Money talks. In the high-stakes world of political forecasting, it doesn't just talk—it screams. If you spent any time on social media during the lead-up to the 2024 vote, you probably saw those neon-colored charts from Polymarket. People were obsessed. While traditional pollsters were biting their nails and talking about "margins of error" and "too close to call" swing states, the bettors on Polymarket were already leaning into a specific reality.

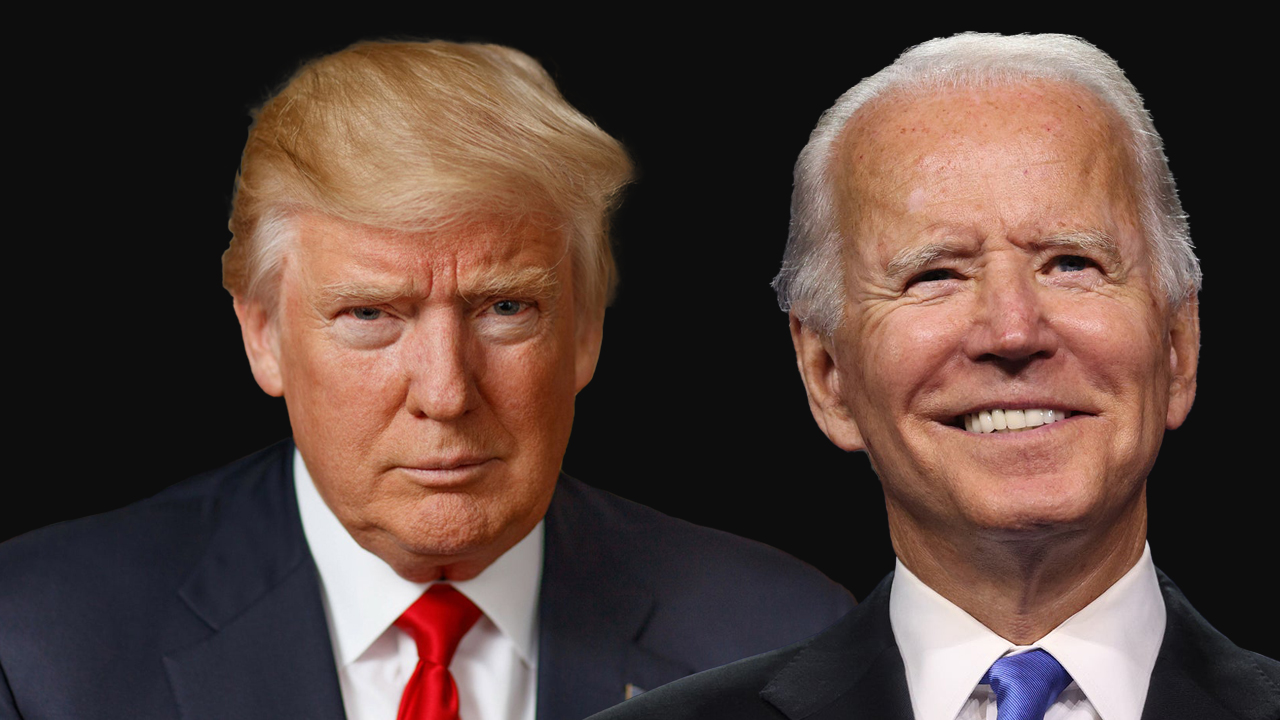

Honestly, the 2024 cycle changed how we look at data. We watched Donald Trump and Kamala Harris battle it out in the polls, often locked in a dead heat. But on the blockchain, the story was different. Polymarket presidential election odds became the de facto "truth signal" for a certain set of investors and political junkies. Why? Because when you have to put your own hard-earned USDC on the line, you stop voting with your heart and start betting with your head.

It’s now January 2026. Looking back, the 2024 election post-mortem shows a startling trend. While some experts called the 2024 results a "polling failure," the prediction markets largely saw the Trump victory coming. He finished with 312 electoral votes and a popular vote win—a sweep of all seven swing states that many betting contracts had priced in while the "experts" were still calling it a coin flip.

👉 See also: Bill Moon Architect Colorado: Why the Quiet Master of Adaptive Reuse Still Matters

Why Prediction Markets Are Eating Polling's Lunch

Polls are basically a snapshot of a moment that has already passed. They’re slow. By the time a poll is conducted, weighted, and published, the news cycle has moved on three times. Polymarket is different because it's live. If a candidate stumbles during a debate or a weird piece of news breaks at 2:00 AM, the odds move in seconds.

