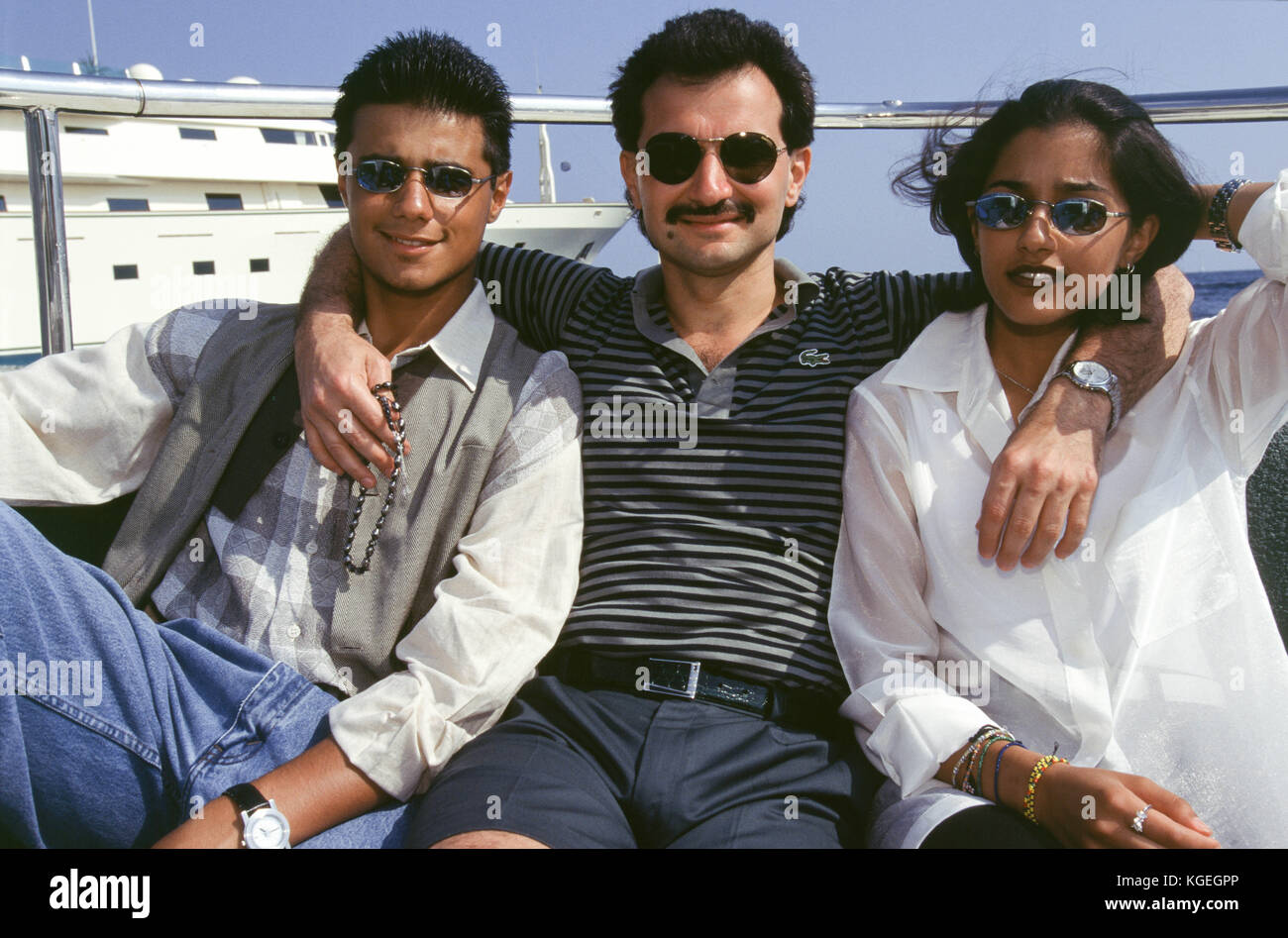

You’ve probably seen the headlines or the glossy photos of the "Warren Buffett of Arabia." Prince Alwaleed bin Talal is a name that usually conjures up images of a massive 420-room palace in Riyadh, a private Boeing 747 with a literal throne, or that incredibly famous (and controversial) stay at the Ritz-Carlton. But honestly, most people don’t actually get the full picture. They see the flash, but they miss the grind and the weirdly specific timing that built one of the most interesting investment portfolios in history.

It isn’t just about being a royal. In fact, his branch of the family was somewhat sidelined from the main levers of political power for decades. That’s probably why he turned to the markets. He had to build something that wasn't just handed to him through a government ministry.

The $800 Million Bet That Changed Everything

In the early 90s, Citicorp (now Citigroup) was basically a mess. They were drowning in bad real estate loans and everyone in the financial world was looking the other way. That's when Alwaleed stepped in. He dropped $800 million into the bank when it was at its absolute lowest point. People thought he was nuts.

But here’s the thing: by 2005, that stake was worth nearly $10 billion.

He didn't just get lucky. He has this almost obsessive "buy and hold" strategy for "irreplaceable brands." Think of it like a collector of trophies that also happen to pay out massive dividends. We’re talking about names like the Four Seasons, Apple (he bought in back in 1997 when Steve Jobs just returned), and even Twitter (now X).

