Checking the price of coinbase stock feels a bit like watching a heart rate monitor after a double espresso. It’s jumpy. One day you’re looking at a 7% surge because Bitcoin teased a new milestone, and the next, a single regulatory headline in a country you’ve never visited sends the ticker into a tailspin.

As of mid-January 2026, the stock is hovering around the $241 mark.

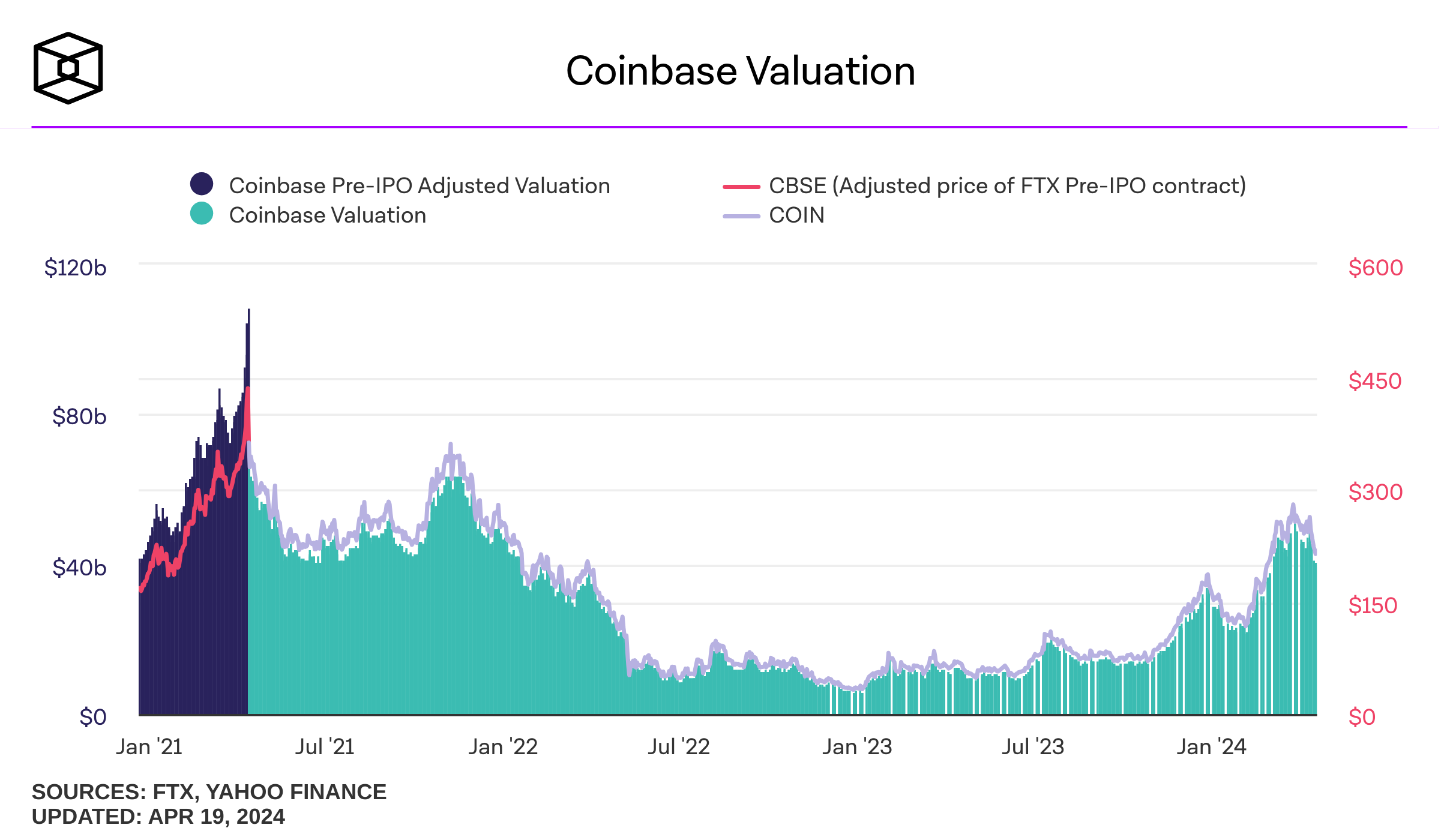

If you’ve been following this ride since the 2021 IPO, you know that number doesn't tell the whole story. We’ve seen a 52-week high of over $444 and lows that would make a seasoned floor trader sweat. Honestly, if you're looking for a "stable" blue-chip investment, you’re in the wrong neighborhood. But if you’re trying to understand why Coinbase is currently valued at roughly $65 billion, we need to look past the daily candles.

The Volatility Reality Check

Most people think the price of coinbase stock is just a proxy for Bitcoin. That’s a mistake. While the correlation is tight—kinda like a shadow that follows a runner—Coinbase has been trying to cut the cord for years.

They don't just want to be the place where you buy crypto. They want to be the "Everything Exchange."

