You just landed a raise. Or maybe a new job in Toronto with a "six-figure" sticker price that made your eyes light up. Then the first Friday rolls around, you open your banking app, and... wait. That's it? Where did the rest go? Honestly, seeing that gap between your gross pay and your net deposit is a rite of passage for every worker in the province. Understanding how a salary tax Ontario calculator actually functions is the only way to stop feeling like the government is playing a trick on you every two weeks.

It’s not just one big "tax." It’s a layer cake of deductions.

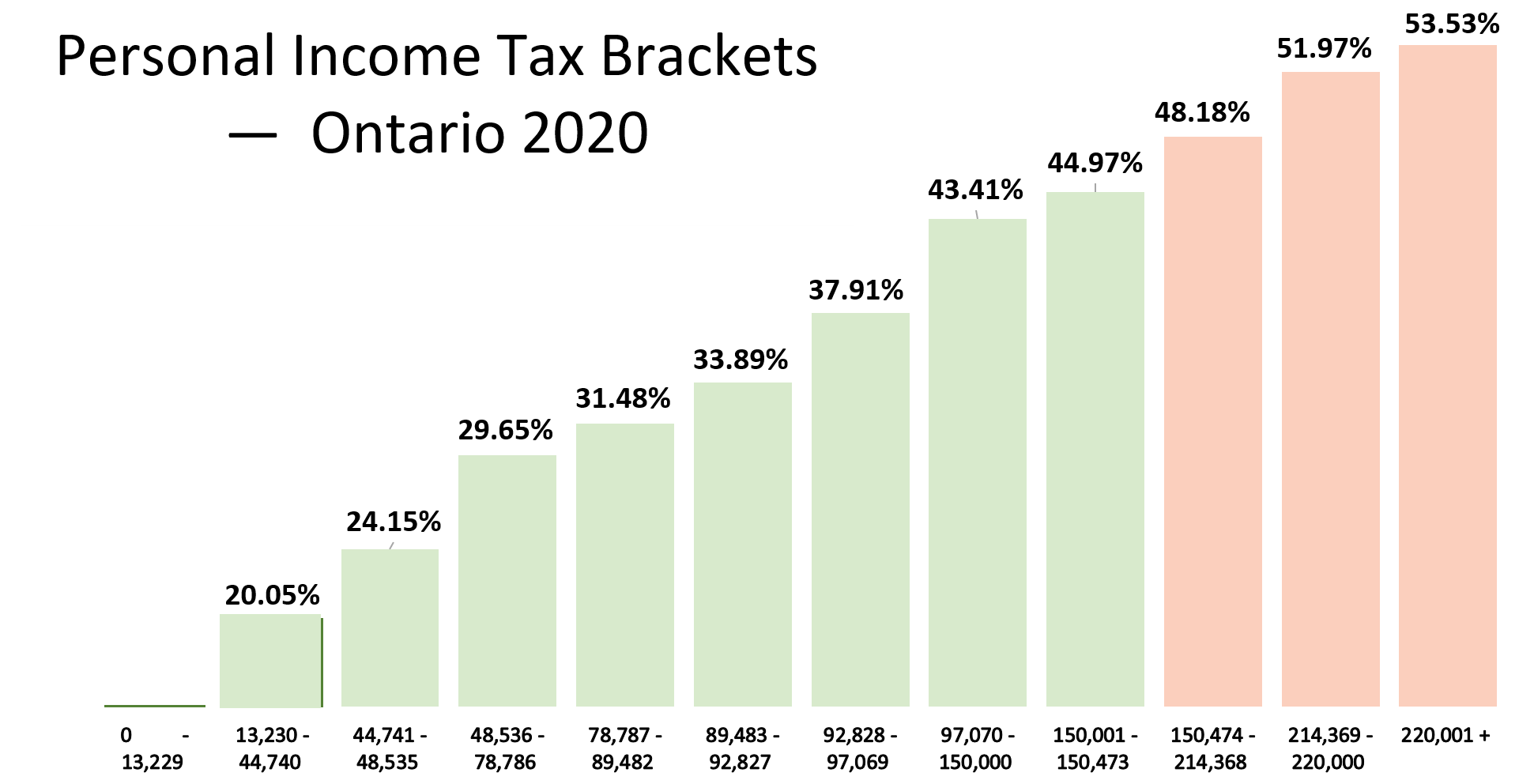

Canada uses a progressive tax system. This basically means the more you earn, the higher the percentage you pay on those "extra" dollars. People often freak out thinking that moving into a higher tax bracket means they’ll take home less money overall. That’s a total myth. Only the money within that specific bracket gets taxed at the higher rate. If you earn one dollar over a threshold, only that single loonie is hit with the new percentage.

