Honestly, if you've been tracking the royal bank stock price lately, you know it's been a bit of a wild ride. We aren't just talking about a casual tick up or down. As of mid-January 2026, the Royal Bank of Canada (RY) is sitting near all-time highs, flirting with that $235 CAD mark on the TSX. It’s a massive number. It feels like just yesterday people were worried about the "mortgage cliff" and whether the Canadian consumer was basically tapped out.

Instead, RBC just dropped a 2025 fiscal year report that saw net income jump 25% to a staggering $20.4 billion. That's not a typo. $20.4 billion.

What’s Actually Driving the Numbers?

Most people assume a bank's health is just about interest rates. While the Bank of Canada holding steady at 2.25% right now definitely matters, the real story for the royal bank stock price is the HSBC Canada acquisition. They swallowed that business whole, and the "synergies"—which is just corporate speak for making more money with less overhead—are hitting the bottom line faster than analysts predicted.

You’ve also got the Wealth Management division doing some heavy lifting. When the stock markets are green, RBC gets paid. Fee-based revenue is up because, well, people have more money to manage, and RBC is the biggest shark in that particular pond.

Why the $235 CAD Mark is a Psychological Battle

If you look at the charts from this week, specifically January 16, 2026, the stock closed at $235.42 CAD. It’s been bouncing around there like a pinball.

✨ Don't miss: The Big Buydown Bet: Why Homebuyers Are Gambling on Temporary Rates

- Resistance: Every time it hits $240, some big institutional players seem to take profits.

- The Dividend Factor: They just bumped the quarterly dividend to $1.64. That’s a 6% raise.

