Checking the mail used to be fun. Now, half the time it’s just bills or those "pre-approved" credit card offers that nobody actually wants. But then, every once in a while, you see it. An envelope with a window. Inside, there is a check. If you’re a freelancer, a small business owner, or someone waiting on a tax refund or an insurance settlement, seeing real company real checks front and back is a relief. It’s also a moment where you need to be smart.

Scammers are getting scary good. Honestly, they’ve mastered the art of the laser printer to the point where a fake check can look more "official" than a real one from a local mom-and-pop shop. If you’re holding a check from a major corporation like Walmart, Amazon, or even a government entity, there are specific things that have to be there. We aren't just talking about your name being spelled right. We’re talking about the physical DNA of the paper itself.

Paper matters.

The Anatomy of the Front: What Legitimate Businesses Can't Skip

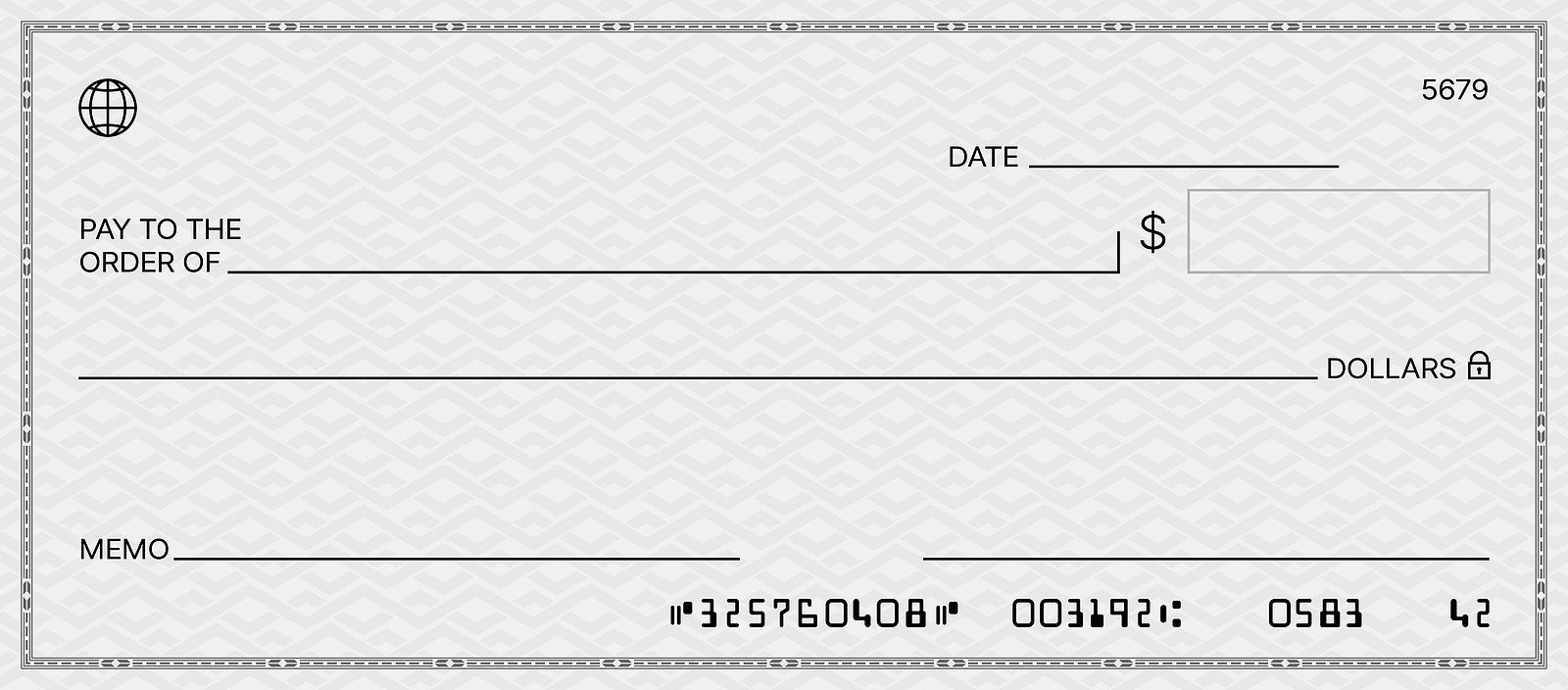

When you look at the front of a check from a real company, the first thing you should notice isn't the logo. It’s the MICR line. That’s the string of funky-looking numbers at the very bottom. Real checks use Magnetic Ink Character Recognition. If you run your finger over those numbers, they should feel flat, but the ink is specialized. It contains iron oxide. Banks use machines that "read" the magnetic signal of that ink. If a check is just a high-res photocopy, a teller’s machine might flag it immediately because there’s no magnetic signature.

Look at the edges. A real check from a business payroll or accounts payable department almost always has at least one perforated edge. Why? Because they come in sheets or are attached to a stub. If all four sides of a check are perfectly smooth, it might have been printed on a standard home printer using basic cardstock. That’s a massive red flag.

Then there is the "void" pantograph. This is kinda cool, actually. Many companies use security paper where, if you try to photocopy the check, the word "VOID" appears all over the copy. If you hold the check up to the light and see a faint pattern that looks like a complex mesh, that’s usually a security feature designed to prevent easy duplication.

