You’ve probably seen the name. It’s plastered on buildings in Tuscaloosa and whispered in the halls of the Alabama Statehouse. But for most folks, Paul W. Bryant Jr. is just a shadow cast by a very large, legendary hat. People assume they know the story. They think he’s just the son of a football coach who inherited a legacy and coasted.

Honestly? That’s not even close to the reality.

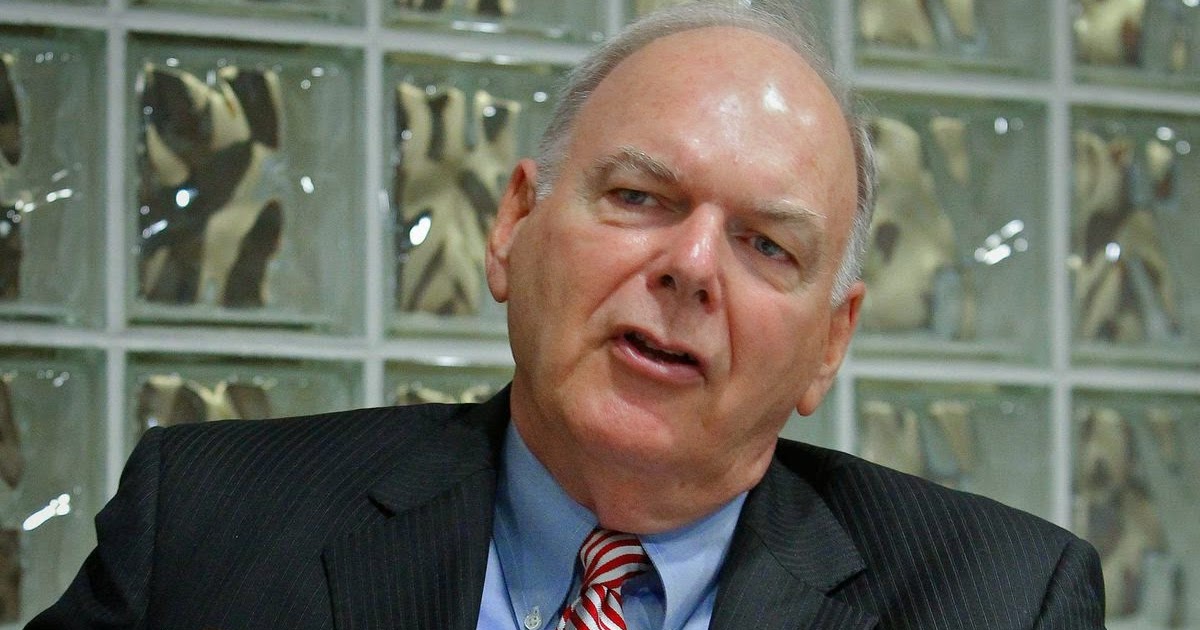

Paul W. Bryant Jr. isn't a coach. He never was. While his father, the iconic "Bear" Bryant, was busy winning six national championships, Paul Jr. was quietly building a financial empire that would eventually touch everything from catfish farms to international reinsurance. He’s a man who values privacy above almost everything else, yet his influence on the state of Alabama is arguably as deep as his father’s, just far less loud.

The Architect of the Greene Group

Most people don't realize that Bryant didn't just inherit money; he built a massive, sprawling holding company called Greene Group, Inc. It’s not a household name, but it’s the engine behind his wealth.

Think of it as a giant umbrella. Underneath, you’ve got a wild mix of businesses. We’re talking about dog racing tracks (like Greenetrack), cement companies, and even aquaculture. One of his biggest wins was Ready Mix USA. He grew that cement business into a powerhouse and eventually sold it to Cemex for a staggering $350 million back in 2011.

That wasn't a fluke.

He has a knack for finding "boring" industries—the kind that keep the world moving but don't get much glory—and scaling them. Catfish? He’s in that too, through Harvest Select Catfish Inc. It’s this weird, fascinatng diversification that makes him hard to pin down. One day he’s dealing with insurance risk, the next he’s looking at cattle ranching or fuel distribution.

Why Paul W. Bryant Jr. Still Matters in Alabama Finance

If you live in Alabama, you’ve likely seen Bryant Bank. Founded in 2005, this wasn't just a vanity project. Bryant wanted to create a family-owned financial institution at a time when big, nameless mega-banks were swallowing up local competitors.

It worked.

