You finally got the offer. The base pay looks massive—twenty grand more than you're making now. You’ve already started picturing the new apartment, maybe that espresso machine you've been eyeing, and definitely a better class of groceries. But then you remember you're moving from a mid-sized city in Ohio to a high-rise district in Seattle. Suddenly, that "raise" starts to look like a pay cut in disguise. This is exactly where the salary com cost of living calculator becomes the most important tab open on your browser.

It’s easy to get blinded by a big number. We're wired to think more equals better. However, the reality of the American economy in 2026 is that a dollar in Des Moines has nothing in common with a dollar in Manhattan. You aren't just buying a lifestyle; you're buying into a local ecosystem of taxes, utility spikes, and skyrocketing insurance premiums.

Most people use these calculators wrong. They look at the "top line" difference and call it a day. Honestly, if you aren't digging into the granular data about state-specific tax burdens or the weirdly specific cost of healthcare in a new zip code, you're flying blind.

What the Salary com Cost of Living Calculator Actually Tracks

It isn't just about the price of a gallon of milk. That’s a common misconception. While "groceries" is a category, it’s usually the smallest variable in your actual month-to-month survival.

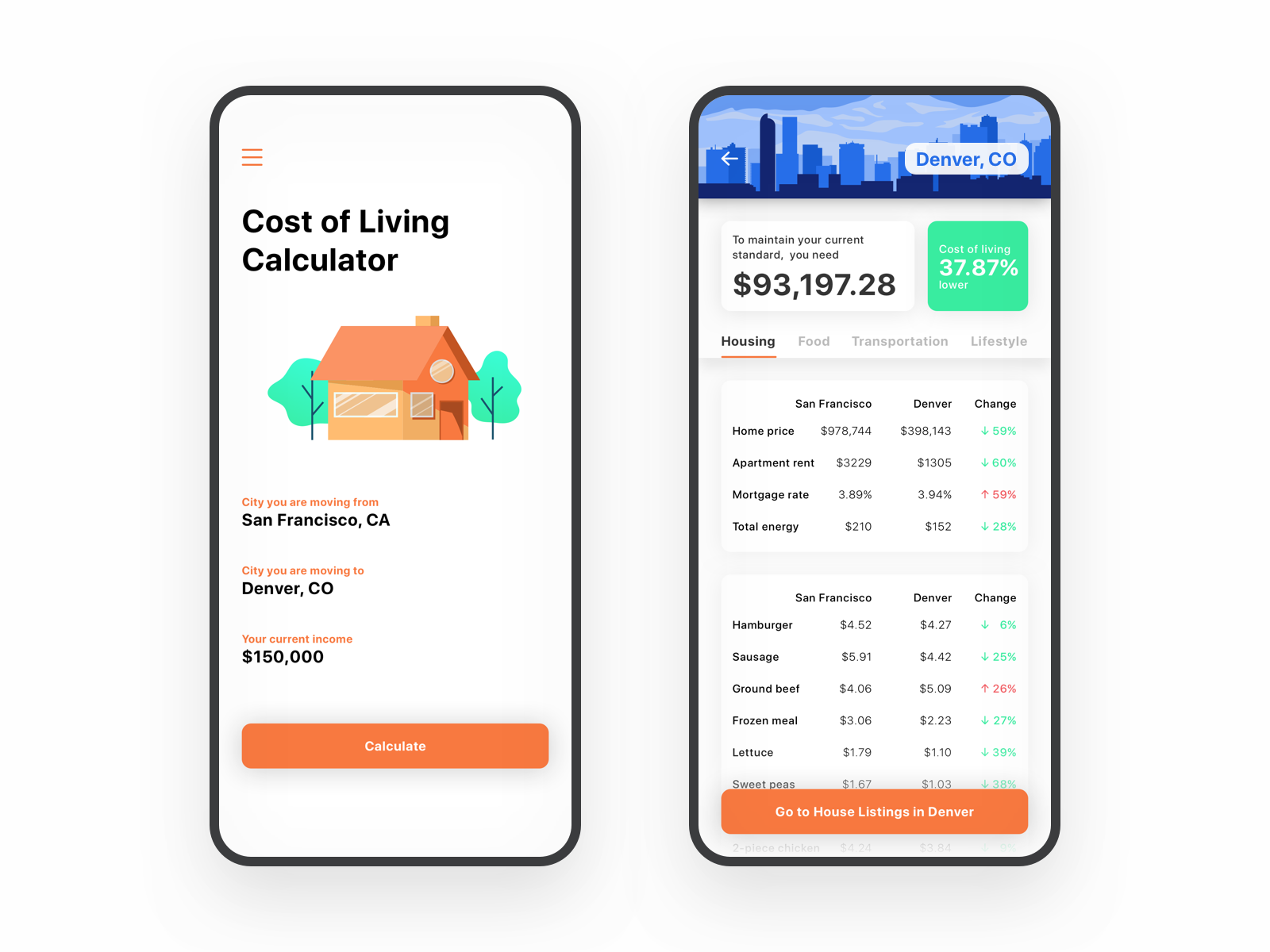

The salary com cost of living calculator aggregates data across several massive pillars. Housing is the elephant in the room. We’re talking about median home prices, but also the rental market volatility that hits younger professionals the hardest. Then you have utilities. Did you know that heating a home in Massachusetts can cost three times as much as cooling a similar square-footage home in Arizona, depending on the season and the grid's health?

There is also the "hidden" cost of transportation. In a city like Houston, you’re basically married to your car. You've got gas, maintenance, and those soul-crushing toll roads. Compare that to Chicago or D.C., where you might ditch the car entirely but pay a premium for "transit-oriented development" housing. The calculator tries to bridge that gap by showing you what it takes to maintain your current standard of living in the new location. It’s a parity tool.

