You’re looking for the sams club stock price, right? It’s a bit of a trick question. See, if you pull up your E*TRADE or Robinhood app and type in "Sam's Club," you aren't going to find a ticker symbol. Honestly, it’s one of those things that trips up a lot of folks who are new to the market.

Sam’s Club isn’t its own company. It’s a child of the massive Walmart empire. So, when you’re talking about the financial pulse of those giant warehouse aisles, you’re really looking at Walmart Inc. (WMT).

As of January 15, 2026, Walmart's stock closed around $119.20. It’s been a wild ride lately. Just yesterday, the price was hovering near $120.04, seeing a slight dip of about 0.7%. But don't let a one-day red candle fool you—the 52-week high is sitting pretty at **$121.23**. Compare that to the 52-week low of $79.85, and you start to see why people are obsessed with the "Walmart-plus-Sam's" combo right now.

Is Sam's Club Carrying the Team?

Investors are basically using WMT as a proxy for the sams club stock price because Sam’s has become the "cool" younger sibling that’s actually bringing home a massive report card. For a long time, Sam's was just the "other" warehouse club. It was always in the shadow of Costco. But things shifted.

✨ Don't miss: Rough Tax Return Calculator: How to Estimate Your Refund Without Losing Your Mind

In the latest Q3 FY26 earnings (which dropped in November 2025), Sam’s Club U.S. saw net sales of $23.6 billion. That’s a 3.1% jump. If you strip out the volatile gas prices, the "comp sales" (sales at stores open at least a year) were up 3.8%. People are coming in. They're buying.

What’s even crazier? The membership income. It grew 7.1%. That’s pure profit.

The strategy is changing, too. After years of just "optimizing" what they already had, they are finally building again. We're talking 15 new clubs a year. They want to double their sales in the next decade. That's a massive bet on suburban bulk-buying.

🔗 Read more: Replacement Walk In Cooler Doors: What Most People Get Wrong About Efficiency