In late 2025, they made a massive move by acquiring Deribit. If you aren't a finance nerd, that’s basically the king of crypto options. This added a huge layer of derivatives volume to their books. In Q3 2025 alone, their total derivatives volume hit a staggering $840 billion. That’s not just retail "diamond hands" buying $50 of Dogecoin; that’s institutional money playing the long game.

👉 See also: Share Market Today Closed: Why the Benchmarks Slipped and What You Should Do Now

Yet, despite that growth, the stock has dipped nearly 40% over the last six months. Why? Because the market is moody.

Even with a revenue beat—pulling in $1.87 billion in a single quarter—investors are worried about whether this momentum can last. Interest rate cuts and fierce competition from places like Robinhood are starting to squeeze those juicy transaction fees Coinbase used to rely on.

The Shift to "Structural" Revenue

Goldman Sachs recently bumped Coinbase back up to a "Buy" rating with a target of $303. They aren't doing that because they think crypto is going to the moon tomorrow. They're doing it because of Subscription and Services revenue.

Think about it this way:

- Staking: Earning rewards on assets held.

- Stablecoins: Coinbase gets a cut of the interest earned on USDC reserves.

- Custody: Keeping the big banks' Bitcoin safe.

Five years ago, this stuff was less than 5% of their business. Today? It’s closer to 40%. This is "boring" money. It’s predictable. And for the price of coinbase stock, predictable is exactly what the big institutional investors want to see before they dive in.

✨ Don't miss: Where Did Dow Close Today: Why the Market is Stalling Near 50,000

Why 2026 is a "Prove It" Year

We’re standing at a weird crossroads. On one hand, you’ve got a "crypto-friendly" vibe in Washington and more big banks like JPMorgan and PNC warming up to digital assets. On the other, the actual trading volume is falling. Rosenblatt analysts recently slashed their price target from $470 to $325 specifically because people just aren't trading as much as they did in the post-halving frenzy of 2024.

Basically, the "hype" is being replaced by "utility."

Coinbase is leaning hard into Base, their layer-2 network. If you’ve ever tried to move money on-chain, you know it can be a nightmare of fees and lag. Base is their attempt to make "on-chain" as easy as "online." If they can capture the developer market there, the price of coinbase stock might eventually decouple from the "crypto winter" cycles entirely.

The Insider Signal

It’s always worth watching what the folks in the C-suite are doing. Recently, co-founder Fred Ehrsam sold about $1 million worth of shares. People usually freak out when they see "Director Sells Stock" in the news.

Don't let it rattle you too much.

🔗 Read more: Reading a Crude Oil Barrel Price Chart Without Losing Your Mind

Executives sell for a thousand reasons—taxes, diversifying, buying a new house. He still holds a massive stake. The real number to watch is the P/E ratio, which is sitting around 21. Compared to the rest of the tech sector, that’s actually somewhat reasonable, though the bears would argue that the earnings themselves are too volatile to trust.

What to Watch Before You Buy

If you're looking at the price of coinbase stock today and wondering if it's a steal or a trap, keep your eyes on three specific things.

- The USDC Market Cap: As of January 2026, USDC is sitting near a $74 billion market cap. Coinbase is a major contributor here. If this grows, their interest-based income grows. It’s basically free money for them when rates stay up.

- Regulatory Clarity in the U.S.: We’ve heard "it's coming" for years. But 2026 feels different. Any actual legislation that defines what is a security and what isn't removes the "cloud of litigation" that has suppressed the stock for a long time.

- Institutional Adoption: Look at the assets on platform. Last we checked, it was over $516 billion. If that number keeps climbing while retail volume stays flat, it means the "big fish" are moving in.

How to Approach COIN Moving Forward

Investing here isn't for the faint of heart. You’ve gotta be okay with 5% swings while you’re eating lunch.

If you want to play the price of coinbase stock, the smartest move is usually to ignore the noise of the "Bitcoin bro" Twitter and look at the quarterly shareholder letters. Specifically, look at Transaction Revenue vs. Subscription Revenue. You want to see that Subscription bar getting taller. That’s the shield that protects the company when the crypto market goes quiet.

Actionable Insights for Your Portfolio:

- Review your exposure: If you already own Bitcoin or Ethereum, buying COIN is doubling down on the same bet. Make sure you're comfortable with that concentration.

- Watch the $225 floor: Analysts have flagged this as a key support level. If it breaks below that, we could be looking at a much longer "valuation reset."

- Monitor the Base ecosystem: Check the Total Value Locked (TVL) on the Base network. It’s a leading indicator of whether Coinbase’s transition to a "utility platform" is actually working.

- Set realistic targets: The average analyst target is around $362, but the range is wild—from $230 to $535. Don't get anchored to the high-end "hopium" numbers.

The bottom line? Coinbase is no longer just a casino. It’s becoming a bank for the digital age. Whether the stock price catches up to that reality depends on how well they execute on the "Everything Exchange" vision throughout the rest of 2026.