Payroll is a headache. Honestly, if you're running a small business or just started managing a team, the last thing you want to do is shell out $50 a month for some flashy SaaS platform that basically just does basic addition. You just need a solid, reliable salary slip format in excel that won't break when you change a tax rate. Most people think they need a complex database to handle monthly pay, but that’s just not true. Excel is still the king of the back office for a reason. It's flexible. It’s free if you already have Office. And, perhaps most importantly, it gives you total control over your data without some cloud provider locking your records behind a paywall.

Why the Basic Salary Slip Format in Excel Still Beats Fancy Software

Software sales reps will tell you that manual entry is "risky." They'll talk about "compliance nightmares" and "human error." Sure, if you're managing 5,000 employees, don't use a spreadsheet. But for a team of ten? Or twenty? Excel is actually safer because you can see every single calculation. You aren't trusting a "black box" algorithm to calculate the local professional tax or the provident fund contribution. You see the formula. You own the logic.

The beauty of a salary slip format in excel lies in its transparency. When an employee walks into your office confused about why their take-home pay is lower this month, you don't have to put in a support ticket. You just click on cell F14. You show them the formula. "Look, your unpaid leave was calculated against 31 days this month instead of 30." Boom. Problem solved in thirty seconds.

Most people get the structure wrong because they try to make it look like a finished document from the start. Big mistake. A functional payroll sheet is actually two different things: a "Data Entry" tab where the math happens, and a "Payslip Template" tab that pulls that data into a pretty, printable format. If you try to do the math inside the pretty template, you're going to have a bad time. You'll end up copying and pasting formatting every month, and that's exactly where the "human error" the software companies warn you about actually happens.

The Anatomy of a Legally Compliant Payslip

You can't just throw some numbers on a page and call it a day. Labor laws—whether you're looking at the Fair Labor Standards Act (FLSA) in the US, the Employment Rights Act in the UK, or the Payment of Wages Act in India—generally require specific disclosures.

