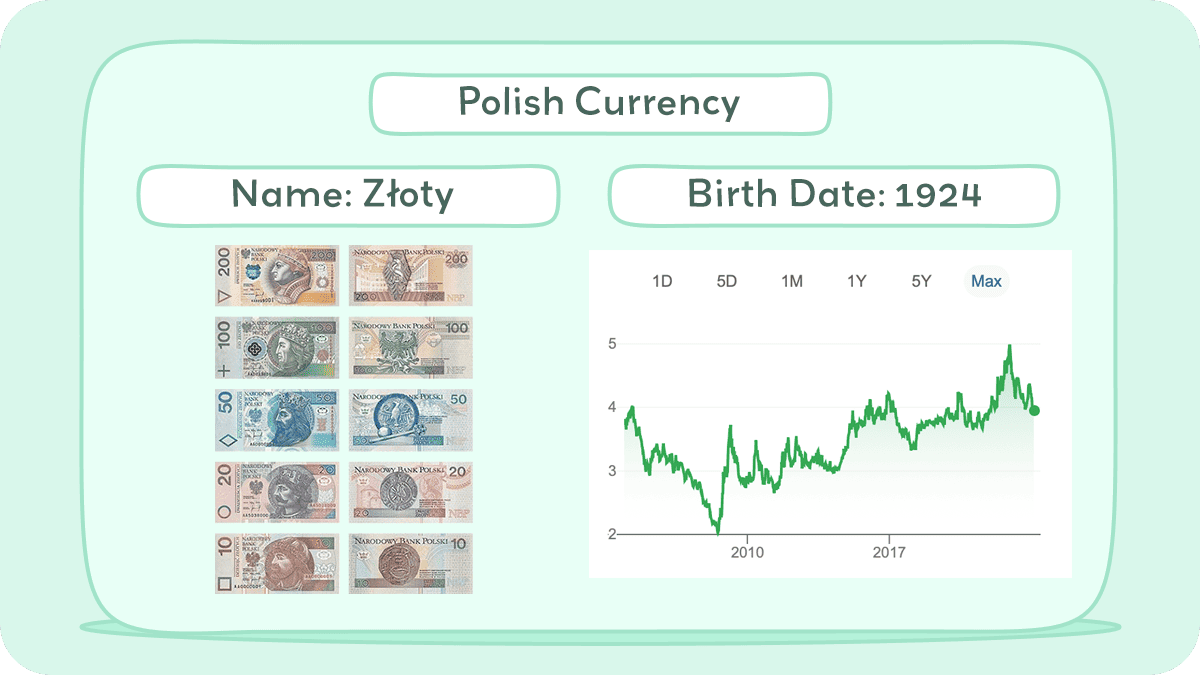

If you’re looking at the Polish currency to USD today, you might notice something a little strange. The Polish Zloty (PLN) is holding its ground. Actually, it's doing more than that—it’s performing like one of the toughest currencies in the emerging market world right now.

Most people expect the US Dollar to steamroll everything in its path. Usually, it does. But Poland’s economy has developed this weird, resilient muscle over the last few years.

The Zloty vs. The Greenback: What’s actually happening?

Right now, as of mid-January 2026, the exchange rate is hovering around 3.64 PLN for 1 USD. To put that in perspective, we’ve seen the Zloty strengthen significantly since those messy days in 2022 and 2023 when people were panicking about energy costs and the war next door.

Why is this happening? Basically, it’s a mix of high interest rates and a massive pile of cash coming in from the European Union.

The National Bank of Poland (NBP) just met on January 14, 2026. They decided to keep the main interest rate at 4.00%. That’s relatively high when you compare it to other developed nations. When interest rates are high, investors want to park their money in Zloty-denominated assets to catch those yields. This creates demand. Demand makes the currency go up.

👉 See also: Modern Office Furniture Design: What Most People Get Wrong About Productivity

It’s not just about the banks, though. Poland is currently in the middle of an "investment boom."

Why the Polish economy is supporting the Zloty

The big story for 2026 is the Recovery and Resilience Facility (RRF). This is basically a giant check from the EU that Poland has to spend by the end of this year. We’re talking about billions of Euros being converted into Zloty to fund bridges, wind farms, and digital infrastructure.

- GDP Growth: Experts at Citi Handlowy and ING are eyeing a growth rate of nearly 4% for 2026. That’s huge.

- Inflation: It’s actually under control. It hit 2.4% in December 2025, which is right in the sweet spot for the central bank.

- Labor Market: Unemployment is sitting near record lows, around 3% by some measures.

When an economy grows that fast while keeping inflation low, the currency tends to look very attractive to global traders. Honestly, the Zloty has become a bit of a "safe haven" within the Central and Eastern European region.

The "Trump Factor" and other risks

You can't talk about polish currency to usd without mentioning the United States. With the current administration in Washington, trade policy is a wild card. There’s a lot of talk about tariffs.

✨ Don't miss: US Stock Futures Now: Why the Market is Ignoring the Noise

If the US slaps big tariffs on European goods, the Dollar usually spikes because people get scared and run to "King Cash." However, Poland’s exports are a bit more diversified than they used to be. While Germany is struggling—basically in a two-year-long slump—Polish companies have started selling more to the US, the UK, and even parts of Asia.

Still, if the Fed (the US central bank) decides to keep their rates higher for longer, it could put pressure on the Zloty. It’s a tug-of-war. On one side, you’ve got a booming Polish industry; on the other, you’ve got a dominant US Dollar.

What should you do if you need to exchange money?

If you’re traveling or doing business, the "perfect" time to trade rarely exists. But 2026 is looking like a year of relative stability for the Zloty.

- Don't wait for 3.00: Unless something catastrophic happens to the US economy, we aren't likely to see the Zloty return to the 3.00-to-1 levels of a decade ago. 3.50 to 3.70 seems to be the new "normal" floor.

- Watch the March meeting: The NBP is expected to maybe cut rates in March 2026. If they cut rates too fast, the Zloty might weaken slightly. If you need to buy USD, doing it before a rate cut might save you a few grozy.

- Check the spread: Whether you're using Revolut, Wise, or a local Kantor (Polish exchange bureau), the spread matters more than the "mid-market" rate you see on Google.

Actionable insights for your wallet

Kinda simple, really. If you're holding USD and want to buy Zloty, you're getting a decent deal compared to a few years ago, but the Zloty isn't "cheap" anymore. It's a premium currency now.

🔗 Read more: TCPA Shadow Creek Ranch: What Homeowners and Marketers Keep Missing

For businesses, the move is to hedge. Don't bet on the Zloty getting much stronger than 3.55. The Polish government actually likes a slightly weaker currency because it makes their exports cheaper for the rest of the world. If it gets too strong, the NBP might intervene to pull it back down.

Keep an eye on the EU fund inflows. As long as those billions are flowing in through 2026, the Zloty has a very solid floor. If the political situation in Europe shifts or those funds get blocked again, that’s when you’ll see the polish currency to usd rate spike back toward 4.00.

For now, the Zloty is the tiger of Europe. Treat it with respect.

Next Steps:

- Monitor the NBP press conferences in February and March for any hints of interest rate cuts.

- Track the US Federal Reserve's stance on inflation; if they pivot to "dovish," the Zloty could see another rally.

- If you are an expat or digital nomad, consider locking in some of your 2026 budget now while the rate is stable.