You’re staring at a stack of state filing forms, trying to figure out why on earth you need to appoint a "registered agent" just to sell t-shirts or start a consulting gig. It sounds like some weird secret society requirement. It isn't. Honestly, it’s one of those bureaucratic hurdles that seems pointless until someone tries to sue you. Then, it becomes the most important name on your paperwork.

Basically, a registered agent for LLC is your business’s official point of contact for the government. If the state needs to send you annual report reminders, they send them here. If a process server shows up with a lawsuit, they go here. You can’t just put "the internet" as your address. You need a physical human or a company standing by during business hours.

Most people think they can just put their home address and be done with it. You can. But you might not want to.

Why the State Cares About Your Registered Agent for LLC

State governments, like the Secretary of State in Delaware or California, need a "reliable" way to find you. They don't want to play hide-and-seek. If your business is involved in legal trouble, the court needs to know you were actually notified. This is called "Service of Process."

Without a registered agent, you could potentially lose a lawsuit by default just because you didn't know you were being sued. Imagine a "default judgment" being entered against your bank account because a legal notice got lost in your junk mail or stuck behind your screen door. It happens. Frequently.

The Strict Physical Address Rule

You can't use a P.O. Box. Period. The law requires a physical street address where a person is physically present during normal business hours. This is why "nomad" entrepreneurs who live in vans or travel the world often struggle with the registered agent for LLC requirement. You need a stationary anchor.

Some states are more relaxed than others, but the core principle is the same: someone must be there to sign for the envelope. If you’re a solo founder who spends all day at a coffee shop or running errands, you technically aren't meeting the requirement if a process server knocks and the door is locked.

Should You Be Your Own Agent?

This is the big question. It's free to be your own agent. You just list your name and your home or office address. Done.

👉 See also: Today Silver Cost in India: Why Most People Are Getting the Timing Wrong

But there's a privacy cost.

When you act as your own registered agent for LLC, your home address becomes a matter of public record. Anyone with a keyboard can look up your LLC on the Secretary of State website and see where you live. If you value your privacy, or if you run a business out of your spare bedroom, this is a massive downside. You’ll also start getting a mountain of "junk mail" from companies scraping those public records to sell you business credit cards and "compliance" posters you don't actually need.

Think about the "knock at the door" scenario. Do you really want a process server handing you a lawsuit in front of your family? Or your neighbors? Or while you're trying to put your kids to bed?

Then there's the "availability" problem. You have to be at that address from 9:00 AM to 5:00 PM, Monday through Friday. If you go on vacation for two weeks and a time-sensitive legal notice arrives, the clock starts ticking the moment it’s delivered. If you aren't there to open it, you might miss a 20-day window to respond. That's a huge risk just to save $100 a year.

Professional Services vs. Individual Agents

You have three main choices for who fills this role:

- You. (The DIY route).

- A Friend or Employee. (Risky, as they might quit or forget to tell you they signed for something).

- A Commercial Registered Agent Service.

