You've probably seen the "God candle" screenshots on Twitter. Some guy turns $500 into $50,000 because he caught a massive breakout on a meme coin or a tech stock. It looks easy. It looks like the dream. But here’s the cold reality: that trade wasn't a strategy. It was a lottery ticket. Most people looking for that kind of action completely ignore the boring, unsexy math that actually keeps professional fund managers in business. We're talking about the risk to return win rate—the actual heartbeat of any profitable trading system.

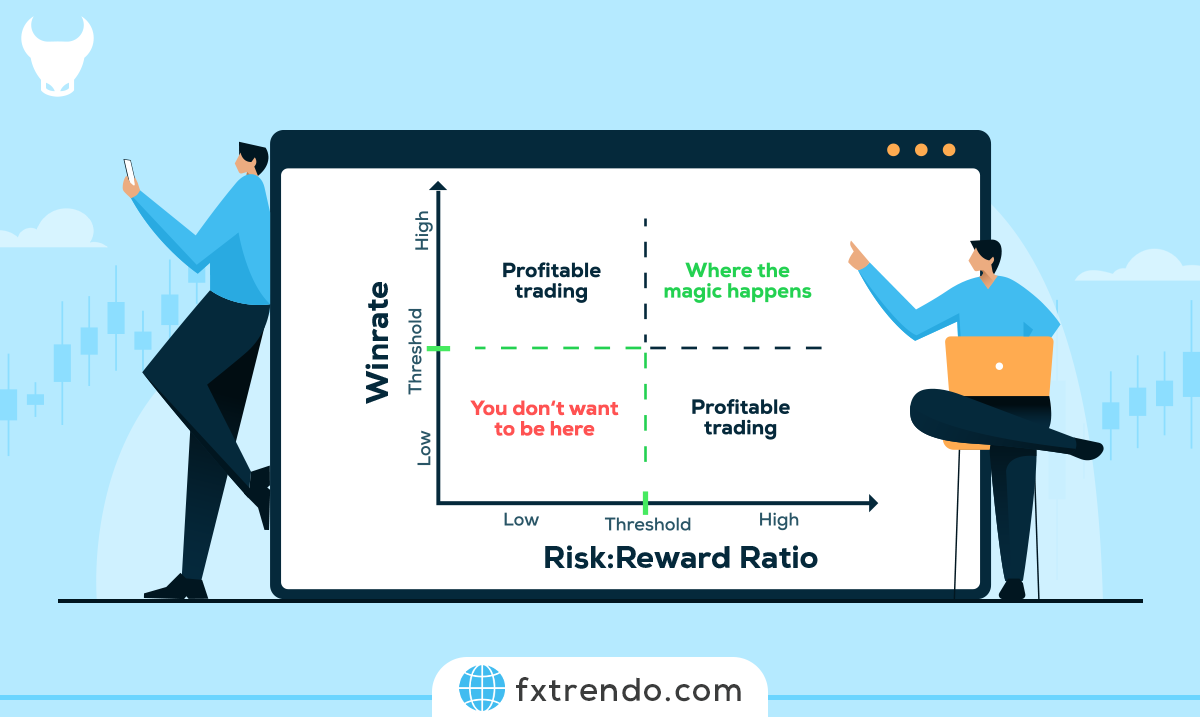

Trading is basically a game of probabilities. Honestly, it's not even about being "right" about where the market is going. You can be wrong 60% of the time and still retire on a beach if your math is tight. Conversely, you can be right 90% of the time and still blow your account in a single afternoon.

The industry calls this the Trader’s Equation.

The Math Behind the Risk to Return Win Rate

Most beginners think they need a high win rate. They want to feel the dopamine hit of a "green" trade every time they click buy. But if you're risking $100 to make $10, you are one bad day away from total liquidation. This is the "picking up pennies in front of a steamroller" problem.

To understand the risk to return win rate relationship, you have to look at Expectancy. This is a formula used by pros like Ed Seykota or Ray Dalio to determine if a strategy is even worth the electricity it takes to run the laptop.

$$E = (W \times R) - (L \times r)$$

In this equation, $W$ is your win rate, $R$ is your average reward, $L$ is your loss rate, and $r$ is your average risk. If the result is positive, you have an "edge." If it's negative, you're just gambling with extra steps.

Think about a 1:3 risk-to-reward ratio. This means for every dollar you're willing to lose, you're aiming to make three. At a 1:3 ratio, you only need to be right 26% of the time to break even. Let that sink in. You could be "wrong" nearly three-quarters of the time and still not lose money. That’s the power of the risk to return win rate dynamic.

The Psychological Trap of the High Win Rate

Humans hate being wrong. Our brains are hardwired to avoid the sting of a loss. This is why so many retail traders "average down" on losing positions. They don't want to realize a loss, so they throw good money after bad, hoping the market will turn around and prove them right.

They’re prioritizing their ego over their bank account.

A high win rate—say, 80%—usually comes with a very poor risk-to-reward ratio. Why? Because to hit that 80% mark, you usually have to take profits very early (small wins) and give your losers a lot of "room to breathe" (huge losses). It feels good for a week. Then, one "Black Swan" event happens, the market gaps down, and your one loss wipes out twenty wins.

Mark Minervini, a legendary U.S. Investing Champion, talks about this constantly. He focuses on the "Risk-of-Ruin." If you have a low risk to return win rate efficiency, your chance of hitting zero isn't just a possibility; it's a mathematical certainty over a long enough timeline.

🔗 Read more: David Abercrombie and the Real History of Abercrombie & Fitch That Modern Shoppers Forget

Why Your Strategy is Probably Leaking Money

Most people build a strategy backwards. They find a flashy indicator—maybe a Relative Strength Index (RSI) or some Bollinger Bands—and try to find entries. They don't think about the exit until they're already in the red.

