New York City is basically the center of the financial universe. Because there is so much money flowing through Manhattan every single second, it’s also the ultimate hunting ground for fraudsters. When people hear the words ponzi scheme New York, they usually think of one name. Madoff. Bernie Madoff’s $64 billion collapse in 2008 changed everything, yet somehow, it changed nothing at all. You’d think we would’ve learned by now. We haven't.

Wall Street isn't just a place. It's an idea. It represents the dream of massive, consistent returns that outpace the "boring" market. That specific dream is exactly what scammers use to bait the hook. They don't usually look like villains in movies; they look like your neighbor in the Hamptons or your trusted advisor at a Midtown firm.

The Anatomy of a Modern Ponzi Scheme in New York

What is it, really? At its core, a Ponzi scheme is just a lie wrapped in a bank statement. The operator promises high returns with little risk. Instead of actually investing the money in stocks, real estate, or crypto, they just use cash from new investors to pay off the old ones. It works great. Until it doesn't.

The "New York" version of this often involves a layer of prestige that you don't find in other cities. It’s about "exclusive" access. It’s about being part of a fund that supposedly uses a proprietary algorithm developed by a math genius from Columbia University. In reality, there is no algorithm. There is just a checking account and a fancy office lease on Park Avenue.

Why New York is Different

In a smaller city, a $10 million fraud is front-page news for a month. In New York, $10 million is a rounding error. The sheer volume of wealth allows these schemes to grow to monstrous proportions before anyone at the SEC or the Manhattan District Attorney’s office even notices.

Take the case of J. Ezra Merkin. He was a pillar of the New York philanthropic community. He sat on boards. He was "one of us" for the city's elite. When it turned out he was funneling billions into Madoff’s black hole, the shockwaves didn't just hit bank accounts—they destroyed the social fabric of the Upper East Side. That's the New York ripple effect.

Recent Cases That Prove Nothing Has Changed

If you think the 2008 crackdown fixed the system, honestly, you're mistaken. Look at the headlines from the last few years. The targets have shifted, but the mechanics remain identical.

The "Hamilton" Ticket Scam

A few years back, a guy named Craig Carton—a well-known sports radio personality—got caught up in a massive mess. He was accused of running a Ponzi-style scheme involving the resale of tickets to concerts and Broadway shows like Hamilton. It wasn't some complex derivative trade. It was just tickets. He allegedly took millions from investors to pay off gambling debts and earlier investors. It’s the same old story, just with a Playbill instead of a stock ticker.

Crypto is the New Frontier

Lately, the ponzi scheme New York landscape has migrated to digital assets. The Southern District of New York (SDNY) has become the de facto "Sheriff of Crypto." We saw this with the collapse of various platforms that promised 15% or 20% yields on "stable" coins. You can't get 20% yield safely. You just can't. If someone tells you otherwise in a coffee shop in Chelsea, they are lying to you.

Red Flags You’re Probably Ignoring

We all want to believe we’ve found the "secret." That’s the problem. Scammers prey on that specific ego.

- The "Consistent" Return: The market is messy. It goes up, it goes down. If an investment produces a steady 1% gain every single month regardless of whether the S&P 500 is crashing or soaring, it’s a fake. Mathematics doesn't work that way.

- Exclusivity as a Shield: "I can only let a few more people into this fund." This is classic FOMO (Fear Of Missing Out). In New York, social standing is currency. Scammers use the "waitlist" or "referral only" tactic to make you feel lucky to give them your money.

- Vague Strategies: If you ask how the money is made and the answer is "proprietary technology" or "complex arbitrage," run. If they can't explain it to a twelve-year-old, it’s probably because there’s nothing to explain.

The Role of the SDNY and the SEC

The U.S. Attorney’s Office for the Southern District of New York is arguably the most powerful prosecutorial body in the country for financial crimes. They deal with the heavy hitters. But even with their resources, they are often playing catch-up. They usually only get involved once the money is already gone.

Recovery rates for victims in these cases are notoriously low. Usually, by the time the FBI knocks on the door of that luxury condo, the money has been spent on private jets, expensive watches, and high-priced lawyers.

The Psychology of the New York Mark

Why do smart people—lawyers, doctors, hedge fund managers—get duped? It’s not about intelligence. It’s about trust and social proof.

