If you’ve been looking at the price of troy ounce of silver lately, you’ve probably noticed things are getting a little weird. Honestly, "weird" might be an understatement. As of mid-January 2026, we are watching the silver market do things it hasn't done in decades—maybe ever.

Silver just smashed through $91 an ounce.

For years, silver was the "boring" sibling of gold. It sat in a range, frustrated investors, and basically collected dust in people's portfolios. But right now? It's the loudest asset in the room. Some people are calling it a "blow-off top," while others, including analysts at Citi, are casually mentioning $100 as a very real possibility for this quarter.

The Math Problem Nobody Talks About

There is a massive gap between what the world needs and what the world is digging out of the ground. That’s the core of the price of troy ounce of silver surge. We aren't just talking about people buying coins for their safes.

We are talking about:

- Solar Panels: The photovoltaic industry is basically a silver sponge.

- Electric Vehicles: EVs use way more silver than your old gas-guzzler for wiring and sensors.

- AI and Data Centers: High-end electronics need silver's conductivity. There’s no good substitute.

The Silver Institute has been pointing out a structural deficit for five years running. In 2025, the demand was around 1.24 billion ounces, but the supply was only 1.01 billion. You don't need a PhD in economics to see why the price is jumping.

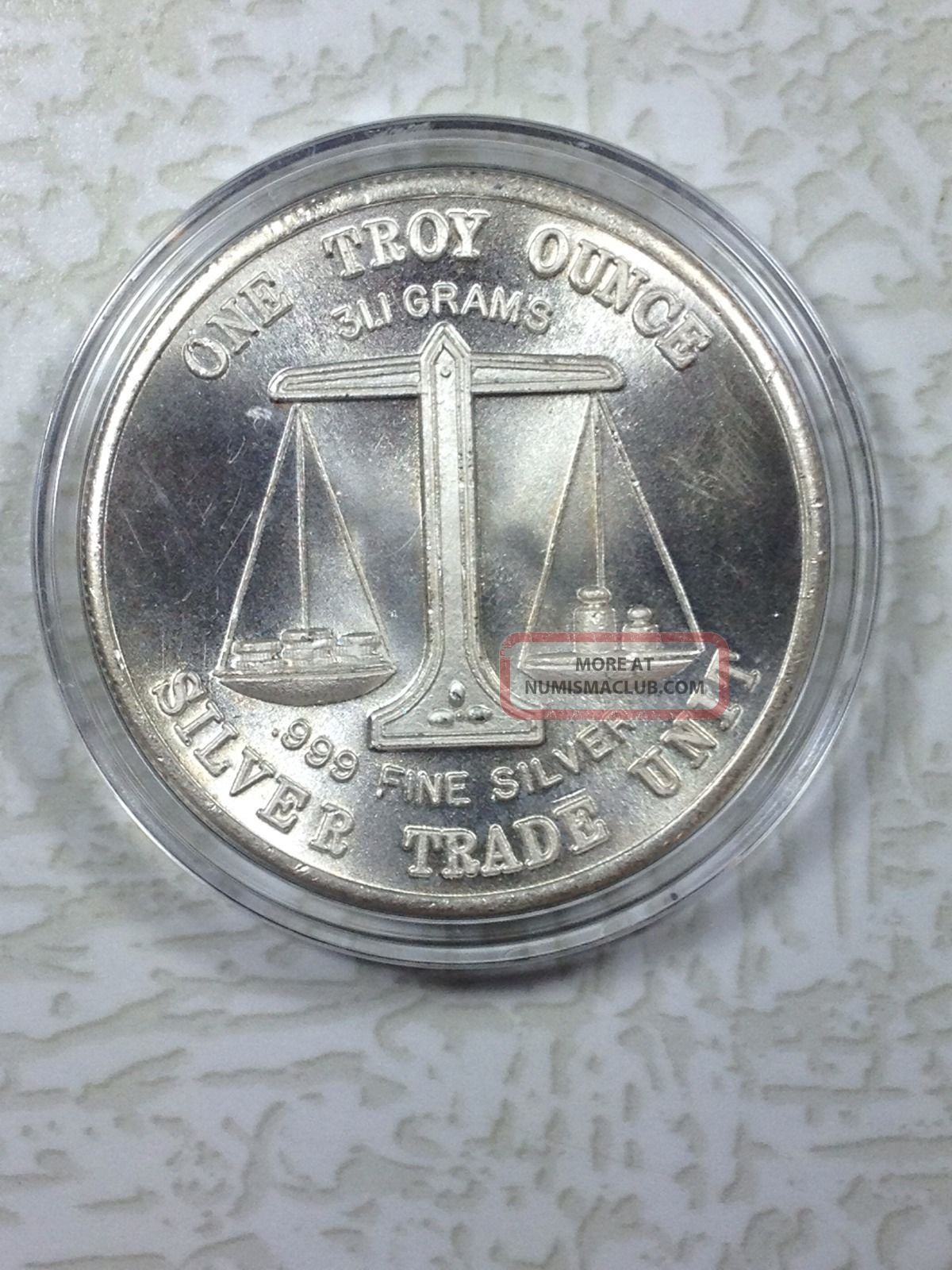

Why the "Troy" Ounce Actually Matters

You’ve probably seen the term "troy ounce" and wondered why we can't just use normal ounces. It’s kinda confusing, but here is the deal: a standard ounce (like for sugar or mail) is about 28.35 grams. A troy ounce is heavier, weighing in at 31.103 grams.

💡 You might also like: Business Model Canvas Explained: Why Your Strategic Plan is Probably Too Long

If you buy a pound of silver, you aren't getting 16 ounces. You’re getting 14.58 troy ounces.

This matters because when the price hits $91.68 (where it’s hovering right now), that extra weight adds up fast. If you're selling old jewelry or coins and the buyer uses a standard kitchen scale to quote you a price, you're getting ripped off. Always make sure the scale is set to ozt, not oz.

The "Perfect Storm" of 2026

Why is this happening now? It’s not just one thing. It's everything happening at once.

Geopolitics are a mess. We’ve seen civil unrest in Iran and tensions with Venezuela driving people toward "safe-haven" assets. Then you have the Federal Reserve. They started cutting rates in late 2025, and when rates go down, non-yielding assets like silver usually go up.

But there’s a wilder story.

China recently started restricting silver exports. They did this as a retaliatory move against U.S. tariffs. Since China is a massive player in the silver market, cutting off that supply is like throwing gasoline on a fire.

📖 Related: Why Toys R Us is Actually Making a Massive Comeback Right Now

The Gold-Silver Ratio is Shrinking

