If you’ve ever stared at your mortgage statement and felt a sudden spike in blood pressure because of that "escrow" line item, you aren't alone. It’s the hidden weight of American homeownership. Most people look at the sticker price of a house and think they know what they can afford. They’re wrong. You aren't just buying a kitchen and a backyard; you are buying into a local government’s budget. Looking at a property tax state map reveals a chaotic, jagged reality that doesn't always make sense at first glance.

Tax rates in the U.S. aren't a monolith. Not even close.

It’s wild. You could be living in a $400,000 house in Honolulu and paying pennies compared to someone in a shack in Newark. Why? Because property taxes are the lifeblood of local services—schools, police, fire departments, and those potholes that never seem to get fixed. But how those funds are extracted varies so wildly from state to state that moving across a single border can change your retirement math by six figures over thirty years.

The Great Geographic Divide

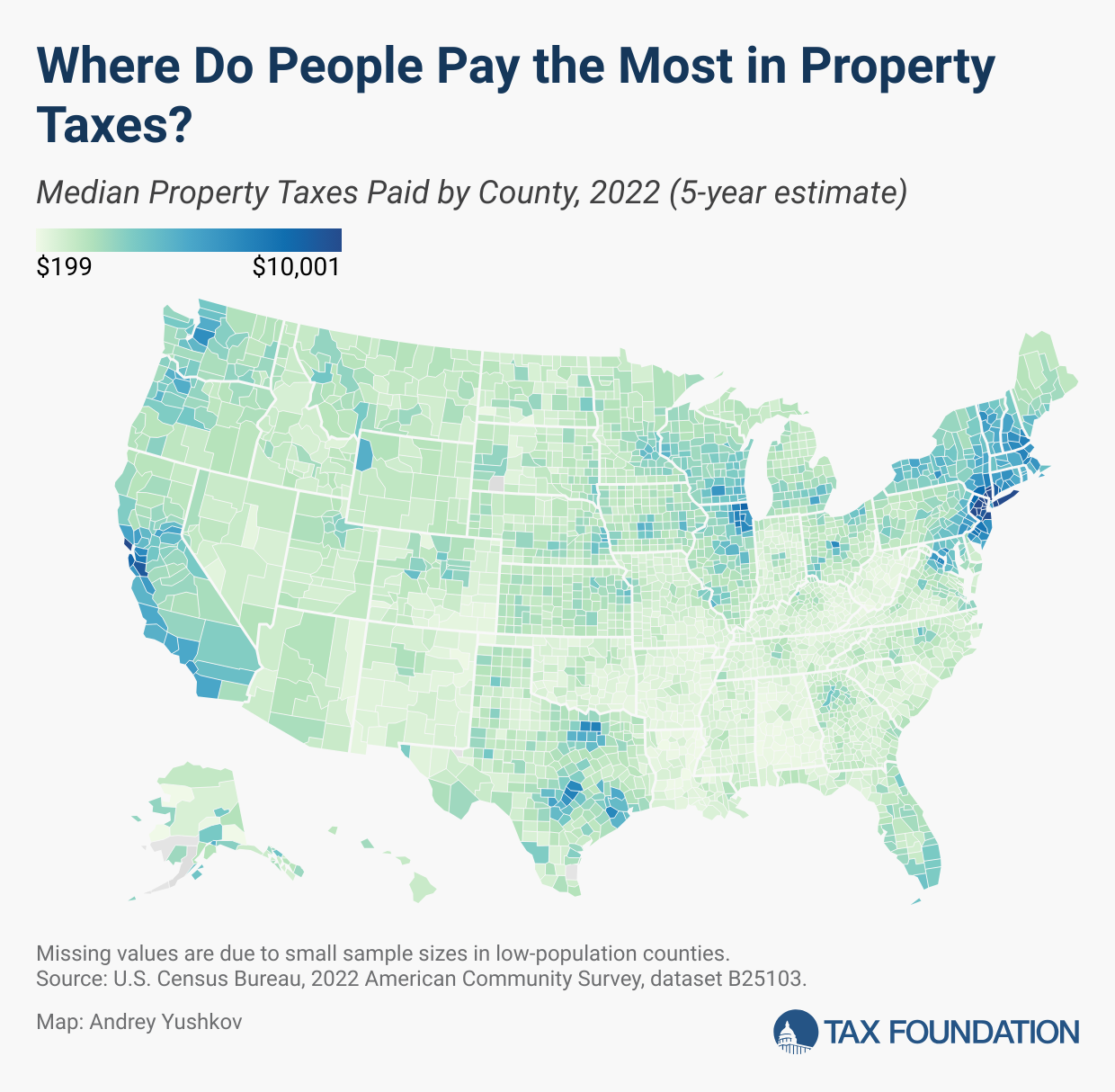

When you pull up a property tax state map, the first thing that hits you is the Northeast. It’s a sea of high-cost red. New Jersey usually takes the crown for the highest effective property tax rates in the nation, often hovering around $2.47%$. If you own a median-valued home there, you’re looking at an annual bill that could easily eclipse $9,000. Contrast that with Hawaii, which sits at the bottom of the map with an effective rate of roughly $0.29%$.

But wait. There is a catch.

Hawaii has some of the highest home values in the galaxy. So, while your rate is low, the actual dollar amount leaving your bank account is still substantial. This is the nuance most "best places to live" lists miss. They focus on the percentage, not the check you actually have to sign.