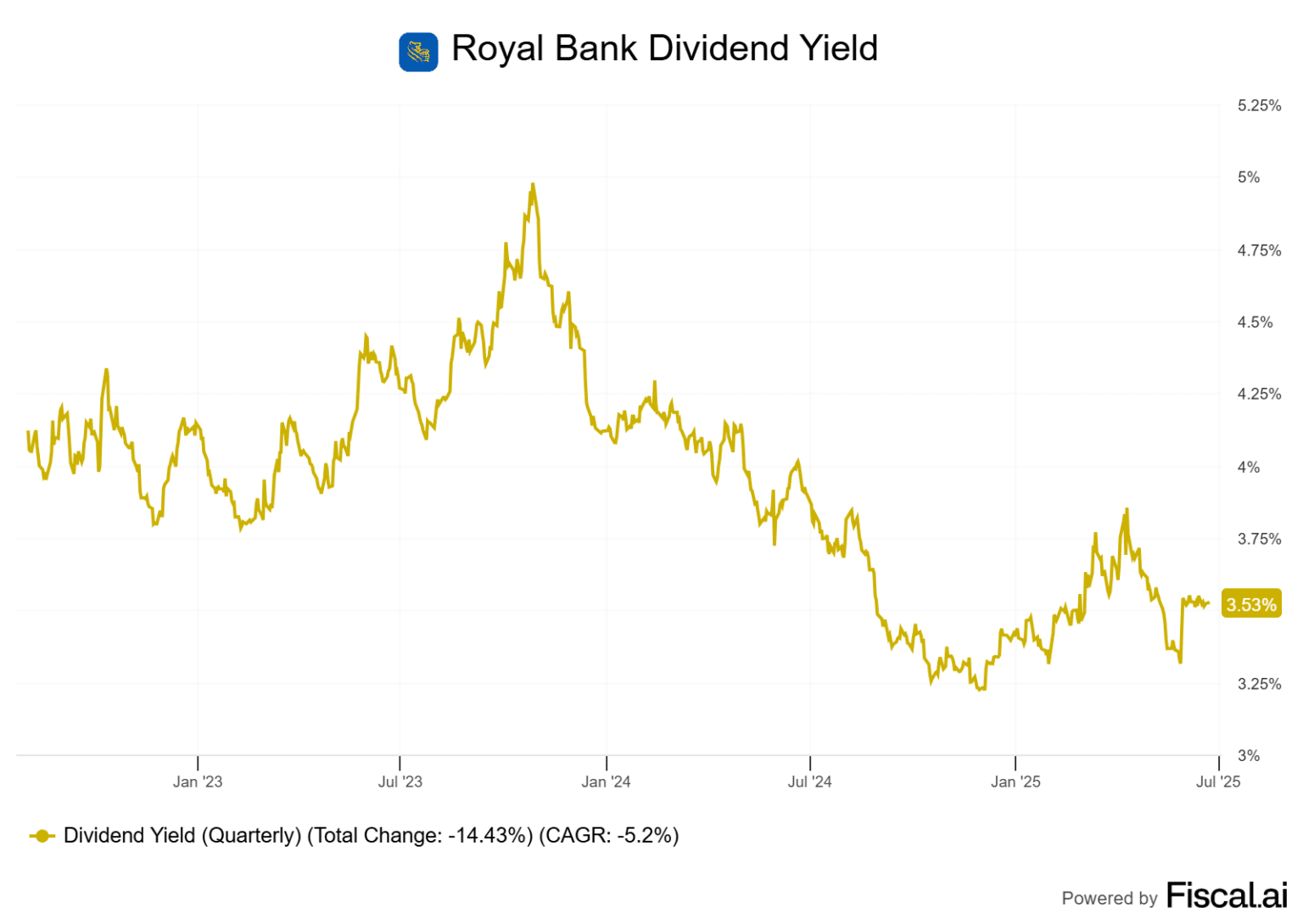

- Yield: At current prices, you're looking at a yield of roughly 2.8%. It’s not the highest in the world, but for a "widows and orphans" stock, it's pretty reliable.

There’s also a bit of a weird disconnect between the Canadian ticker (RY.TO) and the NYSE version (RY). In the U.S., the stock is hovering around $169.15. The currency gap makes it look different, but the sentiment is identical: people are bullish, but they're also waiting for the other shoe to drop regarding U.S. trade policy.

The Elephant in the Room: Interest Rates and Tariffs

The Bank of Canada is in a tough spot. Governor Tiff Macklem and the team decided to hold rates at 2.25% in December, and the market is betting 88% on another hold for the January 28 meeting.

But here’s the kicker.

If the U.S. Federal Reserve keeps cutting while we stay flat, the Canadian dollar gets kicked around. That actually helps RBC in a weird way because a lot of their earnings are in U.S. dollars via City National and their capital markets wing. A weak loonie means their U.S. profits look even bigger when converted back home.

🔗 Read more: Business Model Canvas Explained: Why Your Strategic Plan is Probably Too Long

However, we can't ignore the risk. If the "structural adjustment" the Bank of Canada keeps talking about turns into a full-blown slowdown because of new trade tariffs, the royal bank stock price could see a correction. They’ve already seen a slight uptick in provisions for credit losses (PCL)—basically money they set aside because they think some people might not pay their loans back. In 2025, that was $4.4 billion.

What Most People Get Wrong About RBC

A lot of retail investors think RBC is "too big to grow."

That's sorta' wrong.

They are becoming a technology company that happens to have a bank attached. Their AI-driven "Nomi" platform and their aggressive push into digital-first commercial banking are keeping their efficiency ratio way ahead of peers like BMO or Scotiabank.

💡 You might also like: Why Toys R Us is Actually Making a Massive Comeback Right Now

Also, don't sleep on the ROE. RBC just revised their Return on Equity target to 17%+ for 2026. For a bank of this size, that is an incredibly aggressive goal. It shows that CEO Dave McKay isn't just trying to maintain the status quo; he's trying to squeeze every cent of productivity out of the HSBC integration.

Actionable Next Steps for Your Portfolio

If you're looking at the royal bank stock price and wondering whether to jump in or run for the hills, here is the expert reality check.

- Watch the January 30 Earnings Call: Analysts are projecting an EPS of $2.78. If they beat that, $240 CAD is the next logical stop.

- Check the Ex-Dividend Date: It’s January 26, 2026. If you want that $1.64 payout in February, you need to own the shares before then.

- Monitor the BoC: The January 28 rate decision is the "vibe check" for the whole Canadian sector. If the Bank of Canada sounds more worried about inflation than growth, expect some volatility in bank stocks.

- Diversify Your Entry: Don't go all-in at the all-time high. Using a dollar-cost averaging approach over the next three months helps mitigate the risk of a "tariff tantrum" in the markets.

The bottom line? RBC is the "Fortress" of Canadian finance for a reason. Its stock price reflects a mix of massive scale, successful acquisitions, and a slightly nervous eye on the macro-economic horizon. It’s a hold for the long-term, but a "buy the dips" situation for anyone looking to enter now.