GDP is a liar. Honestly, if you’re looking at those massive spreadsheets from the World Bank or the IMF and thinking you’ve got a handle on which country is "winning," you’re probably missing half the story. It’s easy to look at a trillion-dollar figure and assume everyone in that borderspace is doing great. It's not that simple. Rating economies of the world isn't just about counting the total value of cars, software, and wheat produced in a year.

It’s about the mess. The debt. The inequality. The things that don't show up on a balance sheet.

When we talk about rating economies of the world, we usually default to the "Big Three" metrics: GDP, GDP per capita, and maybe Purchasing Power Parity (PPP). But if you’ve ever tried to buy a coffee in Oslo versus a coffee in Hanoi, you know that a dollar doesn't actually mean anything until it’s spent. That’s where the nuance starts to bleed in. Economics isn't just math; it’s a reflection of how people actually live.

The GDP trap and why we keep falling for it

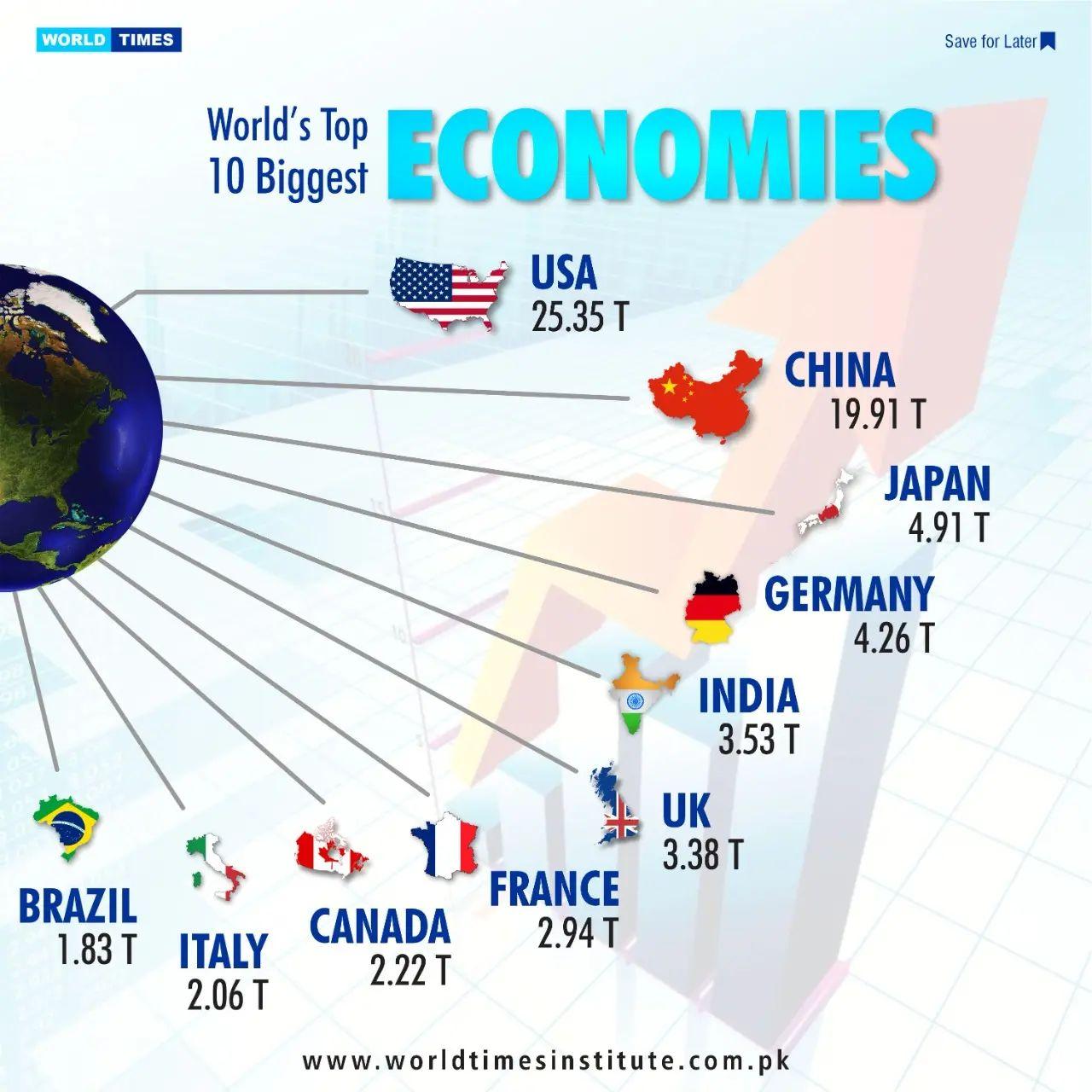

Gross Domestic Product is the king of metrics. It’s the total market value of all final goods and services produced within a country's borders in a specific time period. The United States and China usually sit at the top of this list, trading blows for the number one spot. But here is the thing: GDP measures activity, not well-being. If a country has a massive oil spill and spends billions cleaning it up, the GDP actually goes up. That’s weird, right? Destruction can look like growth on paper.

Simon Kuznets, the guy who basically invented the concept of GDP back in the 1930s, literally warned everyone not to use it as a measure of national welfare. We didn't listen. Now, every news cycle revolves around whether a country's GDP grew by 2% or shrunk by 0.5%.

Take Ireland, for example. For years, Ireland’s GDP looked like it was exploding. It was "Leprechaun Economics," a term coined by economist Paul Krugman. Huge multi-national corporations like Apple and Google moved their intellectual property to Dublin for tax reasons. The money moved through Irish bank accounts, so the GDP skyrocketed, but the average person in Cork or Galway didn't suddenly get twice as rich. The rating was inflated by accounting magic.

📖 Related: Average Uber Driver Income: What People Get Wrong About the Numbers

