Honestly, the "paperless office" is a lie. Every year, right around February, millions of Americans start hunting for printable 1040 tax forms because, let’s be real, staring at a flickering screen for six hours while trying to calculate your adjusted gross income is a recipe for a migraine. Some people just think better on paper. You can circle things. You can scribble notes in the margins about that one weird 1099-NEC you got from a freelance gig three years ago.

It’s not just about being "old school" or tech-averse.

👉 See also: 1 dollar to chinese rmb: What Most People Get Wrong About the Exchange

The IRS still processes millions of paper returns every single year. While the IRS Commissioner, Danny Werfel, has been pushing the "Paperless Processing Initiative" to digitize the agency’s massive backlog, the reality is that many taxpayers—especially those with complex situations or those living in areas with spotty internet—rely on a physical stack of paper. You might be one of them. Or maybe your software glitched and you’re over it. Whatever the reason, grabbing a PDF and hitting "print" is often the most reliable way to ensure you actually see where your money is going.

Finding the Right Version of Printable 1040 Tax Forms

Don't just Google "tax form" and click the first link. That is a terrible idea. You'll end up on a third-party site from 2014 or, worse, a phishing site trying to snag your Social Security number. You need the official source.

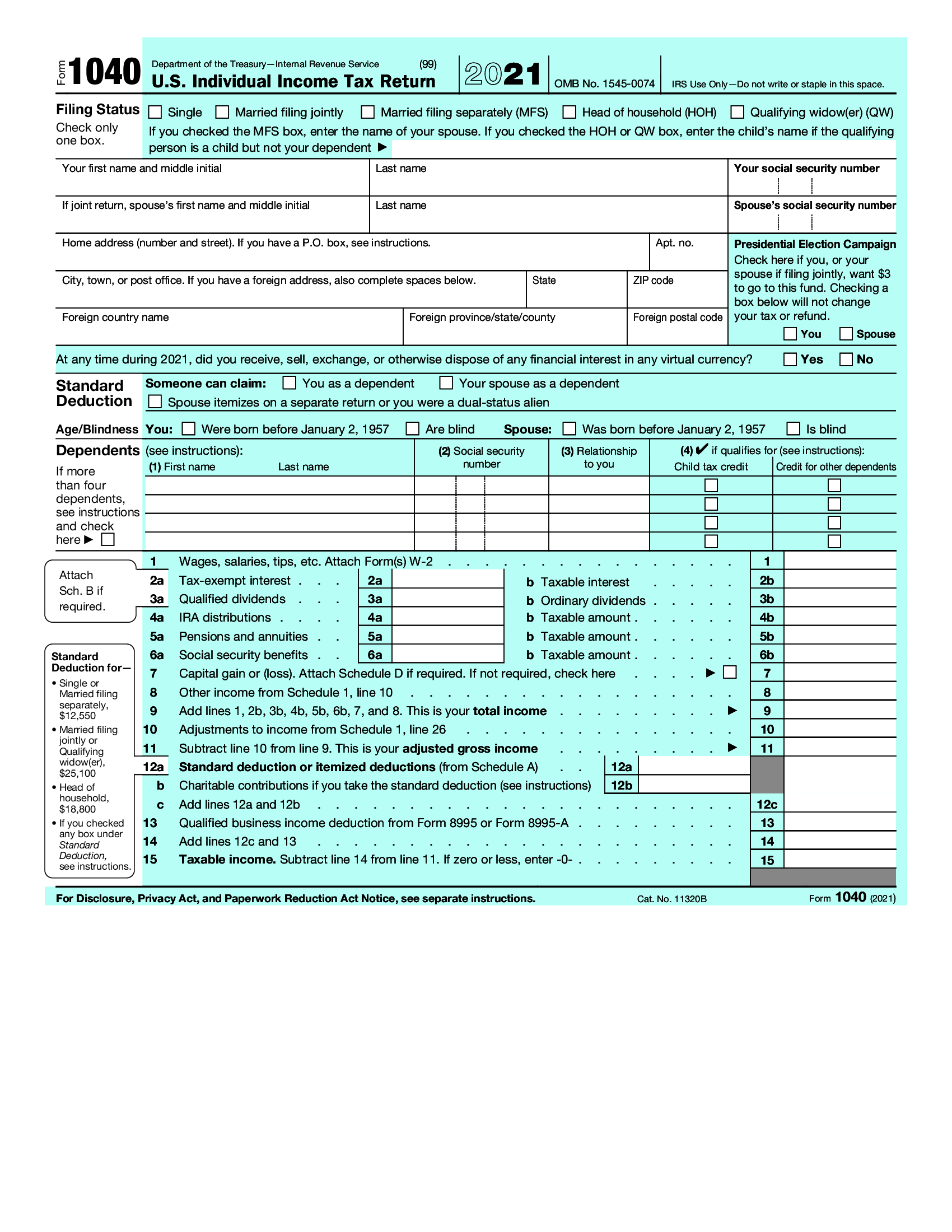

The IRS.gov "Forms and Instructions" page is the only place you should be downloading these. Specifically, you’re looking for the Form 1040, U.S. Individual Income Tax Return. But wait. It’s never just one page anymore. Since the Tax Cuts and Jobs Act of 2017, the 1040 has gone through several identity crises. It used to be a long form, then it became a "postcard" (which didn't actually work), and now it's a two-page main form supported by a small army of "Schedules."

If you’re printing these at home, make sure you check the year in the top right corner. It sounds stupidly obvious, but filing a 2024 return on a 2023 form is a one-way ticket to an IRS rejection notice and a massive headache.

