If you’re sitting in a living room in Bowie, Maryland, or a farmhouse in Disputanta, Virginia, and you’re searching for "prince george county tax," there is a 50/50 chance you are looking at the wrong state's data. It’s a classic East Coast mix-up. We have Prince George's County in Maryland (the "s" is important!) and Prince George County in Virginia.

One is a bustling, suburban powerhouse bordering D.C., and the other is a largely rural, industrial-leaning community south of Richmond. Their tax codes are worlds apart. Honestly, getting them confused can cost you thousands in missed exemptions or miscalculated mortgage payments. Let’s break down what’s actually happening with the money in both places for the 2025-2026 cycle.

The Maryland Side: Prince George’s County Real Estate

In Maryland, property taxes aren't just one flat number. It’s a layered cake. For the fiscal year 2026 (starting July 1, 2025), the base county real property tax rate is $1.00 per $100 of assessed value.

But wait. You’ve also got to add the state tax ($0.112) and the M-NCPPC (Park and Planning) taxes, which vary depending on whether you're in the "Metropolitan" or "Regional" district. Most homeowners in the county end up seeing a combined rate somewhere around **$1.30 to $1.40 per $100.** If you live in an incorporated city like Laurel, Greenbelt, or Upper Marlboro, you’ll pay a municipal tax on top of that, though the county usually gives a "tax differential" credit so you aren't double-charged for services the city provides instead of the county.

That 3% Homestead Cap

Here is the part people miss. Maryland has a Homestead Tax Credit, and in Prince George’s, the cap is set at 3%. This is huge. It means even if the housing market in Hyattsville goes absolutely wild and your assessment jumps 20%, you only pay taxes on a 3% increase. You must live in the house as your primary residence to get this. If you’re a new buyer, make sure the previous owner’s credit didn't just expire, or your second-year tax bill will hit you like a ton of bricks.

