You've probably seen the headlines. Gold is hitting numbers that would have seemed like a fever dream just a couple of years ago. As of right now, January 17, 2026, the live spot price of gold on the stock market is hovering around $4,610.12 per ounce.

It’s wild.

If you bought an ounce a year ago, you'd be looking at a gain of roughly 70%. That is not the "boring" gold performance our parents used to talk about. Honestly, it’s behaving more like a high-growth tech stock than a dusty yellow brick sitting in a vault. But here is the thing: most people looking at the price of gold on the stock market think they’re looking at a single, simple number. They aren't.

Why the price of gold on the stock market isn't just one number

When you check your brokerage app or a site like CNBC, you’re usually seeing the "spot price." This is basically the theoretical price for one troy ounce of 24-carat gold that’s ready for immediate delivery. But you can't just walk into a bank and buy it at that exact price. There's a "bid" (what buyers will pay) and an "ask" (what sellers want). Right now, that gap—the spread—is active.

💡 You might also like: Big Lots in Potsdam NY: What Really Happened to Our Store

Then there’s the London Fix. Twice a day, at 10:30 and 15:00 London time, a group of big-name banks like JPMorgan Chase and Goldman Sachs get together (digitally, of course) to set a benchmark. This helps keep the global markets from turning into the Wild West. If you’re trading gold ETFs like the SPDR Gold Shares (GLD), you’re essentially trading a stock that tracks this price, but you’re also paying a management fee.

It’s a layer-cake of costs.

The "De-Dollarization" tailwind pushing prices toward $5,000

J.P. Morgan Global Research recently dropped a bombshell report suggesting we could see $5,000 gold by the end of 2026. Why? It's not just about inflation. It's about "de-dollarization."

📖 Related: Why 425 Market Street San Francisco California 94105 Stays Relevant in a Remote World

Central banks in emerging markets are buying gold at a pace we haven't seen in decades. They’re nervous. Since the freezing of Russia's foreign reserves in 2022, countries like China and India have been diversifying away from the U.S. dollar. China currently holds less than 10% of its reserves in gold, whereas the U.S. and Germany are up near 70-80%.

That’s a lot of "catch-up" buying left to do.

What actually moves the needle in 2026?

The price of gold on the stock market reacts to a specific "cocktail" of stressors.

👉 See also: Is Today a Holiday for the Stock Market? What You Need to Know Before the Opening Bell

- Real Interest Rates: This is the big one. If a savings account pays 4% but inflation is 5%, you’re losing money. That's a "negative real rate." Since gold doesn't pay interest, it looks a whole lot better when "real" money is shrinking.