📖 Related: 1 CDN Dollar to INR: Why the Rate You See on Google Isn't What You Actually Get

He isn't a day trader. He's a guy who buys a piece of the world's most famous assets and then waits.

What happened at the Ritz-Carlton?

We have to talk about 2017. It’s the elephant in the room. In November of that year, the Saudi government launched what they called an anti-corruption crackdown. Alwaleed, along with hundreds of other princes and businessmen, was detained at the Ritz-Carlton in Riyadh.

It was surreal. One day he’s on TV talking about his stake in Lyft, the next he’s sleeping on a mattress on the floor of a luxury hotel ballroom.

He was released in early 2018 after reaching a "financial settlement." The details are murky—they always are with these things—but it marked a shift. He didn't disappear. He didn't flee the country. Instead, he folded himself into the new Saudi "Vision 2030" reality. By 2022, he even sold a 16.9% stake of his Kingdom Holding Company to the Saudi Public Investment Fund (PIF) for $1.6 billion. It was a clear sign: the Prince is back in the fold, even if the power dynamics have changed forever.

The xAI Connection and the Elon Musk Factor

You might be surprised to know that Prince Alwaleed is one of the biggest backers of Elon Musk’s AI ambitions. As of late 2024 and heading into 2026, Kingdom Holding has pumped hundreds of millions into xAI.

✨ Don't miss: Why 8950 Cypress Waters Blvd Is the Most Interesting Office Building in Dallas

- He initially invested $300 million in Twitter back in 2011.

- He rolled that stake over when Musk took the company private.

- He recently increased his xAI investment to $800 million during a Series C round.

He’s betting on the future of compute. While the world argues about whether X is "dying," Alwaleed is quietly doubling down on the data and the infrastructure behind it.

The Jeddah Tower: A Vertical Ambition

Then there’s the building. The Jeddah Tower. It was supposed to be the first 1,000-meter-high building in the world. Construction stalled for years after the Ritz-Carlton drama and the pandemic. People called it a "dead project."

Well, it’s not dead. In late 2024, contracts were finally signed to finish the job. Kingdom Holding is still the driving force behind it. If it’s completed, it will literally dwarf the Burj Khalifa. It’s a perfect metaphor for the man: a massive, slightly delayed, but incredibly ambitious project that most people had already written off.

Philanthropy Beyond the PR

In 2015, Alwaleed made a wild announcement: he pledged to give away his entire $32 billion fortune to charity.

Now, "giving it all away" is a phrase billionaires love to use, but the timeline is usually "eventually." Still, Alwaleed Philanthropies is genuinely active. They’ve spent over $5 billion so far. They don't just write checks to big NGOs; they do specific stuff like building housing in Yemen, supporting women’s empowerment in Saudi, and even funding Islamic art departments at the Louvre and Oxford.

It’s about "bridging cultures," he says. Sorta ironic for a guy who once had a public spat with Donald Trump on Twitter, but hey, that’s the Alwaleed brand—complexity.

Why He Still Matters in 2026

Alwaleed isn't the "richest man in the world" anymore. Names like Musk and Bezos have passed him by a long shot. But in the Middle East, he remains a blueprint. He showed that you could take Saudi capital and move it into Silicon Valley decades before it was the "cool" thing for sovereign wealth funds to do.

His net worth currently floats around the $17 billion to $19 billion mark. It fluctuates because so much of it is tied to public stocks and the valuation of Kingdom Holding.

Here is the reality of his current standing:

- He is a strategic partner to the Saudi state now, not a rival.

- His focus has shifted heavily toward technology (AI and ride-sharing) and luxury hospitality (the Four Seasons).

- He is still the Chairman of Rotana, the biggest media group in the Arab world.

If you want to understand where global money is moving, you don't look at what Alwaleed says in his infrequent TV interviews. You look at where Kingdom Holding is putting its cash. Right now, that’s AI, high-end tourism in the Red Sea, and tech-driven logistics.

Actionable Insights for Investors

Looking at Alwaleed's career, there are three things any regular investor can actually use, even if you don't have a private jet.

- The "Blood in the Streets" Rule: His biggest wins (Citigroup, Apple) came when those companies were facing an existential crisis. He buys when everyone else is selling.

- Brand Loyalty: He doesn't buy generic companies. He buys "irreplaceable" brands. If a company doesn't have a "moat" or a global name, he usually isn't interested.

- The Power of Staying Power: He holds assets for decades. Most people panic after a bad quarter; Alwaleed waits through entire decades of stagnation if he believes in the underlying asset.

The Prince is a survivor. From the heights of 90s Wall Street to the "shakedown" at the Ritz, he’s managed to keep his seat at the table. In the fast-moving world of 2026, that longevity is arguably his most impressive asset.

To keep track of his current moves, you can monitor the public filings of Kingdom Holding Company (KHC) on the Saudi Tadawul exchange. This gives a transparent look at his major regional shifts, especially in the hospitality and tech sectors. Additionally, following the progress of the Jeddah Tower construction provides a real-world benchmark for his long-term real estate commitments in the Kingdom.