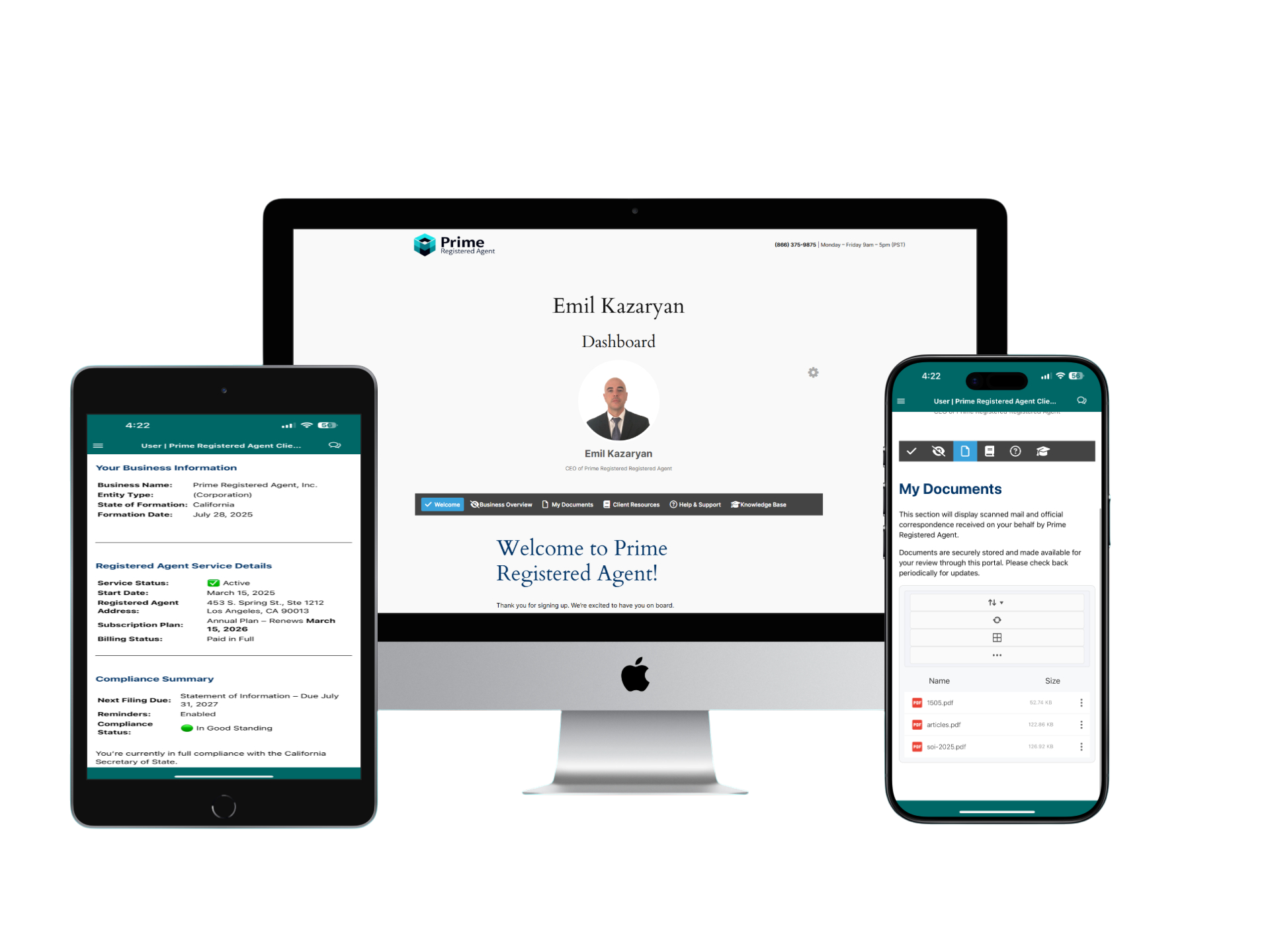

Companies like Northwest Registered Agent, ZenBusiness, or CT Corporation make a living doing this. They have offices in every state. They scan your mail the second it arrives and email it to you. Most of them charge between $100 and $300 per year.

For a lot of founders, that $100 is basically "anxiety insurance." You get to keep your home address off the state’s public search tool, and you know for a fact that if something important arrives, you’ll get a digital notification immediately.

The "Foreign Qualification" Factor

If you live in Florida but you're forming a Wyoming LLC for the asset protection benefits, you must have a registered agent with a physical address in Wyoming. You can't be your own agent if you don't live in the state where the LLC is formed.

👉 See also: Why the New York State Retirement Calculator Matters More Than You Think

This is where the professional services become mandatory. They provide the "nexus" you need to legally operate in states where you don't have a physical footprint.

What Happens if You Forget to Appoint One?

Don't do this. If you fail to maintain a registered agent for LLC, the state can—and will—administratively dissolve your business.

Essentially, the state hits the "kill" switch on your LLC's legal existence. You lose your limited liability protection. You can no longer bring lawsuits in court. You can't get a "Certificate of Good Standing," which you'll need if you ever want to open a business bank account or get a loan.

Reinstating a dissolved LLC is a nightmare. It usually involves paying back-fees, penalties, and filing a bunch of paperwork that costs way more than a registered agent service ever would have.

Changing Your Agent Later

You aren't married to your first choice. If you started as your own agent and now realize your mailbox is overflowing with spam, you can switch.

🔗 Read more: 951 W Bethel Rd: What’s Actually Happening at This Coppell Address?

You’ll need to file a "Change of Registered Agent" form with your Secretary of State. Most states charge a small filing fee—usually $10 to $50. Once the state processes it, the new agent is officially on the hook for your mail.

Real-World Example: The "Lost" Lawsuit

Consider a real-world scenario (illustrative example). A small landscaping LLC in Ohio used the owner's cousin as the registered agent. The cousin moved apartments and forgot to update the state. A former employee sued for unpaid wages. The process server went to the old apartment, couldn't find anyone, and eventually, the court allowed "service by publication" or delivered it to the state. The LLC owner had no idea.

Three months later, the owner tried to withdraw money from the business account only to find it frozen. A judge had granted a default judgment for $15,000 because no one showed up to defend the LLC. This is why the "boring" registered agent role actually matters.

Key Takeaways for Business Owners

- Privacy is the biggest motivator. If you don't want your house on a public map, hire a pro.

- Compliance is binary. You either have an agent or you don't. If you don't, your LLC is a ticking time bomb.

- Physical presence is mandatory. No P.O. Boxes, no "virtual" mailboxes that don't have a human to sign for legal docs.

- Cost is low. It’s one of the cheapest parts of running a business, usually averaging about $10 to $15 a month.

Immediate Next Steps

If you’re currently forming your LLC, stop and decide on your address strategy first. If you decide to use a professional service, sign up for them before you file your Articles of Organization. You'll need their address to put on the form.

If you already have an LLC and you’re acting as your own agent, do a quick Google search for your business name + [Your State]. If your home address pops up in the first three results, decide if you're okay with that. If not, hire a service and file a "Change of Agent" form immediately.

Check your state’s specific requirements as well. Some states, like New York, have additional publishing requirements that might influence who you choose. Others, like Arizona, require the agent to formally "accept" the appointment in writing. Get your agent sorted now so you can focus on actually making money.