How the salary tax Ontario calculator handles the provincial slice

Ontario has its own set of rules that sit on top of the federal ones. While the federal government takes their cut for things like national defense and transfers to other provinces, Queen’s Park takes a bite for healthcare, education, and local infrastructure.

For 2025 and 2026, these provincial brackets remain relatively stable but are indexed to inflation. If you’re using a salary tax Ontario calculator, you’ll notice the first $50,000-ish is taxed at a fairly low rate—around 5.05%. But then it jumps. Once you cross into the middle-income territory, roughly between $50,000 and $100,000, you’re looking at 9.15%.

Then there’s the Surtax. This is where Ontario gets a little "extra."

Ontario applies a surtax on the tax you owe, not your income. It’s confusing. Most people don’t even realize it exists until they look at the fine print of their T4. If your provincial tax exceeds a certain amount—usually around $5,000—the province adds a 20% surtax on the portion above that threshold. If you’re a high earner and your tax exceeds about $6,800, they tack on another 36%. It’s basically a tax on a tax. This is why high-income earners in Ontario often feel a much sharper sting than those in provinces like Alberta or British Columbia.

The CPP and EI "Raise" in the summer

Have you ever noticed your paycheck suddenly gets bigger in August or September? You didn't get a promotion. You just hit your contribution limits.

💡 You might also like: TT Ltd Stock Price Explained: What Most Investors Get Wrong About This Textile Pivot

Every employee in Ontario has to pay into the Canada Pension Plan (CPP) and Employment Insurance (EI). These aren't technically "taxes" in the way income tax is, but they sure feel like it when they leave your bank account. In 2024 and 2025, we saw the introduction of "CPP2." This is an additional tier of contributions designed to bolster the pension fund for future generations.

- CPP: You pay 5.95% on earnings up to the Yearly Maximum Pensionable Earnings (YMPE).

- CPP2: Once you pass the first ceiling, you pay an additional 4% on earnings up to a second, higher ceiling.

- EI: This is usually around 1.66% for employees, capped at a certain yearly maximum.

Once you’ve contributed the maximum amount for the year, your employer stops deducting these from your check. Suddenly, you have an extra few hundred bucks a month. It’s a nice little "summer bonus," but don’t get used to it—it resets every January 1st, which is why your first paycheck of the year always feels like a punch in the gut.

Why your calculator might be lying to you

Most online tools are "best guess" scenarios. They assume you are a standard employee with no special circumstances. But life is rarely that simple.

A standard salary tax Ontario calculator often misses things like taxable benefits. Does your company pay for your life insurance? That’s a taxable benefit. Do you get a car allowance? Taxable. Do they match your RRSP contributions? The match itself isn't taxed immediately, but it affects your room.

Then there are the deductions that reduce your taxable income. This is the good stuff. If you put $10,000 into an RRSP, the government treats you as if you earned $10,000 less than you actually did. If your "top" tax rate (your marginal rate) is 43%, that RRSP contribution effectively "saves" you $4,300 in taxes. This is why people scramble in February to hit their contribution limits. It’s the most effective way to claw back money from the CRA.

Marginal vs. Average Tax Rate: The big confusion

If you tell someone in a bar that you pay 40% tax, you’re probably wrong.

You might be in a 40% marginal tax bracket, but your average tax rate is likely much lower. The marginal rate is what you pay on your next dollar of income. The average rate is the total tax paid divided by your total income.

