If you walk through the streets of Luxembourg City, you might not immediately feel like you’re standing in the middle of a global financial superpower. It’s quiet. It’s pretty. There are a lot of hills. But according to the latest 2026 data, this tiny nation is crushing every other neighbor when it comes to wealth.

Honestly, the "wealthiest" tag is kinda tricky. Are we talking about the country with the most total cash in the bank, or where the average person has the most spending power? It’s a huge difference. If you look at Germany, they have a massive GDP of around $5.3 trillion. They're a titan. But the average German isn't necessarily "richer" than someone in a tiny tax haven or a mountain republic.

Why Richest Countries in Europe Don't All Look the Same

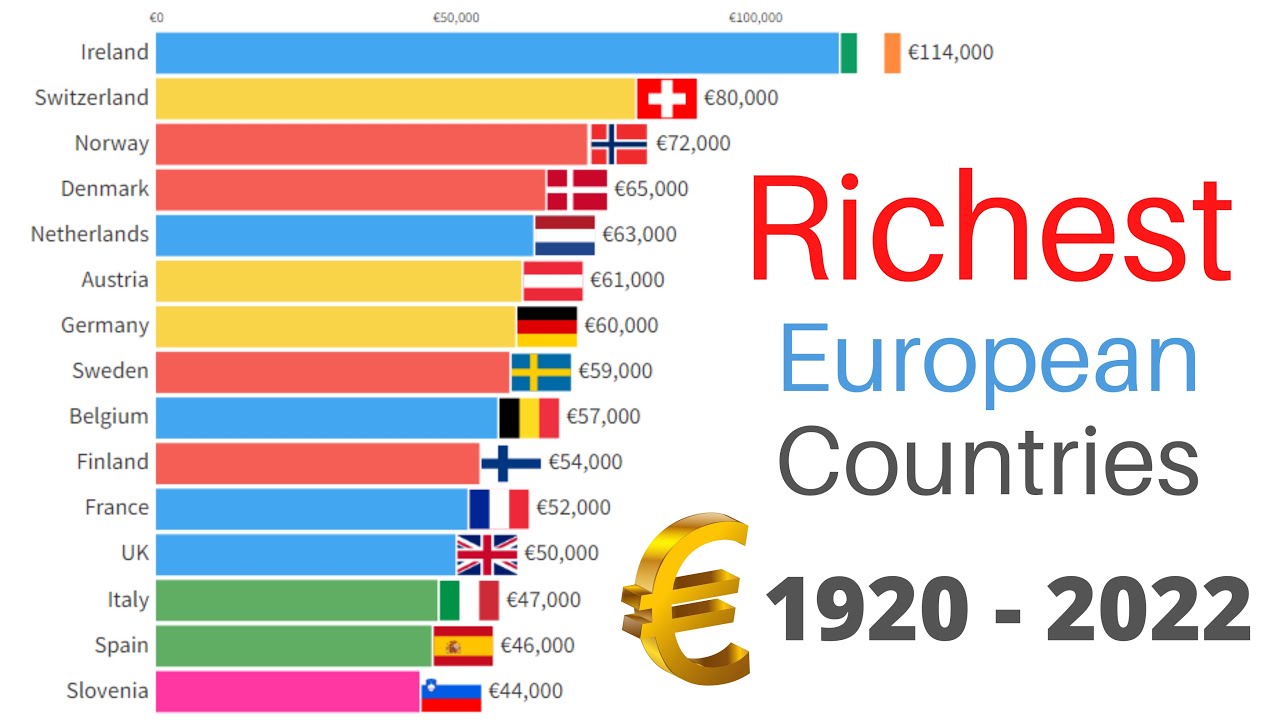

We usually measure this stuff using GDP per capita. Basically, you take all the money a country makes and divide it by the people living there. For 2026, the numbers are pretty wild. Luxembourg is sitting at the top with a projected GDP per capita of roughly $140,000.