Why the PDF Matters

When you download printable 1040 tax forms, they usually come as "fillable PDFs." This is the sweet spot. You can type your name and address into the boxes on your computer so it’s legible—IRS scanning machines hate bad handwriting—and then print it out to do the math by hand. Or, you just print the blank slate. There is something tactile about a Sharpie and a calculator that helps you catch errors.

The Schedule Shuffle: What You Actually Need to Print

Most people think they just need the two pages of the 1040. They’re wrong.

If you have a side hustle, a mortgage, or you donated more than a bag of clothes to Goodwill, you’re going to need the attachments. These are the "Schedules." You’ve got Schedule 1 for additional income like unemployment or gambling winnings. Schedule 2 covers additional taxes like Self-Employment tax. Schedule 3 is for non-refundable credits.

- Schedule A: This is for itemized deductions. If your mortgage interest and state taxes add up to more than the standard deduction ($14,600 for singles or $29,200 for married filing jointly in 2024), you need this piece of paper.

- Schedule C: The "I’m my own boss" form. If you sold stuff on Etsy or drove for a ride-share app, this is where you list your expenses.

- Schedule D: For the investors. If you sold stock or finally got rid of that Bitcoin, you’ll be printing this one.

Printing these out beforehand lets you see the "logic" of the tax code. It's like a map. You follow the instructions from line 1 to line 37. If you use software, that logic is hidden behind a "Next" button. When you use printable 1040 tax forms, you see exactly how Line 11 (Adjusted Gross Income) feeds into Line 15 (Taxable Income). It’s empowering. Sorta.

The Paper Filing Trap

Let’s talk about the downside. If you print your forms, fill them out, and mail them in, you are going to wait. A long time.

👉 See also: Where is Musk Today: What Really Happened Behind the Scenes

While an e-filed return might result in a refund within 21 days, a paper return can take six to eight weeks—sometimes longer if the IRS has a staffing shortage or another pandemic-style backlog. Also, the error rate for paper returns is significantly higher. Humans make math mistakes. Software doesn't (usually).

According to National Taxpayer Advocate Erin M. Collins, paper returns are a primary source of processing delays. If you choose the paper route, you have to be meticulous. Double-check your math. Then check it again. Then have your spouse or a friend check it. One transposed digit in your Social Security number means your return sits in a "suspense" pile for months.

Mailing Tips for the Brave

If you’ve committed to the paper life, do not just drop it in a blue USPS box and hope for the best. Use Certified Mail with a Return Receipt. This is your only proof that you actually filed on time if the IRS claims they never got it.

Common Mistakes When Printing

People often forget the instructions. The 1040 form itself is only two pages, but the instruction booklet is over 100 pages long. You don't need to print the whole booklet—that’s a waste of ink—but you should have the PDF open.

Specifically, look for the Tax Tables. You cannot finish your return without them. Once you find your taxable income on Line 15, you have to look up that number in the tables to find your actual tax amount for Line 16. It’s a tedious process of scanning columns of tiny numbers. It’s easy to slip a line and look at the "Head of Household" column instead of "Single." Be careful.

Another tip: print on white, 20lb paper. Don't get fancy with heavy cardstock or colored paper. The IRS uses high-speed scanners, and anything weird can jam the machine or cause a misread. And for the love of everything, use black ink. Blue is okay, but black is the gold standard for scanners.

The "Free File" Alternative

Before you spend $40 on printer ink, check if you qualify for IRS Free File. If your income is $79,000 or less, you can use professional software for free. If you just like the feel of paper, you can use the software to do the heavy lifting and then print the finished product to mail in. It’s the best of both worlds.

There's also Direct File, the new IRS-run system. It's only available in certain states right now, but it's a direct way to file without a middleman. However, even with these digital tools, the demand for printable 1040 tax forms remains high because sometimes you just need to see the "wet ink" signature to feel like the job is done.

Your Paper Filing Checklist

If you're going ahead with the physical route, keep this sequence in mind to avoid the most common pitfalls:

- Download directly from IRS.gov. Avoid any site that asks for a credit card just to download a blank form.

- Verify the tax year. Ensure "2024" (or whichever year you are filing for) is clearly printed at the top.

- Check for "Fillable" features. Typing into the PDF before printing saves your handwriting from being a liability.

- Assemble in order. The 1040 goes on top, followed by Schedules in alphabetical order (Schedule A, B, C, etc.), then any other forms in numerical order.

- Attach your W-2s. Use one staple in the designated spot on the front of the 1040. Don't hide it in the back.

- Sign and date. This is the most common reason returns are sent back. If filing jointly, both spouses must sign. No signature, no valid return.

- Get a tracking number. Use the post office’s certified mail service. It’s worth the five bucks.

Next Steps for Your Tax Prep

Now that you've got the lowdown on the paper process, start by visiting the IRS Forms and Instructions page. Download the 1040 and the specific Schedules that apply to your income. Before you start writing, gather your W-2s, 1099s, and any receipts for deductions you plan to take. Set aside a solid two-hour block of time—trying to do this in fifteen-minute chunks is how errors happen. Once you've completed the forms, do a "sanity check" by comparing this year's numbers to last year's to ensure nothing looks wildly out of place.

If the math feels overwhelming once you see it on the page, don't force it; that’s the moment to consider switching to a digital filing method or consulting a professional. Filing a correct return slowly is always better than filing a fast one that triggers an audit.