Honestly, if you’ve been watching the space industry lately, you know it’s no longer just a one-horse race. While everyone is busy tracking every Starship hop in Texas, something massive is shifting in Long Beach and Virginia. Rocket Lab isn't just the "little rocket company" anymore. It's becoming the backbone of how the U.S. government actually functions in orbit.

Just this week, the vibes around the company took a wild turn. On January 16, 2026, Morgan Stanley basically set the market on fire by upgrading Rocket Lab (RKLB) to "Overweight" and slapping a massive $105 price target on the stock. That’s a huge jump from their previous $67 target. The reason? Wall Street is finally waking up to the fact that Rocket Lab has moved past just launching small satellites. They are building the satellites themselves, and they're doing it at a scale that makes legacy defense contractors look a little slow.

The $816 Million Elephant in the Room

You can't talk about Rocket Lab recent news without mentioning the absolute monster of a contract they just solidified with the Space Development Agency (SDA). We're talking about an $816 million deal to build 18 missile-tracking satellites.

This isn't just a win; it's a statement.

👉 See also: How to see deleted WhatsApp messages: What actually works without getting scammed

Rocket Lab is now playing in the same sandbox as Lockheed Martin and Northrop Grumman. But here's the kicker: they aren't just a sub-contractor. They are the prime. They’re building the whole bus, the "StarLite" protection systems, and integrating the sensors. The SDA is essentially betting the future of U.S. hypersonic missile defense on Peter Beck’s team.

Wait, it gets better.

Not only is Rocket Lab building their own 18 satellites for this "Tracking Layer Tranche 3" program, but their components are so good that the other prime contractors—the big guys—are buying Rocket Lab hardware to put on their satellites. That’s like a car company winning a race and then realizing half the other cars on the track are using their engines.