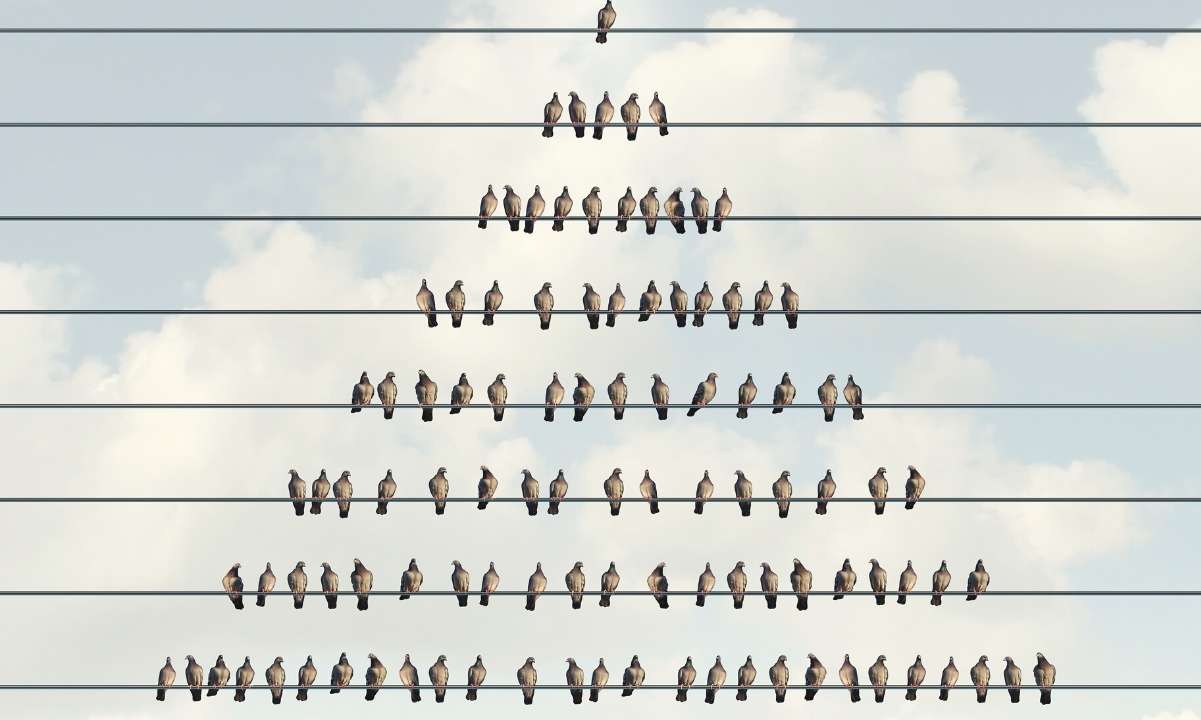

In New York, if you see your boss and your brother-in-law both investing with a guy, you assume the due diligence has already been done. Everyone thinks someone else checked the math. This "cascading trust" is how Madoff took down entire charities and pension funds. Nobody wanted to be the one to ask the "stupid" question and look like they didn't belong in the room.

The "Affinity" Trap

Many New York schemes are "affinity frauds." This is when the scammer targets a specific group—religious communities, ethnic groups, or professional circles. They use shared identity to bypass the natural skepticism we have for strangers. It feels safer because "he's one of us." It’s actually more dangerous because you’ve lowered your guard.

How to Protect Your Capital in the City

You have to be your own private investigator. No one is coming to save your savings until after they've been stolen.

- Check the SEC's IAPD website: Look up the individual and the firm. If they aren't registered, that’s a massive, flaming red flag.

- Request Third-Party Audits: A real fund uses a reputable, third-party accounting firm to verify their holdings. If the auditor is a one-man shop in a strip mall, stay away.

- Understand Custodianship: Your money should be held by a neutral third-party custodian (like Fidelity or Charles Schwab), not by the investment advisor themselves. If you're writing a check directly to the guy in the suit, you're in trouble.

The Long-Term Impact on New York’s Reputation

Every time a major ponzi scheme New York hits the news, it chips away at the integrity of the financial system. It makes the "little guy" believe the whole thing is rigged. And honestly? When you see how long some of these guys operate before getting caught, it’s hard to argue they’re wrong.

However, New York remains the gold standard for finance because of its regulatory density. For every scammer, there are thousands of legitimate professionals. The trick is knowing how to tell the difference when the lights are bright and the promises are big.

Actionable Steps for Investors

If you suspect you are currently involved in a questionable investment or want to vet a New York-based opportunity, take these steps immediately:

Verify the Broker's History

Use FINRA’s BrokerCheck. It’s free. It shows you if the person has been sued, barred, or has a history of "customer disputes." If they have more than one or two "disclosures," you’re looking at a problem.

Demand a Prospectus

A real investment has a formal prospectus or private placement memorandum (PPM). Read it. Look for the "Risk Factors" section. If the document says there is "no risk," it is a fraudulent document.

Watch for the "Roll Over" Pressure

When you try to take your money out, a Ponzi operator will often try to convince you to "roll it over" into a new, even better opportunity. They might even offer you a bonus to keep the money there. This is because they don't actually have the cash to give you. If you ask for your principal and they hesitate, contact an attorney immediately.

Report Suspicions Early

If something feels off, contact the SEC’s Office of the Whistleblower or the New York Attorney General’s Investor Protection Bureau. Do not wait for the scheme to collapse. The first people to complain are often the only ones who get any money back.

The reality of the New York financial scene is that greed is a permanent fixture. You can't eliminate the scammers, but you can make yourself a very difficult target. Stay skeptical. Ask the uncomfortable questions. Never invest money you can't afford to lose in anything that hasn't been vetted by an independent third party. In the city that never sleeps, your due diligence shouldn't either.