Checking your payslip shouldn't feel like a jump scare. But for thousands of UK graduates, that "Student Loan" line item is a confusing, shifting mystery. Honestly, it's less like a traditional debt and more like a graduate tax that's constantly changing the locks.

If you started university in England recently, specifically after August 2023, you're looking at a 40-year commitment. That is a long time. For those on older plans, the rules are different, the interest is higher, and the "wipe-off" date is closer. It's a mess.

Basically, the repayment student loan uk system is split into "Plans." Which plan you’re on determines when you start paying, how much they take, and when the debt finally vanishes into thin air.

The Plan 5 Shock: Why New Grads are Paying More for Longer

Let’s talk about the new kid on the block. Plan 5.

If you began your undergraduate course on or after August 1, 2023, you are on Plan 5. The government basically looked at the old system and decided it was too expensive for the taxpayer. Their solution? Make you pay for 40 years instead of 30.

Under Plan 5, you start repaying once you earn over £25,000 a year.

That threshold is lower than the older Plan 2 (which is currently £28,470 for the 2025/26 tax year). This means you start losing money from your paycheck sooner. The interest rate is tied only to the Retail Price Index (RPI), which sounds "fairer" because there’s no extra 3% added on top, but because the repayment window is ten years longer, more people will end up paying back the full amount they borrowed.

It’s a trade-off. Lower interest, but a much longer "sentence."

What Happens if You Work Abroad?

This is where people get caught out.

You can't just move to a beach in Bali and forget the Student Loans Company (SLC) exists. Well, you can, but they will find you, and they will charge you "default" interest rates that are eye-watering.

🔗 Read more: 2200 Yuan to USD: What You Actually Get After Fees and Inflation

If you’re living outside the UK for more than three months, you have to tell the SLC. They don't use the UK thresholds of £25,000 or £28,470 for every country. Instead, they use something called "Price Level Indices."

If you move to a country where the cost of living is lower—say, Vietnam—your repayment threshold might drop significantly. You could find yourself owing money even on a relatively modest local salary. If you ignore them, they apply a "fixed instalment" and the highest possible interest rate. It’s a headache you don't want.

To Overpay or Not to Overpay?

Most financial experts, including the likes of Martin Lewis, usually say: don't bother. Why? Because for many, the loan will be wiped before it's paid off anyway. If you're on Plan 2 and you're not a high-flyer earning £60k+ early in your career, your voluntary overpayments are essentially just giving the government a gift. You're paying off debt that would have been cancelled in 30 years regardless.

However, the math is changing for Plan 5. Since the interest is lower (RPI only) and the term is 40 years, a much higher percentage of graduates will actually pay off the whole thing. In that specific case, paying it down early might actually save you interest in the long run.

But—and this is a big but—student loan debt doesn't go on your credit file. It doesn't affect your ability to get a mortgage in the same way a credit card does (though it does affect your "affordability" because it lowers your take-home pay).