📖 Related: Disney Stock: What the Numbers Really Mean for Your Portfolio

For example, an individual in Ontario earning $100,000 might have a marginal tax rate of about 33.89%. However, because they didn't pay 33.89% on the first $15,000 (the basic personal amount is mostly tax-free), their actual "blended" or average rate might be closer to 22% or 24%. When you're budgeting for a house or a car, the average rate is what matters for your monthly cash flow, but the marginal rate is what matters when deciding if that Saturday overtime shift is actually worth your time.

Real-world impact: The $80,000 vs. $120,000 jump

Let's look at a semi-realistic example. Imagine Sarah makes $80,000 in Ottawa. After the salary tax Ontario calculator does its thing, her take-home is roughly $60,000. She pays about $20,000 in combined federal and provincial taxes, plus CPP and EI.

Now, Sarah gets a massive promotion to $120,000. That’s a $40,000 increase! She expects her life to change overnight.

But out of that $40,000 raise, the government is going to take a much larger bite than it did on her first $40,000 of income. On that "top" slice of income, she might be losing 43 cents of every dollar to taxes. Her take-home pay might only increase by about $23,000. While she’s definitely richer, the "feel" of a $40k raise is often dampened by the reality of the tax man.

This is where "tax planning" becomes more than just a buzzword for rich people. Sarah needs to look at:

- RRSP Contributions: Shifting income from a 43% bracket to a 0% or 20% bracket in retirement.

- FHSA: If she's buying a first home, the First Home Savings Account is a "double win"—tax-deductible going in, and tax-free coming out.

- Charitable Donations: These provide a tax credit that can offset some of that high-bracket pain.

The "Ontario Health Premium" hidden fee

We like to say Canadian healthcare is "free," and at the point of service, it is. But if you live in Ontario, you pay for it through a specific deduction called the Ontario Health Premium.

This isn't actually a separate insurance premium; it's just an extra income tax. If you earn more than $20,000, you start paying it. It caps out at $900 per year for those earning over $200,600. Most salary tax Ontario calculator tools include this automatically, but if you're doing the math on a napkin, don't forget it. It's one of those "stealth" costs that makes the Ontario tax burden slightly higher than it appears on a simple percentage chart.

👉 See also: 1 US Dollar to 1 Canadian: Why Parity is a Rare Beast in the Currency Markets

Self-employed? You’re in for a surprise

If you're a freelancer or a "gig" worker in the GTA, the tax calculator is your best friend and your worst enemy.

When you work for a company, they pay half of your CPP. When you're self-employed, you are both the employer and the employee. That means you pay double the CPP. That’s nearly 12% of your income gone before you even touch income tax.

Also, nobody is withholding tax for you. You have to be your own accountant. A common mistake is seeing $5,000 land in your business account and thinking it's yours. It isn't. Roughly $1,500 of that belongs to the CRA. If you don't set it aside in a high-interest savings account, tax season in April will be a nightmare.

Actionable steps to maximize your take-home pay

Stop treating your paycheck like a mystery. You can actually influence these numbers.

First, use a reputable salary tax Ontario calculator like the ones provided by Wealthsimple, Talent.com, or the official CRA PDOC (Payroll Deductions Online Calculator). Run your numbers twice: once with your current salary and once with a projected RRSP contribution. You’ll see the "Net Pay" jump significantly.

Second, check your TD1 forms. These are the forms you filled out when you started your job. If your life has changed—you now have a child, you're taking care of an elderly parent, or you're a part-time student—you might be eligible for more credits. If you don't update these with your HR department, you're essentially giving the government an interest-free loan until you file your taxes next year.

Third, understand the "Tax Brackets" for the current year. For 2025, federal brackets increased by 2.7% to account for inflation. This means you can earn a bit more money before hitting the higher tax rates.

Finally, track your non-reimbursed employment expenses. If you work from home (and have a T2200 form from your boss) or pay for your own tools or travel, these can be deducted against your income. Every dollar you deduct is a dollar the salary tax Ontario calculator can't touch.

Taxes in Ontario are high, there’s no way around it. But by understanding the mechanics of how your salary is sliced, you can make better decisions about RRSPs, job offers, and your monthly budget. Don't just look at the bottom line of your pay stub—look at the "why" behind it.