The bank now has 18 locations and over $1.5 billion in assets. But here’s the thing—the bank became more than just a place to keep a checking account. It became a point of contention. For years, critics pointed out that a significant number of the University of Alabama’s Board of Trustees had ties to the bank.

This brings us to the "Power Broker" side of the man.

He served on that board for 15 years, often as the President Pro Tempore. During his tenure, the university saw an explosion in growth. We're talking about $2 billion in construction. He was instrumental in hiring Dr. Robert Witt, the man credited with doubling the size of the student body. You can't talk about the modern University of Alabama without talking about Paul W. Bryant Jr.’s fingerprints on the physical campus.

The UAB Football Controversy: Fact vs. Fiction

You can’t write about this man without hitting the 2014 firestorm. When UAB (University of Alabama at Birmingham) abruptly shut down its football program, the finger-pointing started immediately. Fans and local media pointed directly at Bryant Jr.

The theory? A decades-old grudge.

The story goes back to 1991, when UAB’s Gene Bartow wrote a letter to the NCAA complaining about the Alabama program. People claimed Bryant Jr. never forgot it. They argued he used his position on the Board of Trustees to kill the Blazers' program as revenge.

It’s a juicy narrative. But it's also complicated.

✨ Don't miss: 1 USD in Israeli Shekel: Why Your Dollar Is Shrinking in Tel Aviv

While the board did block a new stadium for UAB and eventually approved the shutdown (based on a financial report that many later called "flawed"), Bryant himself has rarely spoken publicly about it. He’s the "silent power" type. Whether it was a grudge or a cold-blooded financial decision, the fallout was massive. UAB football eventually returned, fueled by a community that was frankly ticked off at the Tuscaloosa-centric power structure.

The Hidden World of Reinsurance

If you really want to understand where the "big money" comes from, you have to look at Alabama Life Reinsurance Co. This is the stuff that makes most people's eyes glaze over, but it’s vital.

Reinsurance is basically insurance for insurance companies.

Bryant’s venture into this field was incredibly lucrative. Between 2002 and 2006 alone, the company reportedly paid out tens of millions in dividends. It wasn't without drama, though. There was a high-profile federal fraud case involving a guy named Allen W. Stewart. While Bryant himself was never charged with any wrongdoing, his company was mentioned in the legal proceedings regarding how certain deals were structured.

It highlights a recurring theme: Bryant operates in high-stakes, highly regulated environments where the line between "shrewd business" and "controversial practice" is often debated by regulators and rivals.

More Than Just a Name

So, who is he really?

He’s a 6-foot-4 history buff who loves the Civil War. He actually helped found the Civil War Trust (now the American Battlefield Trust), putting up his own money to save thousands of acres of historic land. He’s a guy who missed out on his own athletic dreams because of a bout with hepatitis in high school, which diverted him into the world of commerce.

💡 You might also like: Left Hand Studio LLC: The Reality Behind This Niche Creative Agency

He doesn't do many interviews. He doesn't seek the spotlight.

While his father wanted the world to see the winning touchdown, Paul Jr. seems much more interested in who owns the stadium and the bank that financed it. He is a reminder that in the South, names carry weight, but capital carries the power.

What You Can Learn from the Bryant Approach

Looking at his career, there are a few "real world" takeaways for anyone interested in business or influence:

- Diversify or Die: Don't just stick to one niche. Bryant’s leap from dog tracks to cement to banking proves that a broad portfolio protects you from market shifts.

- Institutional Influence: If you want to change a landscape, get on the boards. Whether it was the Civil War Trust or the UA Board of Trustees, Bryant understood that policy is made in committee rooms, not on Twitter.

- The Power of "No": Bryant is famous for his silence. In an age where everyone overshares, there is a distinct tactical advantage to being the most private person in the room.

If you’re researching the Bryant legacy, the next logical step is to look into the Crimson Tide Foundation. It's the private wing that funds much of Alabama's athletic dominance today. Understanding how that foundation interacts with private donors will give you a much clearer picture of how the "Alabama Machine" actually functions behind the scenes.

Next Steps for You:

If you want to dig deeper into the actual filings of his businesses, you should search the Alabama Department of Insurance archives for Alabama Life Reinsurance Co. reports. For a look at his physical impact on the state, a tour of the Bryant-Denny Stadium expansions—specifically the North Zone—shows exactly what that $2 billion in board-approved construction actually bought.