Ever found yourself standing at a pharmacy counter or sitting in a doctor’s waiting room, only to be told your insurance "isn't showing up"? It’s a gut-punch. Honestly, it’s one of those modern-day frustrations that feels like it should have been solved years ago. That’s essentially where the ro co insurance checker—shorthand for the Roman Health (Ro) and its partner systems—comes into play. If you've ever used Ro for something like hair loss, weight management, or heart health, you know they operate a bit differently than your local GP.

Checking insurance shouldn't feel like decoding the Enigma machine.

📖 Related: Flat Rate Box Large Cost: Why Shipping Heavy Stuff Just Got More Expensive

When people search for a "ro co insurance checker," they’re usually looking for one of two things. Either they are trying to see if their specific commercial insurance plan covers the telehealth visits and medications provided by Ro (the digital health company), or they are trying to verify their "Ro" pharmacy benefits through a secondary provider. It's confusing because Ro started as a cash-pay business. But things changed. Big time.

The Reality of Ro Co Insurance Checker and Telehealth Coverage

A few years ago, the idea of using insurance for a digital-first health platform like Ro was basically a pipe dream. You paid your $20 or $30 for a consult, paid out of pocket for the meds, and that was that. It was simple, but it was expensive if you were on long-term treatments. Now, the landscape is shifted. Ro has integrated more robustly with insurance networks, but it isn’t a universal "yes" across the board.

Most people don't realize that the "checker" isn't necessarily a single button on a website. It’s a background process. When you sign up, you provide your PBM (Pharmacy Benefit Manager) details. The system then pings the "Ro Co" infrastructure to see if your plan treats this as an "in-network" or "covered" event.

Why your "Checker" might say no

Don't panic if it doesn't immediately go through. Insurance companies are notoriously slow to update their digital handshakes with telehealth providers. Sometimes the "checker" fails because of a simple typo in your Member ID. Other times, it's because your specific employer-sponsored plan has an exclusion for "lifestyle" medications. This is common with things like GLP-1s (think Ozempic or Wegovy) or certain dermatology treatments.

You’ve got to be your own advocate here. If the internal Ro checker says your insurance isn't valid, call your insurer directly. Ask them specifically: "Do you cover telehealth services provided by Ro or its affiliated medical groups like Ro Pharmacy?"

How Ro Handles Insurance for GLP-1s and Specialized Care

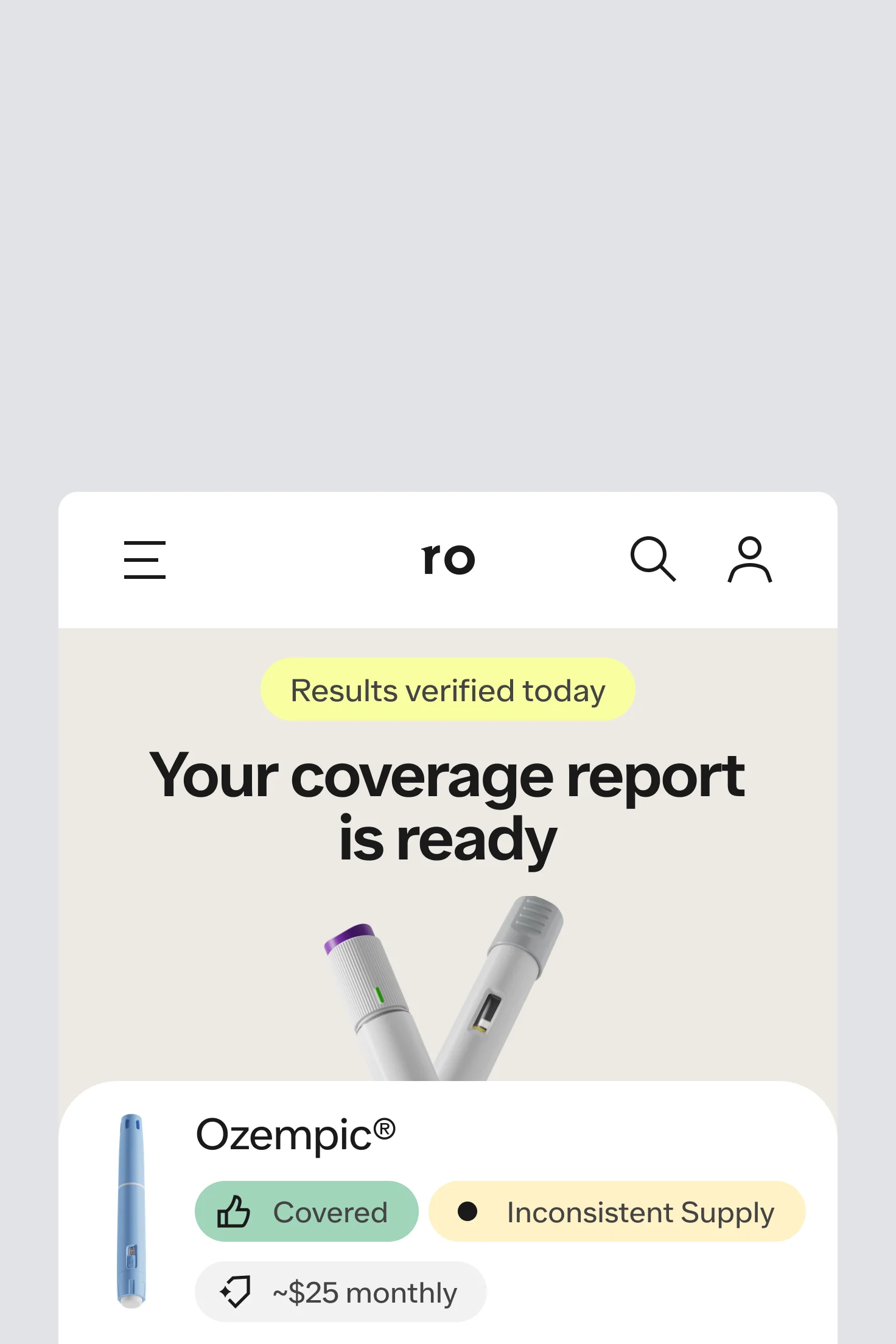

The biggest surge in people looking for the ro co insurance checker lately involves the Body Program. Since GLP-1 medications can cost upwards of $1,000 a month without insurance, the "checker" becomes the most important part of the entire onboarding process.

