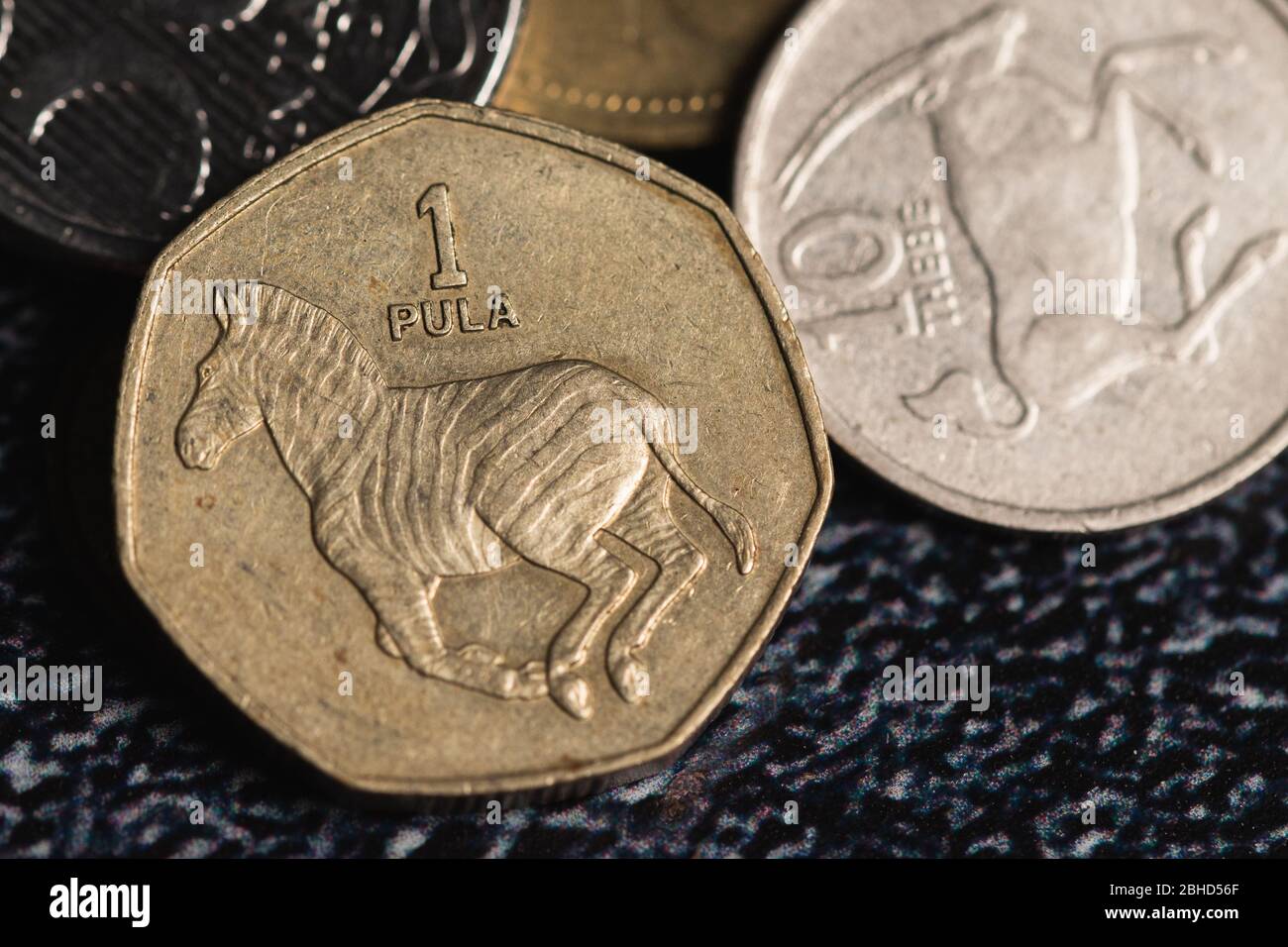

If you’ve ever looked at a chart for the pula currency to usd, you might have noticed something strange. Unlike the wild, heart-attack-inducing swings of the South African Rand or the steady, glacial slide of many other African currencies, the Pula looks... calm. Almost too calm.

Honestly, that’s by design.

Right now, as we move through January 2026, the exchange rate is hovering around 0.074 to 0.077 USD per 1 BWP. If you’re doing the math in your head, that means 1 US Dollar gets you about 13 to 13.50 Pula. But behind those boring digits is a high-stakes balancing act managed by the Bank of Botswana (BoB) that involves diamonds, a "crawling peg," and a very specific basket of currencies.