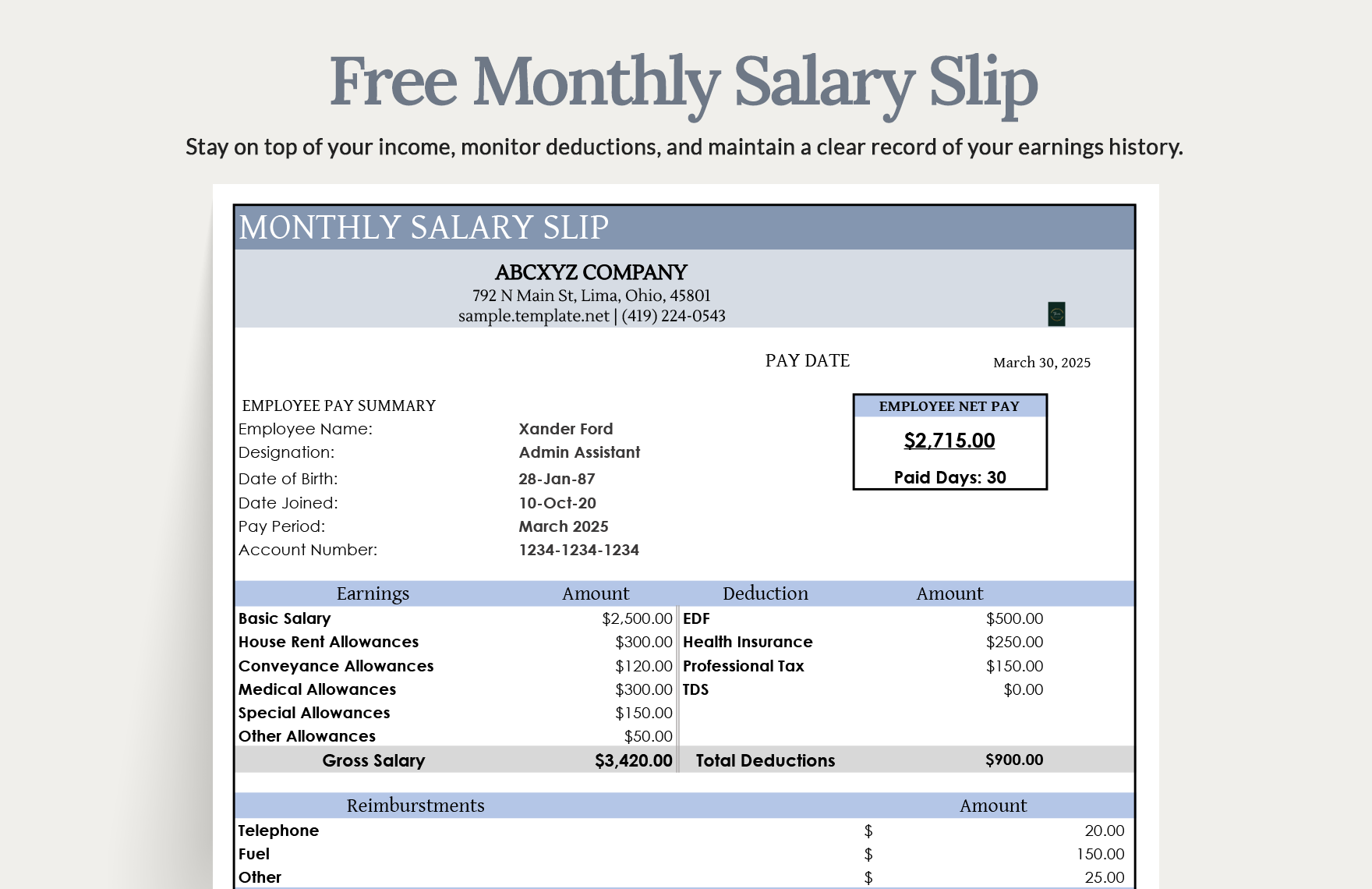

A professional salary slip format in excel must be divided into three distinct zones. First, the header. This isn't just for branding. It needs the legal name of the company, the registered address, and the specific pay period. If you pay bi-weekly, state the start and end dates. Don't just say "June." Say "June 1, 2026, to June 15, 2026."

Then comes the "Earnings" side. This is the "good news" column. It starts with the Basic Salary. This is the core of the contract. Everything else usually stems from this number. Then you’ve got your allowances: House Rent Allowance (HRA), Conveyance, Medical, or those "Special Allowances" that everyone uses to balance the books.

Understanding the Deductions Column

This is where things get sticky. Deductions are the "bad news," and they are usually the source of 90% of payroll disputes. You have two types: statutory and voluntary. Statutory deductions are the ones the government makes you take, like Income Tax (TDS), Social Security, or Provident Fund. Voluntary ones are things like health insurance premiums or repayments for a company loan.

If you're building your salary slip format in excel, use the VLOOKUP or XLOOKUP function for your tax brackets. Never, ever hard-code tax percentages into your main sheet. Tax laws change. In 2026, we’ve already seen shifts in standard deductions. If you have a separate "Settings" tab with the current tax rates, you only have to update one cell to fix every single employee's pay sheet.

📖 Related: Oil Market News Today: Why Prices Are Crashing Despite Middle East Chaos

The Mathematical Engine Behind the Spreadsheet

Let's talk about the actual "Excel-ness" of the task. Your sheet should handle the "Gross to Net" calculation automatically. Gross Salary is the sum of all earnings. Net Salary—the "take-home" pay—is Gross Salary minus Total Deductions.

It sounds simple. It isn't.

One thing people often forget is the "Loss of Pay" (LOP) calculation. If an employee takes two days of unauthorized leave, how do you calculate that? Do you divide their monthly salary by 30? By 22 working days? By 31? Your salary slip format in excel needs a clear "Working Days" variable. A common formula used by HR professionals like Sarah Brennan, a veteran payroll consultant, involves calculating the "Per Day Rate" based on the total days in that specific month to stay compliant with most labor regulations.

Formula-wise, it looks something like this:=(Basic_Salary / Total_Days_in_Month) * Days_Worked

Dealing with Rounding Errors

Excel loves decimals. Your bank does not. If your spreadsheet says you owe someone $2,450.6666667, your bank transfer will fail or your accounting will be off by a cent. Always wrap your final net pay formula in a =ROUND(Formula, 2) or even =ROUND(Formula, 0) if your local currency doesn't use cents. This tiny step prevents those annoying "one-cent discrepancies" that drive bookkeepers insane at the end of the fiscal year.

Designing the Printable Template

Once the math is done on your "Data" tab, you need to make it look professional. Nobody wants to receive a raw spreadsheet row as their proof of income. They need a PDF. They need something they can show a bank when they apply for a mortgage.

The layout should be clean. Use a simple border. Avoid bright colors; greyscale is better for printing. Use a clear, sans-serif font like Calibri or Arial. Put the "Net Pay" in bold and a slightly larger font size. It's the most important number on the page, so make it easy to find.