Ro uses a specialized team to handle what they call "Insurance Concierge" services. It’s basically a human-powered version of an insurance checker. Instead of just a bot saying "No," they actually look at your benefits to see if a Prior Authorization (PA) is possible.

The process is tedious.

It involves:

- Checking your primary pharmacy benefit.

- Seeing if your specific diagnosis meets the insurer's "medical necessity" criteria.

- Filing the PA paperwork on your behalf.

- Following up when the insurance company inevitably drags their feet.

It’s not perfect. Some users report that the "checker" stage takes longer than the actual medical consultation. That’s because the "Ro Co" system has to wait on the legacy systems of companies like Blue Cross Blue Shield, UnitedHealthcare, or Aetna. These systems aren't exactly built for the speed of the internet.

Common Misconceptions About the Checker Tool

A lot of people think that if they use the ro co insurance checker and it "clears," their medication will be free. That is almost never the case. "Covered" just means the insurance company is willing to pay part of it. You might still have a $50 copay, or worse, you might have to hit a $3,000 deductible before they chip in a single cent.

Also, there is a difference between the medical consultation and the medication.

- The Ro "checker" might confirm your insurance covers the doctor’s visit.

- The same "checker" might then tell you the medication itself is out-of-network.

It’s a weird, fragmented system. You can have a "covered" doctor and "uncovered" pills. This happens because medical benefits and pharmacy benefits are often handled by two different companies entirely, even if they're on the same card.

Step-by-Step: Using the Ro Co Insurance Checker Effectively

If you’re about to start a treatment or you're trying to update your billing, don't just wing it. There’s a specific way to handle the data entry to ensure the checker actually works.

✨ Don't miss: Rob Dyrdek Net Worth: Why the Skater is Richer Than You Think

First, get your physical card. Don't rely on memory. You need the BIN, PCN, and Group Number. These are the "coordinates" that the ro co insurance checker uses to find your account in the massive sea of healthcare data. If you miss one digit, the system returns a "Member Not Found" error, which usually triggers a "Cash Pay Only" default setting.

Secondly, check for "Secondary Insurance." The Ro system generally prefers your primary commercial insurance. If you have Medicare or Medicaid, the rules are drastically different. In fact, for many telehealth platforms, federal law actually prohibits them from applying certain discounts or even accepting certain government-affiliated plans for specific types of "lifestyle" care. It’s a legal minefield that has nothing to do with Ro and everything to do with outdated federal regulations.

The "Ghosting" Problem

Sometimes the checker seems to hang. You’ve uploaded the photo of your card, and then... nothing. Usually, this means the system is performing a "Real-Time Eligibility" (RTE) check. If the insurer's server is down for maintenance—which happens more often than you’d think, especially on Sunday nights—the checker just sits there. If it’s been more than 24 hours, it’s worth a quick message to their support team.

Navigating the Costs When the Checker Fails

So, what if the ro co insurance checker tells you that you're out of luck? You aren't necessarily out of options. Ro, like many of its competitors, offers a "cash price" that is often lower than what a traditional pharmacy would charge someone without insurance.

This is because they cut out the middleman. By using their own pharmacy (Ro Pharmacy), they avoid the markups added by the big-box drugstores. Sometimes, paying the "Ro Cash Price" is actually cheaper than using your insurance copay, especially if you have a high-deductible plan. It sounds counterintuitive, but I’ve seen cases where a copay was $60, but the direct-to-consumer cash price was $35.

Always compare.

Actionable Insights for Your Insurance Journey

To get the most out of the ro co insurance checker and avoid getting stuck in a loop of "denied" screens, follow these specific steps:

- Audit Your Card Before Typing: Ensure you have the Pharmacy Benefit (PBM) info, not just the general medical info. Look for logos like Caremark, Express Scripts, or OptumRx on the back of your card.

- Verify the "Telehealth" Clause: Log into your insurance provider's own portal (e.g., the MyUHC or Aetna site) and search for "Telehealth Reimbursement." If they don't allow it, no amount of checking on Ro's side will fix the "denied" status.

- Screenshot Everything: If the checker shows a specific price or coverage level, take a screenshot. Insurance data can fluctuate, and having a record of what the system "promised" at the time of your consult can be a lifesaver if you get hit with a surprise bill later.

- Check for "Step Therapy" Requirements: Many times the checker "fails" because your insurance requires you to try a cheaper medication first. If Ro is suggesting a Tier 3 drug, ask if your insurance prefers a Tier 1 or Tier 2 alternative that Ro can also prescribe.

- Use the Concierge: If you are signing up for the high-cost programs (like the GLP-1s), lean heavily on the Ro administrative staff. That is part of what you are paying for. Let them do the "checking" for you.

Dealing with insurance is easily the worst part of healthcare. It's bureaucratic, slow, and purposefully confusing. But tools like the ro co insurance checker are at least an attempt to bring some transparency to a system that usually hides its prices until it's too late. Use the tool as a starting point, but always keep your insurer's phone number handy just in case the digital handshake misses a beat.