You’re staring at a massive tax bill. It’s April, or maybe you’re an entrepreneur staring down a quarterly estimated payment, and that five-figure number on the screen feels like a punch to the gut. Then you see the option: pay with a credit card. Your brain immediately starts calculating the points. A flight to Tokyo? That new MacBook? It’s tempting. But then, there it is—the "convenience fee." Suddenly, the math gets messy.

Most people assume the fee for paying taxes with credit card is a total scam. They see a 1.82% or 1.96% charge and run for the hills. Honestly, I get it. Why give the government—or rather, their payment processors—even more of your hard-earned cash? But if you’re strategic, that fee isn't always a dealbreaker. Sometimes, it’s actually a shortcut to a massive payout.

The Cold Hard Numbers of Tax Payment Processors

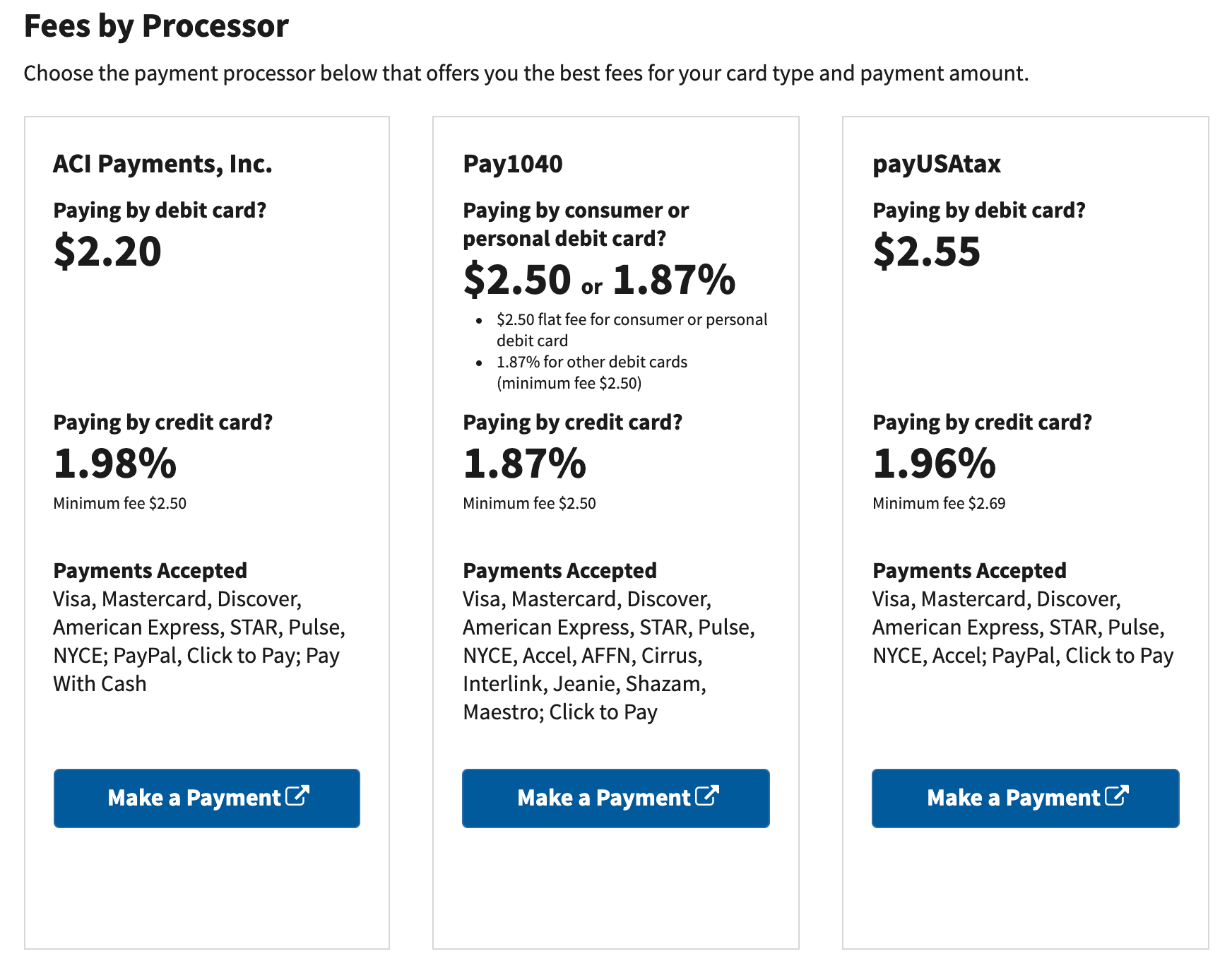

The IRS doesn't actually pocket your credit card fee. They aren't allowed to. Federal law prohibits the IRS from absorbing the costs associated with credit card transactions. So, they outsource the dirty work to third-party processors. As of 2025 and 2026, the three big players are PayUSAtax, Pay1040, and AACI (formerly Official Payments).