One "pro tip" for your salary slip format in excel: include a "Notes" or "Comments" section at the bottom. This is where you explain one-time bonuses or why a certain deduction was made. It adds a human touch and reduces the number of "Hey, why is my pay different?" emails you get on Friday afternoon.

👉 See also: Cuanto son 100 dolares en quetzales: Why the Bank Rate Isn't What You Actually Get

Automating the PDF Export

You don't have to manually save every slip. If you're feeling a bit adventurous, a tiny bit of Excel VBA (Macros) can automate the process. You can write a script that cycles through your employee list, updates the template with their specific data, and saves a PDF named "EmployeeName_June_2026.pdf" into a folder. If you aren't comfortable with code, you can use the "Mail Merge" feature in Microsoft Word, linking it to your Excel data sheet. It’s an old-school trick that still works perfectly.

Common Pitfalls to Avoid

I've seen a lot of messy spreadsheets. The biggest mistake is "Hard-Coding." This is when you type a number like "500" into a formula instead of referencing a cell. If that "500" represents a transport allowance and the allowance changes to "600" next month, you have to hunt through every cell to find where you typed "500." It's a recipe for disaster.

Another issue is security. A salary slip format in excel contains sensitive data. Names, addresses, bank account numbers, and social security numbers. If you're emailing these slips, password-protect the PDF. Usually, a combination of the first four letters of the employee's name and their birth year works well as a standard password.

Also, watch out for "Hidden Rows." Sometimes people hide a row to make the sheet look cleaner, then forget it's there and accidentally include those numbers in a sum. Always use the SUBTOTAL function if you're filtering data, or better yet, just keep your data entry sheet raw and unfiltered.

Real-World Example: The "Startup" Payslip

Imagine a small tech startup. They have four engineers, a designer, and an office manager. They don't have an HR department. The founder uses a salary slip format in excel that they built in an hour.

Each month, the office manager enters the "Days Present" into the tracker. The spreadsheet automatically pulls the "Base Pay" from a hidden "Employee Master" sheet. It calculates the tax based on the 2026 brackets they updated in January. The "Net Pay" is generated. The founder spends ten minutes reviewing the numbers, then hits a button to generate the PDFs. Total cost? $0. Total time? 30 minutes a month. That’s the efficiency you're aiming for.

Making the Transition to Digital

If you're still handing out paper envelopes with cash or handwritten slips, please stop. It's 2026. Even the smallest businesses need a digital trail. A digital salary slip format in excel isn't just about being "modern." It's about protecting yourself. If an employee ever claims they weren't paid for overtime, your spreadsheet—with its clear formulas and date-stamped records—is your best defense.

The goal isn't to have the most complex sheet in the world. The goal is to have one that is accurate, easy to read, and compliant with your local laws. Whether you're in New York, London, or Mumbai, the principles of accounting remain the same: Income - Expenses = Net.

✨ Don't miss: Dealing With the IRS San Diego CA Office Without Losing Your Mind

Actionable Steps to Build Your Sheet Today

Stop overthinking it and just start. Open a blank workbook.

Create your first tab and name it "Employee_Master." This is where you put the permanent stuff: Name, Employee ID, Date of Joining, and their fixed CTC (Cost to Company) components. Use this as your "Source of Truth."

Next, make a "Monthly_Input" tab. This is for the variables. Days worked, overtime hours, any one-time bonuses, or "unpaid leave" days. This is the only sheet you should be typing in once the system is set up.

Then, create the "Calculation_Engine." Use formulas to link the Master data with the Monthly inputs. This is where the heavy lifting happens. Use IF statements to handle things like "if earnings > 5000, then tax = X, else Y."

Finally, design your "Print_Template." Use VLOOKUP based on an "Employee ID" cell. When you change the ID number in that one cell, the entire payslip should update instantly with that person's specific data for the month.

Check your formulas twice. Then check them again. Run a "dummy" payroll for a fictional employee to see if the math holds up against a manual calculator. Once you're confident, save that file as a Read-Only template so you don't accidentally overwrite your hard work next month. You've now got a professional payroll system that didn't cost you a dime in licensing fees.

Be sure to keep a backup of your salary slip format in excel on a secure drive. Data loss is the only thing that can truly ruin a good spreadsheet system. If you keep it clean and keep it backed up, you'll never need to buy expensive payroll software again.