Managing money is usually a headache. It's just one of those things. You open an app, you see a balance, and you hope you didn't forget about that subscription hitting tomorrow. Honestly, the PNC online banking mobile app—mostly known by its "Virtual Wallet" branding—is a bit of a weird beast in the fintech world. It doesn't look like a standard bank app. It doesn't really act like one either. While most big banks like Chase or Bank of America give you a clean, sterile list of transactions, PNC tries to visualize your cash flow using a "Money Bar." It’s polarizing. Some people find the dots and sliders confusing, while others swear it’s the only reason they haven't overdrawn their account in three years.

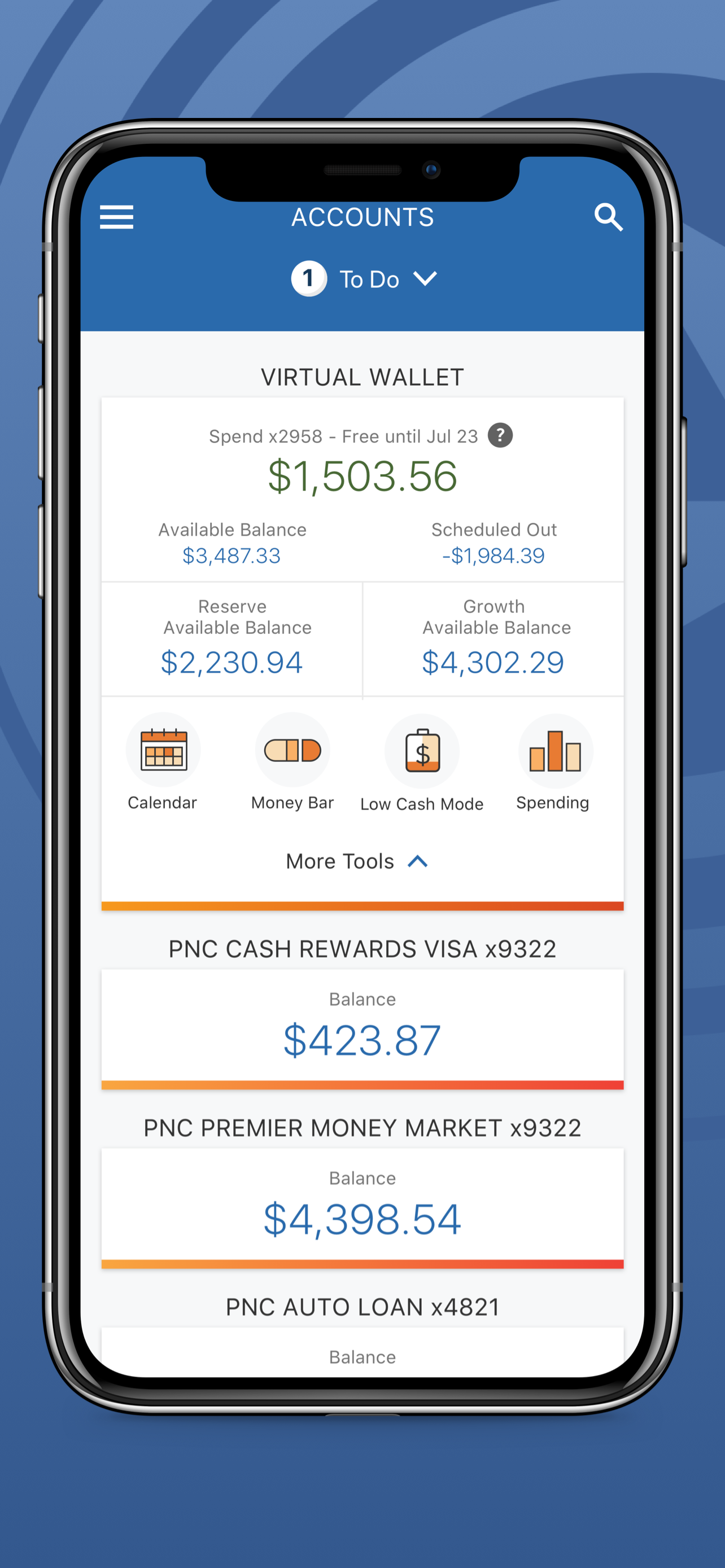

Banking isn't just about moving numbers anymore. It's about psychology. PNC’s mobile interface leans heavily into the idea that we’re all a little bit bad with math. By splitting your money into three distinct "compartments"—Spend, Reserve, and Growth—the app forces a level of organization that most of us are too lazy to do ourselves.

The Virtual Wallet Concept vs. Traditional Banking

Most people think a checking account is just a checking account. PNC disagrees. When you download the PNC online banking mobile app, you aren't just getting a digital ledger. You're getting a three-headed monster.

The "Spend" account is your primary checking for daily expenses. Then there’s "Reserve," which is basically a secondary checking account for short-term goals or "purgatory" for money you know is spoken for. Finally, "Growth" acts as your long-term savings. The magic happens in the "Calendar" view. It’s not just a list. It actually maps out your predicted spending based on historical data. If you have a car payment every 15th of the month, the app sees it coming. It flags "Danger Days" when your balance might dip too low. That’s a level of proactive warning you don't usually get without paying for a third-party app like YNAB or Rocket Money.

