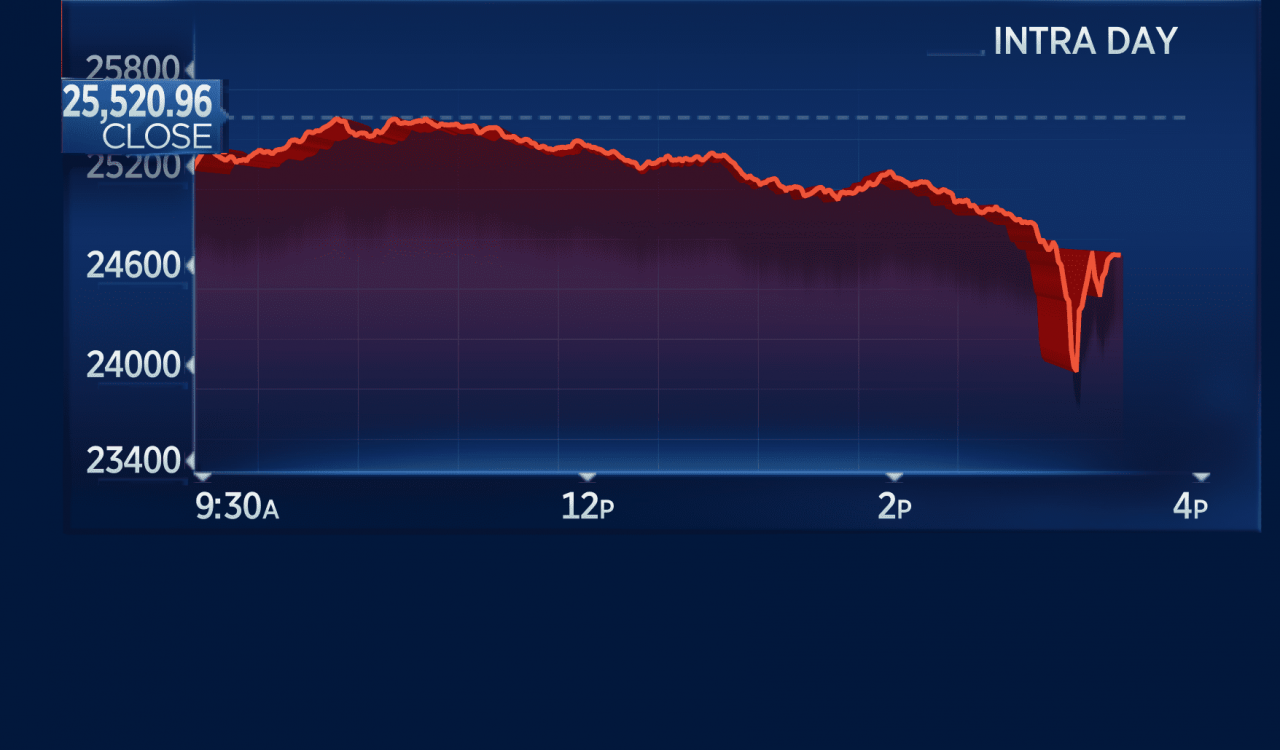

You've probably been there. It’s 6:30 AM, you’re bleary-eyed, clutching a coffee, and you see a notification on your phone: premarket dow jones futures are down 400 points. Your heart sinks. You start wondering if you should sell everything the second the opening bell rings at 9:30. But then, by noon, the market is somehow green. It’s a total head-scratcher, right?

Honestly, the premarket is a bit of a wild west. It’s where the "smart money" and the "panicked money" collide before the rest of us even have our shoes on. If you’re looking at these numbers and thinking they are a perfect crystal ball for the trading day, you’re setting yourself up for a rough ride. They matter, sure. But they don't matter in the way most retail traders think they do.

The Mechanics of the Early Shuffle

When we talk about the Dow Jones Industrial Average (DJIA) futures, we’re actually talking about contracts traded on the Chicago Mercantile Exchange (CME). Specifically, the E-mini Dow ($5) futures. These things trade almost 24 hours a day. While the actual New York Stock Exchange (NYSE) takes a nap, these futures keep chugging along, reacting to news from Tokyo, London, or a random late-night tweet from a CEO.

