You’re staring at a screen. The ticker says Apple is trading at $190.45. You hit buy. Suddenly, the order fills at $190.60. You just lost money before the trade even settled. Why? Because you weren't using a real time stocks tracker. Most "free" apps—the ones we all have on our home screens—actually lag by 15 to 20 minutes. In the world of high-frequency trading and algorithmic scalpels, 15 minutes is an eternity. It’s the difference between catching a breakout and being the "exit liquidity" for a hedge fund in Greenwich.

Investing is hard enough. Doing it with old data is basically like trying to drive on the highway while looking through a rearview mirror.

The Massive Lie About "Free" Data

Most retail investors don't realize that "real-time" is a marketing term, not always a technical reality. When you look at a platform like Yahoo Finance or a basic Google search, you’ll often see a tiny disclaimer at the bottom: Data delayed at least 15 minutes. These delays exist because stock exchanges like the NYSE and NASDAQ charge massive fees for "Level 1" and "Level 2" data feeds.

To give you a real time stocks tracker for free, companies usually have to compromise. Some show you data from a single, smaller exchange like Cboe BZX, rather than the consolidated tape of all national exchanges. This means the price you see might be accurate for that specific exchange, but it’s missing the bigger picture of the entire market. It’s a partial truth. And in finance, a partial truth can be expensive.

📖 Related: Gene Haas Net Worth: Why the F1 Owner Is Way Richer Than You Think

Why Every Second Actually Matters

Markets don't move in straight lines. They move in "ticks." A tick is the smallest possible price movement. If you're a long-term investor holding an index fund for thirty years, a 20-minute delay probably won't ruin your retirement. But let's be honest—most of us are looking for entries. We want to buy the dip. If the dip happened ten minutes ago and the price has already bounced 2%, you’ve missed the "alpha."

Think about earnings season. When Nvidia drops its quarterly report at 4:01 PM ET, the stock can move 5% in thirty seconds. If your tracker is lagging, you’re flying blind while the pros are using fiber-optic connections to execute trades in milliseconds. You need to see the bid-ask spread—the actual gap between what sellers want and what buyers are offering—right now. Not "eventually."

Features That Separate the Pro Tools from the Toys

If you’re hunting for a high-quality real time stocks tracker, don't just look at the pretty charts. Pretty charts are easy. Accurate data is hard.

First, look for "Direct Feed" access. This means the software is pulling data straight from the exchanges. Platforms like TradingView or Thinkorswim are industry standards for a reason. They offer various tiers of data. You might start with the free version, but once you start trading seriously, you’ll likely find yourself paying the $10 or $15 a month for the official NYSE/NASDAQ data packages. It feels annoying to pay for data, but think of it as insurance against bad entries.

