You just got a job offer in Orlando or maybe a nice raise in Miami. The numbers look great on paper. But then reality hits when you realize your gross pay isn't what lands in your bank account. Honestly, calculating a paycheck after taxes Florida style is a bit of a relief compared to most other states, but it isn't exactly "free money" either.

Florida is famous for having no state income tax. It's written right into the state constitution. This is a massive win for your take-home pay. If you moved from New York or California, you're basically giving yourself a 5% to 10% raise just by crossing the state line. But Uncle Sam still wants his cut. He always does.

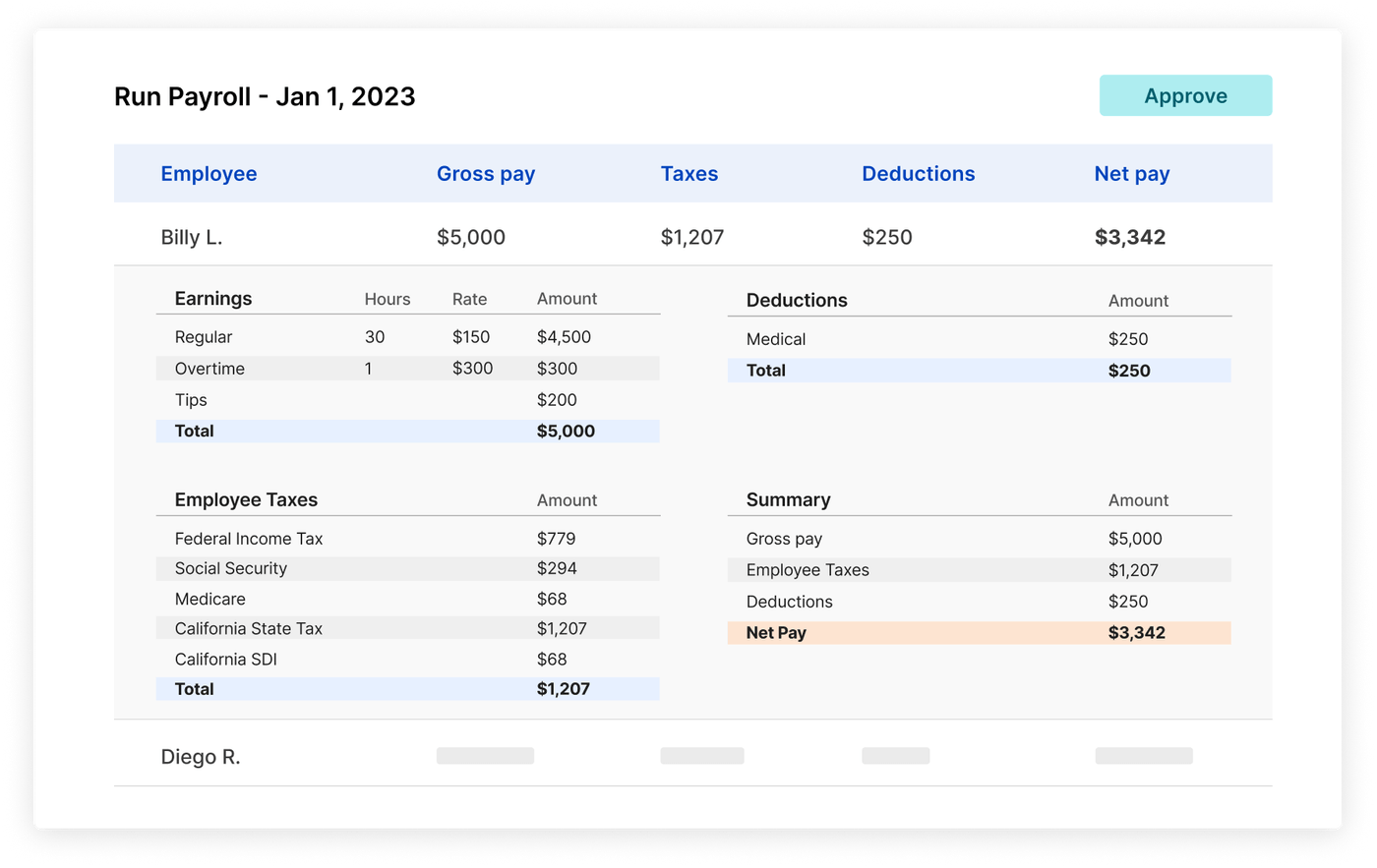

The Three Big Chunks Missing From Your Pay

Federal taxes don't care that you live near the beach.

First, there’s the Federal Income Tax. This is a progressive system. Basically, the more you make, the higher the percentage they take from those top dollars. If you’re a single filer making $60,000, you aren’t paying a flat rate on the whole thing. You're paying 10% on the first chunk, 12% on the next, and so on. It gets complicated fast.

Then we have FICA. That’s the Federal Insurance Contributions Act. It covers Social Security and Medicare.