If you don't know your exit before you enter, you aren't trading. You're praying.

A solid risk to return win rate requires a fixed stop-loss. No exceptions. No "I'll get out when it hits the next support level." Professional desks use "Hard Stops." This ensures that the $r$ in our equation stays small.

Real World Example: The Turtle Traders

Back in the 1980s, Richard Dennis and William Eckhardt ran an experiment to see if trading could be taught. They recruited a group of "Turtles." Their strategy was famous for having a relatively low win rate—somewhere between 30% and 40%.

How did they make millions?

They caught the "fat tails." When they were right, they were really right. They let their winners run for weeks or months, while cutting their losers almost immediately. Their risk to return win rate was skewed heavily toward "high reward, low win frequency."

This is incredibly hard to do emotionally. Watching your account balance fluctuate while you wait for a massive trend to finish requires nerves of steel. Most people get "shaken out" or take profit too early because they're scared of the gain disappearing.

The Sweet Spot for Modern Markets

Markets in 2026 are faster than ever. Algorithms and HFT (High-Frequency Trading) bots hunt for retail stop-losses. This makes the "classic" 1:2 or 1:3 ratio harder to maintain because "noise" often hits your stop before the move happens.

A lot of successful intraday traders have shifted toward a 1:1.5 ratio with a 55-60% win rate. It’s a more stable equity curve. It doesn't have the wild drawdowns of the trend-following systems, but it still provides enough cushion to survive a losing streak.

- The 1:1 Ratio: Requires a win rate > 50% to stay afloat. It's a grind.

- The 1:2 Ratio: Requires a win rate > 33%. This is often the "Goldilocks" zone for swing traders.

- The 1:5 Ratio: Requires a win rate > 17%. This is the venture capital model. Most bets fail, but the ones that hit, hit the moon.

You have to pick a style that fits your personality. If you're the type of person who gets stressed after two losing trades in a row, you cannot trade a low win rate system. You will abandon the strategy right before the big win comes. You'll blame the market. You'll say it's "rigged." Honestly, it’s just your math failing your temperament.

The Impact of Slippage and Commissions

We can't talk about risk to return win rate without mentioning the "hidden" killers: slippage and fees.

If you're aiming for a 1:1.5 ratio on a very small timeframe (scalping), your commissions might represent 10% or 20% of your potential profit. Suddenly, your "profitable" math is actually a losing game. This is why many retail traders fail—they aren't accounting for the house's cut.

Always calculate your "Expectancy" after fees. If the math still holds up, you've got a shot.

How to Audit Your Own Performance

If you want to move from "gambler" to "trader," you need a journal. Not a diary of your feelings, but a spreadsheet of your risk to return win rate data.

- Track every entry and exit price.

- Calculate the R-Multiple. (If you risked $50 and made $150, that’s a 3R trade).

- Group your last 50 trades. 4. Find your average Win Rate.

If your average R-Multiple is 1.2 and your win rate is 40%, you are losing money. You have two choices: find ways to let your winners run longer (increase reward) or tighten your entry criteria to stop getting caught in "fakeouts" (increase win rate).

Most people try to do both at once. Don't.

Focus on one variable. Usually, tightening the risk is the fastest way to see an improvement. Tightening risk doesn't mean a closer stop-loss—it means a better entry point where the stop-loss can be logically placed behind a "structural" barrier like a recent low or a moving average.

Common Misconceptions About Win Rates

There’s a weird myth that a 90% win rate is the goal. Go look at some of the most successful hedge funds in history. Many of them hover around 50%. The difference is they don't have "ego" trades. They don't stay in a position because they "believe" in the company.

The market doesn't care what you believe.

Another misconception is that you can just "set it and forget it." Market regimes change. A 1:3 risk to return win rate might work beautifully in a trending market but get absolutely chopped to pieces in a range-bound, sideways market. You have to recognize the "environment" you're in.

In a "choppy" market, you should actually lower your reward expectations and aim for a higher win rate on smaller moves. In a "trending" market, you do the opposite. You widen your targets and accept a few more stopped-out trades in exchange for the big runner.

Actionable Steps to Fix Your Math

Stop looking at the dollar amounts. Seriously. If you're looking at your P&L (Profit and Loss) while the trade is open, you're going to make emotional decisions. You'll see "$200 profit" and get scared it'll turn to zero, so you close it. But your strategy required a $400 profit to maintain your risk to return win rate. You just sabotaged your own math.

Here is how you actually implement this:

- Define your "R" per trade. This should be a fixed percentage of your account, usually 1% or less.

- Calculate your "Breakeven" Win Rate. Use the formula: $Win Rate = 1 / (1 + Reward:Risk)$. If your target is 2:1, your breakeven is $1 / (1+2) = 33.3%$.

- Backtest for Drawdowns. Even with a 60% win rate, it is statistically possible—even likely—to have 5 or 6 losses in a row. If you're risking too much per trade, a normal "losing streak" will blow your account before the math can even out.

- Use a Trade Journal. Use software like TraderSync or a simple Excel sheet. If you don't have data, you're just guessing.

The risk to return win rate isn't just a metric; it's a survival guide. The market is designed to take money from people who are disorganized and give it to people who are disciplined. By focusing on the expectancy of your trades rather than the "feeling" of the market, you're already ahead of 90% of the people trading today.

Focus on the process. The profits are just a side effect of good math. Keep your losses small, your winners large, and stop obsessing over being "right" on every single trade. It's not about being a genius; it's about being a disciplined actuary who happens to trade stocks.

Get your spreadsheet open. Look at your last 20 trades. Calculate your R-multiple. If the math doesn't work on paper, it definitely won't work in the live market. Fix the math first. The rest will follow naturally.