Gold is weird. Honestly, if you look at the rate of gold for 1 gram today, you aren't just looking at a number on a screen; you're looking at a chaotic mix of global fear, central bank shopping sprees, and the fact that someone, somewhere, is probably worried about their local currency collapsing.

As of mid-January 2026, the gold market is basically on fire.

We just saw gold futures blast past $4,630 per ounce. If you do the math—and let’s be real, nobody likes doing math at the jewelry counter—that puts the raw spot price for a single gram of pure 24k gold at roughly $148.59.

But here’s the kicker: you will almost never actually pay $148.59 for a 1-gram bar.

The gap between spot price and what you actually pay

If you walk into a dealer or browse an online bullion site, you'll likely see prices closer to $180 or even $190 for a single gram.

Why the massive jump?

It's the "premium." When you buy gold in such tiny quantities, the cost of refining that metal, minting it into a pretty little bar, assaying it, and shipping it to your door represents a huge chunk of the total cost.

Think of it like buying a single chicken wing versus buying the whole bucket. The "per wing" price is always going to sting more. For 1 gram of gold, you're often paying a 15% to 20% markup over the global spot rate.

✨ Don't miss: Is US Stock Market Open Tomorrow? What to Know for the MLK Holiday Weekend

That’s why seasoned stackers usually tell you to save up for at least a 10-gram bar or a full ounce. The "rate of gold for 1 gram" is a great indicator of market health, but it's a tough way to actually build wealth because you start your investment 20% in the hole.

Why 2026 is becoming the year of $5,000 gold

We are currently living through a historic rally. Just a year ago, $3,000 seemed like a stretch. Now? Analysts at J.P. Morgan and ANZ are seriously talking about **$5,000 per ounce** before the end of the year.

What’s driving this? A few things that kinda feel like a movie plot:

- Central Bank Hunger: Countries like China, India, and Turkey are buying gold like it’s going out of style. They’ve been aggressively moving away from US Dollar reserves.

- The Powell Investigation: You might have seen the news about the criminal investigation into Federal Reserve Chair Jerome Powell. Whether it leads anywhere or not doesn't matter as much as the uncertainty it created. Markets hate uncertainty. Gold loves it.

- Inflation Gremlins: Despite everyone saying inflation is "under control," the cost of living still feels high. Gold remains the ultimate "I don't trust the paper in my wallet" insurance policy.

When these big institutional players move, the rate of gold for 1 gram moves with them. Every time a central bank adds 10 tons to its vault, your 1-gram necklace gets a little more expensive.

Calculating the rate (the napkin math version)

If you want to check the math yourself without relying on a website that might have a 20-minute delay, here is the basic formula.

The world trades gold in Troy Ounces. A Troy Ounce is exactly 31.1035 grams.

$$\text{Price per Gram} = \frac{\text{Current Gold Spot Price per Ounce}}{31.1035}$$

🔗 Read more: Big Lots in Potsdam NY: What Really Happened to Our Store

So, if the news says gold is trading at $4,600:

$4,600 / 31.1035 = $147.89$ per gram.

Keep in mind this is for 24-karat (99.9%) pure gold. If you're looking at a 14k gold ring, the actual gold content is only about 58.3%. You have to multiply the 1-gram rate by 0.583 to find the "melt value."

Honestly, many people get ripped off because they don't realize their jewelry isn't pure gold. They see the headline "Gold hits record highs!" and think their old broken chains are worth a fortune. They're worth a lot, sure, but only for the gold that's actually in them.

The "Discover" Factor: What to watch for this week

If you're tracking the rate of gold for 1 gram to find an entry point, keep your eyes on the CPI (Consumer Price Index) report coming out this week.

If inflation looks "hotter" than expected, expect the gold rate to jump. If the US Dollar suddenly gains strength because the Fed decides to keep interest rates high, gold might take a temporary breather.

Standard Chartered recently noted that while they are "overweight" on gold (meaning they like it), they expect some volatility. We could see a "mild correction" where prices pull back to the $4,400 range.

For a 1-gram buyer, that's a difference of maybe five or six bucks. Not life-changing, but enough to buy a coffee while you admire your shiny new bar.

💡 You might also like: Why 425 Market Street San Francisco California 94105 Stays Relevant in a Remote World

Real-world 1-gram prices (Estimated Jan 2026)

| Product Type | Spot Value (Gold Only) | Typical Retail Price |

|---|---|---|

| 24k 1g Bar (PAMP) | $148.59 | $183 - $195 |

| 24k 1g Bar (Generic) | $148.59 | $175 - $185 |

| 14k Scrap Gold | $86.62 | $70 - $80 (Pawn/Buyback) |

Common misconceptions about 1-gram gold

A lot of people think buying 1 gram of gold is a "scam" because of the premiums. It’s not a scam; it’s just a convenience fee.