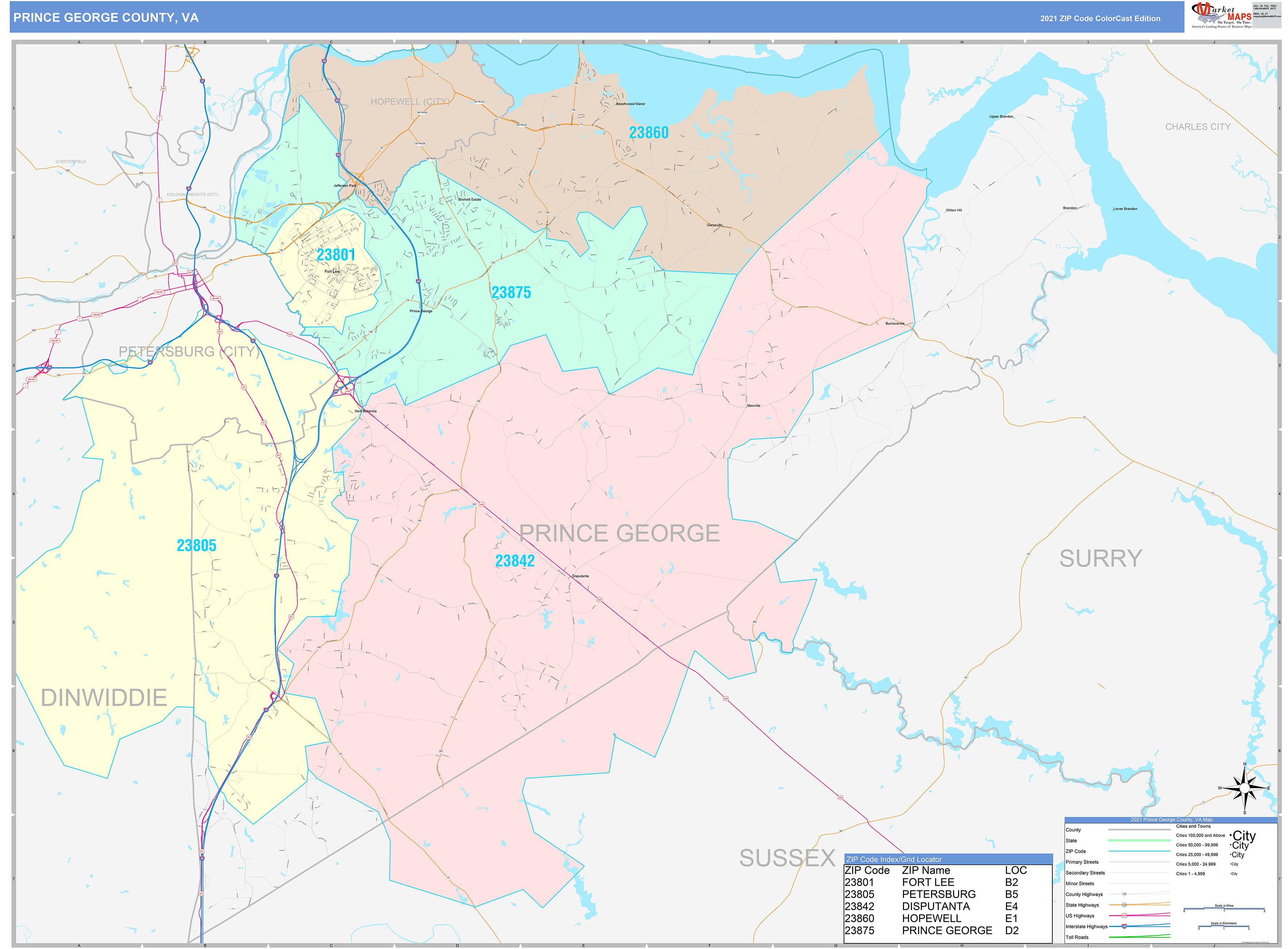

The Virginia Side: Prince George County Personal Property

Down in Virginia, things work differently. They love their "Car Tax." In Prince George County, VA, the real estate rate for the 2025-2026 period has been a point of massive debate. While the Board of Supervisors looked at an "equalized" rate of $0.73 to account for rising home values, they ultimately moved to maintain a higher rate of **$0.82 per $100** to fund county services and schools.

But the real kicker is the Personal Property Tax.

Virginia taxes your "tangible" assets—basically your cars, trucks, and motorcycles. The rate is currently $3.90 per $100 of assessed value. For a $30,000 SUV, that’s a spicy annual bill. The county does provide some "Car Tax Relief" from the state, but it only covers a percentage of the first $20,000 of your vehicle's value.

Why the "Machinery and Tools" Rate Matters

If you’re looking at Prince George County, VA for business, keep an eye on the Machinery & Tools tax ($1.50 per $100). It’s one of the reasons the county is a hub for logistics and manufacturing. They keep that rate relatively competitive compared to the personal property rate to lure in warehouses and production plants.

Income Tax: The Maryland "Local" Surprise

If you live in the Maryland version of Prince George's, your property tax is only half the story. Maryland allows its counties to tack on a local income tax. For 2025 and 2026, Prince George’s County sits at the top tier: 3.20%.

This is pulled directly from your paycheck alongside the state income tax (which scales up to 5.75% for most and higher for high earners). Essentially, you are looking at a combined state and local income tax hit of nearly 9%.

In Virginia, there is no local income tax. You pay the state (maxing at 5.75%), and the county doesn't touch your paycheck. This creates a weird dynamic where a house in MD might look cheaper on paper, but your monthly take-home pay is lower because of the local income tax "piggyback."

✨ Don't miss: Why US treasury yields 10 year are the only number that actually matters for your wallet

Common Pitfalls and Misconceptions

People often assume that "assessed value" is what they paid for the house. Nope.

In Maryland, the State Department of Assessments and Taxation (SDAT) revalues properties every three years. They look at comparable sales in your neighborhood. If you feel they're overvaluing your split-level in Fort Washington, you have a very specific window to appeal. Don't miss it.

In Virginia, Prince George County typically revalues every two years. Because the 2025 assessments saw a double-digit jump in some areas, that $0.82 rate is actually bringing in way more revenue than it did three years ago. It’s a "hidden" tax hike even if the rate stays the same.

The Recordation Tax Trap

When you buy or refinance in Prince George's County, MD, there’s a recordation tax. It’s $5.00 per $500 of the consideration. It sounds small until you're closing on a $500,000 house and realize you owe thousands just to put the deed on paper.

Actionable Steps for Taxpayers

Don't just pay the bill. There are ways to wiggle out of some of this:

- Check your Homestead status (MD): Go to the SDAT website. If your "Homestead Application Status" says "No Application Received," you are burning money. File it today.

- Appeal your assessment (VA): If you’re in the Virginia county and your car is high-mileage or has body damage, you can appeal the NADA "clean trade-in" value the county uses. They don't know your car has a cracked windshield unless you tell them.

- The Senior/Disabled Credit: Both counties offer relief for seniors (usually 65+) and disabled veterans. In MD, it’s often an income-based credit. In VA, it can be a total exemption of real estate tax depending on your income and net worth.

- Business Owners: Look into the "Business Personal Property" depreciation schedules. In Prince George County, VA, the percentage of the original cost they tax drops every year. If you’re still paying on "New" status for a 5-year-old computer, the auditor needs a call.

The reality of prince george county tax is that it’s a game of geography. One county wants your income; the other wants your car's value. Knowing which one you're actually standing in determines whether you're planning for a 3.2% paycheck haircut or a $4.00-per-hundred car bill.

If you are a new resident, the best thing you can do right now is verify your primary residence status with the local assessor's office. This simple check is usually the difference between receiving a manageable bill and a financial "surprise" that breaks your escrow account.