Social Security takes 6.2% of your gross pay. Medicare takes 1.45%. Your employer matches these amounts, but you only see your half disappear. There is a "cap" on Social Security—once you earn over a certain amount ($168,600 in 2024, for example), they stop taking that 6.2% for the rest of the year. It’s like a surprise bonus in November or December for high earners.

✨ Don't miss: Deepak Nitrite Share Price: Why Most Investors Are Getting the Timing Wrong

Why Your Withholding Might Be Wrong

Ever get a $3,000 tax refund?

That's not a gift from the government. It’s an interest-free loan you gave them. If your paycheck after taxes Florida feels too small, check your W-4. If you’re claiming "zero" or haven't updated it since the 2020 redesign, your company might be taking way too much out. On the flip side, if you have a side hustle or capital gains, you might end up owing money in April because your employer didn't know about those extra income streams.

The Hidden Costs: Benefits and Pre-Tax Deductions

Tax isn't the only thing eating your check.

Health insurance is the big one. According to the Kaiser Family Foundation, the average worker contributes thousands annually toward employer-sponsored health plans. If you opt for the "Gold" PPO plan, your take-home pay shrinks.

But there is a silver lining.

📖 Related: The Pepsi Harrier Jet Ad: Why a $23 Million Joke Failed So Spectacularly

Most of these deductions are "pre-tax." If you put $200 into a 401(k) or a Health Savings Account (HSA), the IRS doesn't tax that money. You’re lowering your taxable income. It makes your paycheck look smaller today, but it keeps more money away from the taxman in the long run. It's a trade-off.

Let's look at an illustrative example. Imagine "Sarah" in Tampa. She earns $75,000 a year.

- Her gross monthly pay is $6,250.

- Federal Income Tax takes roughly $780.

- FICA takes about $478.

- She puts 5% into her 401(k) ($312).

- Her health insurance costs $150.

- Her paycheck after taxes Florida ends up being around $4,530.

She’s keeping about 72% of what she earns. In a state like Massachusetts, that number would be significantly lower because of the state's flat tax.

The "Sunlight" Tax: What Florida Doesn't Tell You

No state income tax sounds like a dream. It is. But Florida has to get its money from somewhere. The state relies heavily on sales tax and property taxes.

The state sales tax is 6%, but many counties add their own "discretionary" surtax. If you live in Hillsborough County, you’re paying more at the register than someone in a different part of the state.

Also, property taxes. Because there's no income tax, Florida's local governments lean hard on real estate. If you’re renting, your landlord is passing those high property tax bills onto you through your monthly rent. So, while your paycheck after taxes Florida looks beefy, your cost of living—especially insurance and housing—might eat up those gains faster than you’d expect.

Insurance is a whole other beast here. Homeowners' insurance in Florida is currently some of the highest in the nation due to hurricane risks and litigation. You might save $400 a month on state taxes only to spend an extra $500 a month on insurance and tolls.

High Earners and the "Luxury" of Florida

If you’re a high-net-worth individual or a C-suite executive, Florida is a paradise.

The lack of a state income tax becomes more valuable the more you earn. Someone making $500,000 a year saves tens of thousands of dollars annually compared to living in New York City. This is why you see so many "wealth managers" and "tax refugees" moving to Jupiter or Miami.

But even for the average person, the math usually works out in your favor. You just have to be disciplined.

Real Steps to Maximize Your Take-Home Pay

Stop guessing and start managing.

📖 Related: Canadian Dollar to US Dollar Historical Rates: What Most People Get Wrong

- Use a precise calculator. Don't just multiply your hourly rate by 40. Use a tool like the ADP or PaycheckCity Florida-specific calculators. They account for the exact local tax laws.

- Review your W-4 annually. If you got married, had a kid, or bought a house, your tax liability changed. Don't let the HR department use outdated info.

- Leverage the HSA. If your employer offers a High Deductible Health Plan with an HSA, use it. It is the only "triple tax-advantaged" account. No tax on the way in, no tax on growth, and no tax on the way out for medical bills.

- Watch the local sales tax. If you’re making a huge purchase, like a car or expensive furniture, check the surtax in neighboring counties. A 1% difference on a $40,000 car is $400. That's worth a short drive.

- Adjust for the "Invisible" taxes. Since your paycheck is bigger here, put that "extra" money into a high-yield savings account immediately. This covers the higher-than-average car insurance and utility bills (A/C is expensive!) that Florida residents face.

Living in Florida gives you a unique advantage in the quest for a higher paycheck after taxes Florida. You’ve already cleared the hurdle of state taxes. Now, it’s just about managing the federal bite and making sure your benefits choices aren't accidentally draining your liquidity. Check your last pay stub today. Look at the "Net Pay" vs. "Gross Pay." If the gap is more than 30% and you aren't maxing out a retirement account, you probably need to talk to your payroll department about your withholdings.