You’re standing at the heavy marble counter, the smell of stale coffee and industrial carpet lingering in the air, and you realize you have no idea where the "net deposit" line goes. It’s a classic bank lobby moment. Despite the fact that we live in an era of Zelle and instant transfers, the PNC bank deposit slip remains a weirdly vital piece of paper. Maybe you’re depositing a stack of birthday cash from your grandma or a check from a freelance gig that doesn't support mobile upload. Whatever the reason, getting it right the first time saves you from that awkward "step aside while I fix this" conversation with the teller.

Honestly, it’s not just about writing your name. It’s about ensuring the money actually hits your Virtual Wallet or Performance Select account instead of floating in banking limbo.

Why the PNC Bank Deposit Slip Still Matters in a Digital World

Most people assume paper slips are dead. They aren't. While PNC’s "DepositEasy" ATMs allow for card-in, cash-in transactions without any paperwork, there are specific scenarios where the physical slip is king. Say you have more than 30 checks. Try feeding those into an ATM one by one while a line forms behind you. You'll get some pretty mean glares.

Business owners frequently rely on these slips because they provide a physical audit trail. If you’re managing a small shop or a side hustle, having that carbon copy (the yellow or pink sheet behind the white original) is a lifesaver when your bookkeeping software decides to glitch. PNC provides these slips in the back of your checkbook, or you can grab them from the kiosks near the teller line.

💡 You might also like: Tariff History of the United States: What Most People Get Wrong

One thing people often get wrong: you don't always need a slip if you have your debit card. However, if you forgot your wallet and only have the cash/check and your account number memorized, that slip is your only ticket to a successful transaction. It's a backup system. A reliable, low-tech fail-safe.

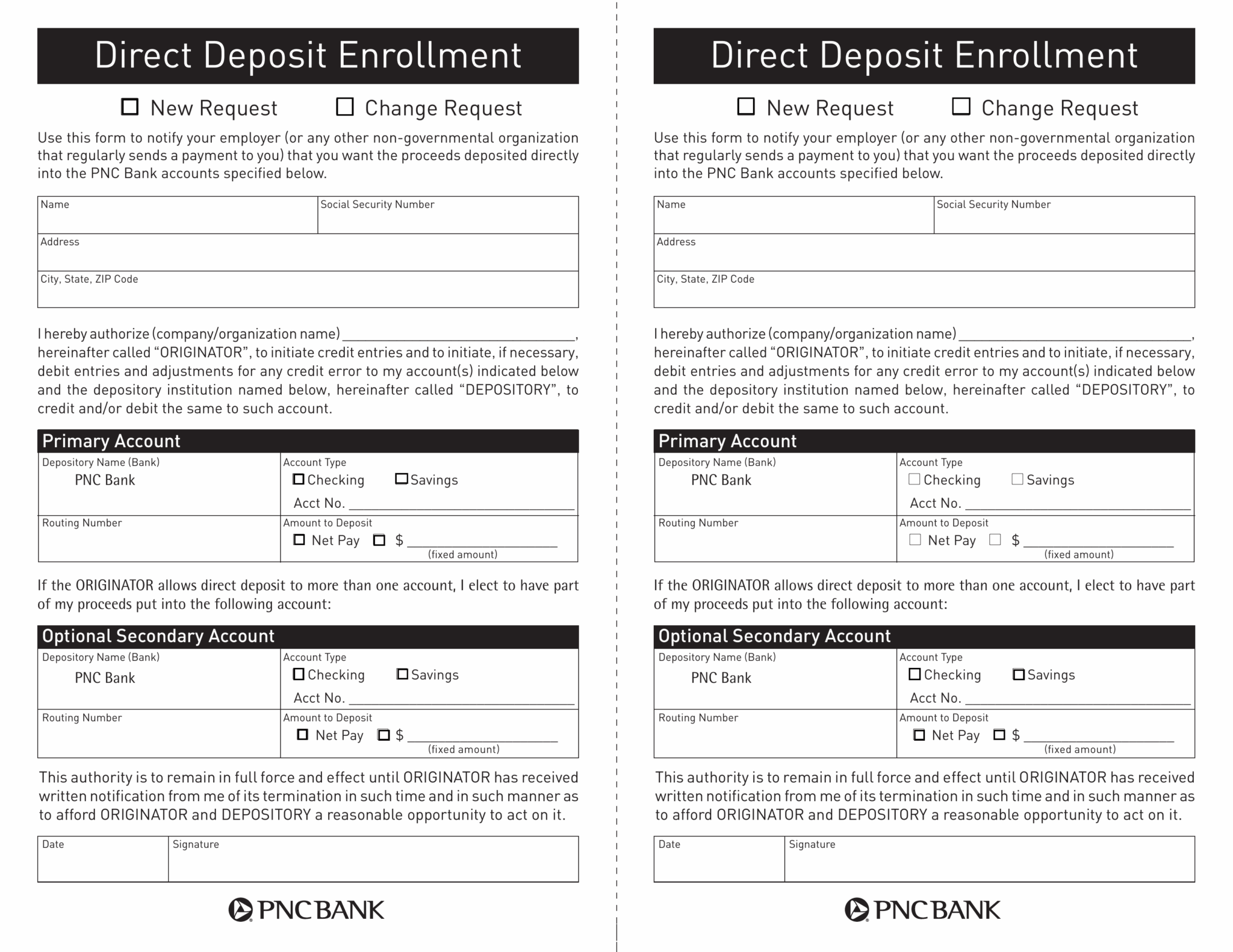

Anatomy of a Proper Deposit: Breaking Down the Fields

Let's look at the actual slip. It’s a rectangular piece of paper with a lot of boxes, and if you’re staring at it for the first time in a year, it looks like a math test.

