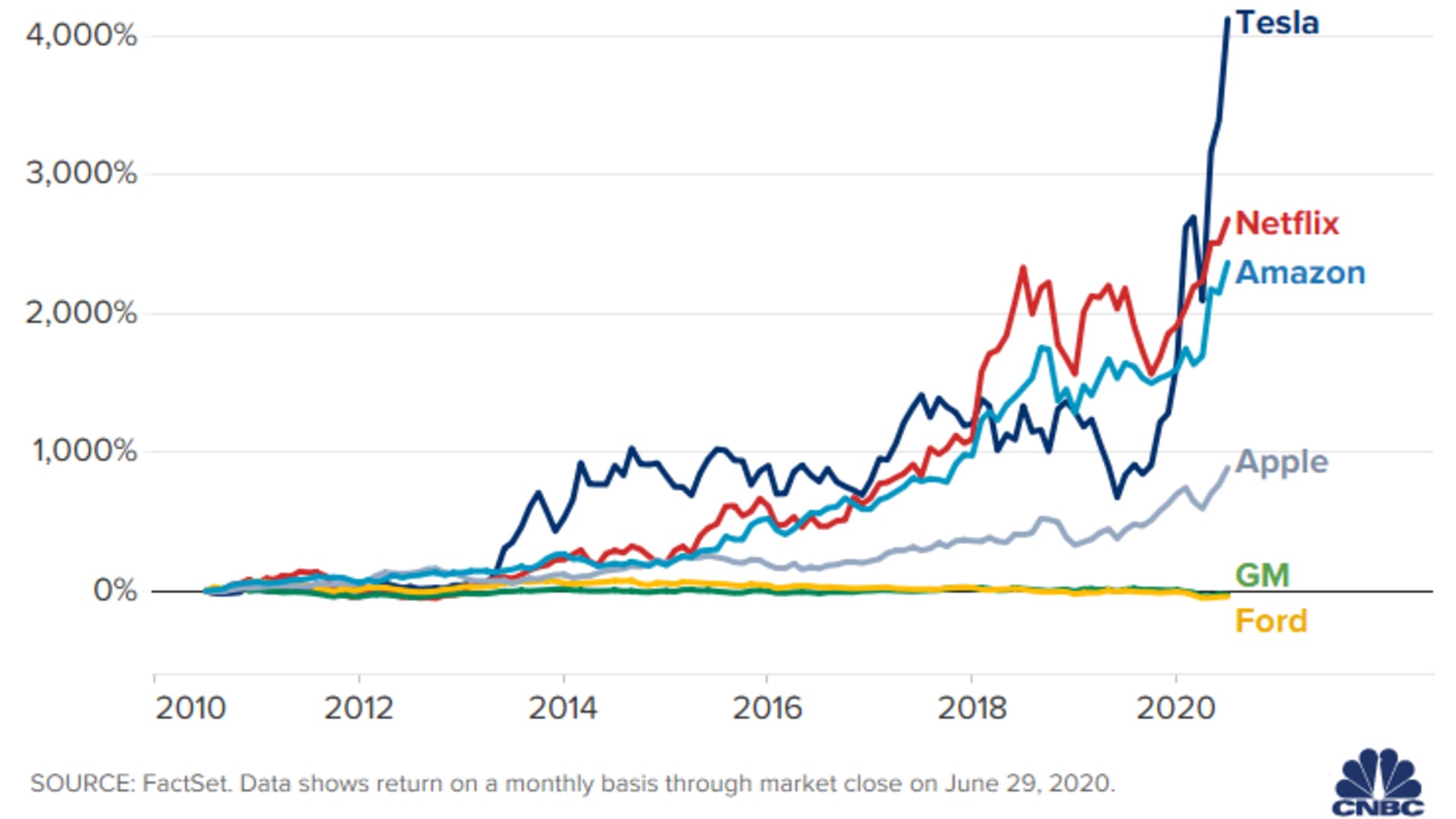

Honestly, trying to track shares of tesla stock lately feels like watching a high-stakes poker game where half the players are bluffing and the other half are counting cards. One day you’re reading about a $3 trillion valuation dream, and the next, a major bank is predicting a 70% crash. It is chaotic.

But if you actually look at the numbers from early 2026, the story isn't just about "Elon Musk did a thing on X." It’s about a company caught in a massive, messy transition from being a car company to whatever "AI and Robotics" actually looks like on a balance sheet.

