You’ve probably heard of the 1980s "greed is good" era, but before the Gekkos and the Boeskys took over, there was Saul Steinberg. He was the original wunderkind of Wall Street. Imagine being a millionaire before you’re 30 and a billionaire before 40. That was Saul.

But if you look at Saul Steinberg net worth today, you aren't just looking at a pile of cash; you're looking at a cautionary tale of how fast $600 million—and eventually billions—can vanish when the music stops. He was a man who lived large, raided companies, and owned the most expensive apartment in New York City history at one point. Then, the insurance empire he spent thirty years building, Reliance Group Holdings, didn't just stumble. It imploded.

From $25,000 to a Billion-Dollar Empire

Saul didn't start with much. He borrowed $25,000 from his father to start Leasco, a computer leasing company, in the early 60s. It was a genius move. He realized he could buy IBM mainframes and lease them out cheaper than IBM did by depreciating them over a longer period.

By the time he was 29, he used that leverage to swallow Reliance Insurance, a company ten times the size of his own. That was the blueprint for the modern leveraged buyout. He became the "enfant terrible" of the financial world. He even tried to take over Chemical Bank—the sixth-largest bank in the U.S. at the time—which, honestly, was a move so bold it terrified the "old money" establishment. They fought him off, but the message was clear: Saul was here to play.

The Peak Years of Wealth

During the 80s and 90s, Saul Steinberg net worth was the stuff of legend. He wasn't just wealthy; he was ostentatiously, unapologetically rich. We're talking about:

🔗 Read more: Stock Market Today Hours: Why Timing Your Trade Is Harder Than You Think

- 740 Park Avenue: He owned the triplex penthouse that once belonged to John D. Rockefeller. He bought it for roughly $285,000 in 1971 and eventually sold it to Stephen Schwarzman for somewhere between $35 million and $40 million in 2000.

- The Art Collection: His walls were covered with Old Masters and contemporary greats. When his empire started to crack, he sold off 61 of these paintings for over $50 million.

- The Lifestyle: He and his third wife, Gayfryd, were the king and queen of the New York social scene. They threw parties that cost millions. One birthday party in Quogue featured a "living tableau" of a Flemish painting.

When the Reliance Empire Crumbled

Everything changed around 1999 and 2000. Reliance Group Holdings, the cornerstone of his wealth, started bleeding money. The company had taken on too much debt and underpriced its insurance policies to stay competitive.

By 2001, Reliance filed for bankruptcy. This wasn't just a corporate failure; it was a personal disaster for Saul. He owned about 42% of the company. When the stock crashed from $20 a share to literally pennies (it was trading at around $0.009 at one point), hundreds of millions of dollars in paper wealth evaporated almost overnight.

The fallout was brutal. He was forced to sell the Rockefeller apartment. He sold the art. He even had to sell the family’s English-style country estate in Quogue. Reports at the time suggested he owed more than $41 million in personal loans that were secured by his now-worthless Reliance stock. Banks were calling, and the collateral was gone.

Saul Steinberg Net Worth: The Final Estimates

So, what was he actually worth when he passed away in 2012? It’s complicated.

💡 You might also like: Kimberly Clark Stock Dividend: What Most People Get Wrong

While he was no longer the billionaire who graced the Forbes 400 list, he wasn't exactly "broke" in the way most people understand the word. He still lived in a luxury apartment (albeit a much smaller one than the triplex) and had family trusts. However, compared to the $600 million+ he commanded in the late 80s, his personal net worth had seen a 90% decline.

Estimates of Saul Steinberg net worth at the time of his death generally hover in the low millions, a far cry from the $1.5 billion empire he once sat atop. Most of his remaining assets were tied up in legal battles or used to settle the massive debts left behind by Reliance's liquidation.

