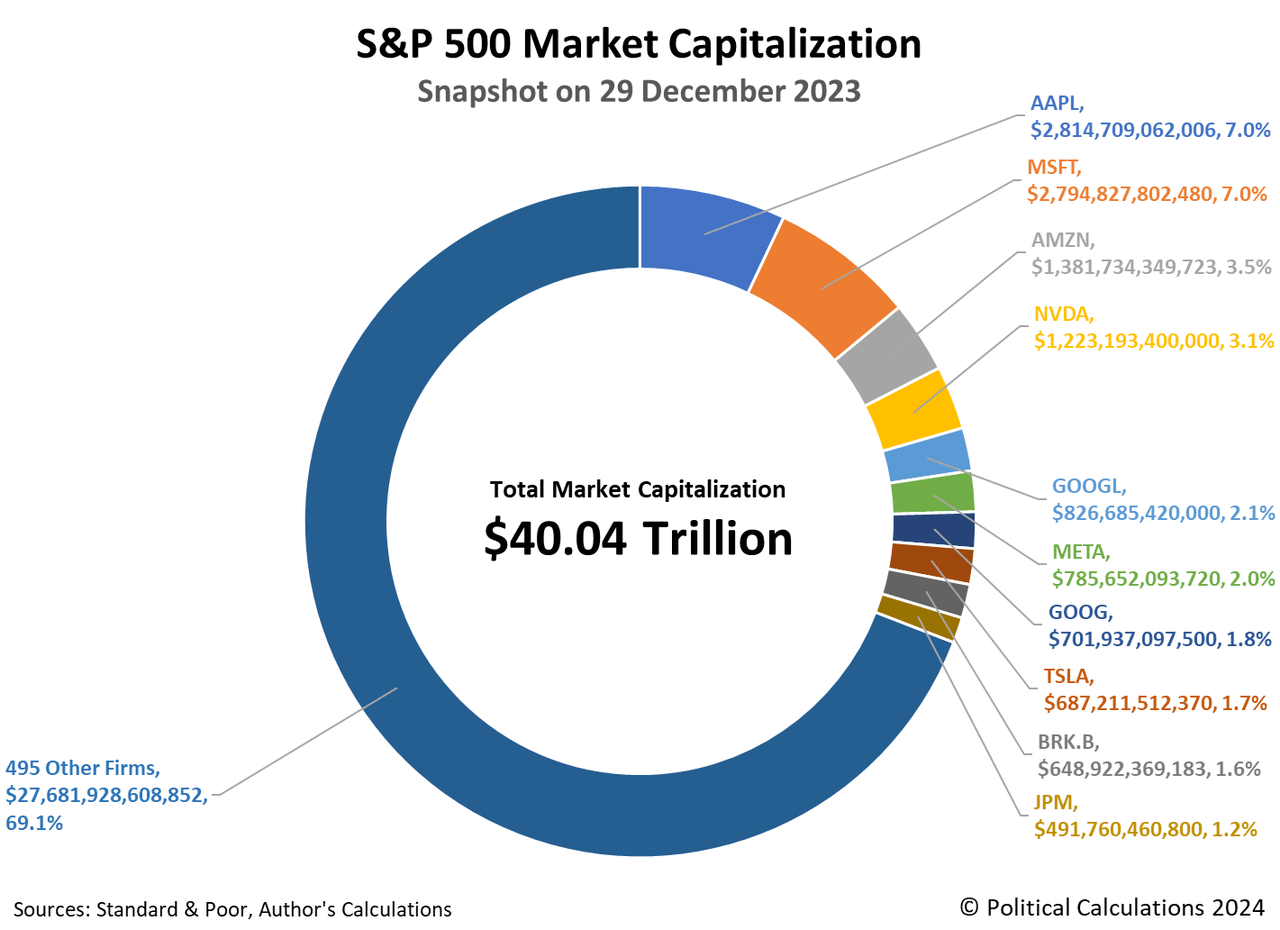

So, you’re looking at the stock market and wondering who really runs the show. It’s a wild time. Honestly, the way people talk about the "market" makes it sound like this giant, uniform beast. But if you look at the s and p 500 companies by market cap, you’ll realize it’s more like a few neighborhood giants and a whole lot of smaller houses.

We’ve officially entered 2026, and the concentration at the top has reached levels that would make 1999 blush. Right now, the 10 biggest names account for nearly 44% of the entire index's value. That is a massive chunk of the $58 trillion total market cap for the S&P 500. If these ten companies sneeze, the whole world gets a cold.

