You're looking for the People's United Bank ABA number because you probably have an old checkbook sitting in a drawer or an automated payment that’s been running since 2020. Or maybe you're just trying to set up a direct deposit and your HR portal is yelling at you because the numbers don't match. Here’s the deal: People's United Bank doesn't technically exist anymore. It was swallowed up by M&T Bank in a massive $8.3 billion acquisition that finalized in April 2022.

Everything changed.

The transition wasn't just a name change on the buildings in Bridgeport or Hartford. It was a massive digital migration of millions of accounts. If you’re hunting for that routing number, you’re basically looking for a ghost. But it’s a ghost that still has some legal weight depending on when your account was opened and where you live.

Why Your Old People's United Bank ABA Number Might Still Work (For Now)

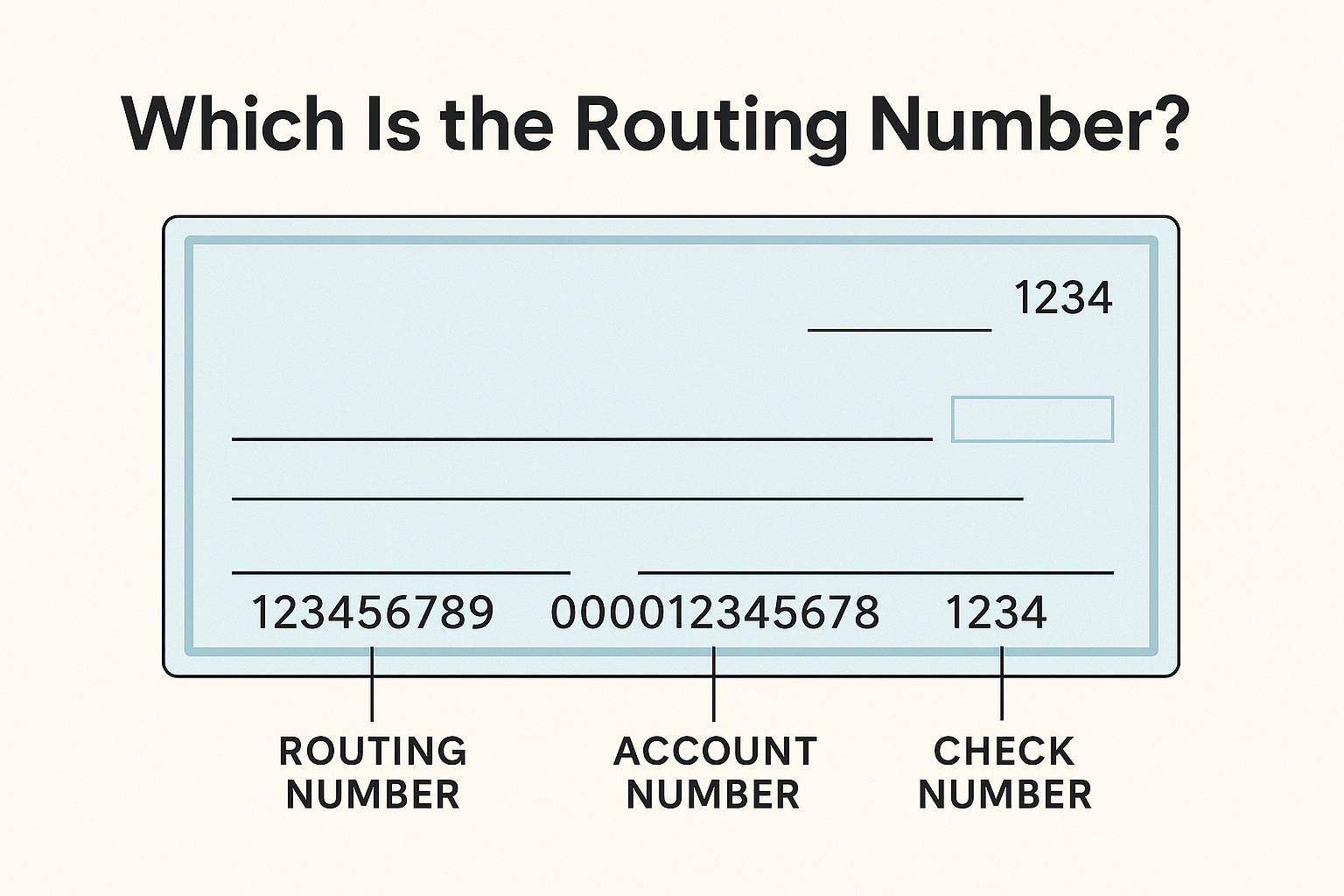

Routing numbers, or ABA numbers, are basically the "address" for your money. The American Bankers Association (ABA) assigns these nine-digit codes so the Federal Reserve knows exactly where to send a wire transfer or a direct deposit. When M&T Bank took over, they didn't just delete the old People's United codes overnight. That would have caused absolute chaos for millions of people waiting on Social Security checks or payroll.

Basically, M&T Bank set up a "forwarding" system.

If you use the old People's United Bank ABA number, which for many was 011100102, the system usually recognizes it and routes the money to your new M&T Bank account. It’s like when you move houses and tell the post office to forward your mail. It works, but it's not a permanent solution. Eventually, the post office stops forwarding.

The primary routing number for M&T Bank now varies by region, but for most former People's United customers in the Northeast, the standard M&T routing number is 022000046. However, you shouldn't just take that at face value. You've got to check your specific region because banking laws in New York, Connecticut, and Massachusetts sometimes force banks to maintain separate routing streams for different legacy "charters."