👉 See also: Walgreens in Hackettstown NJ: What Most People Get Wrong

The Magic of Level 2 Data

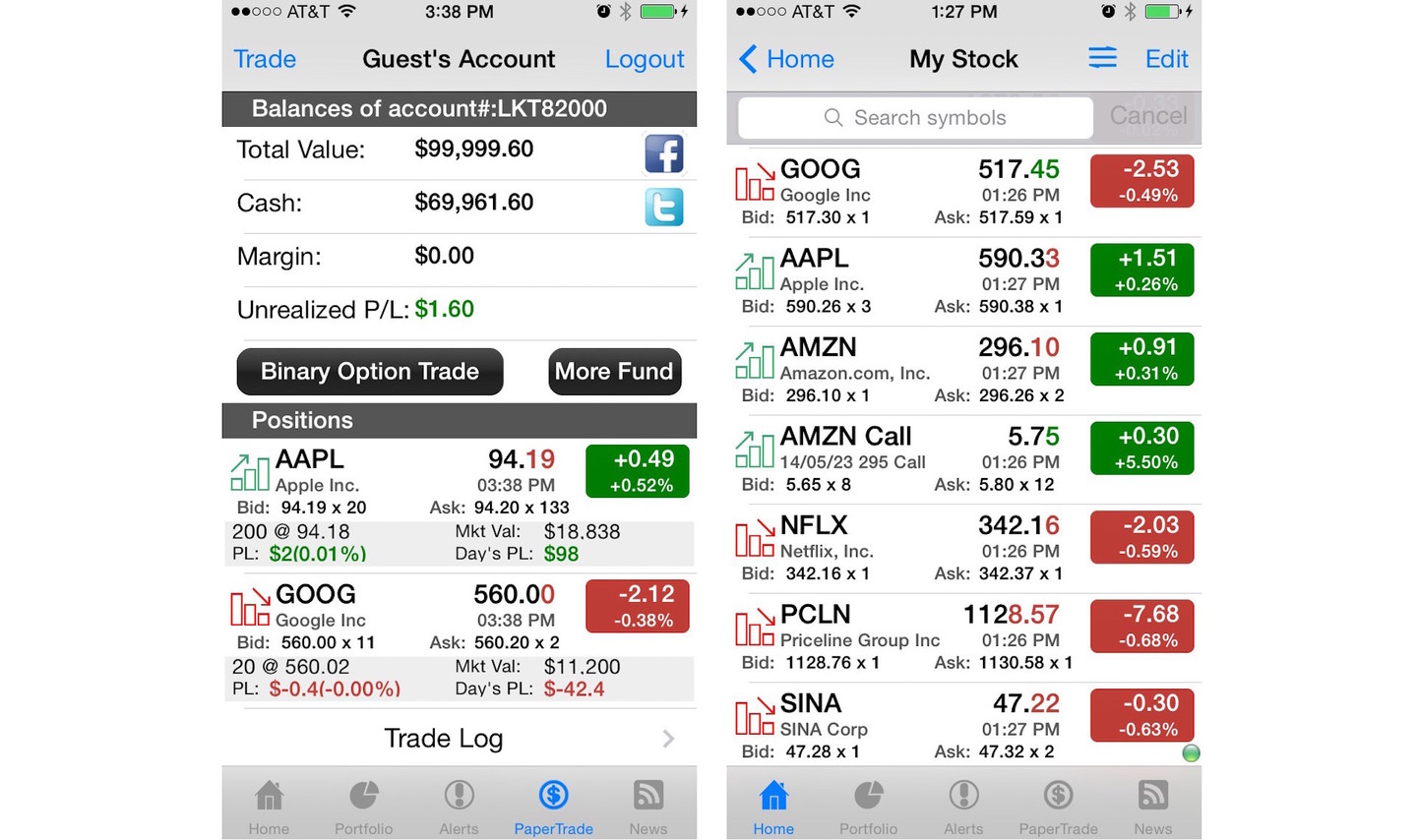

Level 1 data shows you the current price. Level 2 shows you the "order book." It’s basically a peek behind the curtain. You can see how many shares are waiting to be sold at a certain price level. If you see a massive "sell wall" of 50,000 shares at $200, you know the stock is going to have a hard time breaking through that level. A basic tracker won't show you this. A professional real time stocks tracker will.

- Custom Alerts: You shouldn't be glued to your phone. A good tracker lets you set "if-then" logic. "If TSLA hits $180, ping my Apple Watch."

- Multi-Asset Tracking: Crypto, Forex, and Stocks all bleed into each other. If Bitcoin crashes, tech stocks often follow. You need a dashboard that shows the correlation in one view.

- VWAP (Volume Weighted Average Price): This is the "true" price of the day. If the current price is way above the VWAP, the stock might be overextended. Professionals live by this line.

Popular Trackers: The Good, The Bad, and The Laggy

Let's get specific. Robinhood is great for beginners, but its charting is notoriously simplistic. It’s fine for "set it and forget it," but it’s not a precision tool. Webull offers much better technical tools and often gives users a free trial of Level 2 data, which is a huge plus.

Then there’s Bloomberg Terminal. It costs about $24,000 a year. It’s the gold standard. For 99% of people reading this, that’s insane. The middle ground? Koyfin or TradingView. Koyfin is incredible for fundamental data—PE ratios, balance sheets, all that stuff—while TradingView is the king of technical analysis. Both offer incredibly fast updates that qualify as a legitimate real time stocks tracker.

The Psychology of Watching the Tape

There is a danger to real-time data: overtrading. When you see the price flickering every millisecond, your brain starts to itch. You feel like you have to do something. This is "noise." Part of using a real time stocks tracker effectively is learning what to ignore.

I’ve seen traders get stopped out of a great position because they saw a tiny 0.5% dip on a 1-minute chart and panicked. They had the right data, but the wrong perspective. The data is a tool, not a command. You need the speed of real-time info to get a good "fill" price, but you need the patience of a long-term investor to actually make money.

👉 See also: Most Active After Hours Stocks: What the 4 PM to 8 PM Crowd Actually Knows

Setting Up Your Command Center

You don't need six monitors. Honestly, a good iPad or a single 27-inch 4K monitor is plenty. The goal is to have your real time stocks tracker open alongside your brokerage.

- Pick your primary platform. If you're technical, go with TradingView. If you're a data nerd, go with Koyfin.

- Verify the data source. Check the settings. Does it say "Cboe BZX" or "Delayed"? If it does, find the "Market Data" subscription page. Usually, for a few bucks, you can upgrade to the "Consolidated Tape."

- Clean up your watchlist. Most people track 50 stocks. You can't watch 50 stocks in real time. Pick 5 to 10. Learn how they move. Understand their "personality."

- Use mobile as a backup only. Mobile networks have latency. Even with 5G, there’s a delay compared to a hardwired fiber connection at home. For serious trades, use a desktop.

Real World Example: The "Flash Crash" Scenario

Imagine it’s 2:00 PM on a Tuesday. Some random geopolitical news breaks. The market starts sliding. If you're using a delayed tracker, you might see your portfolio down 1%. You think, "I'm okay." But in reality, the market has already dropped 4% in the last ten minutes. By the time your app catches up, the "circuit breakers" have tripped and you're locked out of selling.

Having a real time stocks tracker during high volatility isn't just about making money; it's about defense. It’s about knowing exactly where the exits are before the building starts to smell like smoke.

Actionable Steps to Optimize Your Tracking

Stop relying on the default "Stocks" app on your iPhone. It’s okay for a quick glance while you're in line for coffee, but it’s not a trading tool.

First, download a dedicated platform like Webull or TradingView and actually look at the "Data" section in the settings. If it says "real-time data provided by Cboe," understand that this is only a slice of the market. For most, it’s enough, but for active trading, it’s not.

Second, set up "Price Action" alerts. Instead of watching the price, let the price tell you when it’s doing something interesting. Set an alert for a 52-week high or a break below a key moving average. This keeps your emotions out of the "flicker."

Third, monitor the "Spread." If you see a stock with a $0.50 gap between the bid and the ask, stay away. That’s a sign of low liquidity. A real time stocks tracker that shows the spread will save you from "slippage"—that hidden tax you pay when you buy a stock and immediately lose money because the "ask" price was way higher than the last traded price.

Get the right data. It’s the only way to play the game on a level field. Without it, you’re just guessing, and the market is very good at taking money from people who guess.

Check your current tracking app right now. Look for the "delayed" disclaimer. If it’s there, it’s time to upgrade your toolkit. Focus on platforms that offer consolidated tape data and Level 2 access. Start with one or two stocks to see how the "order flow" actually moves before you commit significant capital. Accurate information is your most valuable asset. Use it.