Healthcare isn't just about stethoscopes and patient charts anymore. It's about data. Specifically, it's about the data that ensures a doctor actually gets paid for the work they do. If you've ever looked at a rcm cycle flow chart and felt like you were staring at a blueprint for a nuclear reactor, you aren't alone. Revenue Cycle Management (RCM) is the lifeblood of any medical facility, yet it’s often the most neglected part of the business.

Revenue leaks. They happen everywhere. A tiny typo in a patient’s insurance ID or a missed deadline for a prior authorization can turn a $5,000 surgery into a $0 payout. Honestly, it's exhausting.

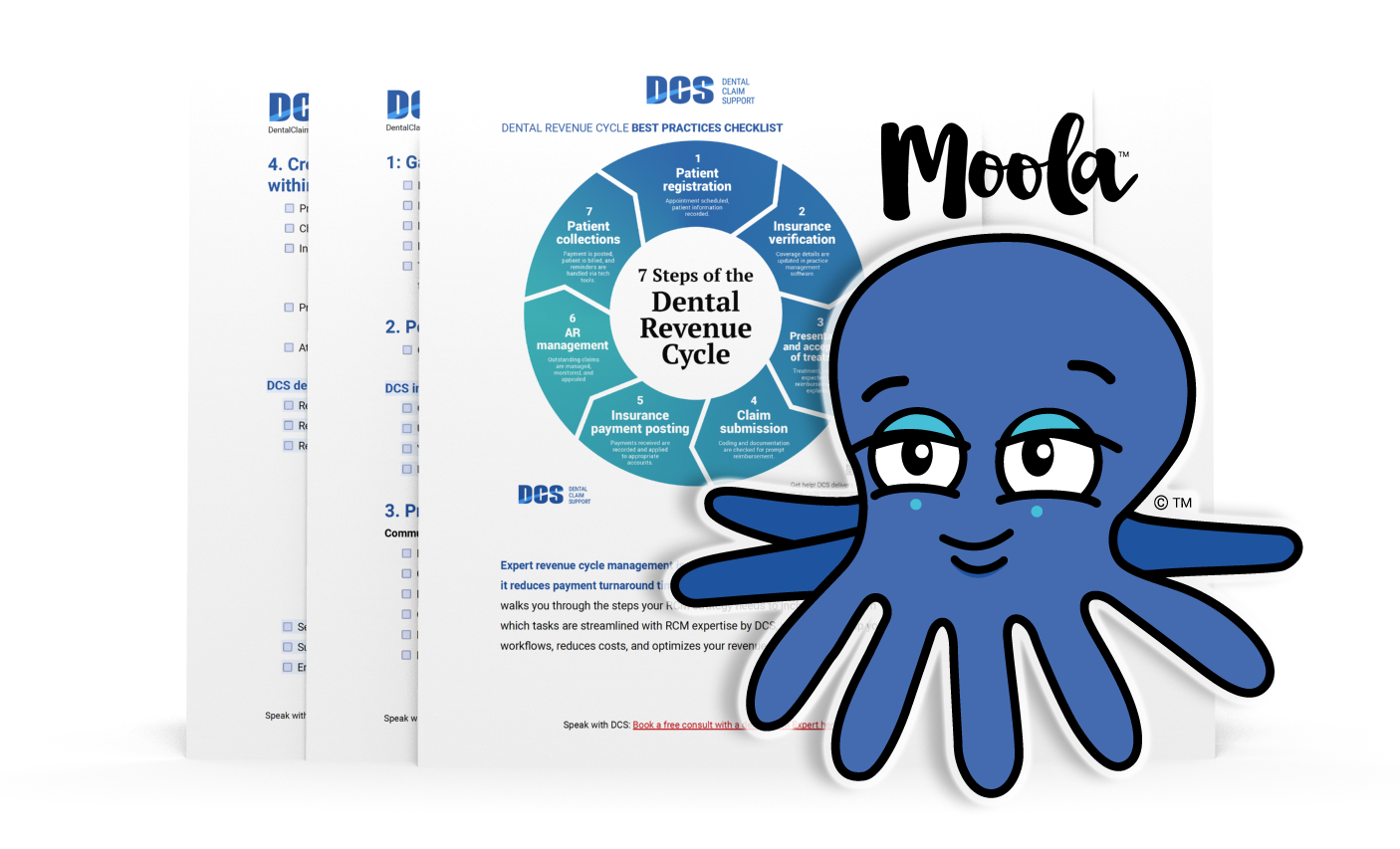

The flow chart isn't just a pretty diagram for a board meeting. It's a map. If you don't know where the gold is buried—or where the holes in your pockets are—you're basically running a charity, not a business. Let’s get into the weeds of how this cycle actually moves from the moment a patient calls for an appointment to the second the balance hits zero.

The Front End: Where Most RCM Cycle Flow Charts Break

Everything starts at the front desk. You’ve probably seen those posters in waiting rooms asking for updated insurance cards. There’s a reason for that. According to Change Healthcare’s 2022 Denial Index, nearly 25% of all claim denials are caused by front-end issues like registration and eligibility.