Take the July 13, 2024, assassination attempt in Pennsylvania. The betting markets spiked for Trump almost instantly. Polls? They took weeks to reflect any shift. It’s that "wisdom of the crowds" thing. You’ve got thousands of people—some with insider info, some just really good at reading vibes—collating every bit of data into a single price.

There's a lot of talk about "smart money." On Polymarket, a single share pays out $1 if you're right and $0 if you're wrong. So, if a candidate is trading at $0.60, the market is essentially saying there’s a 60% chance they win. It’s simple. It’s brutal. And it’s often more accurate than a phone survey of 1,000 people who probably didn't even want to pick up the phone in the first place.

The Real Risks Nobody Mentions

Don’t get it twisted; it’s not a crystal ball. Markets can be manipulated. If a "whale" (a trader with massive amounts of capital) decides to dump millions into a specific outcome, they can artificially move the odds. We saw this in 2024 with a few mystery accounts that were betting tens of millions on a Trump victory. Critics called it "opinion laundering." They argued that by pushing the odds up, these traders were trying to create a sense of inevitability.

Then there’s the "Vegas effect." Sometimes the crowd is just wrong because they’re caught in an echo chamber. If the majority of traders on a platform lean a certain way politically, the prices might reflect their bias rather than the actual reality on the ground. You have to be careful. Betting markets are a tool, not a guarantee.

Comparing 2024 to the 2026 Landscape

We are now staring down the barrel of the 2026 midterms and looking toward 2028. The landscape has shifted. Polymarket is no longer a niche crypto hobby. It’s mainstream. Even the 2026 Golden Globes used real-time Polymarket odds during the broadcast.

The big question for the upcoming cycle is whether the "Trump effect" on the markets was a one-off. In 2024, the markets correctly identified the "silent" support for Trump that polls missed. As we look at the Polymarket presidential election odds for the 2028 cycle (yes, people are already betting on it), we’re seeing new names like JD Vance and Josh Shapiro dominate the boards.

- Speed: Markets react to events in real-time.

- Accountability: Traders lose money if they’re wrong, unlike pundits.

- Access: Anyone with a crypto wallet can participate (depending on local laws).

- Transparency: You can see exactly how much money is backing each side.

The regulatory environment is also changing. The CFTC has been playing cat-and-mouse with these platforms for years. But after the 2024 success, it’s getting harder to argue that these markets don’t provide "public interest" value. They provide a hedge against uncertainty.

What You Should Actually Do With This Info

If you’re looking at Polymarket presidential election odds as a way to predict the future, you need a strategy. Don't just look at the percentage. Look at the volume. A market with $500 million in trades is much more reliable than one with $50,000.

Watch for the "spread." If there's a huge gap between what people are willing to pay for "Yes" and what they'll take for "No," the market is uncertain. Also, keep an eye on the "resolution" criteria. As we saw with the recent dispute over the "invasion" of Venezuela in early 2026, how a question is worded matters more than the actual event. If the contract says "inaugurated," it doesn't matter who wins the popular vote; it only matters who takes the oath.

Actionable Insights for the 2026/2028 Cycles:

- Check the "Order Book": Don't just trust the front-page percentage. See if a few big bets are skewing the price.

- Compare Platforms: Look at Kalshi or PredictIt alongside Polymarket. If they all agree, the signal is stronger.

- Ignore the Noise: When a candidate has a "bad week" in the media, see if the money actually moves. If the price stays steady despite a media firestorm, the "smart money" isn't buying the controversy.

- Hedge Your Life: Some people bet against their preferred candidate. That way, if your candidate loses, at least you have some extra cash to console yourself. It’s a cynical but effective way to manage political stress.

The era of trusting a single "expert" on a news network is over. We’ve entered the age of the decentralized forecast. Whether you love or hate the idea of betting on democracy, the markets are here to stay. They’ve proven they can see things the traditional media misses. Just remember: in the market, as in politics, there’s no such thing as a sure bet.

Keep your eyes on the liquidity. If the money starts moving away from the "consensus," something is about to happen. Usually, the bettors know it before you do.

Next Steps for Traders and Observers

To stay ahead of the curve, you should start tracking the daily volume shifts on the 2028 Presidential Nomination markets. Look for "breakout" candidates who are trading under $0.10 but seeing a steady increase in volume. This often indicates that institutional-level research is beginning to favor a dark horse before the mainstream media catches on.