The New Trillion-Dollar Pecking Order

The rankings have shifted in ways that seemed impossible a couple of years ago. Nvidia isn't just a chipmaker anymore; it’s the king of the hill. As of mid-January 2026, Nvidia (NVDA) sits at a staggering $4.5 trillion market cap. It’s hard to wrap your head around that number. To put it simply, they’ve basically become the "tax man" for the entire AI revolution.

Then you’ve got the battle for second place. Alphabet just recently leapfrogged Apple. On Wednesday, January 14, Alphabet (GOOGL) hit a $4.0 trillion valuation, pushing Apple (AAPL) down to third at roughly $3.85 trillion. It’s the first time Google’s parent company has been ahead of the iPhone maker since 2019.

Here is what the heavy hitters look like right now:

- Nvidia (NVDA): ~$4.53 Trillion

- Alphabet (GOOGL/GOOG): ~$4.02 Trillion

- Apple (AAPL): ~$3.85 Trillion

- Microsoft (MSFT): ~$3.43 Trillion

- Amazon (AMZN): ~$2.54 Trillion

It’s a lopsided world. Microsoft, which was the darling of 2024, is now trailing the pack of $4-trillion-club hopefuls. Amazon is still a beast at $2.5 trillion, but it feels almost "small" compared to Nvidia. Sorta crazy, right?

Why Market Cap Weighting Actually Matters to You

Most people don't realize that the S&P 500 is "market-cap weighted." This means the bigger the company, the more it moves the needle. If a tiny company at the bottom of the list—say, a random regional utility—doubles its stock price, you won't even see a ripple in your 401(k).

But if Nvidia drops 5% in a afternoon?

Everything turns red.

Experts like Lisa Shalett at Morgan Stanley have been pointing out that this "winner-takes-all" dynamic is reaching an extreme. We’re seeing record levels of "crowding." When everyone is piling into the same five or six stocks, the risk isn't just about the company failing; it's about the exit door being too small when everyone tries to leave at once.

The Non-Tech Giants Still Hanging On

It isn't all software and silicon. Berkshire Hathaway (BRK.B) is still holding down the fort for the "old school" economy with a market cap just over $1 trillion. Warren Buffett’s conglomerate remains a massive force, even if it doesn't get the same hype as a generative AI startup.

Then you have the healthcare and retail titans:

- Eli Lilly (LLY): Hovering around $939 billion, fueled by those weight-loss drug revenues that just won't quit.

- Walmart (WMT): Sitting at roughly $940 billion. They’ve managed to tech-ify their logistics enough to stay relevant in a digital-first world.

- JPMorgan Chase (JPM): The banking king at $857 billion.

These companies are the ballast. They don't usually moon by 100% in a year, but they also don't tend to evaporate overnight.

The S and P 500 Companies by Market Cap: Risks Most People Ignore

We have to talk about the "Buffett Indicator." It’s a ratio of total market cap to GDP. Right now, it’s sitting at about 222%. Warren Buffett once said that if this ratio hits 200%, you’re "playing with fire."

We’ve been playing with fire for a while.

The bull market of 2026 is fueled by massive capital expenditure. The "hyperscalers" (Microsoft, Alphabet, Amazon, Meta, and Oracle) are expected to spend over $500 billion on AI infrastructure this year alone. Peter Berezin at BCA Research has been vocal about this, questioning if the incremental revenue will ever actually justify that much spending. If the ROI on AI doesn't show up in the bottom line soon, these market caps could be in for a "correction" that isn't very fun to watch.

How to Navigate This Top-Heavy Market

If you're looking at your portfolio and seeing it's mostly S&P 500 index funds, you are basically betting on Big Tech. That's been a winning bet for a decade. But 2026 feels different. The "Tech Tonic" as Goldman Sachs calls it, is broadening out.

Instead of just chasing the $4 trillion giants, smart money is starting to look at the "S&P 490"—the other companies in the index that haven't had their valuations blown out of proportion yet.

Next Steps for Your Portfolio:

- Check your concentration: Use a tool to see how much of your total wealth is tied up in the top five names. You might be surprised to find you're 25% "Nvidia-dependent."

- Look at Equal-Weight ETFs: If the top-heaviness scares you, look into an equal-weight version of the S&P 500 (like RSP). It gives every company the same seat at the table, regardless of size.

- Watch the Capex: Keep an eye on the quarterly earnings of Alphabet and Microsoft. If they start cutting back on AI spending, that's your signal that the music might be slowing down.

- Diversify into "Real Assets": Morgan Stanley suggests adding exposure to commodities or infrastructure as a hedge against this tech-heavy concentration.