Is it perfect? No. The UI can feel cluttered. If you just want to see if your paycheck cleared, you might find the "Money Bar" distracting. But for the person who constantly asks, "How much do I actually have to spend?" after accounting for bills, this specific logic is a lifesaver.

✨ Don't miss: Zero-Based Budgeting: Why Most Companies Fail at ZBB Before They Even Start

Why the PNC Online Banking Mobile App Actually Ranks Well for Security

Let's talk about the boring stuff that actually matters: security. Everyone is terrified of their phone getting snatched or their credentials being fished. PNC has integrated something called "PNC Easy Lock." This isn't just a standard "freeze my card" button. It’s more granular. You can toggle off the ability to make online purchases while still allowing in-person swipes.

- Biometric authentication is standard—FaceID and fingerprints.

- The "Instant Alerts" are actually instant. I've seen them pop up before the receipt even finishes printing at a register.

- Identity theft protection is baked in through their partnership with various security protocols.

There’s also the Zelle integration. While Zelle has had its fair share of bad press regarding scams, PNC’s implementation includes fairly robust warning screens before you send money to someone who isn't in your contacts. It’s a small friction point, but friction is good when it stops you from sending $500 to a "landlord" you met on Facebook Marketplace.

The Low Cash Mode Feature

This is probably the most significant update to the PNC online banking mobile app in recent years. It’s their response to the industry-wide backlash against overdraft fees. They call it "Extra Time."

Basically, if you overdraw your account, PNC gives you a 24-hour window to bring the balance back to at least zero before they hit you with a fee. You get a push notification immediately. Most banks just take the fee and maybe send you a "sorry" email later. PNC gives you a clock. It’s a remarkably human way to handle a mistake. It acknowledges that sometimes a check clears faster than you expected or you forgot about a recurring utility bill.

Mobile Check Deposits and the "Is It Clear Yet?" Game

We’ve all been there. You sign the back of a check, take a photo in a dimly lit room, and pray the app accepts it. The PNC app is surprisingly picky about lighting. It’s annoying in the moment, but it beats having the deposit rejected four hours later by a human reviewer.

Once it’s in, the "available balance" logic kicks in. PNC usually makes the first $100 to $200 available immediately, depending on your account history and the check type. The rest usually clears by the next business day. It’s standard, but the app does a decent job of showing you exactly when the remaining funds will be "live."

Dealing With the "Glitchy" Reputation

If you go to the App Store or Google Play, you’ll see people complaining about the app crashing. It happens. Often, it’s related to the sheer amount of data the app tries to load at once—your calendar, your savings goals, your "Punch the Pig" (their gamified savings tool), and your transaction history.

If the app feels sluggish, it’s usually because the cache is bloated. A quick reinstall or clearing the app data usually fixes it. It's also worth noting that PNC does heavy maintenance on Sunday nights. If you try to log in at 2:00 AM on a Monday, don't be surprised if the "Reserve" account balance looks wonky for a minute.

Comparing PNC to the Neobanks

You’ve got Chime, Ally, and SoFi breathing down the necks of traditional banks. These apps are sleek. They are fast. They don't have 150 years of legacy code holding them back. So, why stick with the PNC online banking mobile app?

Physical footprint.

💡 You might also like: Trey Jackson New Braunfels: What Most People Get Wrong

When the app fails—or when you need a cashier's check, or when you have a complex fraud issue—you can walk into a physical branch. You can’t do that with a neobank. The app serves as a digital front door, but the building still exists. For people managing significant amounts of money, that's a security blanket that "clean UI" can't replace.

Actionable Steps for New Users

Don't just use it as a digital statement. To actually get the value out of the PNC mobile experience, you need to set it up properly from day one.

- Define your "Danger Days." Go into the calendar settings and make sure your recurring bills are actually recognized. If the app doesn't see your rent, the "Money Bar" is lying to you.

- Enable "Low Cash Mode" alerts. Don't assume they are on by default. Check your notification settings to ensure you get the "Extra Time" push alerts.

- Use the "Reserve" account for taxes or big annual bills. If you're a freelancer or someone with a big car insurance payment twice a year, move that money to Reserve. It keeps it out of your "Available to Spend" tally so you don't accidentally buy a round of drinks with your insurance money.

- Set up the "Punch the Pig" widget. It’s a silly name, but it’s a one-tap way to move $10 or $25 into savings. It’s the digital version of a change jar, and it adds up faster than you’d think.

The PNC online banking mobile app isn't the prettiest software on your phone. It’s a tool. If you use it like a static ledger, it’s just okay. If you use it to visualize the next 14 days of your financial life, it becomes one of the more powerful banking tools available without a monthly subscription fee. Just remember to keep your app updated; those security patches come out more often than you'd think, and in 2026, you really don't want to be running an outdated banking client.

Final Practical Insights

The biggest takeaway for anyone using the PNC platform is to embrace the "Virtual Wallet" logic rather than fighting it. If you try to treat Spend, Reserve, and Growth as one big pot, the app will constantly feel like it's overcomplicating your life. Instead, let the app do the "bucket" accounting for you. If you’re looking for a bank that treats your money as a fluid timeline rather than a static number, this is likely your best bet among the "Big National" options. Stick to the biometric logins, keep an eye on your Calendar view, and utilize the "Extra Time" feature to avoid those predatory fees that used to be the industry standard.