You’ve probably seen the headlines or heard the rumors floating around about some "new" stimulus check coming in 2025. Honestly? Most of that is just noise or outright clickbait. But there is a very real, very legal reason why the recovery rebate credit payment 2025 is actually a thing you need to care about right now. It isn't a new handout from the government. It’s basically a final call for money that was already yours but got caught in the gears of the IRS machine over the last few years.

Let's be real. The pandemic years were a mess of paperwork.

If you didn't get your full stimulus amount back in 2020 or 2021, the clock is ticking. Fast. We are looking at the absolute tail end of the eligibility window. If you're sitting there thinking you missed out, you might actually be right. But you can still fix it. This isn't about some secret government program; it’s about the tax code and how the 2024 tax filing season (the one we do in early 2025) serves as a critical backstop for millions of Americans.

The Truth About the Recovery Rebate Credit Payment 2025

First off, let's clear up the biggest misconception. There is no "fourth stimulus check" authorized by Congress for 2025. I know, it’s a bummer. However, the term recovery rebate credit payment 2025 refers to the credits claimed on tax returns filed this year for previous periods. Specifically, we are talking about the 2021 tax year.

Why 2021? Because the IRS typically gives you a three-year window to claim a refund. If you never filed your 2021 return—maybe you didn't earn enough to be required to file, or life just got in the way—you have until the 2025 tax deadline to claim that money. After that, it’s gone. Poof. The Treasury keeps it.

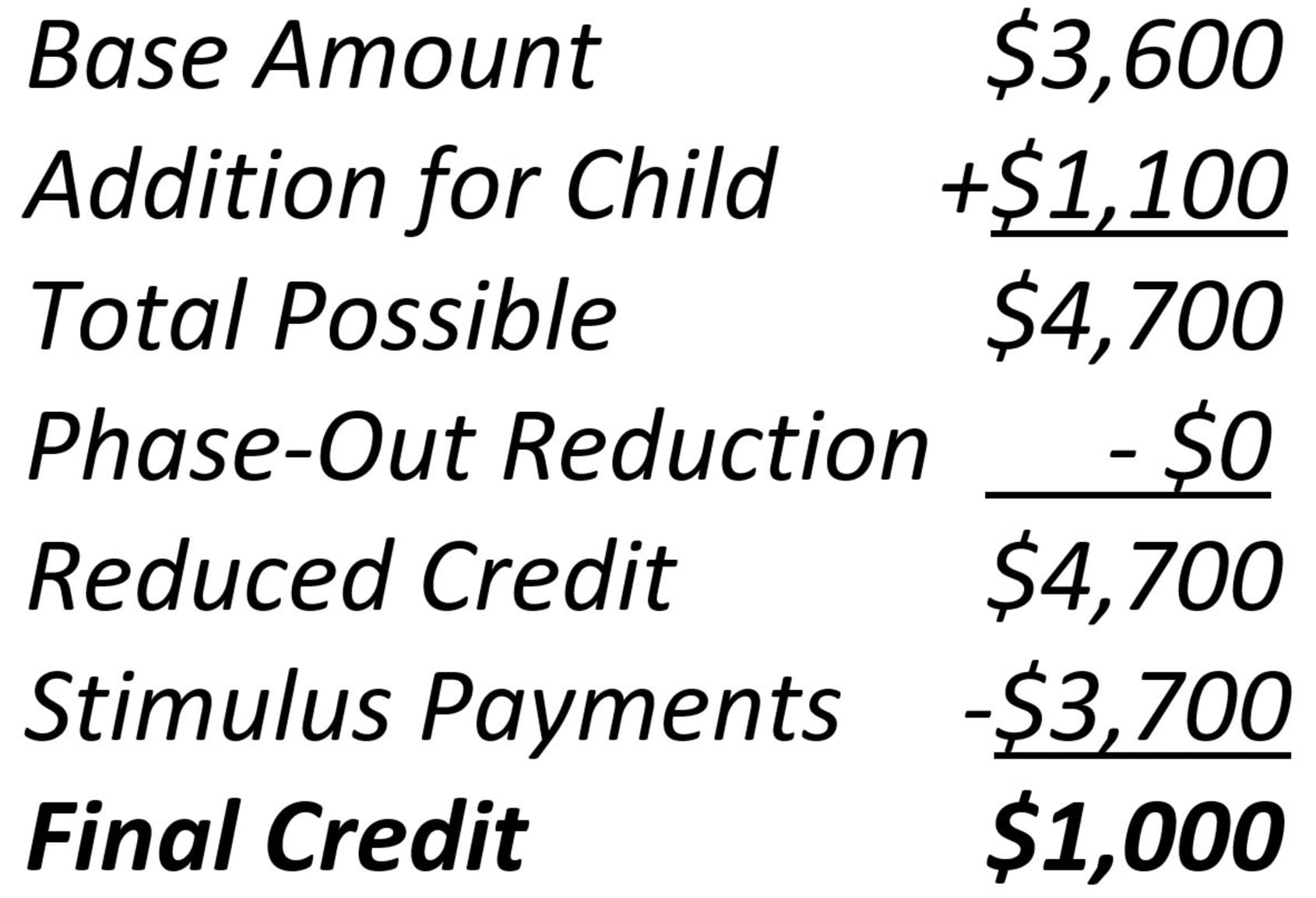

The amounts we are talking about aren't small change. For the third round of Economic Impact Payments, most people were eligible for $1,400 per person ($2,800 for married couples filing jointly), plus another $1,400 for each qualifying dependent. If you had a kid in 2021 and didn't update the IRS, or if your income dropped significantly that year compared to 2020, you’re likely owed a chunk of that.