🔗 Read more: Stock Market Today Hours: Why Timing Your Trade Is Harder Than You Think

Does the Name Match the Registered Business?

One thing people overlook is the actual name of the company in the top left corner. A real company check will have a physical address, not just a P.O. Box, usually. If you see a check from "Google" but the address is a residential street in a city where Google doesn't have a major hub, be skeptical. Legitimate businesses like JPMorgan Chase or Microsoft have very specific, standardized check designs.

Check the check number. It should be in the top right corner and also at the end of the MICR line at the bottom. If those two numbers don't match, you're holding a piece of paper that isn't worth the ink it's printed with. Also, look for the "Security Screen" or "Original Document" warning on the back or front. Most high-level business checks explicitly list their security features in a small box to help tellers verify them.

Flipping It Over: The Back of the Check Secrets

The back is where most people just sign and move on. Don't do that.

Real company real checks front and back have different security layers. On the back, you’ll usually find a "Security Screen." This is very light printing that is almost impossible to replicate perfectly with a scanner. If the back is just plain white paper with a single line for an endorsement, that’s suspicious for a large corporation. Most big companies use "high-security" check stock that includes a watermark.

Hold the check up to a light source at a 45-degree angle. Can you see a watermark? Real checks from entities like the U.S. Treasury or large banks often have watermarks that are only visible when backlit. These aren't printed on top of the paper; they are pressed into the paper fibers during manufacturing.

💡 You might also like: Kimberly Clark Stock Dividend: What Most People Get Wrong

The Endorsement Area and Microprinting

Take a magnifying glass—or just use the zoom on your phone camera—and look at the line where you’re supposed to sign. On many real company checks, that line isn't actually a line. It’s "microprinting." It’s actually a sentence or the company name repeated over and over in letters so small they look like a solid stroke to the naked eye. If you zoom in and it’s just a blurry, pixelated line, the check is likely a fake.

There’s also the "Warning Box." Most legitimate business checks have a box on the back that says something like: "The face of this document has a colored background and microprinting." This tells the person cashing it exactly what to look for. Scammers often forget to include this or they get the descriptions wrong.

Why Checks Still Use This "Ancient" Tech

You’d think in 2026 we’d be done with paper. We aren't. Billions of checks still circulate because they provide a paper trail that digital transfers sometimes complicate for massive corporate audits. But because they are "old school," people get lazy. They assume if it looks professional, it's real.

The Federal Reserve and organizations like the American National Standards Institute (ANSI) set the rules for what these checks should look like. For instance, the routing number—that nine-digit code on the bottom left—must always correspond to a real financial institution. You can actually look up a routing number on the American Bankers Association (ABA) website. If the check says "Bank of America" but the routing number belongs to a credit union in Ohio, you've got a problem.

Practical Verification Steps Before You Deposit

If you have a check and something feels "off"—maybe the paper feels too thick, or the ink smudges when you run a damp thumb over it (real check ink shouldn't do that)—do not use mobile deposit yet. Once you mobile deposit a fake check, you are on the hook for those funds if the bank realizes it’s fraudulent two weeks later.

📖 Related: Online Associate's Degree in Business: What Most People Get Wrong

- Call the issuing bank directly. Don't use the phone number printed on the check. Look up the bank's official number online. Ask them to verify the check by the check number and the amount.

- Inspect the Logo. Real companies are protective of their branding. If the logo looks slightly stretched, pixelated, or the colors seem "off" (like a purple Walmart logo), it’s a fake.

- Check the Amount. High-value checks from companies often have the amount printed in a way that is hard to alter. Some use a "check protector" which indents the paper, or they use "security fonts" where the words are printed in a very specific, blocky style.

- Look for the Padlock Icon. There is usually a small padlock icon on the front of the check. This is the "Security Research Council" (SRC) symbol. It means the check includes at least three security features that make it harder to forge.

Common Misconceptions About Corporate Checks

People think that because a check "clears" in their account the next day, it’s real. That is a dangerous mistake. Banks are required by law to make funds available quickly, often within 24 to 48 hours. However, it can take weeks for the actual "clearing" process to finish between the two banks. If the check is fake, the bank will take that money back out of your account. If you've already spent it, you now owe the bank that money.

Another myth is that real checks always have to be "fancy." Some small companies use basic Quickbooks checks. These are still "real," but they won't have the same level of security as a dividend check from Apple or a settlement check from a law firm. In those cases, the MICR line and the bank verification are your only real defenses.

Actionable Insights for Handling Business Checks

If you are dealing with real company real checks front and back, your best move is physical verification.

First, rub the bottom numbers. If the ink is raised or feels like it’s "sitting" on the paper rather than being part of it, be careful. Second, look for the microprinting on the signature line. Third, verify the routing number independently.

If you're ever in doubt, take the check to the bank it was drawn from. If it’s a Chase check, go to a Chase branch. They can tell you immediately if the account exists and if the funds are there to cover it. This is the only way to be 100% sure before you let that money enter your own ecosystem.

Pay attention to the texture. Real check paper has a specific "snap" to it. It’s 24lb or 28lb bond paper, usually. It shouldn't feel like the stuff you put in your home printer. If it feels like standard 20lb office paper, treat it with extreme caution. Handling corporate finances requires a bit of cynicism. It's better to spend ten minutes verifying a check than ten months trying to pay back a bank for a fraud charge you didn't see coming.