To get a real sense of rating economies of the world, you have to look at the "Modified GNI" or GNI*, which strips out that corporate noise. When you do that, Ireland looks like a very successful European country, but not the global powerhouse the raw GDP suggests.

Purchasing Power Parity is the great equalizer

If you have $50,000 in Manhattan, you’re basically broke. If you have $50,000 in Chiang Mai, you’re living like royalty. This is why economists use Purchasing Power Parity (PPP). It adjusts the exchange rates so that an identical basket of goods costs the same in both countries.

When you look at rating economies of the world through the lens of PPP, the rankings shift dramatically. For instance, China’s economy is actually larger than the U.S. economy when measured by PPP. This is because the cost of living and the cost of labor in China is significantly lower, meaning their money goes further domestically. It’s a bit of a reality check. It tells us that while the U.S. might have more "raw" dollars, China has more "buying power" within its own borders.

But even PPP has flaws. It assumes everyone buys the same stuff. It doesn't account for quality. A $500 fridge in Berlin might last 20 years, while a $200 fridge in a developing market might break in three. The math is hard.

The human element: HDI and Gini

We can't just talk about money. We have to talk about people. The Human Development Index (HDI) was created by Mahbub ul Haq and Amartya Sen to counter the obsession with GDP. It looks at life expectancy, education, and standard of living. This is where countries like Norway, Switzerland, and Iceland consistently dominate. They might not have the raw industrial output of a superpower, but their "rating" in terms of human experience is off the charts.

👉 See also: Why People Search How to Leave the Union NYT and What Happens Next

Then there is the Gini coefficient. This measures inequality. A score of 0 means perfect equality (everyone has the same), and 1 means perfect inequality (one person has everything). South Africa often has one of the highest Gini coefficients in the world, showing a massive gap between the ultra-wealthy and those in poverty. You can have a growing GDP and a failing society at the same time. It happens more often than you'd think.