The Reality Check of 2025 and 2026 Deliveries

Let's be real: the car business has been tough for Tesla recently. Just look at the fresh data. In the fourth quarter of 2025, Tesla delivered 418,227 vehicles. That sounds like a lot until you realize it’s a 16% drop from the same period the year before.

For the full year of 2025, they moved about 1.63 million cars. That is a second consecutive annual decline. You can’t sugarcoat that.

Basically, the "Juniper" Model Y refresh caused some hiccups, and the tax credit changes in the U.S. definitely didn't help. While 2025 saw some record EV sales overall, Tesla’s share of the U.S. market has slipped down toward the 38% to 41% range.

📖 Related: Oil Market News Today: Why Prices Are Crashing Despite Middle East Chaos

If you're holding shares of tesla stock, you've seen the price hover around $446 to $450 in mid-January 2026. It’s a weird spot. The stock is actually up about 7% over the last year, even though car sales are down. Why? Because Wall Street is starting to care less about the cars and more about the "everything else."

The Bulls vs. The Bears: Who's Right?

The divide between analysts right now is wider than a Cybertruck.

On one side, you have Dan Ives over at Wedbush, who is basically the captain of the bull team. He’s out here talking about a $3 trillion valuation by the end of 2026. His theory is that the AI and self-driving software (FSD) part of the business is worth $1 trillion on its own. He expects FSD take-rates to jump massively as the software gets better and moves into China and Europe.

Then there’s Wells Fargo. They are... not as optimistic. They recently bumped their price target slightly to $130, but that is still a massive 70% downside from where we are trading today. Their take? The margins on cars are getting squeezed, deliveries are flatlining, and they think the Robotaxi and Optimus robot are way too far away to justify the current price.

👉 See also: Cuanto son 100 dolares en quetzales: Why the Bank Rate Isn't What You Actually Get

A Quick Look at Current Ratings (January 2026)

- Buy/Strong Buy: 46% of analysts

- Hold: 31% of analysts

- Sell/Strong Sell: 24% of analysts

- Average Price Target: $452.73 (basically where we are now)

It's a "Hold" consensus, which is financial speak for "we have no idea what's going to happen next."

The Optimus and xAI Complication

If you want to understand shares of tesla stock in 2026, you have to look at the "hidden" drama with Optimus.

A lot of the current stock price is baked-in hope for the Optimus humanoid robot. But in early January, reports surfaced that Musk’s private company, xAI, might be the one actually building the "brain" for the robot. This has triggered some nasty breach of fiduciary duty lawsuits.

Shareholders are asking: "Wait, if I own Tesla, do I own the AI, or is Elon going to charge Tesla a licensing fee to use his own private software?" That’s a big deal. If the value of the AI moves from the public company (Tesla) to the private one (xAI), the math for the stock price changes instantly.

✨ Don't miss: Dealing With the IRS San Diego CA Office Without Losing Your Mind

Why 2026 is the "Make or Break" Year

This year is going to be the most important one since the Model 3 ramp-up in 2018.

We are looking at the potential mass production of the Cybercab (the dedicated robotaxi) toward the end of the year. Plus, the "Next Gen" cheaper Tesla model is supposed to start showing up. If Tesla can prove they can build a $25,000 car and make a profit, the "car company" part of the business gets its groove back.

But if deliveries keep sliding and the Robotaxi stays "two years away" (a phrase we've heard since 2016), the floor could drop out.

Actionable Insights for Your Portfolio

So, what do you actually do with this?

First, stop looking at shares of tesla stock as an auto play. It isn't one anymore. It’s a venture capital bet on AI that happens to have a car company attached to it for cash flow.

- Watch the January 28 Earnings Call: This is the big one. We need to hear about the 2026 delivery guidance. If they forecast another decline, expect a rocky February.

- Track FSD Licensing: Keep an eye on any news about other car companies using Tesla’s software. That is the "high margin" dream that would send the stock to the moon.

- Monitor the xAI Lawsuits: If the courts decide Musk is "transferring wealth" to his private companies, it’s a massive red flag for governance.

- Look at the Energy Side: Tesla Energy (the batteries and solar stuff) hit record deployments of 14.2 GWh in Q4 2025. It’s the quietest, most successful part of the company right now.

Basically, if you’re in it for the long haul, you’re betting on the tech. If you’re a swing trader, you’re playing the volatility of the headlines. Just don't expect a boring year.