Each one has a slightly different vibe and a slightly different price tag. Usually, you’re looking at a fee ranging from 1.82% to 1.98%. If you’re paying with a debit card, it’s a flat fee, usually around $2 or $3. But we aren't here for debit cards. We’re here for the high-stakes world of credit card points.

Let's say you owe $10,000. At an 1.82% rate, you’re flushing $182 down the toilet just for the privilege of using your own credit line. If your credit card only gives you 1% cash back, you just lost money. You paid $182 to get $100 back. That’s bad math. Don't do that.

📖 Related: Olin Corporation Stock Price: What Most People Get Wrong

When the Fee Actually Makes Sense

So, when does it work? It works when you’re "Sign-Up Bonus" hunting. This is the holy grail of credit card strategy.

Imagine you just opened a new card that offers 100,000 bonus points if you spend $8,000 in the first three months. Those 100,000 points could be worth $2,000 in travel if you transfer them to the right airline partner. You have a $8,000 tax bill. You pay the $145 fee (1.82%). You just "bought" $2,000 worth of travel for $145. That is a massive win. You've basically turned a tax obligation into a discounted business class ticket.

- The Math Check: Always ensure the value of the points earned significantly exceeds the fee percentage.

- The Cash Flow Play: Sometimes you have the money, but it’s sitting in a high-yield savings account or a short-term investment earning 5%. If you can pay your taxes on a card with a 0% introductory APR for 15 months, you keep your cash earning interest elsewhere. Even after the 1.82% fee, you might come out ahead on the interest spread.

The Dangerous Pitfalls Most People Ignore

Interest is the killer. If you pay your taxes with a credit card because you don't have the money, and you carry that balance at a 24% APR, you are in a world of hurt. The IRS actually has relatively low interest rates for underpayment compared to credit card companies. If you’re truly strapped for cash, an IRS installment agreement is almost always cheaper than a credit card balance.

Then there's the "Section 162" nuance for business owners. If you are paying business taxes, that fee for paying taxes with credit card might be a deductible business expense. I've seen some tax pros argue this back and forth, but generally, if it’s a business-related tax, the cost of paying that tax is a cost of doing business. This effectively lowers the "real" cost of the fee. If you’re in a 30% tax bracket, that 1.82% fee effectively costs you about 1.27% after the deduction.

👉 See also: Funny Team Work Images: Why Your Office Slack Channel Is Obsessed With Them

The Best Cards for the Job

Not all plastic is created equal when Uncle Sam comes knocking. You want "catch-all" cards.

The Capital One Venture X or the Chase Freedom Unlimited (if you’re pairing it with a Sapphire card) are popular choices because they offer higher base multipliers on "everything else" spending. The American Express® Business Gold Card is another heavy hitter for those who can justify the annual fee through other business perks.

You also have to watch the limits. The IRS limits you to two credit card payments per tax period (like your annual 1040). You can't just swipe 50 times to hit 50 different bonuses. You have to be precise.

Real World Example: The "Business Owner" Strategy

I know a consultant in Austin who owes $50,000 in quarterly estimates every year. He doesn't just write a check. He opens one or two new high-tier business cards every year specifically for tax season. By paying his $50,000 bill across two cards, he pays about $910 in fees.

✨ Don't miss: Mississippi Taxpayer Access Point: How to Use TAP Without the Headache

In return? He clears the spending requirements for two massive sign-up bonuses, totaling maybe 250,000 points. He then uses those points to take his family to Europe every summer in lie-flat seats. If he paid cash for those seats, it would be $15,000. He gets them for $910 plus some taxes and fees. To him, the fee for paying taxes with credit card isn't a cost; it's a discounted travel budget.

A Quick Warning on Tax Software

If you're using TurboTax or H&R Block, they will offer to let you pay with a credit card right inside the software. Be careful. Sometimes their integrated fees are higher than if you went directly to the IRS-approved websites like https://www.google.com/search?q=payUSAtax.com. Always check the direct processor sites first before clicking "Pay" inside your tax prep software.

Also, don't forget that the fee is a separate transaction. You’ll see two charges on your statement: one for the IRS and one for the processor. This is actually helpful for bookkeeping purposes.

Actionable Next Steps

- Calculate your break-even: If you aren't earning at least 2% back in value, stop. Use a bank transfer (ACH) for free.

- Check for new card offers: Look for "minimum spend" requirements you otherwise couldn't hit. Taxes are the easiest way to hit a $10,000 spend requirement in one day.

- Verify the processor: Go to the official IRS website and use their links to the approved payment processors to ensure you're getting the lowest possible rate (currently around 1.82%).

- Confirm your limit: Remember, you generally only get two shots at this per tax type per year. Don't try to split a single tax bill across five different cards unless you're paying through different processors or for different tax years.

- Audit your cash flow: Never, under any circumstances, use a credit card for taxes if you cannot pay the statement in full by the due date. The interest will evaporate any benefit instantly.

Paying the government is never fun, but if you're going to do it anyway, you might as well get a "free" vacation out of the deal. Just make sure you're the one winning the math game, not the bank.