💡 You might also like: New Zealand currency to AUD: Why the exchange rate is shifting in 2026

Who actually qualifies for this "late" money?

It's not everyone. Obviously. If you got your checks back then, you’re done. But there are specific groups of people who are essentially leaving money on the table right now.

Think about college students who were dependents in 2020 but became independent in 2021. Their parents didn't get a credit for them because they were over 17, but the students themselves became eligible for the $1,400 as independent filers. Many of these young adults still haven't filed that 2021 return. Then there are the non-filers. These are often seniors or individuals with very low income who aren't used to dealing with the IRS because they don't owe taxes. For them, filing a return is the only way to trigger the recovery rebate credit payment 2025 workflow.

It’s kinda tragic, really. Thousands of people who need the money most are the ones who don't realize they have to ask for it.

How the IRS Handles the Math

The IRS doesn't just send these out automatically anymore. You have to use Form 1040 or Form 1040-SR. When you fill out your taxes in early 2025, you’ll see a line for the Recovery Rebate Credit. You have to know exactly how much you already received to get the math right. If you guess and you're wrong, the IRS will flag your return for "math error" processing. That’s a nightmare. It can delay your refund by months.

You should check your "IRS Online Account" or look for Notice 1444-C. That's the paper the IRS sent out years ago saying what they paid you. If you don't have it, don't wing it. Use the online portal.

📖 Related: How Much Do Chick fil A Operators Make: What Most People Get Wrong

Common Blunders That Stop Your Payment

People mess this up constantly. One of the biggest issues is the "dependent" status. If someone else claimed you on their taxes in 2021, you can't get the credit. Period. Even if they didn't actually get the money for you. The IRS system is binary on this.

Another thing? Social Security numbers. Every person listed on the return needs a valid SSN. If you’re using an ITIN (Individual Taxpayer Identification Number), the rules get a bit more complex, particularly for the earlier rounds of stimulus, but for the third round, at least one spouse usually needed an SSN if filing jointly to get any portion of the credit.

The 2025 Deadline is the Real Deal

IRS Commissioner Danny Werfel has mentioned in various briefings that billions in unclaimed refunds go back to the Treasury every year simply because people don't file. For the 2021 tax year, the deadline to claim a refund is generally April 15, 2025.

Wait.

Actually, if you’re a victim of a natural disaster or living abroad, you might have a bit more time, but for 99% of us, April 15 is the "drop dead" date. If you mail that return on April 16, you’ve essentially donated your $1,400 (or more) to the federal government. Don't do that. They have enough money.

👉 See also: ROST Stock Price History: What Most People Get Wrong

Is This Taxable Income?

Good news here. The recovery rebate credit payment 2025 is not considered taxable income. It’s a refundable tax credit. This means it doesn't count against you for things like SNAP (food stamps), SSI, or Medicaid eligibility. It’s also not going to increase your tax bill for next year. It’s basically the government saying, "We owed you this, here it is."

Actionable Steps to Get Your Money

Don't just sit there. If you suspect you're owed money, you need to be proactive.

- Pull your records. Go to the IRS website and log into your account. Look for "Economic Impact Payment" amounts for 2021. If it says $0 and you know you met the income requirements, you're in luck.

- Download the 2021 Form 1040. You can't use the 2024 form to claim 2021 money. You have to file the specific return for the year you missed.

- Double-check your income. For the third stimulus, the phase-out started at $75,000 for singles and $150,000 for married couples. If you earned $100,000 as a single person in 2021, you won't get a dime. Sorry.

- File electronically if possible. While 2021 returns sometimes require paper filing depending on the software you use, try to use a tax professional who can e-file prior year returns. It cuts the wait time from months to weeks.

- Direct Deposit is king. Don't ask for a paper check. Mail is slow. Mail gets stolen. Use your routing and account number.

If you've already filed your 2021 taxes but realized you didn't claim the credit, you don't file a new return. You file an amended return using Form 1040-X. It’s a bit of a pain, but for $1,400+ per family member, it’s a pretty good hourly rate for your time.

The bottom line is that the recovery rebate credit payment 2025 is the final chapter of the stimulus era. Once this window closes in April, the books are effectively shut on the COVID-era direct relief payments. Check your old records, talk to a tax pro, and make sure you aren't leaving your own money in the government's pockets.