If you stare at an s and p 500 history graph long enough, it starts to look like a heartbeat. A messy, caffeinated, occasionally flatlining heartbeat. Most people see the line going from the bottom left to the top right and think, "Cool, stocks go up." But that's the simplified version they sell you in brochures. The real story is hidden in the jagged drops and the long, boring stretches where nothing happened for a decade.

Context matters.

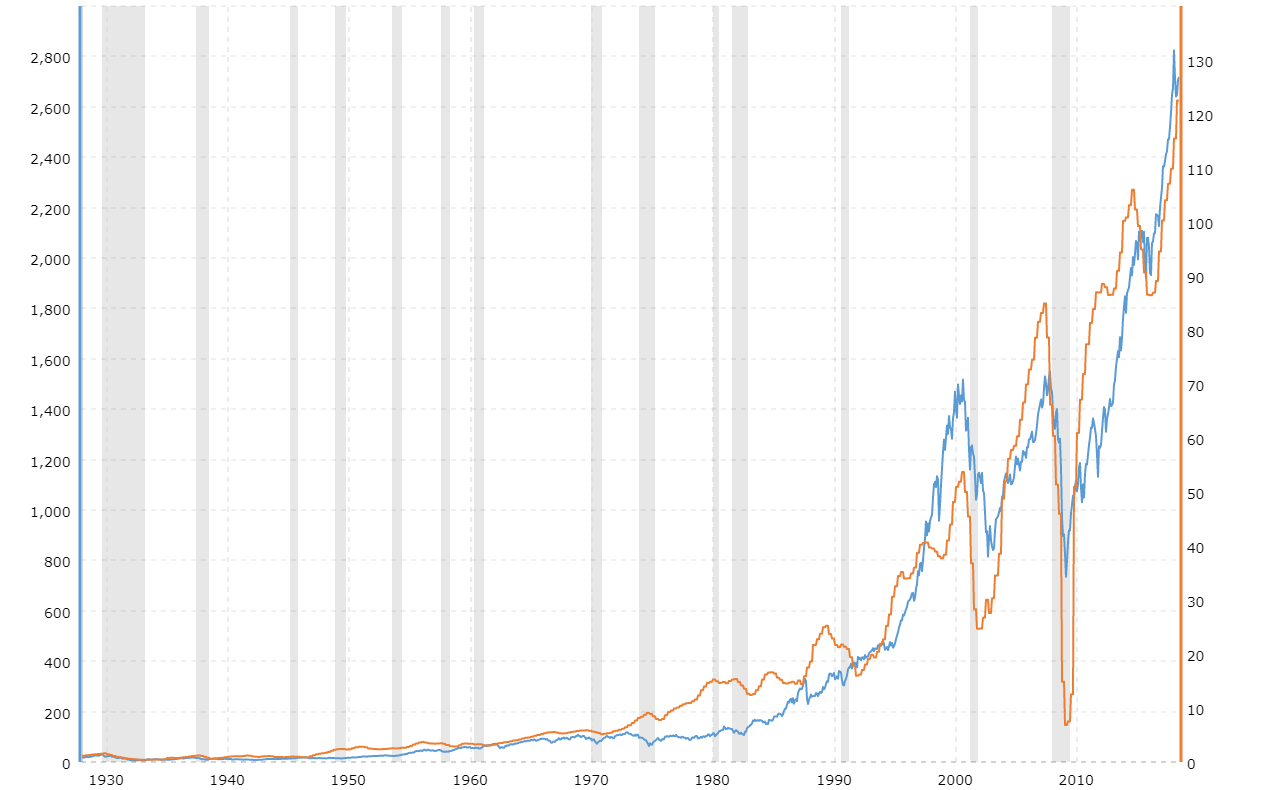

When the S&P 500 officially launched in its current 500-company form back in March 1957, it wasn't exactly a revolution. It was an evolution. Before that, Standard & Poor’s had a 90-stock index, but the leap to 500 companies changed everything for institutional investors. It became the yardstick. Since then, we’ve seen the index survive the collapse of the Bretton Woods system, the stagflation of the 70s, the "Greed is Good" 80s, the dot-com bubble, and the Great Financial Crisis.

The graph isn't just data. It’s a record of human panic and greed.

Reading the S and P 500 history graph without the rose-colored glasses

Look at the 1970s. Seriously, go find a chart that shows inflation-adjusted returns. If you just look at the price, it looks like a flat, bumpy road. But when you factor in the soaring costs of the era, investors were actually losing their shirts. This is what's known as a "lost decade." From roughly 1968 to 1982, the index was basically a treadmill. You ran hard, you took the risk, but you didn't actually go anywhere in terms of purchasing power.

Then came the 80s and 90s.

