Honestly, the state of the property insurance market right now is a bit of a mess. You've probably heard the headlines—premiums are skyrocketing and carriers are pulling out of states like California and Florida faster than people can pack their bags. But there is a lot of property insurance claims news that isn't making it to the evening broadcast, and if you own a home, it’s stuff you actually need to know before you ever have to pick up the phone to call an adjuster.

Basically, the "old" way of filing a claim is dead.

We used to live in a world where you'd have a leak, call your agent, an adjuster would swing by in a week, and you’d get a check. Now? You’re dealing with AI bots that analyze roof damage from space, new laws that can literally strip away your right to sue, and a massive spike in "denied without payment" statuses. In fact, some reports show that nearly 47% of claims following recent major storms were closed without a single penny being paid out to the homeowner. That is a terrifying number when you're staring at a hole in your ceiling.

The Reality of Property Insurance Claims News in 2026

If you think your policy is a safety net, you might want to look closer at the mesh. In 2026, the big trend isn't just that insurance is more expensive—it’s that it’s harder to actually use.

Florida is the poster child for this chaos. After years of "tort reform" designed to stop frivolous lawsuits, the result hasn't exactly been lower premiums for everyone. Instead, it’s become way harder for regular people to find a lawyer to take their case when an insurance company lowballs them. Case in point: the Morales v. Citizens ruling. This was a massive wake-up call. The court basically said if you report your hurricane damage "too late"—even if you didn't notice the leak right away—the insurance company can assume they were "prejudiced" by the delay and deny you entirely.

It's a "presumption of prejudice." Sounds like legal jargon, but it basically means the burden of proof shifted from the billion-dollar company to you. You now have to prove that your "late" notice didn't hurt their ability to investigate. Good luck with that.

✨ Don't miss: Why Your Choice of Paper Shredder for Office Use Actually Dictates Your Legal Safety

Why Everything Costs So Much (It’s Not Just Climate Change)

We always blame the weather. And yeah, $92 billion in insured losses from U.S. catastrophes in the first half of 2025 didn't help. But there’s a new villain in the room: tariffs.

Building materials—lumber from Canada, steel, certain electronics—are getting hit with import taxes that are being "baked" directly into your replacement cost. If it costs 15% more to rebuild your kitchen because of trade policy, your insurance company is going to hike your premium 15% to cover that potential cost. Experts like Andrew Biscay from South Lake Agency have been vocal about this—tariffs are essentially a hidden tax on your insurance bill.

The Rise of the "Robot Adjuster"

You might not see a human for your next claim. Not even joking.