Down in the South, things look better on paper. Alabama and West Virginia consistently show up as "blue" or "green" on these maps, meaning lower rates. However, you have to look at what you’re getting. States with rock-bottom property taxes often make up the revenue elsewhere—higher sales tax, income tax, or simply fewer public services. It’s a trade-off. Always.

Why Texas is the Great Paradox

Texas is the one that trips everyone up. People move to the Lone Star State because there is no state income tax. "Free money!" they shout. Then they get their first tax appraisal.

Texas has some of the highest property tax rates in the country, often exceeding $1.6%$ to $1.8%$. Since there’s no income tax to fund the state, the burden falls almost entirely on the land. If you’re a high-earner, this is a great deal. If you’re a retiree on a fixed income living in a house that just doubled in value because of a tech boom in Austin, you’re in trouble. Honestly, the property tax state map is more of a "choose your poison" guide than a "save money" guide.

The Factors Nobody Tells You About

It isn't just about the state-wide average. That’s a myth. Taxes are local. You might live in a state with a "low" average, but if you happen to reside in a specific school district that just passed a massive bond for a new stadium, your personal map looks very different from your neighbor's.

- Assessment Ratios: This is the "hidden" math. Some states tax $100%$ of your home’s market value. Others, like South Carolina, might only tax $4%$.

- Mill Levies: This sounds like something out of a medieval history book, but it’s how your taxes are actually calculated. One "mill" is $1$ per $1,000$ of assessed value.

- Exemptions: Homestead exemptions are your best friend. In Florida, for example, the Save Our Homes act caps how much your assessed value can rise each year. It’s why the guy who bought his house in 1990 is paying $1,200 a year while the new guy next door is paying $8,000 for the exact same floor plan.

How to Read the Map Without Losing Your Mind

If you are looking at a property tax state map to plan a move, you need to look for "Effective Tax Rate." This is the only number that matters. It’s the total tax paid divided by the total home value.

The Midwest is surprisingly expensive. Illinois and Wisconsin often rival the Northeast. Why? Because they have robust (and expensive) public infrastructures and legacy pension obligations that need funding. Meanwhile, the Mountain West—places like Utah and Arizona—has historically enjoyed lower rates, though the recent explosion in property values is starting to squeeze residents there too.

It’s also worth noting that "assessment lag" is a real thing. In some states, they only reassess your home every few years. If you buy in a rising market, your taxes might stay low for a while and then suddenly "catch up" with a massive $30%$ jump in a single year. That’s the kind of surprise that ruins a Christmas budget.

Real-World Example: The Border Jump

Imagine you’re working in Philadelphia. You could live in the PA suburbs or jump across the river to Southern New Jersey. On the property tax state map, Pennsylvania looks much friendlier. A $300,000$ home in a decent PA suburb might carry $4,500$ in taxes. That same $300,000$ home in Jersey? You’re likely looking at $8,000$ plus.

Is the Jersey school system better? Maybe. Is it $3,500$ a year better? That’s the question you have to answer. You’re essentially buying a subscription to a zip code.

The 2026 Reality: Why Rates Are Shifting

We are seeing a massive shift in how these maps look because of work-from-home trends. As people fled high-tax states like California and New York, they brought their equity to places like Boise, Idaho and Bozeman, Montana.

Local governments in these "receiver" states are now sitting on a goldmine of property value. Some are using it to lower rates, but most are using it to expand services that are now strained by the population influx. Basically, the property tax state map you looked at three years ago is probably obsolete today.

Strategies to Fight Back

You aren't totally helpless. Most people just pay the bill and grumble. Don't be most people.

- Challenging Your Assessment: Roughly $30%$ to $60%$ of properties in the U.S. are over-assessed. If the county says your house is worth $500k but you know the basement leaks and the roof is shot, you can appeal. You’d be shocked how often they just say "okay" if you bring evidence.

- Audit Your Exemptions: Are you a veteran? A senior? Do you have a disability? Did you remember to file your homestead paperwork? These aren't automatic. If you don't check the box, the government is happy to keep your money.

- Renters Aren't Safe: If you think this doesn't apply to you because you rent, think again. Landlords just pass the property tax increase directly to you in the form of higher rent. Everyone is on the map.

Actionable Steps for Your Next Move

If you're using a property tax state map to decide where to plant roots, don't just look at the colors.

💡 You might also like: Search Tax ID Number for Business: How to Find Yours Without Getting Scammed

First, go to the specific county’s "Tax Assessor" website. They almost always have a "Tax Estimator" tool. Plug in the purchase price of the home you want—not the current owner's taxes. The current owner might have a decades-old exemption that will vanish the moment you close.

Second, check the "Long-term Debt" of the municipality. If the city is $2$ billion in the hole for pensions, guess where that money is coming from eventually? Your property tax.

Third, look at the sales tax and income tax in tandem. A state with low property tax and high sales tax is great if you’re a saver. A state with high property tax and no income tax is great if you’re a high-earner.

The map is just a starting point. The real story is in the fine print of the local budget. Understand that you are choosing a lifestyle and a set of public services, not just a plot of land. Be smart about the "subscription fee" of your home, and you won't be the person crying when the escrow analysis hits your inbox in April.