Historically, the gold-to-silver ratio has sat around 80:1. That means it took 80 ounces of silver to buy one ounce of gold. Right now, that ratio has collapsed toward 52:1.

Silver is officially outperforming gold.

In 2025, silver rose over 140%, while gold "only" did 65%. While gold is hitting its own records (around $4,700), silver’s percentage gains are making it the favorite for retail traders.

Real Risks: Is This a Bubble?

Look, we have to be honest here. Silver has a "personality." And that personality is volatile.

In the late 70s, the Hunt brothers tried to corner the market and drove the price of troy ounce of silver to $50. Then it crashed back to $10. We saw another spike in 2011 that didn't hold.

Zacks Investment Research has warned that we might be seeing a "blow-off top." That’s technical speak for "everyone is buying because of FOMO, and the crash is coming."

👉 See also: Price of Tesla Stock Today: Why Everyone is Watching January 28

If the Fed suddenly stops cutting rates, or if global manufacturing slows down, silver could pull back to the $40s or $50s quickly. UBS and Bank of America have high targets ($55 to $65), but they also acknowledge that the ride won't be a straight line up.

Practical Steps for 2026

If you're looking at the price of troy ounce of silver and thinking about jumping in, don't just FOMO into the first thing you see.

- Check the Premiums: The "spot price" is what you see on the news. The "physical price" is what you actually pay for a coin. Right now, premiums are high—sometimes $10 or $20 over spot. If you pay $110 for a coin when spot is $90, you’re already "down" 20% on the investment.

- Paper vs. Physical: Buying an ETF (like SLV) is easy. You can sell it in seconds on your phone. But you don't own the metal. If there's a true shortage, "paper" silver might not track the "physical" price perfectly.

- Storage and Security: If you buy $10,000 worth of silver today, you’re getting over 100 ounces. That’s heavy. And it’s a target for theft. Factor in the cost of a safe or a bank box.

- Tax Implications: In many places, silver is treated as a "collectible" for tax purposes. That means you could be hit with a higher capital gains tax than you would with stocks.

The market is currently in "price discovery mode." We are in uncharted territory. Whether we hit $100 by March or see a correction back to $60, the fundamental reality is that the world is short on silver.

Keep an eye on the industrial demand. If the solar and EV sectors keep growing at double digits, the supply-demand imbalance isn't going away. This isn't just a speculative bubble; it's a resource crunch.

Actionable Insight: If you're buying for the long term, focus on the most liquid forms of silver, like 1-ounce Government-minted coins (Eagles, Maples, or Britannias). They carry higher premiums than bars, but they are much easier to sell quickly if the market turns. Avoid high-premium "collectible" or "limited edition" coins unless you are a numismatic expert; in a bull market, you want to be paid for the metal content, not the artwork.