The Two Sauls: A Common Confusion

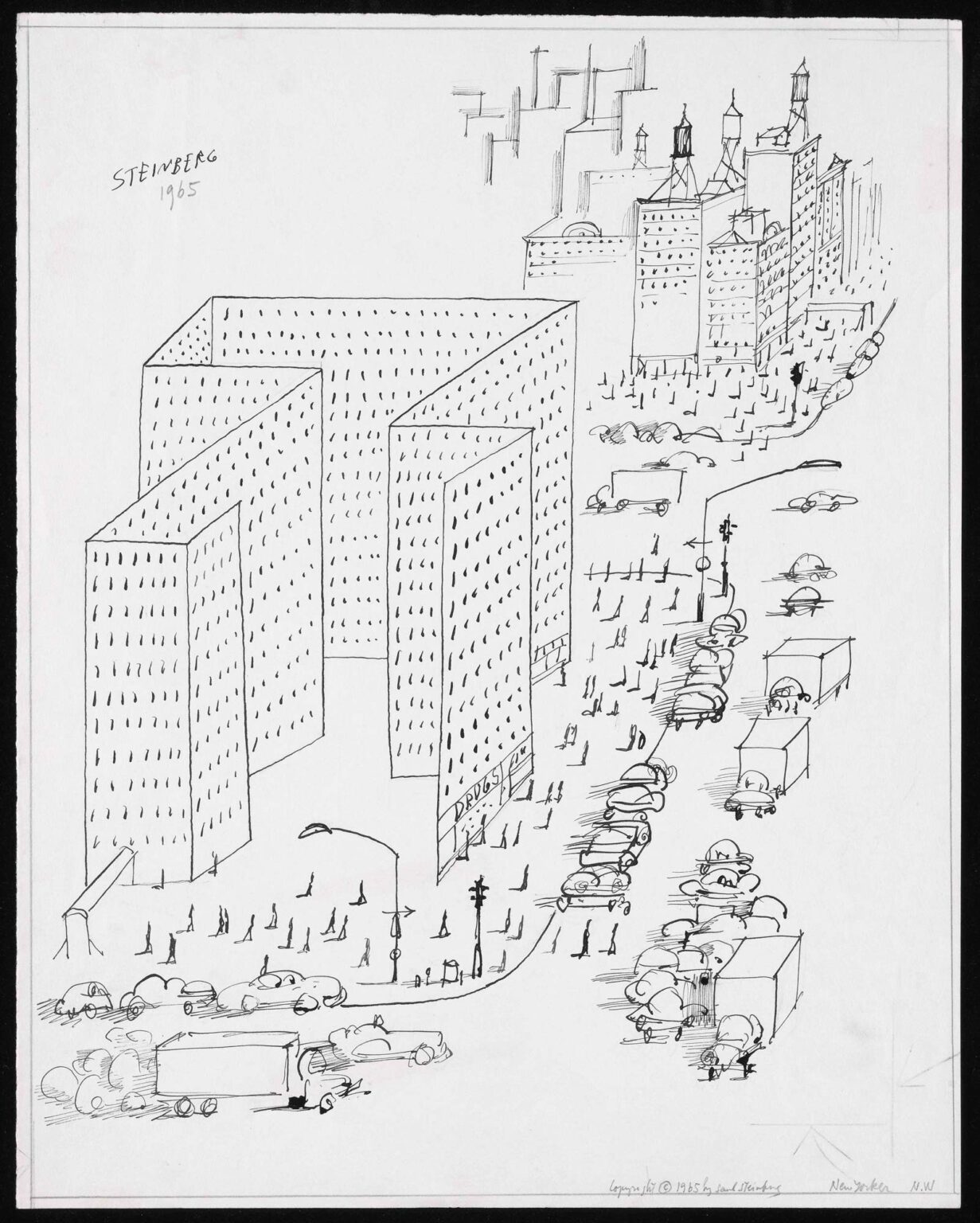

If you’re searching for this, be careful. There are actually two famous Saul Steinbergs.

- The Financier: The one we're talking about here, the corporate raider and insurance mogul.

- The Artist: A famous Romanian-American artist known for The New Yorker covers.

The artist Saul Steinberg died in 1999 and left behind a massive legacy of drawings, but his "net worth" was measured in sketches and influence, not leveraged buyouts and Park Avenue penthouses.

📖 Related: Online Associate's Degree in Business: What Most People Get Wrong

Why Saul’s Story Still Matters in 2026

Looking back, Saul Steinberg was a pioneer of the "greed" era, but he also showed how fragile that kind of wealth is. He relied on leverage—borrowed money—to build everything. When the market turned and the debt became unpayable, the whole house of cards fell.

Actionable Takeaways from the Steinberg Legacy:

- Diversification is Life: Saul’s wealth was almost entirely tied to Reliance. When the company went down, he went down with it. Never keep more than 10-15% of your net worth in a single asset.

- Lifestyle Creep is Dangerous: Even a billionaire can run out of cash if they spend millions on parties and art while their primary business is failing.

- Leverage is a Double-Edged Sword: It makes you rich fast on the way up, but it liquidates you even faster on the way down.

If you're tracking the history of American finance, Saul's name is a permanent fixture. He was the man who showed the world how to buy a giant with its own money—and then showed everyone what happens when you can't pay the bill.

For those looking to understand modern private equity or the risks of high-stakes insurance, studying the rise and fall of Saul Steinberg is basically a requirement. It’s a story of brilliance, ego, and the cold reality of the balance sheet.