re looking in the wrong place. Most of these plans exclude:

- Maternity care: Almost 100% of the time, pregnancy is not covered.

- Mental health services: Rarely included in the basic packages.

- Prescription drugs: Some offer a discount card, but few actually pay for the meds at the pharmacy counter.

- Pre-existing conditions: This is the big one. If you had the condition before the policy started, don't expect a dime.

There’s also the "look-back period." In Arizona, insurers typically look back five years. If you received treatment, advice, or even showed symptoms of a condition in that window, they can classify it as pre-existing. It’s a narrow tightrope to walk.

Arizona-Specific Considerations

Arizona has a unique demographic. We have a lot of "snowbirds" and a massive population of gig workers or 1099 contractors in the tech corridors of Chandler and Scottsdale.

If you’re a digital nomad just passing through, a short-term plan makes total sense. You’re only here for 90 days? Perfect. That fits the new federal guidelines like a glove.

However, if you’re a long-term resident, you need to be aware that once that four-month limit hits, you can’t just buy the same plan again from the same company. The law prevents "stacking" or "rolling over" these policies to circumvent the duration limits. You’d have to find a completely different insurance carrier, and you’d have to go through medical underwriting all over again.

What happens if you got sick during those first four months? The new company will see that as a pre-existing condition and deny you. It’s a dangerous cycle.

Comparing the Big Players in the Arizona Market

You’ll mostly see names like UnitedHealthcare (Golden Rule), Pivot Health, and Everest.

🔗 Read more: Is Tap Water Okay to Drink? The Messy Truth About Your Kitchen Faucet

UnitedHealthcare is the 800-pound gorilla. They have a massive network in Arizona, which matters because "out-of-network" costs on a short-term plan can bankrupt you. If you go to a Banner Health facility but your plan only likes HonorHealth, you’re going to be writing some very large checks.

Pivot Health is often a bit more flexible with their plan designs, offering "economical" tiers that are basically just for "if I get hit by a bus" scenarios.

Wait, what about the "Broker" factor?

In places like Gilbert or Peoria, you’ll see local insurance offices everywhere. It is almost always better to talk to a local broker than to buy a plan from a random pop-up ad on social media. Why? Because a broker knows which companies are currently fighting claims in Arizona and which ones are actually paying out.

They also won't charge you a fee—the insurance company pays them.

The "Gap" Strategy: When Does This Make Sense?

Let's get practical. There are exactly four times when short term health insurance Arizona is actually a smart move:

- The New Job Wait: You started a great job at a firm in downtown Phoenix, but your benefits don't kick in for 90 days. You need a bridge.

- Aging off Parents' Vision: You just turned 26. You’re healthy. You’re freelancing. You missed the special enrollment window for the Marketplace.

- Moving States: You just moved from California to Scottsdale. You need something while you set up your new life.

- The COBRA Escape: COBRA is $1,800 a month. You’re a triathlete with zero health issues. You just need a "stop-loss" so a car accident doesn't ruin your life.

If you fall into these categories, short-term is a lifesaver. It keeps you from having a "lapse in coverage," which is a red flag for future insurers and can sometimes affect your ability to get certain types of life insurance or disability benefits later.

A Warning About "Association" Plans

Sometimes, you’ll be offered a plan through a "Health Excellence Association" or some other fancy-sounding group. Be wary. These often skirt the lines of traditional insurance regulations. They might be "Health Sharing Ministries" (which are not insurance at all) or "Fixed Indemnity" plans.

A fixed indemnity plan doesn't pay your doctor; it pays you. If you stay in the hospital, it might pay you $500 a day. But if the hospital bill is $5,000 a day, you’re still on the hook for the other $4,500. Don't mistake indemnity for actual short-term medical coverage. They are different beasts.

💡 You might also like: The Stanford Prison Experiment Unlocking the Truth: What Most People Get Wrong

Navigating the Costs: It’s Not Just the Premium

When people search for short term health insurance Arizona, they usually sort by "lowest price." This is a mistake.

Look at the Maximum Out of Pocket (MOOP).

On a standard ACA plan, the MOOP is capped by federal law (usually around $9,200 for an individual in 2024/2025). On a short-term plan, there is no cap. Well, there's a cap per term, but you have to read the contract. Some plans have a $10,000 deductible but only pay $50,000 total for the whole three months. If you have a $200,000 heart attack, that plan covers 25% and leaves you with a $150,000 bill.

Check the "Per-Period Maximum." A "good" short-term plan in Arizona should have at least a $1 million or $2 million lifetime/term limit. Anything less is honestly gambling with your future.

How to Apply Without Getting Scammed

The Arizona Department of Insurance (DIFI) monitors these companies, but they can't catch everyone. Here is the move:

Go to the official website of a major carrier or use a reputable aggregator like HealthCare.gov first. Wait—HealthCare.gov won't sell you short-term plans. It will only show you ACA plans. To find the short-term stuff, you have to go to private marketplaces or carrier sites directly.

- Step 1: Check if you qualify for a Special Enrollment Period (SEP) on the ACA Marketplace. Losing a job, moving, or getting married all count. If you can get an ACA plan with a subsidy, it will almost always be better than a short-term plan.

- Step 2: If you don't qualify for an SEP and it’s outside of Open Enrollment (Nov 1 - Jan 15), then look at short-term.

- Step 3: Use a throwaway email address or a secondary Google Voice number. The moment you put your real info into a "Get a Quote" site, your phone will ring 40 times in 10 minutes.

- Step 4: Ask for the "Summary of Benefits and Coverage" (SBC). If they can't or won't provide it before you pay, run away.

Real Talk on the "Network"

Arizona is dominated by a few major health systems: Banner, Dignity Health, Abrazo, and HonorHealth.

Before you click "buy," call your favorite doctor's office. Ask them, "Do you take the UnitedHealthcare Choice network for short-term plans?" Do not ask "Do you take UnitedHealthcare?" They might take the employer version but not the short-term version. There is a difference.

Final Strategy for Arizonans

Short term health insurance Arizona is a specific tool for a specific problem. It is the "spare tire" of the insurance world. You shouldn't drive on a spare tire for 500 miles, and you shouldn't rely on a short-term plan for years.

Actionable Steps:

- Verify the Duration: Ensure the plan you are looking at complies with the new 2024 "3-month initial / 4-month total" rule. If a site offers you a 12-month plan today, they are likely selling you a non-compliant product or an association membership.

- Audit Your Meds: If you take expensive prescriptions, realize they won't be covered. Factor that out-of-pocket cost into your monthly budget.

- Check the Deductible Reset: If you buy a 3-month plan and then have to buy another one, your deductible usually resets. You have to spend that $5,000 all over again.

- Download the App: Most modern carriers like Sidecar Health or Pivot have apps where you can see the "pre-negotiated" price for services in Phoenix or Tucson. Use this to shop around for imaging or labs.

The Arizona healthcare market is shifting. Staying informed means knowing that these plans are getting harder to find and more restricted in their length. Use them to bridge the gap, but keep your eyes on the next Open Enrollment period so you can get back into a comprehensive plan that actually covers your long-term health.