The Confusion of the Legacy Codes

Most people think there is only one routing number per bank. That is a myth. Large banks like the former People's United often had several. They grew by buying smaller banks themselves over the decades.

✨ Don't miss: Jerry Jones 19.2 Billion Net Worth: Why Everyone is Getting the Math Wrong

If your account originated in a specific part of Vermont or New Hampshire, you might have been using a completely different string of digits than someone in Fairfield County, Connecticut. Honestly, it’s a mess. When the M&T merger happened, they tried to consolidate these, but legacy systems are stubborn.

How to Find Your Current Routing Number Without Losing Your Mind

Don't guess. If you put the wrong ABA number into a wire transfer form, that money can vanish into a "suspense account" at the bank for weeks while they try to figure out who it belongs to. That's a nightmare nobody wants.

- Look at your "New" Checks: If you have ordered checks since late 2022, look at the bottom left corner. The first nine digits are your routing number. These are the "real" numbers M&T wants you to use.

- The M&T Mobile App: This is the fastest way. Log in, tap on your checking account, and look for "Account Details." It will list the ABA routing number specifically assigned to your account.

- The "Check 21" Rule: Under federal law, the numbers on your check must be readable by high-speed scanners. If you are still using old People's United checks with the old logo, they might still scan, but the bank is likely "intercepting" that data and correcting it on the back end.

Why the 011100102 Number is Famous

This specific number—011100102—was the flagship routing number for People's United for years. It’s the one most people have saved in their Venmo, PayPal, or utility bill autopay. If you see this number in your settings, you are looking at a legacy People's United code.

Is it "wrong"? Not technically.

Is it "current"? No.

You should update it.

I've seen cases where people had their tax refunds delayed because the IRS tried to verify the bank name against the routing number and found a mismatch. The IRS computer sees "M&T Bank" on the name line but "People's United" on the routing line and hits the "Reject" button. It’s better to be proactive.

Wires vs. ACH: There is a Difference

This is where people get tripped up. An ABA number is used for ACH transfers (like your paycheck or paying your electric bill). However, Wire Transfers sometimes use a different number entirely.

🔗 Read more: Missouri Paycheck Tax Calculator: What Most People Get Wrong

For the former People's United footprint, M&T Bank generally uses a centralized domestic wire routing number. If you are receiving a domestic wire, you usually use 022000046. But if you are receiving an international wire, you don't use an ABA number at all. You need a SWIFT Code.

M&T Bank’s SWIFT code is generally MUBKUS33.

If you give a sender in London or Tokyo your old People's United ABA number, the money will never arrive. International banks don't understand the "forwarding" logic that domestic banks use for mergers. They just see an invalid destination and send the money back—often after charging you a $50 "failed transfer" fee.

What Happened to the People's United Brand?

It’s gone. It’s weird, right? One day you’re walking into a branch you’ve visited for twenty years, and the next day the green signs are replaced with green-and-white M&T logos.

The merger was about scale. People's United was a powerhouse in New England, but M&T wanted that footprint to compete with the likes of Bank of America and Chase. For you, the customer, it meant your "People's United Bank ABA number" became a legacy data point.

Real-World Problems with Legacy Routing Numbers

I recently spoke with a small business owner in Vermont who kept using his old People's United deposit slips. For six months, everything was fine. Then, suddenly, three large payments from a vendor were returned. Why? The vendor's bank updated their "valid routing number" database and flagged the old People's United code as "inactive/closed."

The bank didn't tell him. The vendor just thought he had a closed account.

💡 You might also like: Why Amazon Stock is Down Today: What Most People Get Wrong

This is the "silent failure" of legacy banking info. It works until it doesn't. Systems update at different speeds. Your local utility company might still accept the old number, but a high-security government agency or a major brokerage firm like Fidelity might reject it.

Steps to Ensure Your Money Stays Moving

If you are still clinging to the old People's United identity, it's time to move on for the sake of your financial security.

Update your Direct Deposit immediately. Go to your employer's portal. Don't wait for them to ask. Replace the old routing number with the M&T Bank number found on your most recent statement.

Check your linked apps. Venmo, CashApp, and Zelle. These apps are notorious for glitching when a bank merger happens. Unlink your "People's United" account and re-link it as an "M&T Bank" account using the current routing and account numbers.

Destroy the old checks. Seriously. It’s tempting to use them up because checks are expensive, but you’re risking a "Return to Sender" situation on a mortgage payment or a car note. That leads to late fees and credit score hits that cost way more than a $20 box of new checks.

Nuance: The "Electronic" Routing Number

Some banks have a separate routing number for electronic payments versus paper checks. M&T usually keeps it simple with one for both, but always verify on your digital banking dashboard.

If you’re looking at your account online, look for a link that says "Standard Routing Number (ACH)". That is the specific one you want for 99% of your needs.

Actionable Next Steps

- Log in to your M&T Online Banking portal. Do not rely on memory or old paperwork.

- Navigate to "Account Services" or "Account Details" to see your specific, current ABA routing number.

- Download your most recent PDF statement. The routing number is almost always printed clearly on the first page, usually near the top or bottom.

- Identify every automated payment (Netflix, Gym, Electric, Mortgage) and update the banking info to the M&T details.

- Notify your HR department to update your payroll info. Most payroll cycles take 1-2 periods to update, so do this before your next "big" paycheck.

- Confirm your Account Number hasn't changed. While ABA numbers change in mergers, sometimes account numbers do too if there was a conflict with an existing M&T customer. Check both.