The Header Information

First, the date. Use the current date, not the date on the check you’re depositing. Then, your name. Write it exactly as it appears on your PNC account. If your account is "Jonathan Q. Public," don't just write "Jon Public." Accuracy matters for the optical scanners the bank uses.

Next is the account number. This is the big one. If you’re using a slip from your own checkbook, this is already encoded in MICR ink at the bottom. If you’re using a generic slip from the lobby, you have to write this in perfectly. One wrong digit and you're depositing money into a stranger's account in Scranton.

Listing Your Assets

The right side of the PNC bank deposit slip is where the math happens.

- CASH: This is for your greenbacks. Count them twice. Write the total here. If you have no cash, leave it blank or put a dash.

- CHECKS: Most slips have a few lines for individual checks. If you have two checks, list them separately. If you have twenty, you’ll need to list them on the back of the slip and put the "Total from Rear" on the front.

- SUBTOTAL: Add the cash and all the checks together.

The "Less Cash Received" Trap

This is where people trip up. If you want to deposit a $500 check but keep $40 in your pocket for groceries, you write "$40.00" in the "Less Cash Received" box. You then subtract that from your subtotal to get your NET DEPOSIT.

Crucial Note: If you are taking cash back, you MUST sign the slip. If you are depositing the full amount, no signature is required. It's a security thing. PNC needs proof that you were the one who authorized the "withdrawal" portion of that deposit.

Avoiding Common Mistakes That Delay Your Money

PNC, like most national banks, uses high-speed scanners to process these forms. If your handwriting looks like a doctor’s prescription, the machine will kick it to a human for manual review. That adds time.

Use blue or black ink. Never use pencil. I’ve seen people try to use red glitter pens—just don't. The scanners hate it. Also, ensure your numbers are aligned within the boxes. If your "7" looks like a "1," the teller has to stop, verify, and potentially re-run the whole batch.

Another tip: check the "Total" twice. It sounds simple, but the most common reason for a delay at the teller window is a math error. If your slip says $1,000 and the checks add up to $1,010, the teller has to clarify the discrepancy with you. It’s annoying for everyone involved.

Mobile vs. In-Person Deposits

While we’re talking about slips, it’s worth mentioning the alternative. If you have the PNC Mobile app, you can snap a photo of a check. But did you know there are limits? For many standard accounts, there’s a daily and monthly limit on how much you can deposit via your phone. If you just sold a used car for $8,000, you’re likely going to need that physical PNC bank deposit slip because the app might cap you at $2,500 or $5,000 depending on your account tier and history.

Technical Details: MICR Lines and Routing Numbers

At the bottom of every pre-printed slip, you’ll see a string of weird-looking numbers. This is the MICR (Magnetic Ink Character Recognition) line. It contains three main pieces of info:

- The Routing Number: This identifies PNC Bank.

- The Account Number: This is uniquely yours.

- The Transaction Code: This tells the computer "This is a deposit, not a check being written."

If you’re using a "counter slip" (the blank ones in the lobby), it won't have your account number. You’ll see spaces where you need to fill it in. Don't guess. If you don't know your account number, log into your app or check your debit card—though your debit card number is not your account number. You'll need to find the actual 10-digit account number in your app’s account details section.

Pro Tips for Business Owners

If you're running a business, stop using the generic lobby slips. Order a set of personalized PNC bank deposit slips that come in duplicate or triplicate. Why? Because when tax season rolls around and the IRS asks why you had a $4,500 deposit in July, you can pull your yellow copy and see exactly which three clients paid you and in what amounts.

Also, keep a "deposit log." Even with the slip, writing down the check numbers and the names of the issuers in a separate notebook is a "best practice" that separates the amateurs from the pros. It's all about redundancy.

What About "Vanish" Ink?

I once heard a story about a guy who used a "erasable" pen to fill out a deposit slip. By the time it got to the central processing center, the heat from the machines had turned the ink invisible. He had a receipt, but the bank had a blank piece of paper. Use a standard Ballpoint. It’s the safest bet for permanent records.

Actionable Steps for Your Next Branch Visit

Don't wait until you're at the front of the line to start filling things out. That's how mistakes happen and how you lose your cool.

- Pre-fill at home: If you have your checkbook, rip out a slip and fill it out at your kitchen table.

- Endorse your checks: Write "For Deposit Only to PNC Account [Your Number]" and sign the back of every check before you even walk into the bank. This is a massive security win—if you drop the check in the parking lot, nobody else can cash it.

- Check for "Cash Back" needs: If you need $20 for the weekend, do it on the slip instead of making a separate ATM withdrawal later. It keeps your bank statement cleaner.

- Verify the Net Deposit: This is the most important number. It's the "bottom line." Make sure it reflects exactly what you expect to see in your balance.

When you hand the slip to the teller, stay put until they hand you the printed receipt. Compare the receipt to your slip immediately. Tellers are human; they make typos too. If the receipt says $500 and you gave them $5,000, you need to fix that before you walk out those double doors. Once you leave, proving a discrepancy becomes ten times harder.

Organizing your finances doesn't have to be a chore. It starts with small, disciplined habits like filling out a PNC bank deposit slip with precision. It’s one of those "old school" skills that actually keeps your modern life running smoothly. Take the extra thirty seconds to be neat, be accurate, and keep your copies. Your future self—especially during an audit or a budget review—will thank you.