Compare that to the EU average, and it's nearly double. Why? Well, it’s not just because they’re all millionaires. It's largely due to cross-border workers. Thousands of people commute from France, Belgium, and Germany every day. They produce wealth for Luxembourg, but they aren't counted in the population. It skews the stats, making the "per person" wealth look astronomical.

Then you have Ireland. For 2026, Ireland’s GDP per capita is expected to hit $120,000. If you’ve been to Dublin lately, you know it’s expensive, but does it feel "richest in the world" rich? Maybe not. That’s because of "Leprechaun Economics." Tech giants like Apple and Google headquarter there for the tax perks. Their global profits get tallied in Ireland, even if that money never actually touches a local's wallet.

The Real Wealth: Switzerland and Norway

If you want to talk about "real" wealth—the kind that translates to high wages and a crazy high standard of living—you have to look at the non-EU heavyweights.

- Switzerland ($105,000 per capita): They don't rely on accounting tricks. They do banking, luxury watches, and high-end pharma. They’ve stayed neutral for centuries, and it paid off.

- Norway ($100,000 per capita): They have oil. Lots of it. But instead of blowing it all, they put it into a Sovereign Wealth Fund. It’s essentially the world's biggest piggy bank, ensuring that even when the oil runs out, the country stays loaded.

The Mid-Tier Powerhouses

It's easy to ignore the "boring" countries that just work well. Denmark, the Netherlands, and Austria all sit in that comfortable $60,000 to $75,000 range. These places have what experts call "social cohesion." You pay high taxes, sure. But you get world-class healthcare, free college, and transit that actually shows up on time.

The Netherlands, for instance, uses the Port of Rotterdam—Europe’s biggest—to keep the cash flowing. They are also masters of high-tech agriculture. It's weird to think about, but this small, rainy country is one of the world's top food exporters.

What happened to the Big Three?

You might be wondering where the "famous" countries are. The UK, France, and Italy.

💡 You might also like: Mike Lindell: What Really Happened to the MyPillow Guy

The UK is hovering around $55,000. Post-Brexit structural issues are still a thing in 2026, and growth has been a bit sluggish compared to the pre-2020 era. France is right behind at $52,000. They have a massive economy, but they also have a lot of people and a very complex social safety net that costs a fortune to maintain.

Italy is a tale of two countries. The North (around Milan) is as rich as Germany. The South? Not so much. This drags their average down to about $45,000.

The Convergence of the East

The most exciting thing happening in the 2026 economic landscape is the "catch-up."

Countries like Slovenia ($42,000) and the Czech Republic ($38,000) are closing the gap fast. They have highly skilled workers and have become the manufacturing backbone for German industry. Honestly, it won't be long before some of these "Eastern" countries leapfrog the traditional "Western" powers in terms of individual wealth.

How to use this info if you're traveling or moving

If you’re looking at these richest countries in Europe for a move or a long trip, remember that GDP isn't everything.

High GDP usually means a high cost of living. In Zurich or Geneva, a basic lunch can easily set you back $40. In a place like Poland—which is growing fast but still "cheaper"—your money goes three times as far.

✨ Don't miss: The Protecting Americans from Tax Hikes Act: Why This Old Law Still Hits Your Wallet

Actionable Insights for 2026:

- Look at GNI, not just GDP: If you're researching a country's actual wealth, search for "Gross National Income." It filters out the corporate tax-haven noise you see in Ireland.

- Check the PPP: "Purchasing Power Parity" tells you what your money actually buys. A high salary in Luxembourg might leave you with less "fun money" than a medium salary in Spain once rent is paid.

- Follow the "Mittelstand": If you're an investor, look at Germany's mid-sized manufacturing sector. It's less flashy than tech, but it's the most stable wealth generator in Europe.

- Monitor the Nordic Model: For long-term stability, Denmark and Sweden remain the gold standard. They manage to stay rich while keeping the gap between the richest and poorest very small.

Europe's wealth map is shifting. The old empires are stable, but the small, nimble, and tech-focused nations are the ones actually winning the "richest" race right now. Keep an eye on those "mid-tier" stars; that’s where the real growth is happening.