Debt, demographics, and the invisible anchors

You can't rate an economy without looking at its credit card bill. Japan is a fascinating case study. Their debt-to-GDP ratio is over 250%. In most countries, that would mean immediate collapse. But Japan is unique because most of that debt is owned by its own citizens, not foreign investors. They also have an aging population. Fewer workers, more retirees. This demographic "time bomb" is a massive factor in rating economies of the world over the next fifty years.

China is facing a similar issue. The "One Child Policy" legacy means their workforce is shrinking. India, on the other hand, has a "demographic dividend"—a huge population of young people. If they can provide jobs and education, they could potentially leapfrog others. If they can't, it’s a recipe for social unrest.

The role of the "Informal Economy"

In many developing nations, the "real" economy isn't what the government tracks. It’s the street vendors, the backyard repairs, and the under-the-table trade. In places like Nigeria or parts of Latin America, the informal economy can represent 30% to 50% of total activity. When we are rating economies of the world, we are often ignoring half the people working in those countries because they don't have a tax ID or a formal paycheck.

How to actually judge a country's strength

So, if GDP is flawed and PPP is complicated, how do we actually do this? You have to use a composite view. You need to look at:

✨ Don't miss: TT Ltd Stock Price Explained: What Most Investors Get Wrong About This Textile Pivot

- Economic Complexity: Does the country make high-tech chips, or do they just sell raw dirt (mining)? Countries that produce complex goods are more resilient.

- Institutional Strength: Can you trust the courts? Is the central bank independent? Look at the World Bank’s "Ease of Doing Business" rankings (though they’ve had some controversy lately).

- Energy Transition: In 2026, if an economy is still 90% dependent on coal and hasn't started moving toward renewables or nuclear, they are at massive risk of "stranded assets."

- Innovation Output: Patents per capita. If a country isn't inventing new things, they are just managing decline.

What's actually happening right now?

We are seeing a massive shift toward "friend-shoring." After the supply chain disasters of the early 2020s, countries are no longer just looking for the cheapest place to build things. They are looking for the safest. This is why Mexico is currently booming as a manufacturing hub for the U.S. market. It’s not just about the cost of labor; it’s about proximity and political alignment.

When you see a "rating" for Mexico’s economy go up, it’s not just a random fluke. It’s a structural shift in how global trade works.

Actionable ways to analyze global markets

If you want to move beyond the headlines and actually understand how the world's economies are performing, you should follow these steps:

- Check the "Big Mac Index": It sounds silly, but The Economist's index is a brilliant way to see if a currency is undervalued or overvalued compared to the US Dollar based on the price of a burger.

- Look at the Yield Curve: Specifically for developed nations. If short-term debt pays more than long-term debt (an inverted yield curve), it’s a historically accurate warning of a recession.

- Monitor Foreign Exchange Reserves: If a country is burning through its US Dollar or Euro reserves to propping up its own currency, they are in trouble. Sri Lanka and Turkey have faced versions of this.

- Follow the "Fragile Five": Keep an eye on emerging markets that rely heavily on foreign investment. When the U.S. Federal Reserve raises interest rates, money tends to flee these countries, causing local crashes.

- Analyze Energy Independence: Look at which countries are net exporters of energy versus those that are at the mercy of global price spikes.

Rating economies of the world is a moving target. The data is always lagging. By the time the IMF releases a report, the situation on the ground has already changed. To be a smart observer, you have to look at the people, the power grids, and the ports—not just the spreadsheets.

Stop looking at the single number. Look at the momentum. A country with a small GDP that is growing at 7% with a young population and rising literacy is a much better "bet" than a stagnant giant with a mountain of debt and a shrinking workforce. Economics is a story of human behavior, and the numbers are just the footnotes.

Focus on structural health over quarterly growth. Check the debt-to-GDP, but then check who owns that debt. Look at the education levels. Look at the infrastructure. That is how you find the real winners in the global economy.