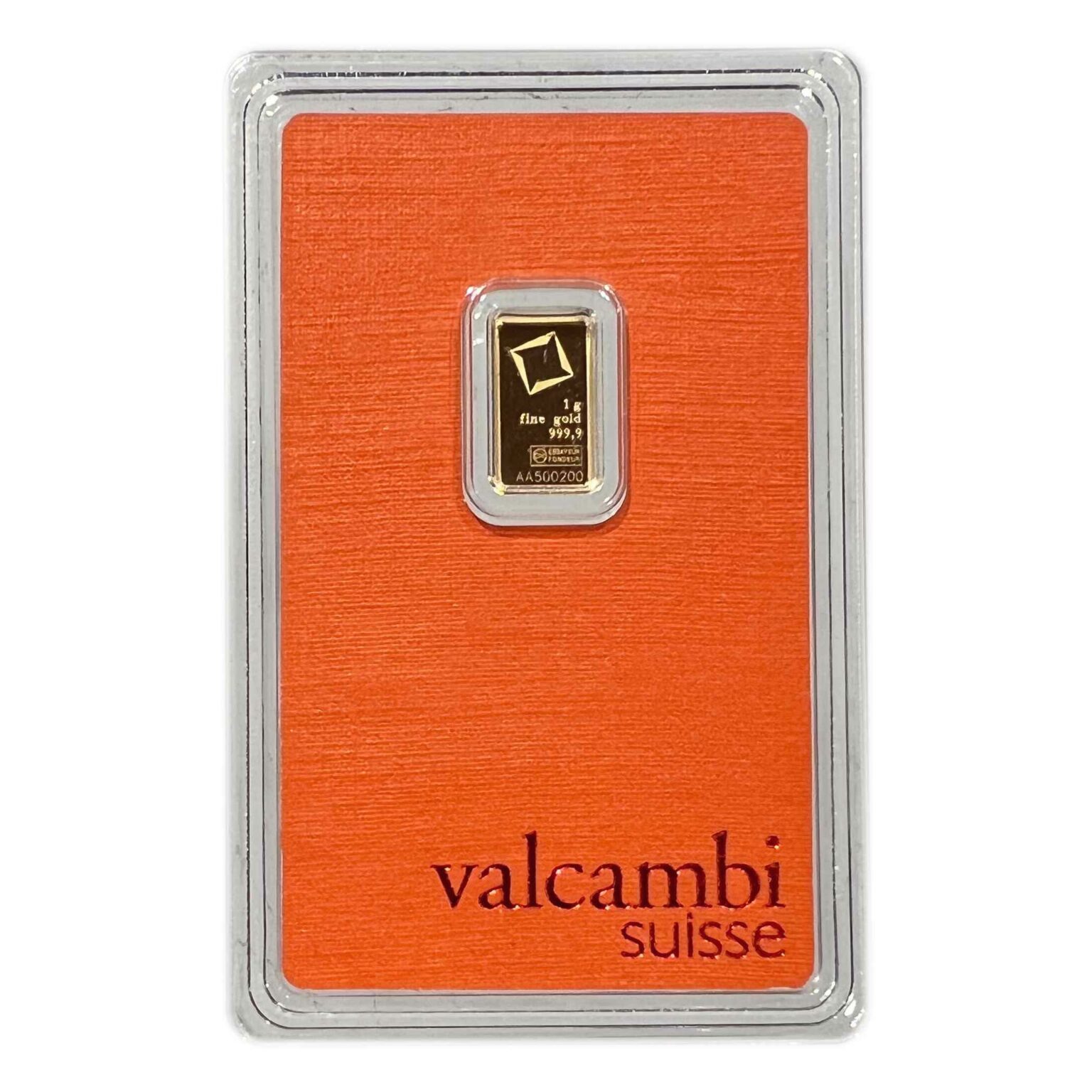

Think about it. 1 gram of gold is tiny. It’s about the size of a thumbtack's head if it were a cube. The machinery required to stamp that, package it in a tamper-proof "certicard," and track its serial number costs money.

Another big mistake? Buying "gold-plated" or "gold-filled" items thinking they have a gram of gold in them. They don't. Gold plating is usually only a few microns thick. You could scrape the gold off a plated 1-gram item and you'd have about three cents' worth of metal. Always look for the hallmark "999" or "24k" if you're buying for investment.

How to actually buy 1 gram without getting burned

If you're dead set on starting small, don't just go to the first "We Buy Gold" shop on the corner.

- Check the Live Spot: Use a site like Kitco or GoldPrice.org to see the real-time rate of gold for 1 gram.

- Compare Premiums: Check at least three major online dealers (like Apmex, JM Bullion, or SD Bullion).

- Look for "Secondary Market": Sometimes you can buy "used" 1-gram bars that other people sold back to the dealer. They aren't as pretty, but the gold is exactly the same and the premium is usually lower.

- Consider Fractional Coins: Sometimes 1/10th ounce coins have slightly better resale value than 1-gram bars, though the entry price is obviously higher.

Actionable Next Steps

Instead of just watching the charts, do these three things today:

First, figure out your "why." If you're buying for a "world ends tomorrow" scenario, 1-gram bars are actually great because they are easy to trade for supplies. If you're buying to get rich, stop looking at grams and start saving for 1-ounce bars to avoid the premium trap.

Second, verify any gold you already own. Use a basic kitchen scale and a magnet. Real gold isn't magnetic. If your "1-gram" bar sticks to a magnet, you've got a paperweight, not an investment.

Third, set a "buy price." If the rate of gold for 1 gram (spot) hits a specific number you're comfortable with—say $140—pull the trigger. Don't try to time the absolute bottom. In a bull market, the best time to buy was yesterday; the second best time is when you can afford it.

Gold is a long game. It doesn't pay dividends, and it doesn't grow like a tech stock. But it also has never gone to zero in 5,000 years. That’s a track record no bank can match.