The premarket session specifically refers to the period between 4:00 AM and 9:30 AM ET. It’s thin. Liquidity is basically a puddle compared to the ocean of the regular session. Because there are fewer people trading, a single large sell order can send the price screaming downward. It’s volatile. It’s jumpy. It’s often a big fat lie.

Think of it like this: the premarket is the movie trailer. Sometimes the trailer makes the movie look like a high-octane thriller, but then you sit down in the theater and realize it’s actually a slow-burn indie drama. The "action" in the premarket is often just a reaction to one specific data point—like a higher-than-expected Consumer Price Index (CPI) report—that the market eventually digests and ignores by lunchtime.

Why Everyone Obsesses Over the "Indicated Open"

There is a psychological weight to seeing a red or green number before you start your day. People love certainty. We want to know if today is going to be a "good" day or a "bad" day for our 401(k)s.

Professional traders use premarket dow jones futures to gauge "sentiment." If the futures are up, it suggests that, for now, the bulls have the microphone. But professional desks at firms like Goldman Sachs or JP Morgan aren't just looking at the price; they are looking at the volume. If the Dow futures are down 200 points on tiny volume, they mostly ignore it. If they are down 200 points on massive volume, then okay, maybe there’s a real institutional shift happening.

The Earnings Impact

This is where things get spicy. Most big companies—think Apple, Microsoft, or Disney—report their earnings either right after the market closes or right before it opens. Since these giants are heavily weighted in the major indices (though the Dow is price-weighted, which is its own weird quirk), their individual performance can single-handedly drag the futures up or down.

👉 See also: Why Amazon Stock is Down Today: What Most People Get Wrong

Take a company like UnitedHealth Group (UNH). Because it has a massive share price, it has an outsized influence on the Dow. If UNH misses earnings at 7:00 AM, the Dow futures might look like the sky is falling. Is the whole economy tanking? No. It’s just one insurance company having a bad quarter. This is why you have to look under the hood. You can't just see a red number and assume the world is ending.

The Myth of the "Predictive" Gap

A "gap" happens when the price at the 9:30 AM open is significantly different from the 4:00 PM close the day before. You'll hear traders say things like "the gap always gets filled." This is one of those trading adages that is true just often enough to be dangerous.

If premarket dow jones futures are signaling a 1% gap down, many people try to "fade" the move, betting that the market will immediately bounce back up to "fill" that empty space on the chart. Sometimes it works. But sometimes, that gap is the start of a massive trend change.

Real-world example: Look back at the early days of the 2020 pandemic. We saw "limit down" moves in the premarket constantly. The futures hit a floor where trading was actually halted because things were dropping so fast. In those cases, the premarket wasn't lying; it was a warning flare. But in a standard, non-crisis year? The premarket is mostly just noise created by algorithmic bots reacting to headlines faster than any human could.

Key Players in the 4:00 AM Club

Who is actually trading this stuff while you're asleep? It’s not your neighbor Joe on his phone. Well, it might be, but Joe isn't moving the needle.

- Hedge Funds: They use futures to hedge their existing positions against overnight news.

- International Investors: If you're in London, 4:00 AM ET is 9:00 AM your time. You're just starting your workday.

- High-Frequency Trading (HFT) Bots: These are the real kings of the premarket. They are programmed to sniff out news releases and execute trades in milliseconds.

- The "Smart Money": Large institutional players often use the lower volume of the premarket to subtly position themselves before the retail crowd rushes in at 9:30 AM.

Don't Forget the "Price-Weighted" Problem

We have to talk about how the Dow is actually calculated because it's kinda ridiculous. Unlike the S&P 500, which is market-cap weighted (meaning bigger companies matter more), the Dow is price-weighted. This means a stock with a $500 share price has ten times the impact on the index as a stock with a $50 share price, even if the $50 company is actually "bigger" in terms of total value.

When you see premarket dow jones futures moving, you have to ask yourself: is the entire market moving, or is it just Boeing or Goldman Sachs having a weird morning? Often, the S&P 500 futures are a better "vibe check" for the overall economy, while the Dow futures are a very specific look at 30 "blue-chip" giants.