Patient scheduling is step one. But it’s not just picking a time slot. It’s about data capture. When the receptionist forgets to ask if the patient’s primary insurance has changed, the rcm cycle flow chart takes a massive hit before the patient even sees a provider. Eligibility verification needs to happen in real-time. If you wait until the claim is filed to find out the coverage terminated last month, you've already lost.

✨ Don't miss: Brandon B. Rafi Net Worth: The Real Story Behind the Billboards

Prior authorization is the real villain here. It’s a tedious, manual process that keeps clinicians up at night. You need that "yes" from the payer before the service happens. Without it? The claim is dead on arrival.

Patient Financial Responsibility is the New Frontier

High-deductible health plans (HDHPs) changed the game. Nowadays, patients are essentially their own secondary payers. If your flow chart doesn't include "point-of-service collections," you're leaving money on the table. It is significantly harder to collect $50 from a patient once they’ve left the building than it is while they’re standing at your window.

Middle Revenue Cycle: Clinical Documentation and the Art of the Code

Once the patient is in the exam room, the RCM process shifts. This is the "Middle" of the cycle. It’s where the actual medical work gets translated into a language insurance companies understand: ICD-10, CPT, and HCPCS codes.

If the documentation is vague, the code will be wrong. If the code is wrong, the claim gets rejected. It’s a domino effect. Clinical Documentation Improvement (CDI) is the bridge here. Doctors hate paperwork. We get it. But if a surgeon writes "knee surgery" instead of specifying "arthroscopic lateral meniscectomy, right knee," the billing department is left guessing.

Charge capture is the next hurdle. This is the process of recording every single billable item used during a visit. A vial of medicine. A specific type of suture. In large hospital systems, millions of dollars vanish every year because nurses or techs simply forget to click a button in the EHR (Electronic Health Record) to "charge" for a supply.

The Back End: Chasing the Paper Trail

This is the part of the rcm cycle flow chart that most people associate with "billing." It’s the gritty work of claims submission and accounts receivable (AR) management.

Most claims are sent electronically through a clearinghouse. Think of a clearinghouse as a filter. It "scrubs" the claims for obvious errors—missing birthdays, invalid zip codes—before they reach the insurance company. This is called "Clean Claim Rate," and in a healthy practice, it should be above 95%.

But then come the denials.

Denial management is where the real experts earn their keep. You can't just accept a "no." You have to analyze the "why." Is the payer claiming the service wasn't medically necessary? Is there a coordination of benefits issue? A robust rcm cycle flow chart must include a feedback loop. If you see a pattern of denials from Cigna regarding a specific procedure, that information needs to flow all the way back to the front desk or the coding team to fix the root cause.

The Problem with "Days in AR"

How long does it take for you to get paid? If your "Days in AR" is over 50, you have a problem. The industry standard is usually around 30 to 40 days. The longer a bill sits unpaid, the less likely you are to ever see that money. After 90 days, the value of that debt plummets.

The Tech Stack: Can AI Fix Your Flow Chart?

Everyone is talking about AI in 2026. In the world of RCM, it’s actually useful. Predictive analytics can now look at a claim before it's sent and tell you, "Hey, there's an 80% chance this will be denied based on how BlueCross handled this last week."

Automation is also taking over the "boring" stuff. Robotic Process Automation (RPA) can handle the status checks. Instead of a human staff member sitting on hold with UnitedHealthcare for forty minutes just to ask "is this claim paid?", a bot can log in and check thousands of claims in seconds. It frees up your humans to do the hard work—like arguing with insurance adjusters over complex medical necessity cases.

👉 See also: JCPenney Closing 2025: What Really Happened With the Store List

Real World Example: The "Small Office" Nightmare

Let's look at a hypothetical (but very common) scenario. Dr. Aris runs a small neurology clinic. Her rcm cycle flow chart is basically a series of sticky notes.

- Patient comes in.

- Dr. Aris sees them.

- The biller, who only works Tuesdays, submits the claims.

- Six weeks later, a rejection comes back because the patient's ID was missing a prefix.

- The biller doesn't see the rejection for another week.

- By the time it's fixed, the filing limit has passed.

Dr. Aris just lost $300. Do that five times a week, and she’s losing $75,000 a year. That’s a nurse’s salary. That’s new equipment. That’s the difference between thriving and barely hanging on.

Actionable Steps to Optimize Your Revenue Flow

If you want to tighten up your RCM, stop looking at it as a "billing" problem. It’s a departmental problem.

- Audit your front desk. Run a report on how many claims are denied for "Patient Not Found." If it's more than 2%, your registration team needs better training or better tools.

- Implement a "Credit Card on File" policy. It sounds aggressive, but it’s the only way to handle small balances and co-pays effectively in the age of high deductibles.

- Focus on the 80/20 rule. 80% of your denials likely come from 20% of your procedures or payers. Find that 20% and fix it first.

- Automate the status checks. If your staff is still calling payers to "check on a claim," you are wasting money. Use a clearinghouse that provides automated status updates directly into your software.

- Look at the data every week. Not every month. Not every quarter. By the time you look at a quarterly report, the damage is already permanent.

RCM is a circle. If there’s a break anywhere in that circle—from the first phone call to the final payment—the whole thing stops moving. You've got to treat the flow chart like a living document, constantly tweaking and adjusting based on what the data tells you. Don't let the paperwork bury the practice.