The Problem With Regional Averages

Data is messy.

✨ Don't miss: Cox Tech Support Business Needs: What Actually Happens When the Internet Quits

One thing that kinda bugs me about general advice is the reliance on state averages. California is the classic example. The cost of living in San Francisco is a completely different universe than the cost of living in Fresno. If you use a calculator that only looks at state-wide data, you are going to get burned. Salary.com specifically leans into metro-area data and zip codes because they know that "Los Angeles" isn't a monolith—Santa Monica and East L.A. might as well be in different countries when it comes to your disposable income.

The 100k Trap: When a Six-Figure Salary Feels Like Poverty

We used to think $100,000 was the promised land. In 2026, depending on where the calculator puts you, that six-figure salary can actually feel like you're struggling.

Let's look at a hypothetical. You're living in Charlotte, NC, making $85,000. You're doing okay. You have a nice two-bedroom, you're saving for retirement, and you go out on weekends. You get an offer for $115,000 in San Jose, California. On paper, you're rich! You've joined the six-figure club!

But run those numbers through the salary com cost of living calculator.

- Taxes: California's state income tax is progressive and, frankly, aggressive compared to North Carolina's flat-ish structure.

- Housing: You might go from a $1,800 mortgage to a $4,200 rent for a smaller space.

- Energy: PG&E rates in Northern California have historically been some of the highest in the nation.

By the time the calculator spits out the "comparable salary," it might tell you that you need $140,000 in San Jose just to feel the same way you did on $85,000 in Charlotte. That "raise" just cost you $25,000 in purchasing power.

Beyond the Basics: Taxes and Healthcare

People forget about the tax man. It’s the most frequent mistake I see. They see the salary, they see the rent, and they think they've done the math.

🔗 Read more: Canada Tariffs on US Goods Before Trump: What Most People Get Wrong

Federal taxes are the same everywhere, but state and local taxes vary wildly. Some states have no income tax—think Florida, Texas, Washington, or Tennessee—but they usually make up for it with higher property taxes or sales taxes. The salary com cost of living calculator factors these nuances in because your take-home pay is what actually pays the bills, not your gross salary.

Healthcare is another weird one. It’s not just about the premium your employer charges. It's about the "usual and customary" rates for a doctor's visit in that city. Some regions have a shortage of specialists, which drives up the cost of every outpatient procedure. If you have a chronic condition, a move to a "cheaper" state that has a consolidated healthcare market might actually end up costing you more out-of-pocket.

How to Negotiate Using Cost of Living Data

If a recruiter comes at you with a number that doesn't clear the cost-of-living hurdle, you shouldn't just say "it's too low." You need to show your work.

- Print the Report: Use the calculator to generate a specific comparison between your current city and the new one.

- Focus on "Disposable Income": Don't talk about the gross. Talk about the net. "To maintain my current quality of life and savings rate, the math shows I need X."

- Account for the "Relocation Hit": Even if the salary matches the cost of living, moving itself is a massive capital outlay. If they aren't offering a relocation bonus, that's a year's worth of "savings" gone in a weekend.

Employers often use their own data sets, like Mercer or Radford, which tend to favor the company. Bringing your own data from a reputable source like Salary.com levels the playing field. It shows you aren't just guessing; you're looking at the economic reality of their geography.

The Psychological Component: The "Quality of Life" Ghost

Here is something the salary com cost of living calculator won't tell you: your happiness isn't a line item.

You might move to a cheaper city to save money, but if that city lacks the amenities, culture, or community you value, you'll end up spending money to "escape" on vacations or through "retail therapy." Conversely, you might take a slight "effective" pay cut to move to a city where you don't need a car, or where the air quality is better, or where you're closer to family.

💡 You might also like: Bank of America Orland Park IL: What Most People Get Wrong About Local Banking

The calculator is a tool for your brain, not your soul. Use it to ensure you can afford to live, but don't let it be the only voice in the room.

Why the 2026 Data Matters

Inflation hasn't been a straight line. We've seen spikes in insurance (especially home and auto) that have outpaced general CPI. A calculator that hasn't been updated in six months is basically a paperweight. Salary.com tends to stay on top of these shifts because they sell this data to HR departments—they have a financial incentive to be right.

When you're looking at the numbers, pay close attention to the "Year-over-Year" shifts in the specific city you're targeting. If the cost of living is rising at 8% but the "merit increases" in that area are capped at 3%, you're moving into a deficit.

Actionable Steps for Your Next Move

Don't just stare at the screen. Use the data to build a real-world budget before you sign that offer letter.

- Run three scenarios: A "bare bones" budget, a "current lifestyle" match, and a "dream life" version. Use the calculator to find the salary requirements for all three.

- Check the commute: Use a secondary map tool to see where you’ll actually be living versus where the office is. If the calculator says housing is cheap, it might be because the "cheap" houses are a 90-minute crawl from the downtown core.

- Validate with local listings: Take the housing number the calculator gives you and go to a real estate site. See what that money actually buys. Does "median rent" get you a renovated studio or a basement apartment with a leak?

- Talk to a local: If you can, find someone on LinkedIn or a local subreddit who lives there. Ask them about their utility bills. The calculator is a benchmark; a local is a witness.

The goal isn't just to get paid more. The goal is to make sure your move actually moves you forward. Using the salary com cost of living calculator is the difference between a calculated career risk and a blind financial leap. Get the data, do the math, and then make the move that actually adds up.