You're sitting there with two numbers that should match, but they don't. It’s frustrating. One number is from the bank statement, and the other is what your ledger says. For Candace Co., this isn't just a homework problem; it’s a real-world snapshot of how cash actually moves. Honestly, a bank reconciliation is basically just a giant "where is my money?" puzzle. If you’ve ever felt like your bank account and your brain aren't on the same page, you're in good company.

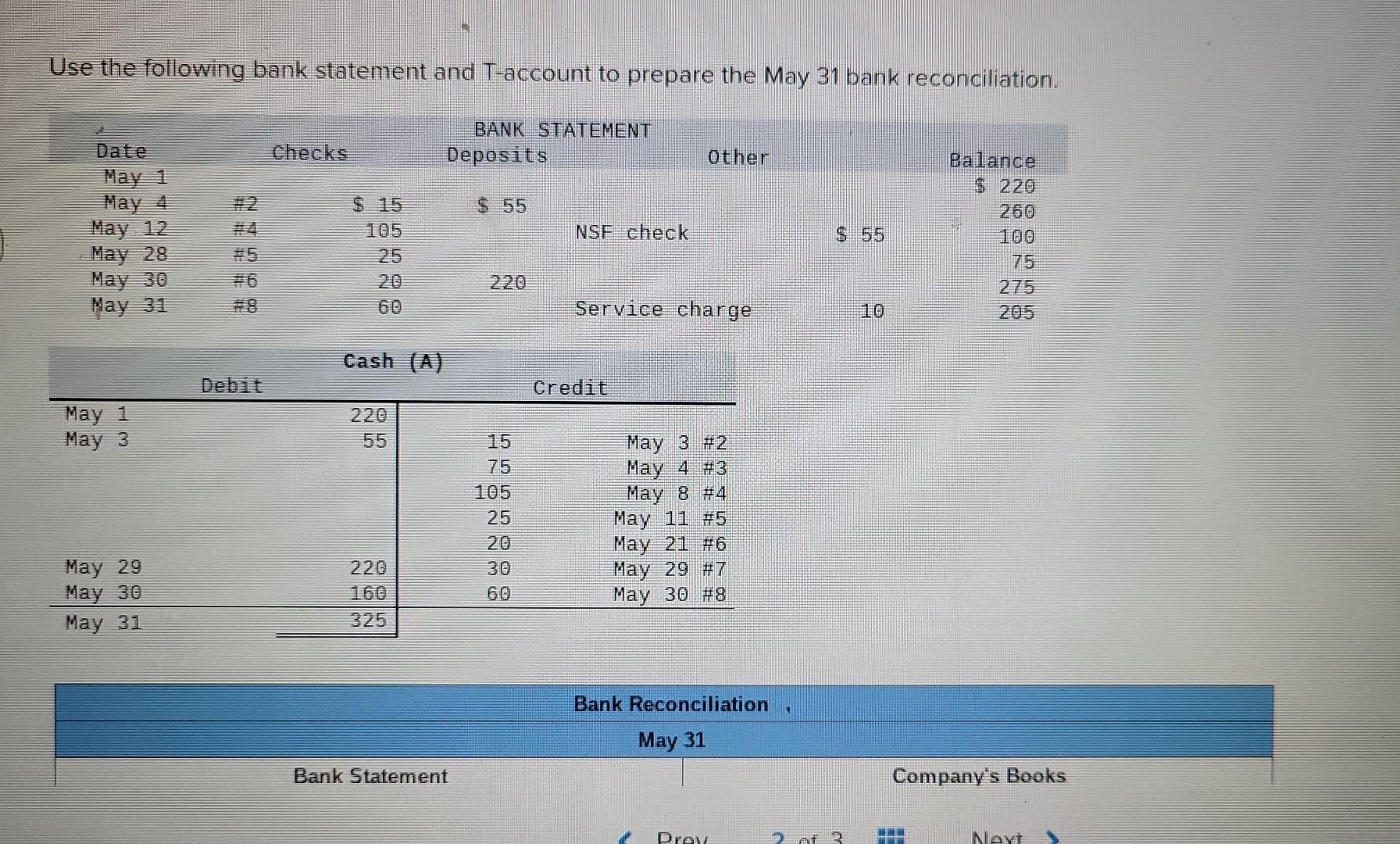

To prepare a bank reconciliation for Candace Co. for May 31, you have to look at the gaps in time. Banks are slow. Humans make typos. This guide breaks down exactly how to bridge that gap using the specific data often found in these financial scenarios.