Neutron: The Make-or-Break Moment

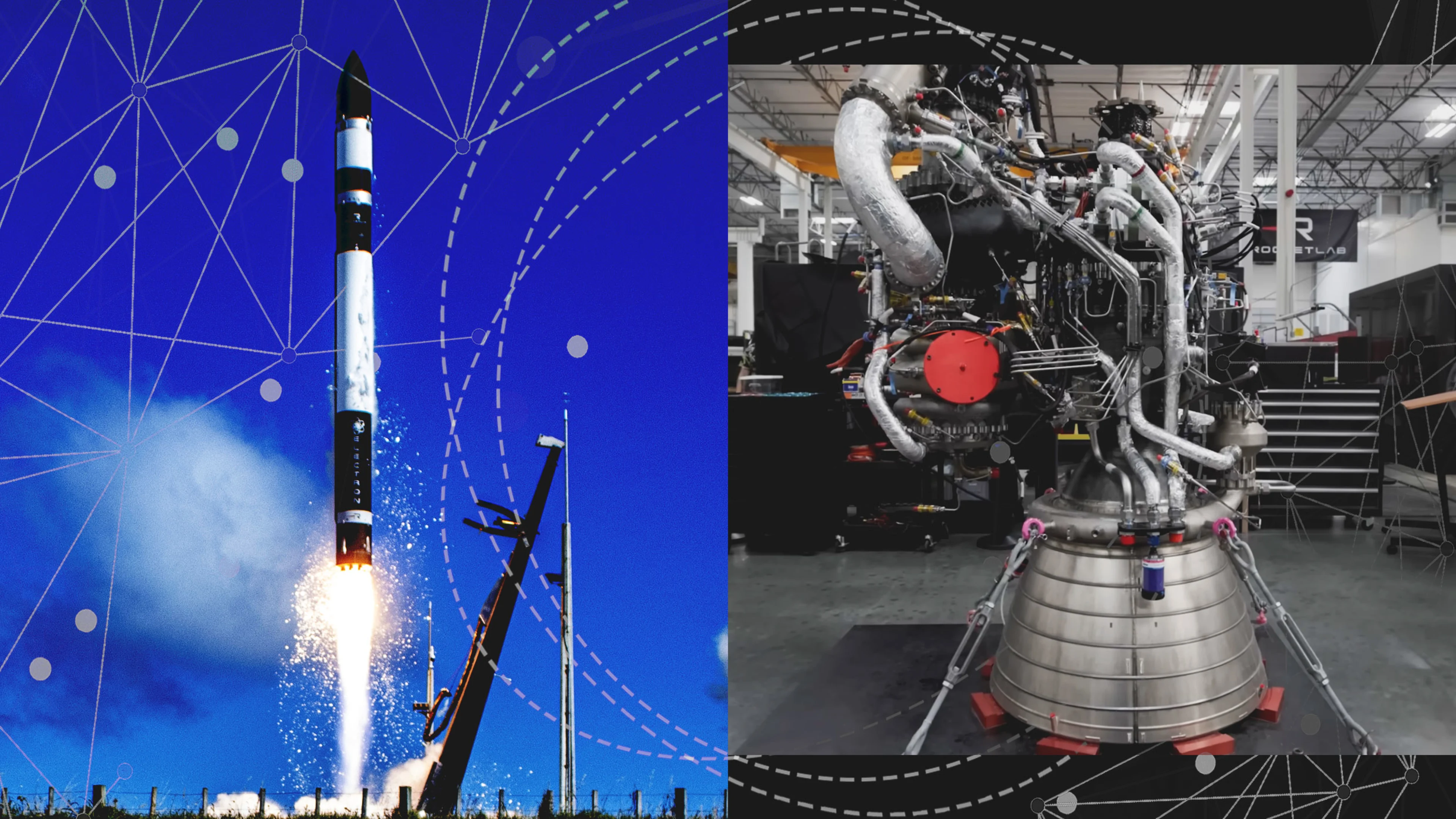

Okay, let’s talk about the big guy. Neutron.

If you've been following the schedule, you know the maiden flight has been the subject of a lot of "will they, won't they" drama. As of right now, in early 2026, the rocket is expected to arrive at Launch Complex 3 (LC-3) in Wallops Island, Virginia, sometime this quarter.

The first launch? We’re realistically looking at mid-2026.

Some people are annoyed by the delays. Honestly, it’s a brand-new medium-lift rocket with a "Hungry Hippo" fairing and Archimedes engines that need to work perfectly the first time. Peter Beck has been pretty vocal about not rushing this. They want a success on Flight 1, not a spectacular fireball.

- Payload Capacity: 13,000 kg (that's roughly 40x what Electron can do).

- The Mission: To eat Falcon 9’s lunch in the constellation deployment market.

- The Strategy: Use the "Archimedes" engine, which is designed for fast turnaround and reuse.

It's a risky game. But 2025 was a record-breaking year for them with 21 successful Electron launches and a 100% success rate. That kind of operational excellence buys you a lot of patience from investors.

Why 2026 Feels Different

The company's backlog is sitting at a staggering $1.1 billion.

Think about that. A few years ago, people weren't sure if small-launch was even a viable business. Now, Rocket Lab has a diversified revenue stream where "Space Systems"—the part that builds satellite components—is actually bringing in more money and higher margins than the launches themselves.

We’re seeing a shift from a "launch company" to an "end-to-end space company."

In March 2026, keep an eye out for a flurry of missions. We’ve got "Kakushin Rising" for JAXA, a fuel depot tech demo for NASA called LOXSAT 1, and more Earth-imaging satellites for Synspective. It’s a relentless pace.

The Financial Reality

It’s not all sunshine and rocket fuel, though. KeyBanc actually downgraded the stock to "Sector Weight" just yesterday. Their logic? The "growth drivers are common knowledge." Basically, they think the stock has run up so fast (up over 250% in a year) that the good news is already "priced in."

They’re also worried about the burn rate. Developing Neutron is expensive. Really expensive. While Rocket Lab has about $1 billion in liquidity, they aren't profitable yet. They lost about $18 million last quarter. If Neutron slips into 2027, things could get sweaty.

But if you ask the folks at Morgan Stanley, they'll tell you the risk-reward is finally leaning toward the "reward" side. The maturity of the commercial space sector in 2026 is lightyears ahead of where it was even two years ago.

💡 You might also like: Soundcloud Playlist to Zip: Why Most Online Tools Are Sketchy

What You Should Actually Do With This Information

If you're watching Rocket Lab, the "news" isn't just about the next launch. It's about the industrialization of space.

Watch the Archimedes hot fires. If those tests go well in the coming weeks, the mid-2026 Neutron launch date becomes a lot more real.

Keep an eye on the SDA milestones. The first satellites for the Transport Layer are supposed to start launching later this year. If Rocket Lab hits those delivery dates, it proves they can handle "Big Space" manufacturing.

Monitor the "Space Systems" revenue. If that segment continues to grow at 40%+ year-over-year, the launch business starts to look like the "loss leader" that gets customers into the ecosystem, while the satellite parts provide the actual profit.

Space is hard. It’s cliché, but true. However, Rocket Lab has spent the last decade proving they aren't just another PowerPoint rocket company. They’re building a real, gritty, manufacturing-heavy business. 2026 is the year we find out if they can scale that grit into a multi-billion dollar empire.

Actionable Next Steps:

- Check the Wallops LC-3 Progress: Follow local notices or Rocket Lab's social feeds for the arrival of the Neutron stages at the pad. This is the ultimate "it's happening" signal.

- Analyze the Q4 2025 Earnings: When they report in late February, look specifically at the "Space Systems" gross margin. If it stays above 35%, the business model is working.

- Track the Electron Cadence: They are aiming for more than 25 launches this year. Any significant pause in Electron flights could signal a resource shift to Neutron that might delay revenue.