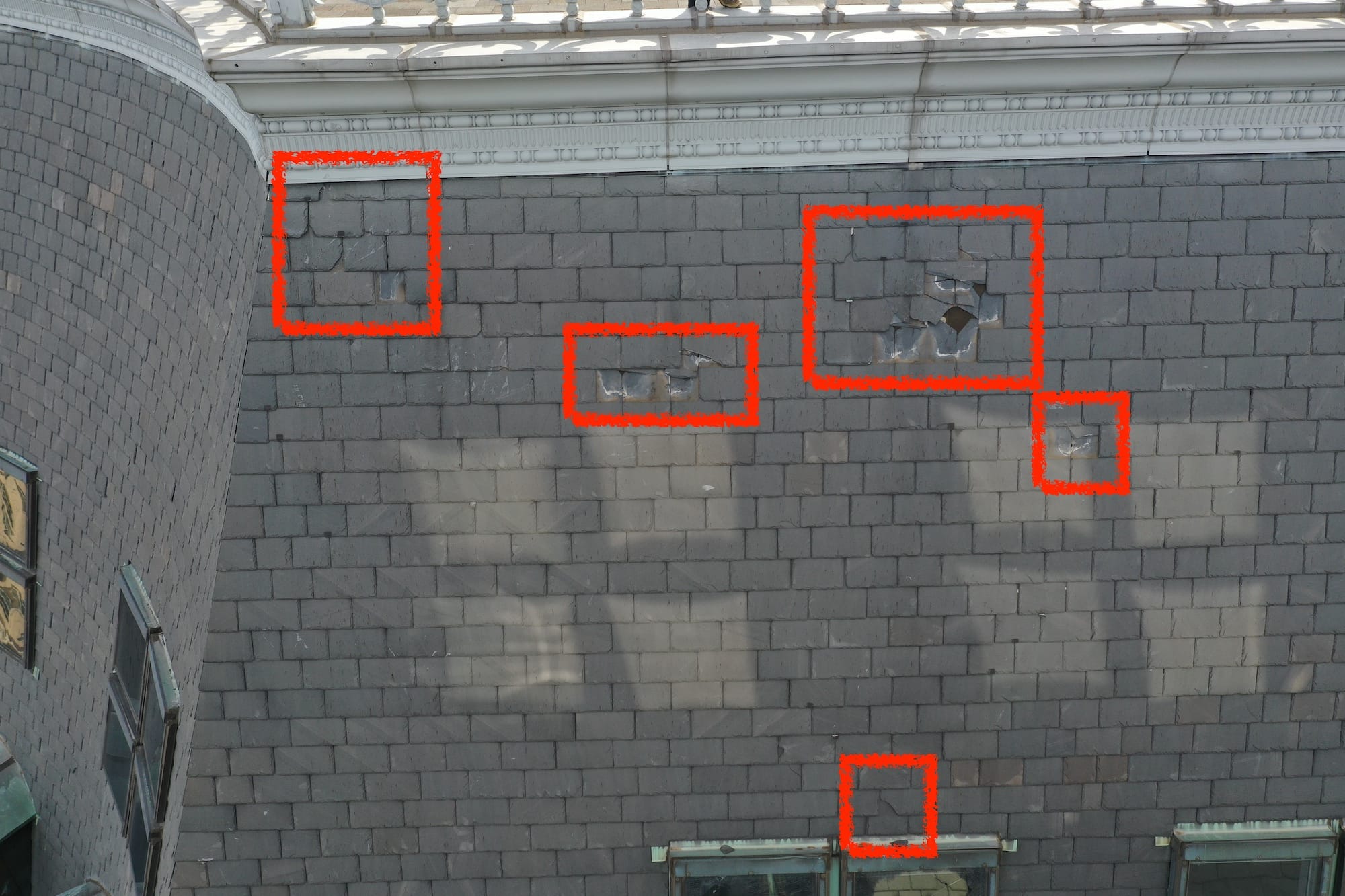

In 2026, carriers are leaning hard into Agentic AI. This isn't just a chatbot that tells you "sorry for the inconvenience." These are autonomous systems that scan satellite imagery of your roof and compare it to historical data from five years ago. If the AI decides that the "wear and tear" on your shingles existed before the storm, your claim could be auto-rejected before a human even looks at it.

The plus side? Claims could be settled in hours instead of weeks.

The downside? AI doesn't have empathy. It doesn't see the "nuance" of a weirdly shaped roof or the fact that your neighbor’s tree was the real culprit.

New Laws You Actually Need to Know About

California is finally trying to push back a little. As of January 1, 2026, several new laws sponsored by Commissioner Ricardo Lara have gone into effect to protect survivors of those massive wildfires.

- No more "inventory hell": In the past, if you lost your home to a fire, you had to list every single pair of socks and toaster you owned to get paid. The new law (SB 729 and related updates) pushes the mandatory "no-inventory" payment up to 60% of your personal property limit.

- The Public Wildfire Model: This is a big deal. For years, insurers used "black box" models to decide your risk score. Now, the state is building a publicly available model so you can actually see why your house is considered high-risk and what you can do to fix it.

- Standardized Building Code Coverage: Starting July 1, 2026, new policies must include at least 10% for "ordinance or law" coverage. This pays for the extra cost of building back to modern codes, which is where most people used to get stuck with a massive bill.

What People Get Wrong About "Bad Faith"

A lot of folks think that if an insurance company says "no," they can just sue for "bad faith." It's not that simple anymore.

To win a bad faith case in 2026, you generally have to show that the company didn't just make a mistake, but that they intentionally acted in a way that disregarded your rights. With the new AI-driven systems, companies can often hide behind "algorithmic errors" or "data discrepancies."

Also, in states like Florida, the elimination of "one-way attorney fees" means that even if you win your case, you might have to pay your lawyer out of your own pocket. If your claim is for $20,000 and the lawyer costs $15,000, you're basically left with nothing. This is why "public adjusters" are becoming the new go-to for homeowners—they work for a percentage of the claim and handle the fight so you don't have to.

Actionable Steps: How to Not Get Screwed

If you take away anything from this property insurance claims news, let it be these three things. Seriously.

- Document your "Before" right now. Go outside with your phone today. Record a slow-pan video of your entire roof, all four sides of your house, and every room inside. Upload it to a cloud drive. If a storm hits tomorrow, you have proof that your house was in good shape.

- The "24-Hour Rule." If a storm hits or a pipe bursts, report it immediately. Even if it looks minor. In 2026, "waiting to see if it gets worse" is a recipe for a denied claim. Report first, figure out the details later.

- Check your "Replacement Cost" annually. With inflation and tariffs shifting construction costs, your 2023 coverage levels are likely obsolete. If your policy says it covers $300,000 to rebuild, but the actual cost is now $420,000, you are "underinsured," and the company might only pay a fraction of your claim due to "co-insurance" penalties.

The reality is that insurance companies are businesses. They are currently looking for every reason to say "no" to protect their bottom line after a few years of massive losses. Being a "nice" policyholder who doesn't complain doesn't get you paid anymore. Being an informed, documented, and proactive policyholder does.

👉 See also: What Times Does the Stock Market Open: What Most People Get Wrong

What’s Next for the Market?

We are starting to see some "softening" in the market for 2026—meaning rates aren't jumping by 20% like they did in 2024—but "stabilization" just means things are staying expensive, not getting cheaper. The influx of "Alternative Capital" (like catastrophe bonds) is helping, but it’s a fragile balance. One major hurricane in a metro area like Miami or a massive wildfire in a California suburb could send the whole system back into a tailspin.

Your Next Steps:

- Call your agent and ask specifically if you have "Building Code Upgrade" coverage and what your "Wind/Hail Deductible" is.

- Download your insurer's app and familiarize yourself with their photo-upload claim process before you actually need it in a crisis.

- Review your "Notice of Loss" provisions in your policy to see exactly how many days you have to report damage before it’s considered "late."