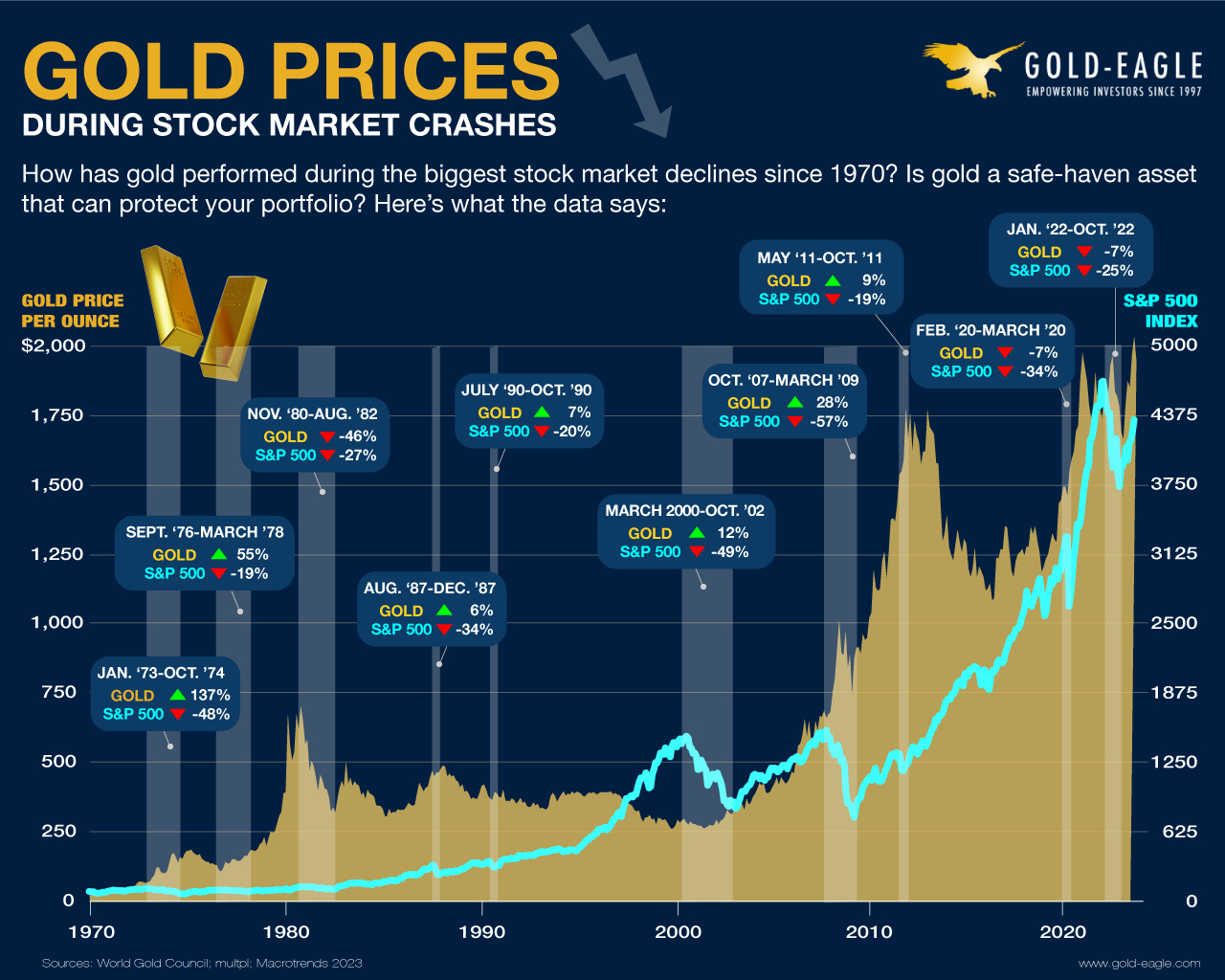

- The Fear Gauge: Geopolitical tension in the Middle East and ongoing trade tariff uncertainty are acting as a floor. When people are scared, they sell "risk assets" (like stocks) and buy "safe havens" (like gold).

- ETF Inflows: Institutional money is pouring back in. In the third quarter of 2025 alone, gold ETFs saw inflows of $26 billion. That's "conviction buying" in the industry parlance.

The trap of the "Gold Miners"

Don't confuse the metal with the companies that dig it up.

A lot of investors think if the price of gold on the stock market goes up, gold mining stocks like Newmont (NEM) or Barrick Gold (GOLD) will rocket even higher. Sorta. But miners deal with "all-in sustaining costs" (AISC). If the price of fuel, labor, and machinery goes up faster than the price of gold, their profit margins actually shrink.

Plus, no major new gold mines have opened in the U.S. since 2002. Regulatory hurdles are a nightmare. Morgan Stanley Research pointed out that while higher prices help, we aren't likely to see a "super-cycle" of new mine production. The supply is basically stuck.

Where do we go from here?

If you’re looking to act on the current price of gold on the stock market, you need a strategy that isn't just "buying the top."

- Check the Premium: If you're buying physical coins (like American Eagles), expect to pay $100-$150 over the spot price. If the premium is higher than that, you're getting ripped off.

- Watch the Fed: Watch for any signs of the Federal Reserve pausing rate cuts. If they stay higher for longer, gold might pull back to the $4,300 range. That’s usually a "buy the dip" zone for big players.

- Diversify your entry: Don't dump everything in at $4,600. Use dollar-cost averaging. Buy a little every month to smooth out the volatility.

The structural bull run seems intact for 2026. Between central bank demand and the hedge against a weakening dollar, gold has transitioned from a defensive play to an offensive one. Stay focused on the macro trends, not the daily price wiggles.