✨ Don't miss: Stock Market Today Hours: Why Timing Your Trade Is Harder Than You Think

Understanding "Fair Value"

You might see a financial news site show "Futures vs. Fair Value." This is a technical calculation that accounts for things like dividends and interest rates. If the futures are "above fair value," it implies a positive open. If they are below, it implies a negative one. It’s a way of stripping away the "noise" to see what the actual expected opening price should be.

Most people ignore fair value and just look at the raw point change. That's a mistake. The raw point change doesn't account for the fact that the futures contract is a derivative, not the index itself.

Specific Strategies for the Casual Observer

So, how do you actually use this info without losing your mind? First, stop checking the futures at 11:00 PM. Nothing that happens at 11:00 PM matters by 9:00 AM. The "real" premarket action—the stuff that actually carries over into the trading day—usually starts around 8:30 AM ET. This is when the big economic data drops, like the Jobs Report or Retail Sales.

If the market reacts violently at 8:30 AM, pay attention. If it’s just drifting at 5:00 AM, go back to sleep.

Another thing: watch the "pivot." If the premarket was down 200 points but starts recovering right before the bell, that’s often a sign of strength. It means buyers are stepping in to "buy the dip" before the general public even has a chance to trade. Conversely, if the futures were up and start selling off into the open, watch out. That "fading" momentum often carries through the first hour of regular trading.

Real-World Nuance: The London Crossover

Around 8:00 AM to 9:00 AM ET, the US premarket overlaps with the London session. This is arguably the most important hour of the premarket. There is actual liquidity here. Big European banks are active, and US traders are logging on. If you see a major trend change in the premarket dow jones futures during this window, it’s much more likely to be "real" than a move that happened at 3:00 AM.

Common Misconceptions to Ditch

- "The futures are down, so I should sell my stocks immediately." No. Just no. Often, the market opens low and immediately rallies. Selling at the open is frequently selling at the "low of the day."

- "The Dow is the best indicator of the economy." It's okay, but it's only 30 stocks. It misses tech, it misses small businesses, and it's heavily skewed by high-priced stocks.

- "Futures tell you what will happen tomorrow." Futures tell you what people think will happen tomorrow right now. And people change their minds every five minutes.

Actionable Steps for Tomorrow Morning

Instead of just staring at the red or green numbers, try this specific routine to get a clearer picture of what's actually happening.

🔗 Read more: Kimberly Clark Stock Dividend: What Most People Get Wrong

Look at the "Big Three." Don't just look at the Dow. Compare it to the S&P 500 futures and the Nasdaq-100 futures. If the Dow is down but the Nasdaq is up, it's not a "market" crash; it's just a rotation out of industrial stocks into tech. That's a very different story.

Check the Economic Calendar. Use a site like Forest Factory or the Bureau of Labor Statistics. See if there’s a major report at 8:30 AM. If there is, wait until 8:45 AM to even look at the futures. Anything before the report is just guessing.

Identify the "gap." Note the closing price from yesterday. If the premarket is significantly different, ask yourself why. Is there actual news? If there's no news and the futures are down, it might just be a "liquidity grab" where big players are trying to trigger stop-loss orders from retail traders before pushing the price back up.

Monitor the VIX. The "Volatility Index" or "Fear Gauge" usually has a futures component too. If the Dow futures are down and the VIX is spiking, the fear is real. If the Dow is down but the VIX is calm, it’s probably just a boring, healthy pullback.

Stop treating the premarket like a fortune teller. It’s a weather vane. It tells you which way the wind is blowing right this second, but it won't tell you if a storm is going to clear up by noon. Use the data to prepare your plan, but never let a 5:00 AM print dictate a 10:00 AM trade. The most successful traders are the ones who wait for the "initial balance"—the first 30 to 60 minutes of the regular session—to see if the premarket move actually has legs or if it was just a bunch of early morning noise.

Keep your eyes on the volume, stay skeptical of "limit moves" on low liquidity, and remember that the opening bell is often the end of the premarket trend, not the beginning of it. Trading is about patience, not reacting to every flicker on a screen before the sun is even up.