The Scan & Go Factor

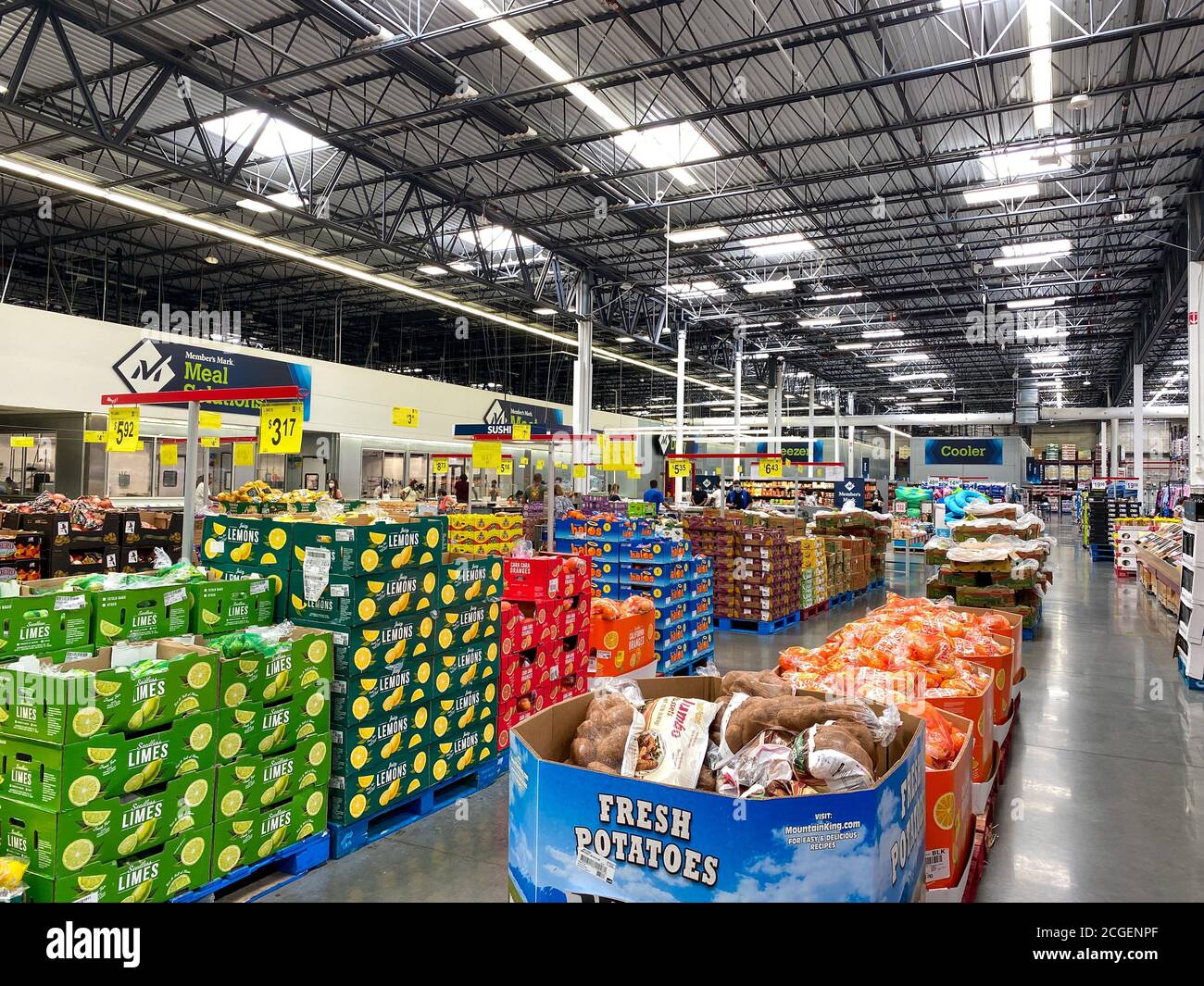

If you’ve been in a Sam’s lately, you know the vibe is different. They’ve gone all-in on tech. Their Scan & Go feature—where you just scan items on your phone and walk out—is a hit. In the Q3 report, Sam’s Club U.S. eCommerce growth hit 22%.

Why does this matter for the stock? Because tech-savvy shoppers are cheaper to serve. No cashiers. No long lines. Just high-margin membership fees and efficient exits.

Why the "Price" Feels Expensive Right Now

Kinda feels like everything is pricey in 2026, doesn't it? WMT stock is currently trading at a P/E ratio of about 41.8. To put that in plain English: investors are paying almost $42 for every $1 of profit the company makes.

💡 You might also like: Share Market Today Closed: Why the Benchmarks Slipped and What You Should Do Now

- Momentum: It’s bullish. The stock is above its 20-day and 100-day moving averages.

- Dividends: It’s not a huge payer, with a yield of roughly 0.79%, but it’s consistent.

- The "Tariff" Problem: There’s a lot of talk about price hikes. In June 2025, reports surfaced that Sam’s had to nudge prices up on certain items because of trade policies. It’s a delicate dance. If they raise prices too much, members might flee to Costco or BJ's.

How to Actually "Track" Sam's Club

Since there's no independent sams club stock price, you have to look at the Walmart 10-Q and 10-K filings. They break Sam's out as its own "segment."

- Look for "Membership and Other Income": This is the heart of the business. If this number goes up, the "Sam's value" within Walmart is rising.

- Monitor the Expansion: Watch for news about the 30 new clubs. If they hit delays, it might drag on the parent company's growth projections.

- Check the Symbol SAM: Warning! Don't get confused. SAM is the ticker for The Boston Beer Company (the Sam Adams folks). It has absolutely nothing to do with the warehouse club. I've seen people make that mistake on forums, and it’s a quick way to lose money.

If you’re looking to invest, you’re buying the whole basket. You get the rural Walmart Supercenters, the international business in China, and the high-growth Sam's Club warehouses. It's a diversification play.

The stock hit all-time highs recently because the market finally realized that Sam's isn't just a grocery store—it's a tech-powered subscription service. With an RSI (Relative Strength Index) of 66.83, it's getting close to "overbought" territory, but it’s not quite there yet.

If you want to play the warehouse wars, keep an eye on February 24, 2026. That’s the next big earnings date. Analysts are looking for an Adjusted EPS of around $2.58 to $2.63 for the full year.

Next Steps for Investors

- Verify the segment data: Download the Walmart Q3 FY26 earnings presentation to see the specific operating income for the Sam's Club division.

- Set a Price Alert: Since the stock is near its all-time high, setting an alert for a 5% pullback (around $113) might offer a better entry point.

- Watch the Competition: Keep an eye on Costco (COST) earnings. Often, these two move in sympathy. If Costco misses, Sam’s (via Walmart) might see a sympathy drop, even if their own numbers are solid.