The Secret "Basket" Behind the Pula Currency to USD

Most people think a currency just "is" what the market says it is. For the Pula, that's only half the story. Botswana uses what’s called a crawling peg.

Imagine the Pula is a kite. The Bank of Botswana is the person holding the string. They don’t let the kite fly wherever it wants, but they don't nail it to the ground either. Instead, they tie the Pula's value to a "basket" made of two things:

- The Special Drawing Rights (SDR): A mix of global heavyweights like the USD, Euro, and Yen.

- The South African Rand (ZAR): Because South Africa is Botswana’s biggest trading partner.

As of the latest January 2026 update, the split is a clean 50/50. Half the Pula's value is influenced by global trends (SDR), and the other half is basically stapled to how the Rand is performing.

Why does this matter for your pula currency to usd conversion? Well, if the Rand crashes in Johannesburg, the Pula is going to feel the heat in Gaborone, even if Botswana’s own economy is doing just fine.

The "Crawl" and the 2.76% Depreciation

Here is where it gets technical but vital. For 2026, President Duma Boko and the Ministry of Finance have maintained a downward rate of crawl of 2.76%.

That sounds like a bad thing—who wants their currency to lose value? But it’s actually a strategic move. Botswana’s inflation is usually a bit higher than the countries it trades with. If the Pula stayed at the exact same price while domestic costs went up, Botswana’s exports (like those famous diamonds) would become too expensive for the world to buy.

By "crawling" the currency down by 2.76% over the year, the government keeps local businesses competitive. They’re basically letting the air out of the tire slowly so it doesn't pop later.

Diamonds: The $5 Billion Elephant in the Room

You can't talk about pula currency to usd without talking about rocks. Specifically, diamonds.

Diamonds make up roughly 80% of Botswana's export earnings. When the global market for luxury jewelry is hot, USD flows into the Bank of Botswana, and the Pula stands tall. But the last year hasn't been easy. The global diamond market has been in a bit of a slump, and Botswana’s GDP actually contracted slightly at the end of 2025.

Because of this, foreign exchange reserves hit a bit of a low point—about five months of import cover. It’s not a crisis yet (nothing like what we've seen in Nigeria or Zimbabwe), but it’s why the BoB is being so aggressive with their exchange rate policy right now. They need to protect those reserves like a hawk.

What This Means for Your Money

If you’re a traveler or a business owner, the pula currency to usd rate is remarkably predictable compared to its neighbors.

- For Travelers: If you're heading to the Okavango Delta, you'll find your Dollars go quite a bit further than they did two years ago. The gradual depreciation means your purchasing power is slowly increasing.

- For Investors: The Bank of Botswana kept the Monetary Policy Rate at 3.5% recently. While that’s lower than the double-digit rates in some emerging markets, the Pula’s stability makes it a "safe haven" play in Africa. You aren't going to wake up and find 30% of your value gone overnight.

How to Handle Your Conversions

If you need to move money, don't just look at the mid-market rate on Google. The BoB recently widened the "trading margins" to 7.5%.

Basically, this means commercial banks have more room to charge you a spread. If the "official" rate is 13.50, don't be surprised if the bank offers you 12.90 or 14.10 depending on whether you're buying or selling.

Actionable Steps for 2026:

- Monitor the Rand: If the South African Rand takes a dive on the news, wait a day or two. The Pula usually follows, but with a slight delay because of the 50% SDR buffer.

- Use Interbank Apps: Given the wider 7.5% margins at physical banks in Gaborone, using digital platforms like Revolut or Wise often gets you closer to that 0.075 USD sweet spot.

- Watch the June Review: The government reviews the "crawl" twice a year. The next one is June 2026. If diamond sales haven't picked up by then, they might increase the depreciation rate, making the USD even stronger against the Pula.

The Pula is a "managed" currency. It’s not a wild horse; it’s a well-trained stallion. It moves exactly where the central bank wants it to go, which usually means a slow, predictable path that favors stability over shocks.

👉 See also: Finding City of Cincinnati Internships That Actually Pay Off

To stay ahead of the next shift, track the Bank of Botswana’s monthly inflation reports. As long as inflation stays within their 3–6% target range (it was 3.9% in December 2025), the pula currency to usd exchange rate will likely stick to this steady, downward crawl without any nasty surprises.