If you’ve been staring at a palladium metal price chart lately, you might feel like you’re looking at the heart rate of someone running a marathon in a thunderstorm. One day it’s soaring, the next it’s taking a nosedive that would make a falcon jealous. Honestly, it's a bit of a mess. But if you want to understand why your portfolio is behaving this way—or why that catalytic converter in your driveway is suddenly a hot commodity again—you have to look past the jagged lines and into the weird, messy reality of global trade in 2026.

Prices are weird right now.

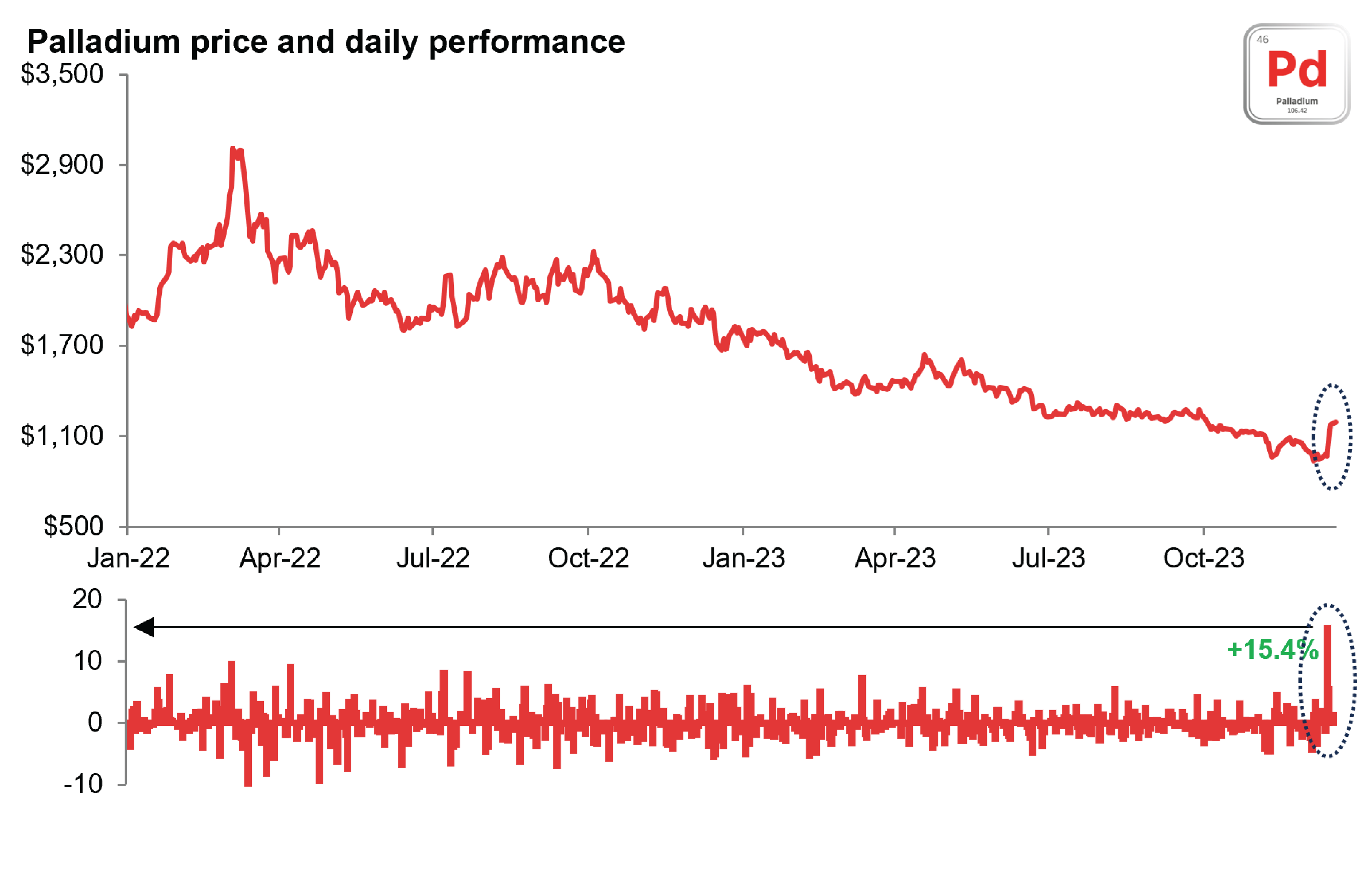

Early this January, we saw spot prices for palladium dancing around the $1,800 to $1,850 per ounce range. That sounds high, right? Well, compared to the start of 2025 when it bottomed out near $1,000, it’s a massive recovery. But if you’re one of the folks who bought in back in 2021 when it was nearly $3,000, you’re probably still waiting for the "moon" that never came. The chart isn't just a record of numbers; it's a map of geopolitics, car engine designs, and some very aggressive moves by the U.S. Department of Commerce.

Why the Palladium Metal Price Chart Just Woke Up

For a long time, palladium was the boring sibling of the precious metals family. Gold got the glory. Silver got the hobbyists. Palladium just sat in the tailpipes of gasoline cars, quietly scrubbing toxic fumes. But then everything changed.