The 2026 Reality Check: Thresholds and Numbers

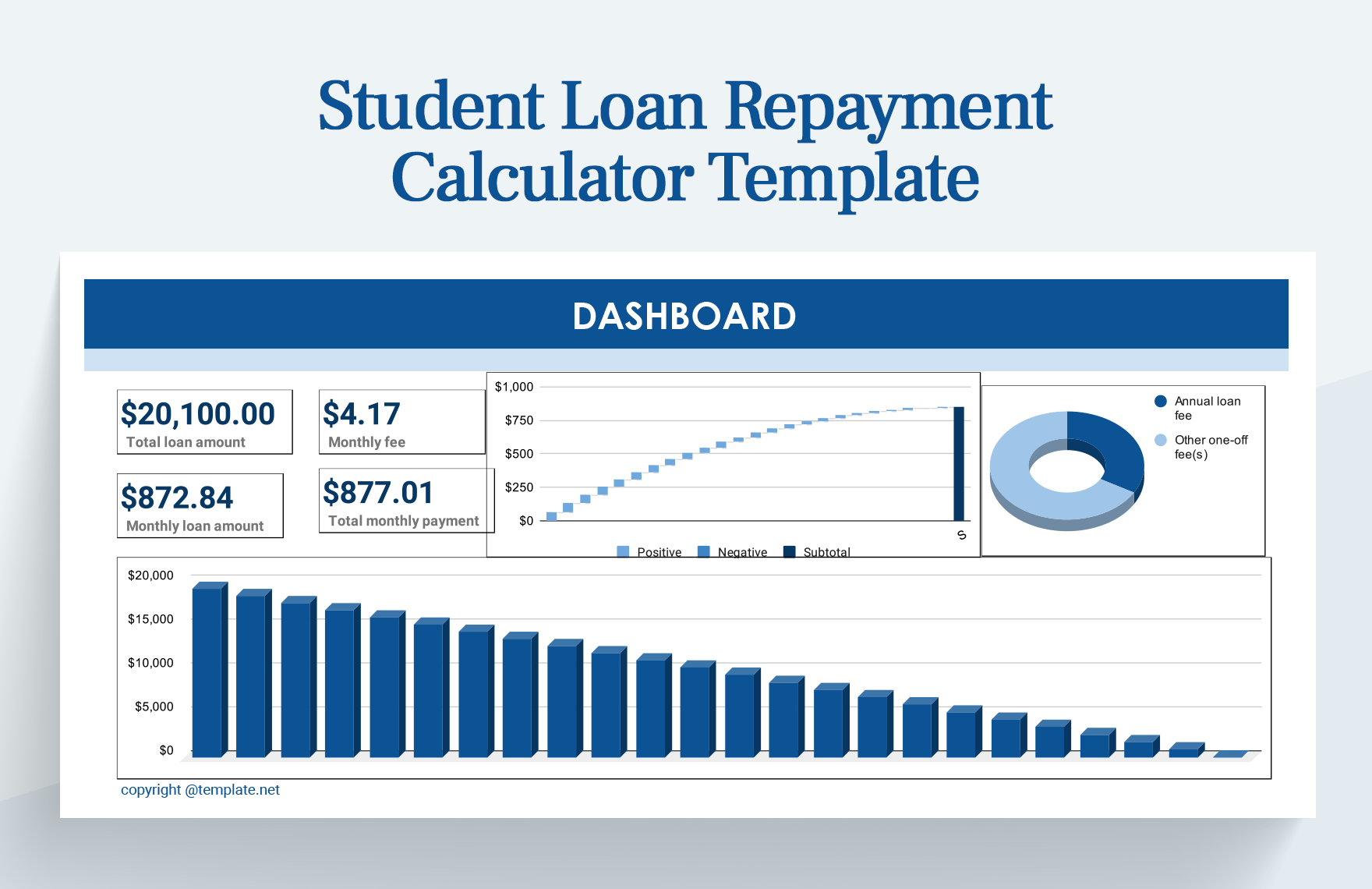

As of the 2025/26 tax year, here is the breakdown of what you actually need to earn before a single penny leaves your account:

- Plan 1 (Pre-2012): £26,065

- Plan 2 (2012–2023): £28,470

- Plan 5 (Post-2023): £25,000

- Postgraduate Loan: £21,000

If you're on a Postgraduate loan and an undergraduate plan, they take both. You'll pay 9% of everything over your undergrad threshold plus 6% of everything over £21,000. It can feel like a massive chunk of your "extra" income disappears before it even hits your bank account.

Myths vs. Reality

- "It's like a mortgage." No. If you lose your job, your mortgage still needs paying. If you lose your job, your student loan repayment stops instantly.

- "Debt collectors will come to my door." Only if you've been overpaid a grant or you've moved abroad and refused to communicate. For standard PAYE employees, the money is taken by HMRC before you even see it.

- "I should pay it off to help my credit score." It won't help. Lenders look at your net income. Paying off the loan might increase your net income, but using that same cash for a house deposit is almost always a better move.

Real-World Action Steps

Stop guessing and actually look at the numbers.

Log in to the Student Loans Company (SLC) online portal. It’s surprisingly better than it used to be. You can see exactly which plan you’re on and how much "interest" is being added every month.

If you are a high earner on Plan 2, calculate if you’re likely to pay it off before the 30-year mark. If you are, overpaying might be a savvy move. If you’re a mid-to-low earner, treat it like a tax. Forget about the total balance; it's just a number on a screen that will eventually disappear.

Finally, keep your P60s. If you worked a job for six months, earned over the weekly threshold, but then didn't work the rest of the year, you might have paid "too much" student loan overall. You can claim that back. It’s your money. Don't let the government keep it just because you didn't check the math.

Check your current salary against the 2026 thresholds. If you’re hovering just above the limit, even a small pension contribution might bring your "taxable" income below the threshold, saving you those monthly repayments while building your own future instead of the Treasury's.