💡 You might also like: Big Lots in Potsdam NY: What Really Happened to Our Store

That was the "Golden Age" for the s and p 500 history graph. You had falling interest rates, the birth of the personal computer, and a massive shift in how Americans saved for retirement via the 401(k). The index went on a tear that culminated in the late 90s tech frenzy. People were buying Pets.com and Webvan, and for a minute, everyone was a genius. Until they weren't.

The 2000s: A double-whammy of pain

The "Lost Decade" part two happened between 2000 and 2010. If you invested $10,000 in the S&P 500 on January 1, 2000, you would have had less than that ten years later. This is the part of the graph that scares the hell out of people who are five years away from retirement.

First, the dot-com bubble burst. Then, just as things were looking up, the 2008 housing crisis hit.

I remember the feeling in late 2008. It wasn't just a "dip." It felt like the entire financial plumbing of the world had frozen shut. On the s and p 500 history graph, this looks like a terrifying vertical cliff. The index dropped roughly 50% from its peak. Think about that. Half of your money, gone, in a matter of months. But—and this is the "but" that makes millionaires—the bottom in March 2009 kicked off one of the most aggressive bull markets in human history.

Why the composition of the index keeps changing

The S&P 500 isn't a static list of companies. It's an elite club with a very strict bouncer.

📖 Related: Why 425 Market Street San Francisco California 94105 Stays Relevant in a Remote World

To get in, a company generally needs a market cap of at least $18 billion (as of recent 2024/2025 updates), it has to be highly liquid, and—crucially—it must show positive earnings over the last four quarters. This means the index is constantly "pruning" the losers and adding the winners.

- In the 70s, the graph was dominated by industrials and oil.

- In the 90s, it shifted toward GE and Microsoft.

- Today, it’s all about the "Magnificent Seven"—Apple, Nvidia, Amazon, and the rest of the tech giants.

Because the index is market-cap weighted, these giants have a massive pull. When Nvidia moves 5%, the whole s and p 500 history graph twitches. Some critics, like Rob Arnott of Research Affiliates, have argued that this weighting makes the index top-heavy. If the biggest companies fail, the whole index drags. It's a valid concern. You aren't really "diversified" across the economy as much as you are diversified across "Big Tech."

Surprising blips you might have missed

Everyone knows about 1929 (technically the pre-S&P 500 days, but often back-tested) and 2008. But what about 1987? Black Monday.

On October 19, 1987, the index plummeted 20% in a single day. One day. There was no war, no sudden economic collapse, just a cascade of program trading and panic. If you look at a long-term s and p 500 history graph, 1987 looks like a tiny little blip. At the time, people thought it was the end of the world.

Perspective is a funny thing.

👉 See also: Is Today a Holiday for the Stock Market? What You Need to Know Before the Opening Bell

Then there's the 2020 COVID crash. It was the fastest 30% drop in history, followed by an equally insane recovery fueled by government stimulus and zero-percent interest rates. It proved that the graph isn't just about corporate profits—it's about liquidity. When the Federal Reserve pumps money into the system, the graph goes up. When they take it away (like in 2022), the graph struggles.

Real-world math for the skeptic

Let's talk about the 10% average.

You've heard it a thousand times: "The S&P 500 returns 10% a year on average."

Kinda true. But "average" is a sneaky word. In reality, the S&P 500 rarely returns exactly 10% in a calendar year. Usually, it's up 25% or down 15%. It's a wild ride that happens to average out to 10% over many decades. If you can't handle the -20% years, you don't deserve the +30% years. That's the brutal honesty of the market.

Actionable insights for your portfolio

Don't just look at the s and p 500 history graph and think you've missed out. The best time to invest was twenty years ago; the second best time is today, provided you have a long horizon.

- Check your timeline. If you need the cash in three years for a house down payment, the S&P 500 is a casino. If you need it in thirty years for retirement, it's a wealth machine.

- Watch the concentration. Since the index is currently dominated by tech, consider if you're already over-exposed to tech in other areas of your life (like your job or individual stock picks).

- Dividend reinvestment is the "cheat code." If you look at a "Price Only" graph vs. a "Total Return" graph, the difference is staggering. Reinvesting those small quarterly dividends accounts for a massive chunk of the long-term gains.

- Ignore the "noise" of the daily candles. The S&P 500 has a 100% success rate of recovering from every single crash it has ever had. Every. Single. One.

Stop trying to time the "dips" based on a hunch. The history of the index shows that "time in the market" beats "timing the market" almost every time. Whether you use a low-cost ETF like VOO or SPY, the goal is to stay strapped in while the roller coaster does its thing. The graph will keep wiggling, and as long as the global economy grows, that line has a very strong incentive to keep climbing.

Keep your eyes on the long-term trend, not the daily drama.