The biggest thing driving the chart right now isn't actually "green energy." It's irony.

Everyone thought Electric Vehicles (EVs) would kill palladium demand by now. They haven't. In fact, hybrid vehicle production actually jumped about 2% in the latter half of 2025. Hybrids still need catalytic converters. Sometimes they need more palladium than standard gas cars because their engines run cooler and need more metal to trigger the chemical reaction. This "reverse substitution" is basically keeping the floor from falling out from under the price.

🔗 Read more: Jamie Dimon Explained: Why the King of Wall Street Still Matters in 2026

Then you have the Russia factor. You can't talk about palladium without talking about Norilsk Nickel. Russia supplies roughly 40% of the world's palladium. Lately, the U.S. has been looking at "anti-dumping" investigations. We’re talking about potential duties on Russian palladium that could be as high as 828%. When traders hear "828% tariff," they don't walk to the "buy" button—they sprint. That fear is what caused that massive spike we saw on the charts earlier this week, pushing spot prices up over 3% in a single session.

The Numbers You Need to Know

Let's look at the actual data points from the last few days to see how volatile this really is:

- January 12, 2026: Prices hit a local high near $1,939.

- January 15, 2026: A quick correction saw it dip back to $1,861.

- Today (Jan 16): We’re seeing a bit of a "hangover" effect, with spot prices hovering around $1,780 to $1,807.

Bank of America recently hiked their 2026 forecast to $1,725, which is actually lower than where we are right now. Why? Because they expect a "measured" supply response. Basically, they think South Africa is going to start digging faster to capitalize on these prices, which will eventually cool the market down.

The "Green" Trap and Other Misconceptions

There’s this idea that because we’re moving toward a "net-zero" world, palladium is a dead asset. That’s sort of like saying candles died the day the lightbulb was invented. They didn't. They just changed jobs.

We’re seeing palladium start to pop up in hydrogen fuel cells and specialized electronics. While the automotive sector still gobbles up about 80% of the supply, these new industrial uses are creating a "buffer."

💡 You might also like: Influence: The Psychology of Persuasion Book and Why It Still Actually Works

Also, have you checked out the Guangzhou Futures Exchange (GFEX)? The launch of new palladium contracts in China has introduced a whole new group of speculators into the mix. More speculators usually means more "noise" on your palladium metal price chart. It’s why you see these 5% swings in a single day for no apparent reason. It’s just liquidity finding a home.

Reality Check: Is a Surplus Coming?

Honestly, it depends on who you ask.

Heraeus, a big name in the industry, thinks we might see a wider surplus soon. Their logic? As Battery Electric Vehicles (BEVs) continue to chip away at the market, the need for auto-catalysts has to drop. They’re forecasting a range of $950 to $1,500 for the rest of 2026.

On the other side, you’ve got firms like Metals Focus. They’re looking at the charts and seeing a potential retest of $2,000 before the year is out. They think the "scarcity" mindset will win out, especially with the ongoing power grid issues in South African mines and the technical "hiccups" Norilsk Nickel has been reporting with their new equipment.

How to Read the Chart Like a Pro

If you're looking at a palladium metal price chart and trying to make sense of the chaos, stop looking at the minute-by-minute candles. That’s a great way to get a headache. Instead, focus on these three things:

- The Gold/Palladium Ratio: Historically, palladium is "cheap" right now compared to gold. When gold hits record highs (like it did recently, crossing $4,000), investors often look for "cheaper" alternatives in the same family.

- The "Gap" in Recycling: For years, we relied on old cars being scrapped to provide a secondary supply of palladium. But people are holding onto their cars longer because new ones are so expensive. This is starving the recycling market and keeping the supply tighter than it should be.

- The 200-Day Moving Average: Right now, the price is sitting well above its long-term averages. That's a "bullish" sign in technical terms, but it also means the risk of a "mean reversion" (a fancy way of saying a crash back to reality) is growing.

Actionable Insights for the Week Ahead

If you’re holding physical palladium or trading the futures, don't get married to the current price. This is a "headline-driven" market. One tweet about a Russian export ban or a new U.S. tariff and the chart will jump $100 in ten minutes.

📖 Related: How to make a living selling on eBay: What actually works in 2026

Keep an eye on the $1,750 support level. If we break below that, the next stop could be the $1,500 range. Conversely, if we can clear the $1,950 resistance that we bumped into on January 12th, then the path to $2,000 is wide open.

Watch the hybrid sales data. Forget the "EV vs. Gas" war. The middle ground is where the palladium demand lives. If Toyota and Honda continue to report record hybrid sales, the demand for this metal isn't going anywhere.

Diversify your entry points. If you're looking to buy, don't go all-in on a green day. This metal loves to "re-test" its lows. Wait for those red candles on the palladium metal price chart before you commit your capital. The volatility is your friend if you have patience, but it's your worst enemy if you're chasing the rally.

Stay updated on the U.S. Department of Commerce rulings regarding Russian dumping margins. That is the single biggest "black swan" event on the calendar for the next three months. If those 800%+ tariffs actually go into effect, the "historical highs" on your chart might need a new y-axis.