Why the Numbers Never Match (At First)

Timing is everything. You might write a check to a supplier on May 29, but that supplier doesn't walk into a bank until June 4. You’ve already deducted it from your books, but the bank hasn't seen it yet. These are called outstanding checks.

📖 Related: Triad Center Salt Lake City UT: Why This 80s Vision is Rebranding for the Future

On the flip side, maybe you dropped a stack of cash in the night deposit on May 31. You counted it in your records for May, but the bank won't process it until the morning of June 1. That’s a deposit in transit. These two items are the most common reasons why the Candace Co. May 31 balances are off.

It's also worth noting that banks charge fees. You probably won't know the exact service charge until you open the statement. That’s why we reconcile—to find those little "gotchas" like the $50 bank service charge that Candace Co. usually deals with in this specific case study.

Breaking Down the Candace Co. Data

Let’s look at the actual numbers. In the classic version of this problem, Candace Co. starts with a bank statement balance of $2,936. Meanwhile, the company’s internal cash account balance is $3,194.

A difference of $258. Not huge, but enough to fail an audit or bounce a check if you aren't careful.

Here is what we know about the month of May:

- Deposits in transit: $655.

- Outstanding checks: $465.

- Bank service charge: $50.

- Error in the ledger: A check for supplies was written for $97 but recorded as $79.

That last one is a classic human error. Someone at Candace Co. transposed numbers or just had a "Monday morning" moment. Because $97 was actually paid but only $79 was recorded, the books think there is $18 more in the account than there actually is. We have to fix that.

Step 1: Adjusting the Bank’s Side

We start with the bank. We trust the bank’s record of what has already happened, but we have to add what they haven't seen yet.

🔗 Read more: U.S. Government Money Market Funds: Why They Aren't as Boring as You Think

Bank Balance (May 31): $2,936

First, we add the deposits in transit. These are funds Candace Co. knows it has, but the bank hasn't "realized" yet. We add $655 to the bank balance.

Next, we subtract the outstanding checks. These are "promises to pay" that are already floating around out there. We subtract $465.

When you do the math—$2,936 plus $655 minus $465—you get an adjusted bank balance of $3,126. This is the "true" cash amount the bank would show if every transaction cleared instantly.

Step 2: Fixing the Books for Candace Co.

Now for the messy part: the ledger. This is where Candace Co.’s internal records get cleaned up.

Book Balance (May 31): $3,194

First, we handle the bank service charge. The bank already took this $50, so we have to deduct it from our books.

Then, we deal with that ledger error. This is where people get tripped up. The check was for $97. The bookkeeper wrote down $79.

$97 - $79 = $18 difference.

Since the actual payment ($97) was larger than what was recorded ($79), we need to take another $18 out of our book balance to reflect the real cash spent on supplies.

Calculation time: $3,194 minus $50 (fees) minus $18 (error) equals... **$3,126**.

Look at that. The adjusted bank balance and the adjusted book balance are identical. It’s a beautiful thing when it works out.

What Happens if it Doesn't Balance?

If you get to the end and the numbers are still different, don't panic. Honestly, it happens to the best of us. Usually, it's a simple mistake.

Check for transposition errors. If your discrepancy is divisible by 9, you probably flipped two numbers (like writing 54 instead of 45). Also, make sure you didn't add something you should have subtracted. Did you add the bank fee instead of taking it out? It sounds silly, but it's the #1 reason reconciliations fail on the first try.

Sometimes, there are NSF (Non-Sufficient Funds) checks. If a customer gave Candace Co. a check for $200, and the bank later found out the customer was broke, the bank will take that $200 back. You’d need to subtract that from your books too.

Why This Matters for Small Business Owners

If you're running a company like Candace Co., reconciliation isn't just a chore. It's your defense against fraud. If a check cleared for an amount you didn't authorize, or if a deposit went missing, the May 31 reconciliation is exactly where you’ll catch it.

Waiting until the end of the year to do this is a nightmare. Do it monthly. It keeps the "detective work" manageable. If you find an error from three days ago, you can fix it. If you find an error from eight months ago? Good luck.

Actionable Next Steps for Candace Co.

Once the reconciliation is done, you aren't actually "finished." You have to update your accounting system.

- Create Journal Entries: You must record the $50 service charge and the $18 supply error in your general ledger. If you don't, your books will start June 1 with the wrong balance.

- Verify the Outstanding List: Keep that list of $465 in outstanding checks. You’ll need to see if they clear in June.

- Notify the Bank if Necessary: If you found a bank error (which didn't happen in this specific Candace Co. example, but it happens), you need to call them immediately.

Ensure your May 31 records are locked after these adjustments. This prevents "accidental" changes to past data that could throw off your June reconciliation before it even starts.